“With a graduate degree in Aerospace, Aeronautical and Astronautical Engineering, Stuart Sopp could have easily been working alongside Elon Musk or Sir Richard Branson — sending people on a private shuttle to space. But, like many graduates, the degree didn’t stick.

Not to say he hasn’t had a fruitful career so far. Sopp founded and now runs one of the most successful neobanks out there: Current.

Finance lured him away from aerospace engineering and decided to try his hand with “friends who were working at these things called hedge funds,” he told EFinancial Careers. It worked out for him as he spent 20 years in trading at major financial institutions including BNY Mellon, Citi, Deutsche Bank and Morgan Stanley.

That alone would make for a respectable resume. Yet, Sopp wasn’t satisfied. He stepped away from Wall Street and, in 2015, launched his brainchild — Current — a challenger bank which has consistently been moving up the neobank charts the past several years.

Current is on the rise — it has three million customers to date and, according to Insider Intelligence, the neobank is projected to be second in the country (in account holders) by the end of 2021, moving ahead of Aspiration and paced only by Chime with about 13 million account holders. Insider projects Current will reach four million customers by yearend.

“Current has done a great job of articulating how its products help users improve their financial standing,” Insider Intelligence Senior Forecasting Analyst Oscar Bruce told The Financial Brand for a previous story, adding the neobank’s “emphasis on accessibility and affordability has resonated in this time of crisis.”

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The neobank isn’t just attracting users; Current has also grabbed — and held — the attention of investors for the last six years. Since it was founded, Current’s business model has attracted over $400 million in total funding. The latest Series D funding round, led by Andreessen Horowitz in April 2021, was $220 million.

Current’s Chief Technology Officer (CTO) Trevor Marshall says Sopp’s expertise in the banking industry is what has set the digital bank up for success.

“Stuart had been on Wall Street, or working at a bank, for at least 16 years before I met him — working out of London, Sydney, Singapore, Hong Kong and then New York,” Marshall tells The Financial Brand. “He has this unique perspective of seeing the way money truly moves from the vantage point of all these places around the world.”

But Sopp’s experience isn’t all that sets Current apart from the crowd. In a feisty attempt to break away from traditional banking methodologies, the neobank has fashioned a unique set of strategies. Here are several that are propelling its growth:

( Dive In: Neobank Tracker: The World’s Biggest Database of Digital-Only Banks )

‘We’re Not A Bank.’

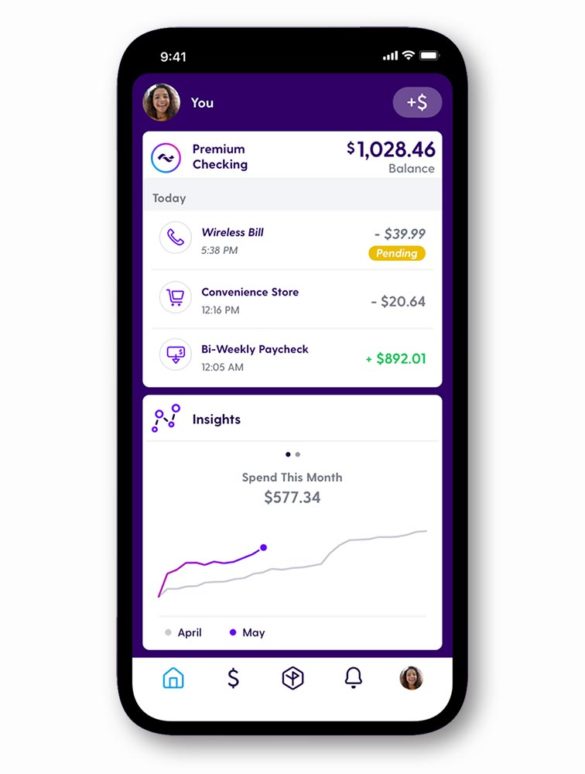

The teen banking product was Current’s first product (launched in 2017) that costs $36 per year per teen. The neobank then launched its personal checking accounts in 2019, which include a free, basic account and a premium account that costs $4.99 per month.

Current’s Director of Communications Erin Bruehl explains that the neobank’s revenue spools from this subscription model, in addition to money made from debit card interchange.

All its Own Technology

What’s also unique about Current is that it has built its own backend systems. It’s full suite of products are assembled on what the neobank coins its “Current Core” — in-sourced technology that accommodates Current’s features, such as early paycheck deliveries, cashback and its “Overdrive” service, which allows people to overdraw $100 on the premium accounts.

Marshall says most financial institutions rely on the backend solutions provided by large technology companies, but their progress is limited by that arrangement. His team, on the other hand, wanted to create a “vertical sliver of that functionality,” tailored to what the neobank needed it for.

“If we can define that, we can control our destiny and the types of products that we can build and provide to users, while maintaining the option to work with alternative things in the future,” the CTO explains.

( Learn More: How Neobanks Are Catering to the Youngest Generation of Consumers )

Banking Charter? No Thanks

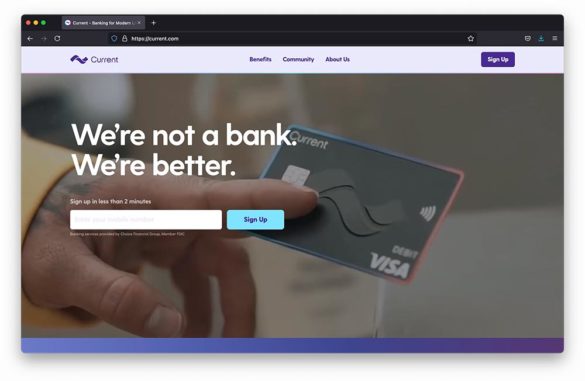

At the top of the neobank’s website, one of its marketing campaign taglines — “We’re not a bank. We’re better.” — stands out on the page.

