Trying to stay on the leading edge of bank tech today is a challenge for banks and credit unions not because there is a lack of information but because there’s such a deluge of it that sorting out the truth feels impossible.

“I get emails every week from fintech vendors, and I don’t know what’s real and what’s ‘slideware,’ and what will work in some verticals of banking and what doesn’t work in others,” says Carson Lappetito, president of the $2.5 billion-asset Sunwest Bank in Irvine, Calif. (“Slideware” is a term for technology touting benefits that are more wish than reality.)

Beyond that is the challenge of finding technology that helps the bank or credit union advance without outstripping its needs — tech that just does too much.

“I see a lot of technologists who are trying to build amazing Ferraris for the industry,” says Lappetito. This stuff can be fascinating, he adds, “but the reality is the banking industry needs single and double hits from a technology standpoint, things that are not overly complex that will help them execute the blocking and tackling of their business model.”

That’s why Lappetito says he was drawn to a new peer-exchange network, where Sunwest Bank is one of about 250 financial institutions sharing insights on technology vendors with each other.

Finding those technologies that are just right — they’re effective, a good fit, not overly complex — can be a time-consuming process. A big part of that is getting honest views from executives at other banks and credit unions about how well the technology works with various core systems. Conferences can be helpful, but often financial institutions have pressing needs.

Though every vendor is happy to give references to their satisfied customers, Lappetito says that’s not very useful by itself. The better option is to find institutions that had challenges implementing the software and will talk about the process of making it work.

But how do you track down those beyond the 100% happy ones?

Enter True Digital Group.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Fractional Marketing for Financial Brands

Services that scale with you.

Database for Researching Fintechs and Other Bank Tech Vendors

Sunwest Bank, which serves markets in Arizona, California, Florida, Idaho and Utah, is among the early adopters of an offering from True Digital. The fledgling company approaches the sharing of information about technology vendors as a membership concept.

The banks and credit unions that sign on as members contribute to a database, inputting what vendors they are working with, what technology products they are using and what their general experience has been. Then they get access to the database, where they can research a variety of things. Maybe they want to vet a new technology they are considering or to find other financial institutions that may have solved a similar challenge they are having with a particular integration.

For institutions $2 billion and above in assets, the annual membership fee is $10,000, half that for smaller banks and credit unions.

Rebooting Tech Vendor Evaluation:

In less commercial times, industry trade organizations often served as clearinghouses of information about vendor options, but the explosion of information, the expanding role of tech in banking, and the widespread practice of association endorsements and vendor sponsorships has muddied that well.

Lappetito estimates that once his bank has fully implemented True Digital’s approach to vendor research it will save at least half a full-time equivalent in salary and time. But that’s only part of the savings.

Lappetito points out that the savings in money, time, lost momentum and angst of not attempting to adopt and implement tech that’s a bad fit is almost incalculable.

In addition, being able to readily discuss potential new tech with present users may hasten going live with a given package. Not every journey has to be a complete voyage of discovery.

Read More:

A Virtual Forum for Sharing Bank Tech Experiences

Patrick Sells, co-founder of True Digital, has had a varied career in financial services, including stints as chief innovation officer at NYDIG, a bitcoin company, and at the tech-oriented Quontic Bank in New York City. He launched True Digital, which is based in Austin, Texas, in April. The pioneer members range in size from de novos with $40 million of assets to regionals with $100 billion of assets.

Along the way in developing the True Digital platform and the bank and credit union network it will rely on, Sells says he had something of a tech epiphany.

“A bank today is really just a combination of a whole bunch of vendors, more so than other kinds of companies,” says Sells. “It’s just a stack of vendors, and no wonder, then, that it’s so complicated. You have all of these vendors’ offerings stitched together — a bank of 500 employees will typically have more than 250 vendors.”

Sells says True Digital gives institutions a place where they can get insights about specific technology provided by specific companies from other institutions who have used it, all in a noncommercial atmosphere. Only banks and credit unions are permitted to join and access the database. Membership is not available to vendors or consultants and there are no sponsored pages, advertising or other content with a commercial purpose. No data from the network nor the database is sold.

