Fintechs and traditional financial institutions have had an odd relationship over the past decade or so.

Many fintechs started out declaring their intent to replace banks, then morphed into vendors eager to offer their tech innovations to those very same rivals. Other fintechs are customers — or partners, depending on your viewpoint — of the traditional banks that have made a business of banking as a service.

Overlaying these relationships is an economy that is becoming more challenging for all. That’s sure to set new dynamics in motion, especially with funding issues expected to grow acute for many fintechs this year.

Ron Shevlin, chief research officer at Cornerstone Advisors and author of its annual “What’s Going On In Banking” study, says both sides have fresh thinking to do about their vision for the future.

In an interview with The Financial Brand, Shevlin offered an overview of the key factors he sees affecting how banking institutions and fintechs relate to each other going forward.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Rethinking Where Fintech and Banking Fit into the System

“If you look at fintech penetration, adoption and displacement in banking, we saw it increasing for a while and now we’re on the downside of that,” Shevlin says.

The tumult will sort out the fintech survivors, and Shevlin believes they will be better and smarter afterward.

“Fintechs took a hit and they’re down this round. But they’re going to get back up. And some are going to be stronger than they were before.”

— Ron Shevlin, Cornerstone Advisors

Shevlin also has a pointed — and surprising — message for fintechs: “There is no ‘fintech industry.’ There are fintech companies, sure, but they’re in the banking industry or, more broadly, in the financial services industry. They don’t understand that. It’s going to be a hard realization for them that they’re just another financial services company.”

Right now there’s a lot of focus on fintech problems, something of a boomerang syndrome. The press seemed to get enamored with fintech and neobank “cool” without questioning how they would actually make money, Shevlin says.

But for all the disruption they caused, and the way they have changed how financial services are delivered, “they haven’t displaced the incumbents,” Shevlin says.

“I like to say that I’m a technology realist,” he adds. “New technologies come, we adopt them. The change that happens takes so long that incumbent players often have plenty of time to adapt and to adopt.”

Read More:

- Where to Look for Value in the Fintech Wreckage

- Banks Should Scavenge Troubled Fintechs’ Talent and Technology

- Why Neobanks and Fintechs Have Made ‘Underbanked’ an Obsolete Term

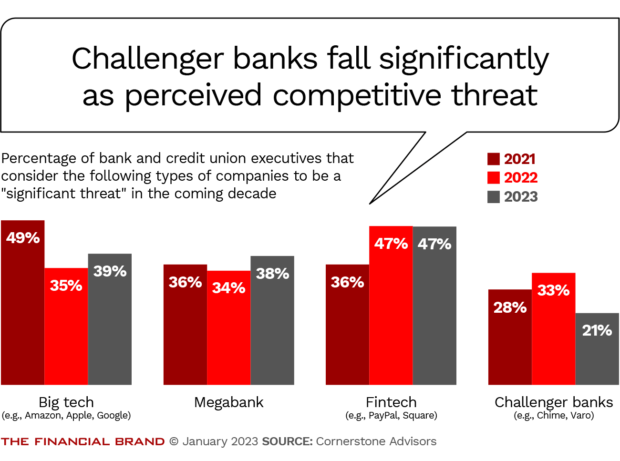

How Bankers Assess the Impact of Challenger Banks

Fewer traditional financial institutions view challenger banks like Chime and Varo as worrisome these days, according to Cornerstone’s survey. Only 21% of respondents described them as a major threat — down 12 percentage points from the previous year.

Executives at about 300 banks and credit unions, mostly in the range of $250 million to $50 billion of assets, participated in the survey. Shevlin says a large share of the respondents are forward-thinking types that favor industry evolution. (Cornerstone calls them “the troublemakers.”)

But even if challenger banks seem less threatening, the share of banking executives who view fintechs as major competitors has remained steady at 47%. And it is now more than twice as high as the share who view challenger banks as a threat. In the Cornerstone study, the fintech category consists of companies like PayPal and Square.

“Challenger banks had a good hook for acquiring customers,” such as a lack of fees and high interest rates on savings, said Curt Queyrouze, the president at the $3.1 billion-asset Coastal Community Bank, who participated in Cornerstone’s webinar about the “What’s Going On In Banking” study. But many have failed to create engagement levels that prompt consumers to move a provider to their top of their wallet, so haven’t produced the profitability needed, he said.