Of course, regulators have been requiring unchartered financial institutions to make very clear that they are not a traditional bank. In March Chime was called out by the California Department of Financial Protection for using the words “bank” and “banking.”

Current’s Vice President of Marketing Adam Hadi says, however, that Current’s “What do you think we are, a bank?” marketing campaign was being planned before that. And Bruehl insists their motto is not just a short-term promise to its customers. Instead, it’s a lifelong strategy for the company.

In fact, going after a bank license is just not in the plans for Current.

“Pursuing a bank charter would mean a business model shift from spend to focusing on deposits,” Bruehl explains.

Out Of The Box:

There are many neobanks that want a banking charter so they can attract deposits more efficiently. Current, however, has no interest in a bank license.

Marketing To The Youngest Consumers

Although it first branched out with teenage banking products, Current has since extended its catalog of services to include customers of all ages. In 2019, the neobank launched its personal banking account with a debit card, which Current advertises can be used fee-free at over 55,000 ATMs.

While anyone can sign up for Current’s personal account now, the bulk of its customers are still the youngest generations (Gen Z especially). They don’t see that as a negative. Marshall argues that Current’s substantial portfolio of the youngest consumers might be one of the neobank’s biggest differentiators.

“50% of our customers have never had a bank account before,” Marshall maintains. “We do really well with Gen Z, so we’re banking people either right out of college or early on in their careers, right out of high school in many cases.”

Robbing the Cradle:

Current specializes in Gen Z (and soon Gen Alpha), making it a threat to any financial institution which expects those consumers to be up for grabs.

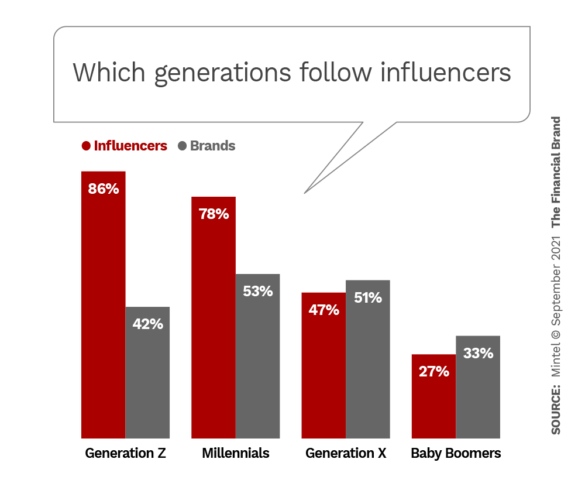

Marshall says the team at Current has become “experts” at onboarding younger groups. He attributes a portion of their expertise to their marketing campaigns, which over the last six years has garnered over 1,000 social media influencers, such as Josh Zilberberg and Kelz Wright. The neobank also launched a long-term partnership with Youtuber MrBeast, who Bruehl says has “given away over $100,000 on Current to 100,000 fans.”

“At this point, we realized that the way for people to hear about us, the way that young people trust in companies is when the people they trust, trust in them,” Marshall says.

A Winning Strategy:

One effective way that Current has earned the loyalty of younger consumers is by partnering with social media influencers.

Building up a repertoire with influencers isn’t easy, says Hadi. However, it is almost essential in today’s marketing world because “Gen Z and young Millennials have been trained well to be very skeptical of the average ad.” By working with these social media professionals, Current can more easily “shortcut the trust process.”

The Culture Shift That Helped Current’s Trajectory

Both Marshall and Sopp agree that Current’s primary competition is not its brethren fintechs and neobanks crowding the industry. Instead, the parties they’re looking to disrupt are the big legacy institutions.

“Our direct competitors aren’t really Chime and the challenger banks,” Marshall says. “Our direct competitors are the larger institutions, because there’s such a large market share and direction to go.”

The reputation of the traditional financial institution used to hold Current back. That is, without a banking license and the portfolio of local branches and ATMs to go with it, they weren’t a real bank.

“There is a reality that you don’t see our name inside a CVS at an ATM or down the street at a branch, where one can say ‘oh, that’s the place where that bank is,” Marshall admits. Although the neobank teamed up with FDIC-insured banks like Metropolitan Commercial and Choice Financial to back their suite of products, not that physical presence restricted growth.

No more. The worldwide shift to digital banking in 2020 changed the name of the game. People now realize, Marshall says, that digital access to services can be just as efficient — and more convenient — than relying on physical access to financial institutions.

That Next Step

The Financial Brand asked Marshall what the world should expect to see next from Current next. He says the company would like to expand its customer base — a lot. No surprise there.

Adding some color to that, Marshall maintains that the top 1% of customers may be a very hard (if not impossible) get. These individuals are already loyal to their American Express Black accounts and First Republic checking accounts, he says, explaining that “those businesses were built on different types of mechanisms that are actually not super scalable, but are extremely monetizable.”

However, Marshall goes on to say that Current’s target audiences could start to include the top 10% of marketable consumers. Looking forward, the neobank is focusing on building on the appeal of their existing strategies to potentially attract more affluent customers.

In the long run however, Hadi says Current wants to offer products that are relevant to everyone, “regardless of how much money you make.”

“Today, we’re solving the biggest problems in banking — which largely exists for people who are living paycheck to paycheck — but we’re going to be conquering more problems for people,” he explains. “We want to build a brand that can solve that.”