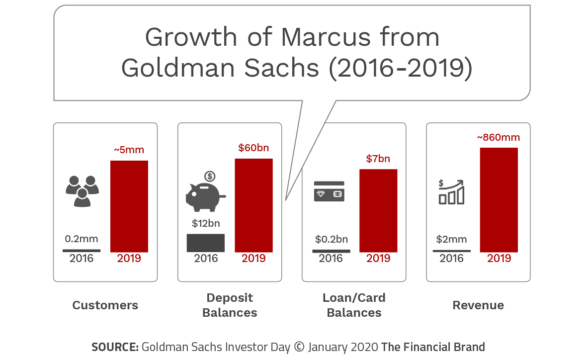

In 2016, Goldman Sachs introduced Marcus, the firm’s first consumer banking offering that included an online saving account and no-fee personal loans for retail consumers. Named after Goldman’s founder, the Marcus platform provided highly competitive rates, delivered without the branch and back office infrastructure that often hampers legacy financial institutions.

Beyond organic growth, Marcus has increased their consumer banking business with the acquisition of the deposit base of GE Capital Bank and the personal finance management capability and customer base of Clarity Money. In 2019, Marcus introduced a highly successful consumer credit card in conjunction with Apple.

Since the 2016 launch, Marcus has grown into a formidable digital banking platform, leveraging extensive research and development, advanced digital technology and a focus on simplicity and transparency. The result has been a consumer business with $60 billion in U.S. and U.K. deposits, $7 billion in consumer loan balances and more than four million customers in the United States and the United Kingdom.

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape. Read More about Move the Needle from Attrition to Acquisition Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers. Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Send the Right Offers to the Right Consumers

The expansion of the consumer business made a significant jump forward early in 2020, with the long-awaited introduction of the Marcus mobile banking app. Built with the assistance of many of the same developers and engineers who worked on Clarity Money, the app is very clean and straightforward.

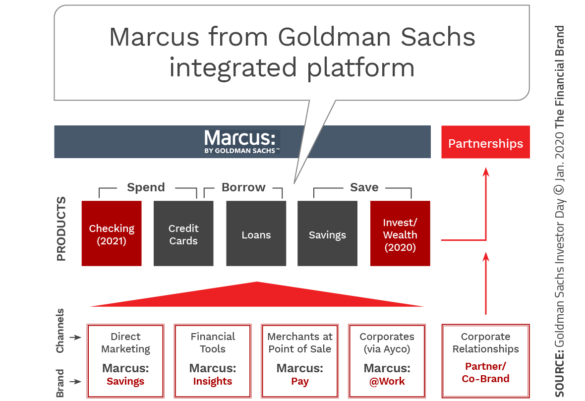

Completing the portfolio of products consumers expect from their primary digital banking provider, Goldman Sachs has just announced plans to offer retail consumer checking accounts in 2021. Obviously, the intention is to expand the relationship in place with more than four million existing customers as well as to build new relationships without a bricks and mortar infrastructure. The bank will also offer zero-fee wealth management services accessed through the mobile app by the end of 2020.

“We aspire to be the leading digital consumer bank,” stated Eric Lane, Global Co-Head of Goldman’s Consumer and Investment Management Division. “We’re starting with loans, we added savings and cards, and we’re working to build out the balance of the digital products suite, including wealth and checking.” Lane continued, “We’re trying to deliver a retail bank branch through your phone.”

The growth targets for the Marcus banking app reinforce their commitment to the retail consumer and the reason why all retail banks should keep a watchful eye on Goldman Sachs going forward. According to Goldman, they have plans to more than double consumer deposits to at least $125 billion over the next five years and to grow loans and credit card balances fourfold, to over $20 billion during the same period.

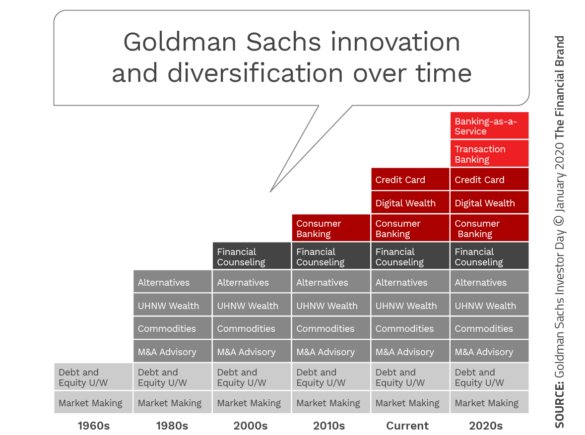

The introduction of Marcus has transitioned Goldman Sachs from their investment bank and trading legacy. Marcus allows Goldman to diversify its revenue and funding sources by offering savings and lending services to retail consumers. To illustrate one reason retail deposit growth is important, Goldman CFO Steven Scherr states, “For every $10 billion in new deposits, Goldman can reduce the cost of capital by $80 million.”

Read More:

- Marcus by Goldman Sachs: Perfectly Positioned Post-Pandemic

- Why Bank + Fintech Partnerships Are Going Nowhere

- What the Surge in Fintech Launches Signals for Banking’s Future

Integrated Platform Banking

Five years ago, former Goldman chief executive Lloyd Blankfein declared that their company had become a tech firm. This is very clear when you see the massive commitment that has been made to engineers, developers and R&D. This was further reinforced during the firm’s recent investor day presentation, where the consumer banking platform was introduced.