“It’s not ‘game over,'” said Queyrouze, “but that’s where things stand right now.”

As the label “challenger banks” suggests, one thing they did was challenge traditional banks to get better.

“Challenger banks have been an opportunity for us to learn,” said Julieann Thurlow, president and chief executive officer at the $744 million-asset Reading Cooperative Bank in Massachusetts. “It’s disappointing to have to say that for our industry. But they created better experiences for consumers, and made it frictionless to become members or customers.”

Thurlow said she habitually tries out new players’ offerings to see what her bank could emulate. “We have to make sure our customer experiences are as delightful as the Chime experience and the SoFi experience — and just as quick and effective — because that’s how we’re going to win the game,” she said.

Read more:

- Core Issue: Plug-and-Play Trend Is Transformative for Banks

- Three Ways to Invest in Innovation for Growth-Minded Banks

‘Community Fintechs’: The Challenger Banks That Could Defy the Trend

Shevlin warned webinar listeners against complacency. Generalists like Chime that aim for middle-income and low-income consumers may not end up holding the “primary accounts” for many of them, he said. However, challengers that he’s dubbed “community fintechs” may be more of a long-term threat.

“The challenger bank/neobank label is too broad,” Shevlin said. Successful community fintechs would go beyond generic offerings. Instead, the ones with the best chance of success will be those that craft approaches that meet specific needs of a market. Examples Shevlin gave include Panacea, which serves young physicians, and Nerve, which serves musicians and other gig workers. Another is Totem, which intends to work through tribal governments to meet Native Americans’ special financial needs.

“That’s where the threat for a lot of midsized community-based financial institutions will be,” said Shevlin. “It’s not head-on competition. It’s new organizations chipping away at their customer base by meeting the unique needs of certain segments.”

Partnerships with ‘Embedded Fintech’ May Outweigh ‘Embedded Banking’

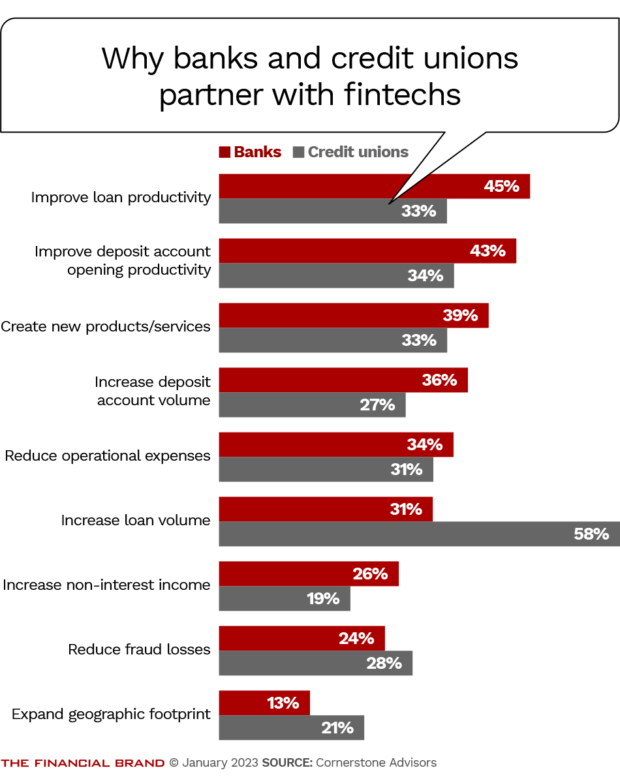

In the Cornerstone survey, seven out of 10 financial institutions agreed that fintech partnerships will be important to their future as a way to improve their operations. Stepping up productivity was a priority among banks, while the top priority among credit unions was increasing loan volume.

In both the 2023 and 2022 studies, a quarter of respondents reported investing in fintech startups. Banks tend to do this more than credit unions, according to the study data.

Shevlin said that some banks have flipped the idea of “embedded banking,” adding “embedded fintech” to their operations. The fintechs enable banks to offer new kinds of functionality and products.

Thurlow said Reading Cooperative finds this strategy essential: “We have to offer more than a checking account. We have to recognize that our customers’ lives have changed in many different ways.”

