Already a powerhouse in small business finance, American Express gave a big clue as to what its mid 2020 acquisition of online lender Kabbage might mean for banking with the launch of Kabbage Checking, Amex’s first checking account for small businesses. The card giant is now poised to pick off small-business customers — not just with card-related products, or online loans, but with interest-bearing checking accounts.

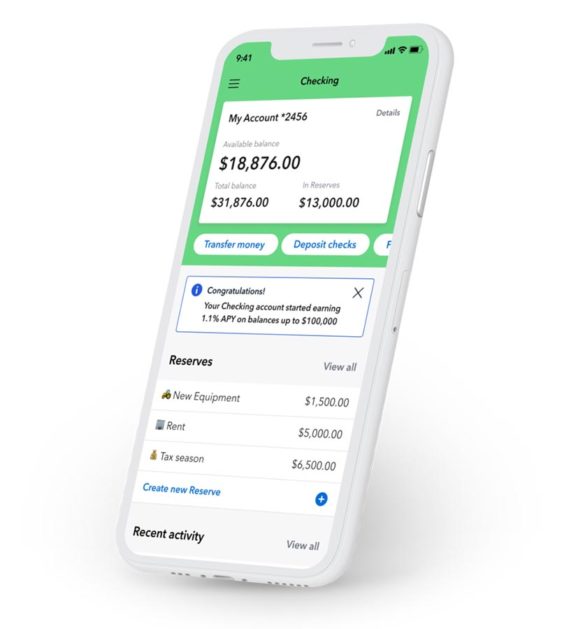

Kabbage Checking is a free, no-overdraft checking account paying 1.1% on balances up to $100,000. The account also comes with a Kabbage debit card, free in-network ATM access, electronic bill pay, and PFM wallets. Business customers can make in-person cash deposits at 90,000 participating retailers nationwide.

The bank behind the account is not American Express Bank, but Green Dot Bank. Just prior to its acquisition by Amex, Kabbage had partnered with Green Dot to offer a business checking account. Amex elected to continue that banking-as-a-service relationship for the new checking account.

When Amex acquired Kabbage, it stated its intention as “being an essential partner to small businesses through a broad range of payment, cash flow and financial management tools.” The company notes that Kabbage Checking “marks the first of several new digital cash flow management solutions from American Express.” Next up is a flexible line of credit offering between $1,000 and $150,000 through Kabbage Funding.

With no minimum daily balance requirements, the new checking account seems like it is designed for the smallest of small businesses such as gig workers and “solopreneurs.” In a statement, Kabbage President Kathryn Petralia described Kabbage checking as “a new banking service built to give those small businesses an upper hand to earn more, save more, and grow their business faster without sacrificing anything they expect from a bank.”

Read More: Rethinking Checking Account Strategy in a Digital Banking World

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Amex Is Tapping a Huge Market Banks Mostly Ignore, But Shouldn’t

Ron Shevlin, Director of Research, Cornerstone Advisors, isn’t surprised by the checking account offering. Amex has always had a strong hold on small and mid-size businesses (SMBs) but has faced increasing competition from Brex, OnDeck and other fintech lenders. Kabbage Checking is a way to retain SMB relationships, says Shevlin.

“Banks have such tunnel vision when it comes to SMBs. They only want to work with businesses with sophisticated cash management needs.”

— Ron Shevlin, Cornerstone Advisors

While Kabbage Checking isn’t what Shevlin would call a killer app, it’s yet another way that fintechs are chipping away at bank relationships. “Banks have such tunnel vision when it comes to SMBs. They don’t want to do business with businesses with less than $5 or $10 million in revenue. They only want to work with SMBs with sophisticated cash management needs,” said Shevlin.

Risk makes the smallest businesses unattractive, but Shevlin thinks banks and credit unions need to shed some of their risk aversion. Sure, some start-ups fail, he says, but some will succeed and grow. After all, much business growth happens in the sub-$10 million market. “If you decide not to go after SMBs, be prepared to miss out on growth opportunities,” warns Shevlin.

SMBs represent a $370 billion revenue opportunity for banks and credit unions, according to a Cornerstone Advisors report. Revenue could come from accounting, invoicing, bill payment or payment acceptance services. To capitalize on this opportunity, Shevlin suggests bundling small business back office and merchant services with deposit and lending services. He writes, “Integrating online receivables to a standard small business checking account makes the account much more valuable for the small business and more profitable for the bank.”

Read More: Fintechs + Ecosystems = Big Pressure on Banks’ Business Lending Role

More than Meets the Eye:

The 1.1% interest rate Kabbage Checking pays may seem paltry, but is way above what most financial institutions pay on business deposits, which often is nothing.

For some small businesses, the 1.1% rate could be the push they need to make a switch, or at the very least, open up a secondary business checking account to earn a bit of interest on money they don’t need access to right away.

The ‘Thank You’ Bounce From Covid Has Evaporated

According to PwC, 22% of small businesses are considering switching banks. Although you might think that those businesses that received Paycheck Protection Payment (PPP) loans from their financial institution would be the most loyal to their bank, in fact, the opposite is true. PPP loans didn’t make small businesses stickier to their primary financial institution: Four times as many of those small businesses that say they would switch actually applied for PPP funding.

Perhaps these small businesses are unhappy and frustrated by the hoops they had to jump through to secure PPP cash from their primary bank or credit union. Maybe they didn’t get all the funding they needed and have had to scramble to secure additional credit.

Of those small businesses that didn’t get the cash infusion they needed from PPP, more than one-third (34%) are considering a secondary bank and 26% are eyeing emergency loans — something Kabbage does very well. Kabbage, by the way, processed $7 billion in PPP loans to almost 300,000 SMBs, many of whom were self-employed (67%) or had ten or fewer employees (90%).

We’ll Take Your Leftovers

American Express isn’t necessarily looking to replace small business’s primary checking relationship with their bank or credit union. The company sees value in using its Kabbage brand to play second fiddle and simply get SMBs in the door with services beyond lending.

An article on Kabbage’s website titled “3 Benefits of Having a Secondary Business Checking Account in 2021” tells small businesses how they can use a secondary account to manage taxes, reduce liabilities and feel more secure. The article also notes that small businesses can get these benefits either temporarily or long-term. It’s a low commitment “hook.”

This idea could appeal to small businesses who aren’t exactly in love with their primary financial institution. J.D. Power’s Small Business Banking Satisfaction Study found that only 37% of small business customers feel that their financial institution appreciates their business and only 32% say their institution understands their small business.

Another BaaS Opportunity?

The usual concept of Banking-as-a-Service (BaaS) puts a regulated bank or credit union at the backend and a non-regulated brand on the front end. Kabbage already has Green Dot to handle FDIC-insured deposit accounts, but what’s to say that Kabbage couldn’t front-end a group of banks or credit unions that are after greater loan production but don’t want the associated high acquisition costs? It’s just another step towards the future that Paul Schaus, Founder and CEO, CCG Catalyst, envisions.

Such a model could make sense for some institutions. Say your bank would like to expand to a niche small business banking market — be it garden-centers and landscapers, hospitality businesses, or minority-owned business — but cannot due to geographic constraints. There simply aren’t enough garden centers within your banking footprint to make the segment strategy work — but surely there are enough garden centers and landscapers across the U.S. to make the segment viable.

You supply the backend requirements and the fintech takes care of acquiring customers from anywhere. It’s a variation of the LendingTree consumer loan model applied to small businesses.

“This is an exciting opportunity,” says Schaus. “Why can’t a bank or credit union team up with a fintech that represents different financial institutions? Banks and credit unions need to look at fintechs as symbiotic partners and not competitors.”