Sells’ pricing for the service — at no more than $10,000 annually for membership — is meant to be affordable but also provide sufficient support to make it profitable without the need for ancillary revenue streams.

Lappetito, of Sunwest Bank, is among those who see value. “If you can’t spend $10,000 to try to optimize your vendor management, you’re just not looking at the big picture,” he says.

Though there are other platforms to help with vetting tech providers — Bank Director’s FinXTech Connect, for example — Sells contends True Digital is unique. “We allow for big banks and small banks and big credit unions and little credit unions. What that does is create a very rich database. Most associations or most networks in the industry don’t cross over in those same ways,” he says, adding that when new institutions onboard, typically less than 5% of the vendors they submit are new to the database.

Read More:

The Process to Get Started Using the Database

“To be a member you have to be willing to share with other members a certain amount of information about your institution and the vendors and products it uses,” Sells explains. This entails not only providing information that appears in the pages of the database, but also sharing experiences good and bad with fellow True Digital members, who might send a message through the system to inquire. (The database does not include such information as a vendor’s pricing.)

Every entry submitted by a bank or credit union is vetted to be sure it reflects current information concerning vendor firms, according to Sells. True Digital’s vetting has actually found incorrect information about vendors, and even found that different divisions within a financial institution sometimes have solved for similar challenges with different vendors.

Sunwest Bank’s Lappetito says the time taken to upload data is approximately the same as doing so in a vendor management system.

True Digital understands institutions’ concerns about data security and has built routines to control risks. One, without getting too specific, is designed to flag activity exceeding human reading speed and block access to such inquiries.

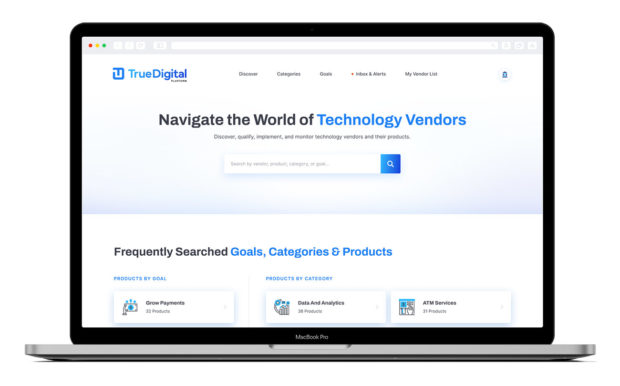

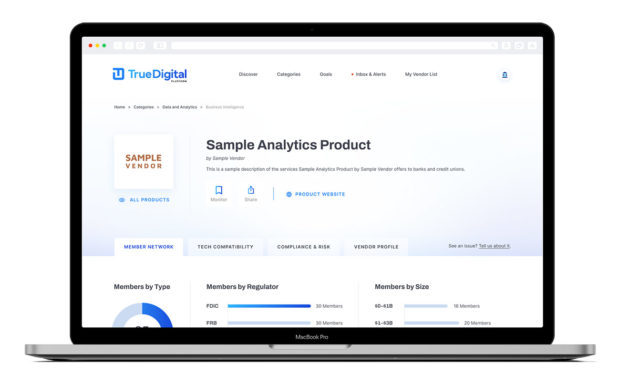

Here’s a short test drive of the main features of the True Digital platform, based on a demonstration that Sells gave for the editors of The Financial Brand. (Please note that the following screens are for illustrative purposes only.)

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Test Driving the True Digital Platform

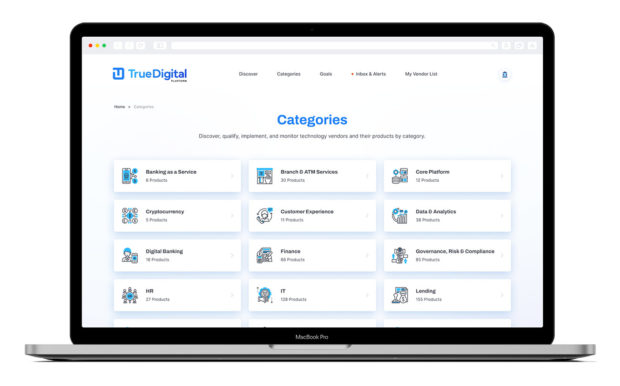

The database can be navigated from True Digital’s homepage, shown below. Users can search by goals (such as improving balance sheet management), by categories (such as compliance) or by specific products.