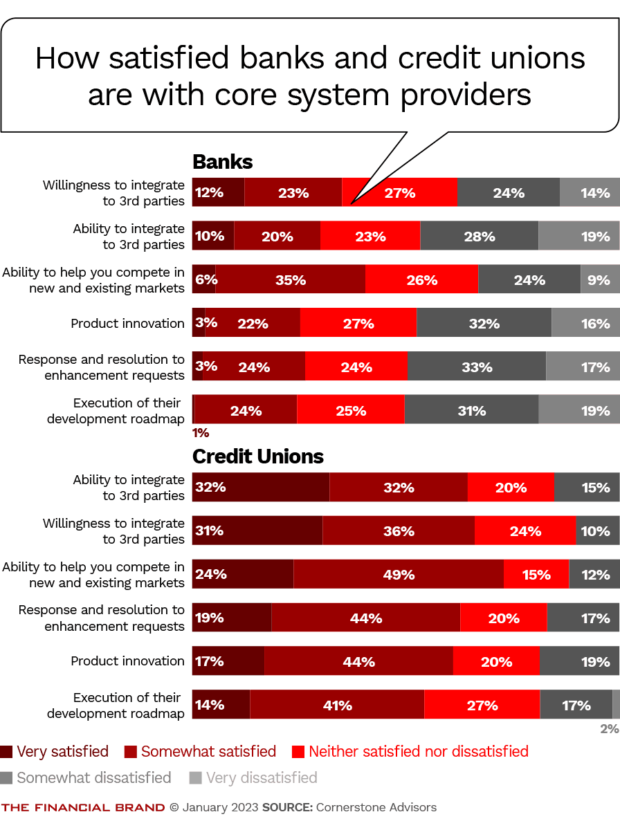

The urgency to adopt and adapt — “digital transformation” for short — is what’s lurking behind this. The study found that banks continue to be significantly dissatisfied with their core providers, especially in their willingness and ability to integrate core processing with third parties like fintechs. Credit union executives responding to the survey were more likely to express some satisfaction in these categories.

Digital Transformation Progress May Sometimes Be an Illusion

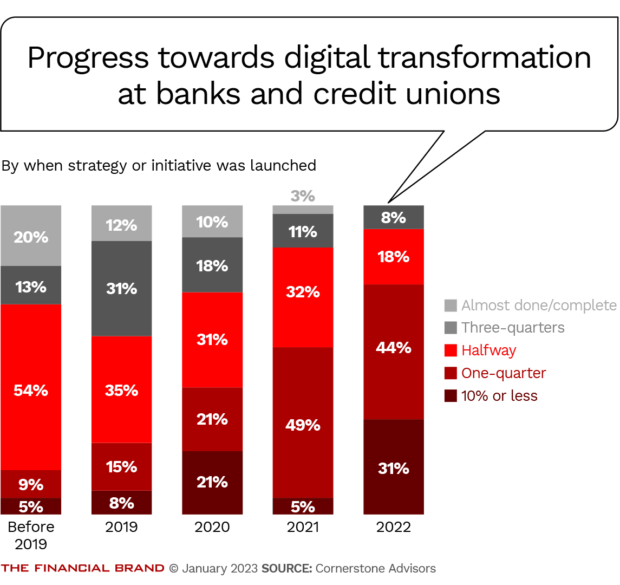

The study also raised an eyebrow when it comes to how banks and credit unions judge their progress on digital transformation. For example, as shown in the chart below, there’s a strong belief that they have completed their digital transformations, or are making significant progress. This is especially so with efforts that are a few years old.

Shevlin offered a snarky observation in response: “Wow! That was fast. And to think there are people who say the banking industry moves slowly!”

The veteran researcher points out that this perception of progress depends heavily on how “digital transformation” is defined by the financial institutions, “but we’re not buying these claims.”

“Overall, 25% of institutions said they’re three-quarters or more done with their digital transformation efforts. What do they have to show for their efforts? Not as much as we would expect,” the study says. Institutions that claimed to be at least three quarters of the way through their transformation were asked if they had improved by 5% or more in nine categories. In no case did more than two out of five institutions report such results.

“Five percent improvement isn’t exactly a high bar, but not even a majority of institutions have achieved that level of improvement in any of the metrics we asked about,” the study says.

