MoneyLion likes to use the word “roar” in its marketing. It’s a pretty obvious connection for the mobile-only brand that aims to empower everyday consumers in their financial lives.

The bigger question for the company and its competitors — both traditional and neobank — is whether MoneyLion will begin to roar in a much bigger way than it has since it launched in 2013.

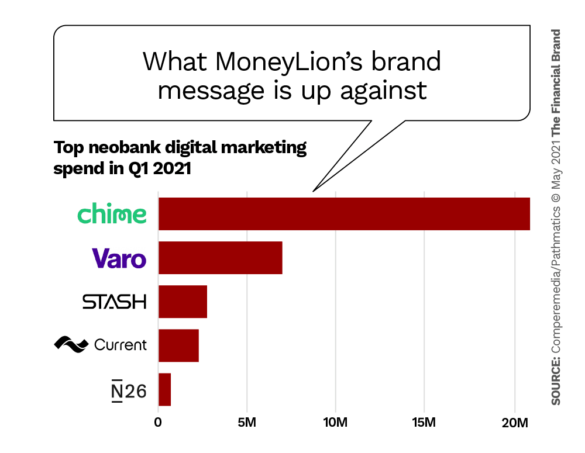

With 7.5 million registered users on it mobile personal finance platform, MoneyLion is well ahead of some well-known neobank players including Varo Bank, N26 and Monzo, according to The Financial Brand’s List of Digital Banks. But it trails Revolut, Chime and Robin Hood, among others. Revolut is a global brand with much of its base outside the U.S. and Robinhood concentrates on brokerage. But Chime is U.S.-based and dominates the neobank space with about 12 million users.

Three significant developments, however, may cause other financial institutions to rethink assumptions about MoneyLion.

In one deal, the company acquired Wealth Technologies, a pioneer in algorithmic financial planning technology. The buy took MoneyLion’s existing artificial intelligence and machine learning capabilities to “another level,” as MoneyLion Co-Founder and CEO Dee Choubey told The Financial Brand in an interview.

Read More: How This Ex-Apple Card Strategist Is Taking ‘Dave’ to Next Level

The second development is MoneyLion’s move to go public via a special acquisition company (SPAC). The deal, in which MoneyLion will merge with “blank-check” company Fusion Acquisition, gives MoneyLion an equity value of $2.9 billion — up from $675 million in 2020 — and could provide the company with $526 million in cash, according to PitchBook. The funds will enable MoneyLion to build its brand and expand it’s marketplace.

The launch of that marketplace is the third development.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

MoneyLion’s Marketplace Strategy

Choubey says the company has been developing the marketplace concept for some time, but used the announcement of a partnership with insurance broker NFP as the occasion to officially launch the MoneyLion Marketplace, a platform that matches the neobank’s members with various financial brands.

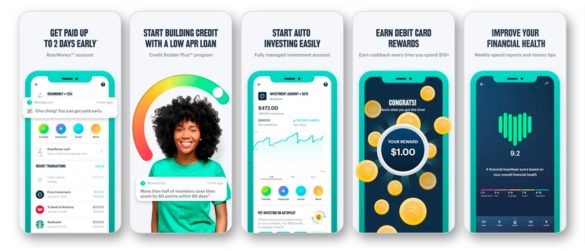

NFP will provide MoneyLion members with direct access to insurance and financial wellness offerings. Nationwide will be the first insurance provider available to MoneyLion members through its marketplace. Choubey says the NFP partnership adds insurance to the “all-in-one” platform where consumers can already do banking, investing, apply for credit, and get financial advice and insights.

“Traditional financial services providers are built to keep people in their ‘swim lane.’ There’s a banking swim lane, an insurance swim lane, an investing swim lane.”

— Dee Choubey, MoneyLion

“This is the coming out party for the marketplace strategy,” Choubey states. The key to that strategy is having data of all a consumer’s financial life in one place, enabling them to have what Choubey calls “a single model of the consumer.”

“Traditional financial services providers are built to keep people in their swim lane,” the CEO maintains. “There’s a banking swim lane, an insurance swim lane, an investing swim lane.

As an example of why this can be problematic, Choubey says that if a consumer’s dishwasher conks out and they need a few hundred dollars to get a new one, if their banking “swim lane” shows them to be low on funds, they’re out of luck.

“Many times the consumer isn’t given credit for actually having a very healthy financial life overall — in their insurance vertical, or their savings or in their 401(k) or their investment account,” say Choubey. MoneyLion has been steadily building the AI-based data capabilities that enable a more complete view.

Read More: Is Challenger Bank Chime the Future of Retail Banking?

The insurance deal also highlights how MoneyLion is not going to create every financial product it offers on its marketplace. “The whole strategy here is to help consumers deal with financial pain points,” Choubey observes. “With insurance it made a lot of sense for us to partner rather than build it ourselves.”