The origin of the Marcus platform was a no-fee, no-minimum online savings account that offered above market interest rates. This was a key differentiator as Goldman sought to lure clients away from national as well as regional banks that kept rates exceedingly low. The platform expanded to offer no-fee loans and credit cards in partnership with Apple. The platform is now further expanding into checking and wealth management later this year and in 2021.

In explaining the movement into new services and new delivery channels, CEO David Solomon stated, “We set out to build our consumer business from a clean sheet of paper. In designing Marcus, we spoke with more than 10,000 people across the country to understand their banking needs. Value, simplicity and transparency are at the core of our consumer products, which is based on this feedback.”

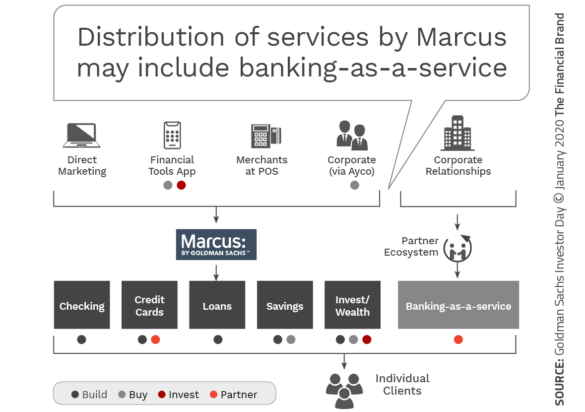

As shown in the chart above and the one below from Goldman Sachs, the Marcus platform is also open to other partnerships and collaborations to build additional services or find new ways to expand market share. There is even positioning of the Marcus brand as banking-as-a-service.

Marcus to Offer Loans to Amazon Merchants

It has been reported by The Financial Times that Goldman Sachs is close to signing an agreement with Amazon to offer small business loans to companies that utilize Amazon’s e-commerce platform. While Amazon already offers credit for their small business clients, the Marcus partnership would extend the capability, helping both Amazon and Goldman Sachs in the space. Amazon introduced their lending capability in 2011, with $863 million in small business loans reported at the end of 2019.

This is an excellent example of the positioning of Marcus as a ‘Banking-as-a-Service’ (BaaS) provider. This is also the second time Goldman has sought to partner with a tech giant to expand their market reach. Their partnership with Apple in the credit card business is considered a success by many industry observers, giving Goldman access to Apple’s 100 million U.S. customers. The partnership with Amazon would connect Goldman to 1.9 million merchants that work with Amazon.

Read More: Walmart’s Fintech Deal Threatens a Much Deeper Banking Incursion

Commitment to R&D

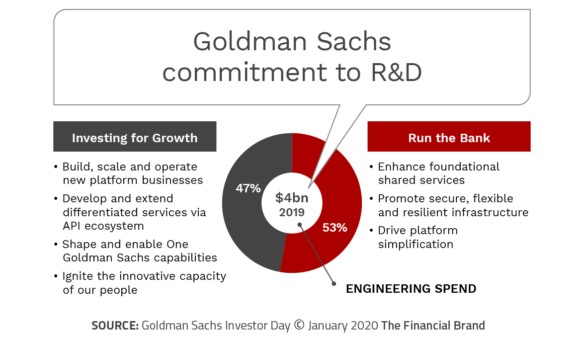

Unlike other traditional financial institutions, but similar to fintech organizations globally, Goldman Sachs has committed enormous resources to support R&D and technology. As shown below, this commitment extends beyond just resources to ‘run the bank’, but also includes close to half of the investment being spent to set the firm up for future growth.

More importantly, as a corporation, 46% of Goldman Sachs job postings are in technology. The key is that Goldman has committed extensively to leveraging technology to efficiently scale the delivery of products and services to clients.

Positioned for the Future

Unlike most fintech start-ups, Goldman Sachs has strong corporate name recognition to support issues around trust and security with the Marcus brand. When asked about brand recognition, Goldman executives state, “It’s not just Marcus. It is Marcus by Goldman Sachs. There is a high familiarity with the brand and people want to engage with Goldman. … We are creating a user experience that is tethered to the mother brand.”

Obviously, with the Goldman organization behind the Marcus brand, there is also significant investment potential. While many fintech firms need to go to the marketplace for funding rounds, Marcus has funding available from the parent organization. When we think about some of the challenges that many fintech firms have, it’s things like scale and distribution, which many can only get through partnerships.

“The tech capabilities of Amazon, Apple and their peers combined with the regulatory know-how of incumbent FIs like Goldman is a powerful force,” states Business Insider. “Such collaborations can allow these firms to offer digital financial products directly to millions of customers at price points that can significantly undercut their fintech peers, creating a huge competitive barrier for fintechs to navigate.” Obviously, this also changes the traditional banking competitive landscape as well.

In the future, the Marcus brand will only grow. With the addition of wealth management and eventually checking accounts that are 100% supported by a mobile app, financial institutions of all sizes should take note of the potential for Goldman Sachs to be a major player in the marketplace. If banks and credit unions are not paying attention today (when there is time to react), there is a good chance Marcus will be the source of nightmares going forward.