The cause? Cornerstone thinks they’ve been undermined by failure to deploy some technologies that the firm considers to be table stakes. For example, three out of 10 institutions claiming to be at least three-quarters of their way through digital transformation haven’t adopted cloud computing.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Partnership with Nonbank Players: Banking as a Service

Fintech partnerships also take the form of banking-as-a-service relationships, or BaaS. That’s where the traditional financial institution provides banking services that a nonbank can’t provide on its own, due to either practical or legal barriers.

The Cornerstone study found that 7% of the survey respondents currently offer BaaS services. In addition, 4% are developing a BaaS strategy, 13% are actively considering one, and 46% say they might consider BaaS in the future.

“Why the strong interest in banking as a service? Growth and return. In addition to providing banks with new sources of revenue, the returns on assets and equity for BaaS banks … exceed the industry averages for all banks.”

— Cornerstone’s “What’s Going On In Banking” study

The study points out that BaaS can enable a bank to increase revenue from fees to the fintech or challenger bank for fraud management, risk management, compliance and processing. This can be on top of generating loans and deposits.

Thus far, chiefly smaller banks have taken this tack. Queyrouze’s Coastal Community is a leader among a relatively small part of the industry pursuing the strategy. He estimates around 100 institutions are actively doing BaaS now.

“Coastal wants to see this community grow,” he said during the webinar. “We’re actively encouraging other banks to get into this space. Why would we ask competitors to join us? Because this strategy takes a complicated ecosystem to pull off. That ecosystem can’t survive unless there’s a certain scale to it.”

For example, beyond the banks that provide the guts of BaaS, there are third-party firms that provide certain “middleware” services between the bank and its fintech client. These companies also often serve as matchmakers between potential entrants and various BaaS providers.

How long community banks will have this business line to themselves is a big question. Shevlin believes big banks will move into BaaS.

“Conventional wisdom holds that BaaS is a small bank’s game because of the favorable interchange rates” for banks with less than $10 billion in assets, the study says. However, the movement to pass a “Durbin 2.0” law, which made progress in Congress in 2022, would “hammer on those interchange rates,” it says.

Read More:

- Banking as a Service May Be Best Community Bank Survival Strategy

- When Is BaaS the Wrong Strategy for a Community Bank?

How Fintechs’ Current Slump Creates Opportunities

Thousands of people with tech skills and experience have been losing their jobs with fintechs and big tech firms.

“This is an opportunity to ‘right skill’ the organization for the future,” said Thurlow. The availability of ex-fintechers can help financial institutions tune their employee base to modern needs.

Queyrouze said his email inbox has been filling up with resumes since late 2022. “We’re moving on these and our hires don’t necessarily have to match a position that is open,” he said. “That’s an opportunity to us. We take talent when it becomes available.”

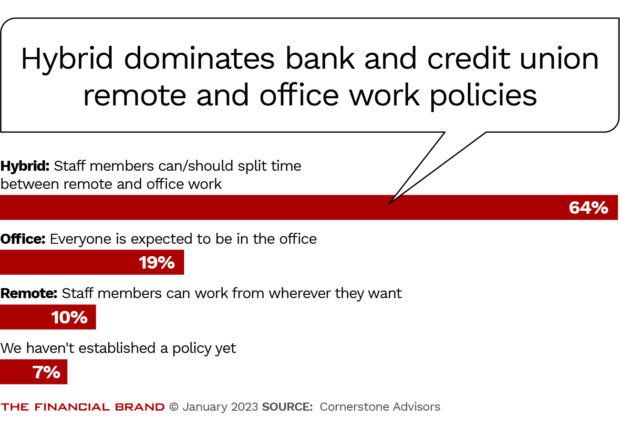

Some of that talent would rather work remotely. Queyrouze said the pandemic period marked a change for Coastal Community. It now has employees working in 32 states and Canada.

Survey respondents overwhelmingly reported a hybrid work policy — which allows some split of time between remote and office work. Thurlow indicated that at Reading Cooperative flexibility depends on a person’s job function.

Cornerstone’s Shevlin suggested that many industry executives have to readjust their thinking. Frequently, he said at the webinar, the reason they resist full work-from-home is fear that it will hinder collaboration.

He said executives must recognize that community banks and credit unions increasingly will depend on third-party firms’ employees — and those people won’t be based in the banks’ offices either.