MoneyLion Leader on a Banking Charter:

There are benefits to a charter and we’re actively monitoring it, but we feel today it’s better for us to be a ‘router’ of services for the consumer and provide really contextualized experiences around financial products.

Upcoming products to be added to the marketplace “at the right point,” according to Choubey, include student loans, home equity lines, mortgages and other traditional lending products.

The CEO notes that MoneyLion’s platform uses a commission advertising model and that the company shares commission revenue with its partners.

What the Platform Data Enables Them to Do

Choubey says MoneyLion is “onboarding preferences continuously” as consumers open a RoarMoney mobile banking account, an investment account or borrow. That plus the insights it gathers about “how they’re spending, how they’re investing, how quickly they’re spending — once their paycheck comes in — the amount of money they’re earning gives us, from a double-blind perspective, a significant amount of insight into that consumer’s financial life,” Choubey states.

“The real elegance of this is that not every MoneyLion member gets the same offer,” Choubey continues. “It’s contextualized and personalized for exactly what you need that day or where you are or as a person — or as a family — from a financial perspective.”

Advice on Advice:

You’re not going to get people to ‘eat broccoli’ every day. You’ve got to present financial data in ways that are humorous, and in the right tone.

The Wealth Technologies acquisition enhances the ability to personalize. “Traditional financial planning is very linear,” Choubey maintains. He says that Wealth Technologies’ fGPS (financial GPS) capability, which is trademarked, allows MoneyLion to not only advise a consumer how their investment portfolio should change, but how they should be thinking about insurance, cash flow and even non-financial product consumption.

“A lot of folks build various financial products — a debit card or a robo advisor app, for example. We don’t think that’s necessarily innovative in 2021,” Choubey states. So what is? “The ability to tell consumers how to use these products and piece them together. That’s the interesting part and we believe that this capability is where finance is going.”

For example, MoneyLion already lets people know how much they’re spending buying coffee every week, but it can now go much deeper and say ‘You’re spending more on auto insurance compared to people like you. Here are three better options.’ And the platform will suggest, ‘Take that $17 a month you saved and put it into your managed account at a 90/10 aggressive strategy. That $17 a month for the next three years will compound into $700 by 2027.”

What It Means:

The power of fintech is taking financial advice that you would get from JPMorgan, and making that available to the gig economy worker making $70,000 or $100,000.

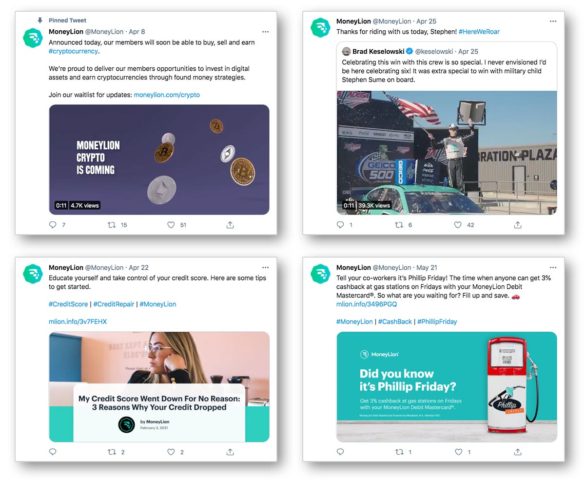

“We can even tell a consumer, ‘Hey, it’s safe for you to invest in single stocks,” Choubey states. Or even, “It’s safe for you to maybe take a couple hundred bucks this month — your ‘safe-to-play’ money, to invest in crypto.” In fact, MoneyLion is in the process of rolling out the ability for consumers to buy and sell Bitcoin, Ethereum and other cryptocurrencies.

Read More: Why Do Consumers Love Fintechs Like Chime and SoFi?

How MoneyLion Will Grow its User Base

Can MoneyLion catch Chime? And, for that matter, how can it compete with the megabanks?

“For the last eight years we’ve been highly focused on building the technology,” says Choubey. He believes the time to leverage that into rapid growth has come. Hence, the SPAC transaction.

The biggest use of the proceeds will be to “increase awareness of the brand, invest in our affiliates business and partnerships, and invest in influencers,” Choubey states. The branding expansion alone will require a big war chest considering the kind of digital marketing dollars being spent by neobank/fintech competitors.

Beyond marketing, Choubey believes MoneyLion’s technology allows it do more than just talk about viewing the consumer holistically. “The ability to wrap our low-friction financial accounts with ‘what to do next’ advice, and turn-by-turn instructions, differentiates us significantly from the competition,” he states.

As for competition from the likes of Chase, Bank of America and Wells Fargo, Choubey is sanguine. “America is incredibly large,” he says. “From a mobile digital wallet perspective, we’re still in the third inning of trillions of dollars in retail deposits finding a mobile, digitally-native home.”