It is not possible to pick a specific bank or credit union and pull up all of their vendors, Sells says. That is considered too invasive, in terms of exposing a bank’s or credit union’s tech stack to potential competitor institutions.

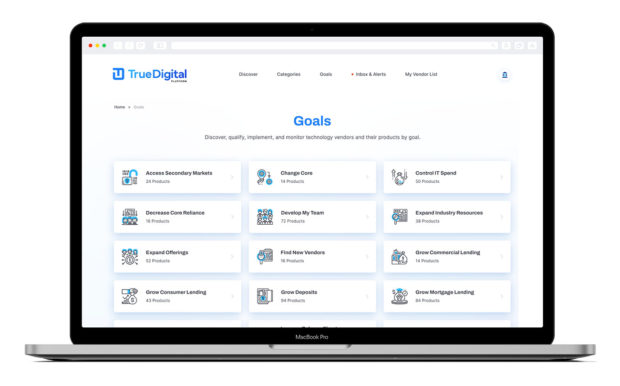

“Goals” is important as a search option because the user may have a better idea of what they want to accomplish than the specific type or types of tech that will achieve it, according to Sells.

“This will show me the types of vendors my peers are using to accomplish that,” Sells explains.

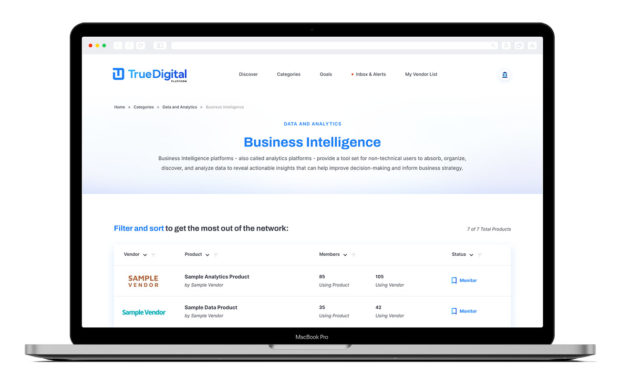

Data included in overview screens of specific companies and products includes the number of member banks and credit unions doing business with the vendor overall and the number who are using specific products.

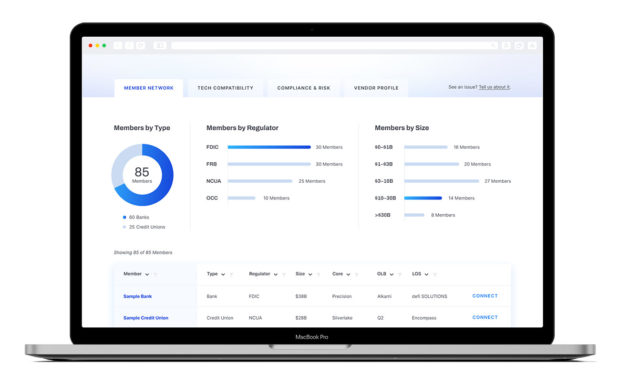

Among the statistics the platform shows are breakdowns of product users by institution type, regulatory agency and asset size. Specific counts of clients using various technologies can be helpful to illustrate whether a given product is widely used.

