Following through on its earlier promise, PayPal announced an expanded PayPal app with new features including a high-yield savings account in partnership with Synchrony Bank. Additionally, the personalized app includes faster access to direct deposit funds, peer-to-peer transfers, an enhanced bill pay capability, in-app shopping tools with deals and rewards, messaging, as well as the ability to defer payments on purchases (buy now, pay later) and support for buying, selling and holding cryptocurrencies.

And that might be just the start. According to Dan Schulman, CEO of PayPal, the development of this app is far from complete: “In every single quarter, we are going to make substantial upgrades. We are either going to improve things that are already out there or add new functionality like investments, QR codes for offline payments, and budgeting tools.” Reiterating what he said in February, Schulman adds, “I want this to be an everyday platform for consumers… and this is the way that’s going to happen.”

Desire for Everyday Usage:

PayPal believes the super app is a major key to the company’s mission of reaching 1 billion active daily users.

One of the major benefits PayPal expects to leverage in the rapid development of new services and enhancements to existing services is the size of their active database. Not only do they have over 400 million users, but they also do more than 5 billion transactions a quarter that feeds into their sophisticated AI and machine learning capabilities. The goal is to make the app highly personalized, smarter and easier to use over time.

Read More:

- Why Square’s Expanding Ecosystem Threatens Banking’s Future

- Is Stripe’s Lending and Payments Platform Move the Future of Banking?

- Zelle Stretches Far Past P2P Payments to ‘Digital Cash’ Role

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Rationale for a ‘Super App’

The move from single-purpose apps to multi-purpose app (super apps) continues. The rationale of a super app is that consumers increasingly want the ability to engage and transact as simply as possible. Beyond just making payments or shopping, research shows that a digital consumer wants to integrate functionality of several varied apps into a single platform for ease and convenience. The super app model was born in Asia, with apps such as WeChat, Alibaba and Alipay.

There are several benefits to the development of super apps:

- Ability to drive greater engagement with a large, established database of consumers through the deployment of multiple interrelated functionalities (eg. shopping and payments).

- Opportunity to innovate and deploy products and services across a wide database, with agile testing and iteration using a AI-driven platform-based approach to scale products.

- Simplification of the onboarding process for new customers and reduced KYC (Know Your Customer) risks and costs.

- Provide a platform for partnering with external product and service providers to enhance customer experiences through integrated functionality. For instance, WeChat in China enables many apps which are built on top of their ecosystem.

Super App Surge:

Firms such as Uber, Facebook, Google and Amazon are taking steps to develop broader platforms built from their primary services.

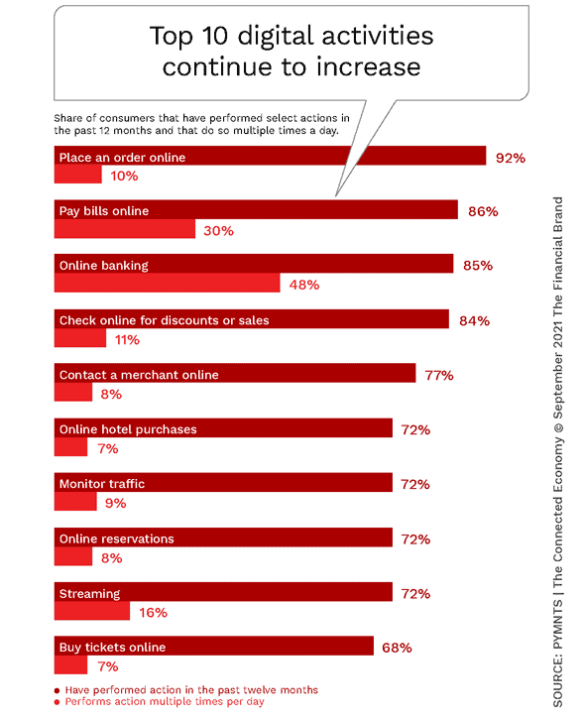

According to research done by PYMNTS, consumers who are highly digitally connected at home are also highly connected in banking (91%), travel and leisure (92%) and health (84%). This provides the potential for more big tech, big bank and other players with large databases to offer super app functionality that can combine many of the primary digital activities of connected consumers.

‘PayPal Bank’ or Banking Partner?

When PayPal, or any other payment or tech firm, expands their financial service offerings, the question always becomes, “Are you going to become a ‘bank’?” This is an important question, especially because of the massive database and the level of engagement consumers have with firms like PayPal, Amazon, Apple and Google.

In the case of PayPal, the shift to using digital wallets as opposed to using plastic is escalating – with no reason to believe this shift will stop. This provides a significant advantage when consumers are naturally using the PayPal platform to make online and offline purchases. Despite this advantage, Schulman makes it clear that his desire is not about becoming a “bank,” but about turning PayPal into a banking hub: “We’re not going to move into banking services, but we’re going to offer them on our platform.” He believes that, especially with commoditized financial services, PayPal can provide a platform that can distribute these services at scale.

For instance, most of the major financial institutions put their rewards points into PayPal, allowing customers to spend points at any of the 32 million merchants supported by PayPal. This was also the strategy to offer a high-yield savings account through Synchrony Bank. With the new savings feature, customers will be able to transfer money between PayPal Savings and their PayPal balances to use for purchases.

“Our clear business model is to work hand-in-hand with financial institutions, the networks and the regulators to define what the best value proposition is for consumers and merchants,” says Schulman.

Other banking functionality that is included in this newest upgrade of the PayPal app is the support of direct deposit, allowing customers to add all or a portion of their paychecks to their PayPal accounts. There will also be enhanced bill pay functionality enabling users to track, view and pay their bills.

Finally, the enhanced PayPal app will include a new shopping hub where customers will be able to make purchases and earn rewards. They will also be presented highly personalized deals based on purchase activity over time leveraging their acquisition of the Honey platform in 2019.

The end goal for PayPal is not only to increase payment volume, but also increase customer engagement that impacts loyalty and eventually could make the PayPal app an indispensable part of every consumer’s life.