Read More:

- Arvest’s Digital Transformation Focuses on Customer Pain Points

- Banks Seek Digital Transformation via Fintech Collaborations

Data to Help Satisfy Compliance and Regulators

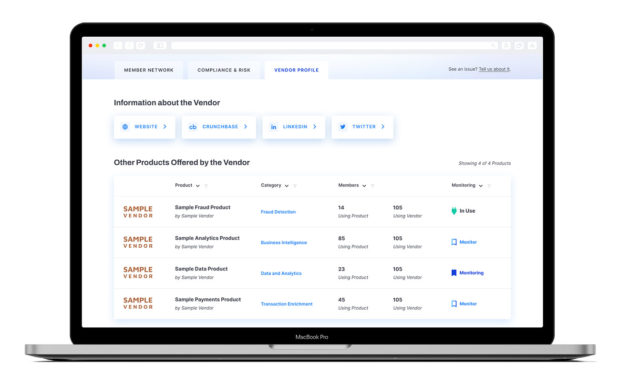

Product pages link to such items as vendor websites, additional information concerning the product, and news items concerning the vendor. There is also a tab on each product page leading to a profile of the vendor and a tab covering the product’s compatibility with other software.

“For every vendor in the system we also create a monthly report that shows if the vendor has gained or lost institution clients in the system, which could be an important risk factor,” says Sells. This can help satisfy regulatory expectations that institutions are using third-party monitoring of their vendors.

Users can set up monitoring of given vendors that they aren’t currently using but are considering trying in the future. This serves as an alert for any events that may influence the institution’s product decision.

Product pages also include a “compliance and risk” tab, as seen above. Sells plans to incorporate a risk assessment there for every vendor in the system. This will identify types of risks that must be considered when evaluating that type of software, in general, and also flag incompatibility issues and other alerts.

Lappetito says this function should help with regulators, who are concerned about vendors overall, but are especially amped up about fintechs.

“There’s a big regulatory fear about fintechs. Fintech gets painted with a broad brush.”

— Patrick Sells, True Digital

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Researching a Tech Product and Connecting with a Current User

Further down on the product screen are listings for all of the institutions using the given product. These line items include the following data about the institution: institution type, regulator, size, core system and more. That’s to help members who are making an inquiry select which institutions might be the best sources to offer input.

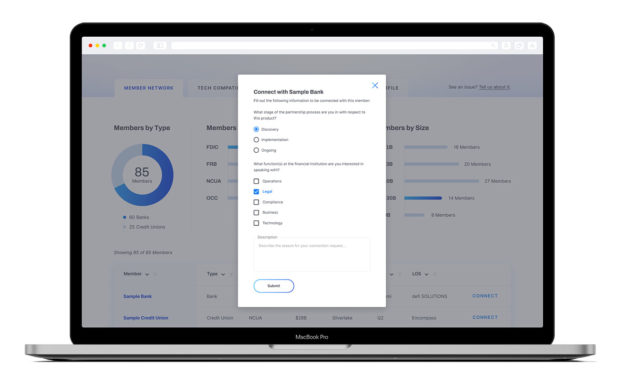

The platform is designed to facilitate communication between those searching for new solutions and those who are working with the products. The screen below shows the process to make the appropriate contact with the institution using the product.

Part of the logic behind the checkboxes is to direct the reference contact to the person at the institution best qualified to address a specific query. A compliance question best goes to a compliance officer, for example.

Sells says this should make contacts more productive on both ends and may even, in time, drive more queries to be made by email rather than time-consuming telephone calls. (Both emails and phone calls are a private exchange between the two institutions participating in True Digital’s platform.)

There are also comprehensive listings of all products offered by the vendors that are covered by member entries in the system.

Read More:

- This Community Bank Innovation Lab Picks Its Battles — and Wins

- Banks Should Scavenge Troubled Fintechs’ Talent and Technology

Seeking More Ways to Help Solve Technology Problems

True Digital is working to develop new functions and enroll more members, Sells says.

One task ahead is expanding the ways members will be able to search. Take a process that entails multiple types of software — for example, online account opening. Some bank and credit union executives may not know all of the elements that would go into a given process.

The database could show them what assorted technology others have used to achieve that goal and which products have played well with each other.

But Sells’ vision is that True Digital will offer some tips, almost like the recommendations Amazon gives when it says others who bought this also bought that. “It could say, ‘You’re using these five vendors to accomplish this process. Did you know that other institutions who use those five vendors also use these other two vendors for the process?’” Sells says. “That could save a ton of time.”