It’s now about a decade, depending on where you start counting, since the retail banking business began to be disrupted by fintech companies. One of the earliest players was BankSimple, which launched its beta version in 2012. BBVA, an original investor, acquired what is now known as Simple two years later.

Ten years back, “disruption” typically referred to fintech firms’ tough talk about replacing traditional banks, notes Ron Shevlin, Director of Research at Cornerstone Advisors. Shevlin and other commentators said at the time that they didn’t think replacement was in the cards.

Gradually, the fintech vocabulary evolved so that “disruption” came to refer to changing consumer behavior in banking, until finally, says Shevlin, talk of disruption has evolved further towards a more collaborative environment. Now, traditional banking and the fintech industry work together to provide new services, or at least new twists on traditional services.

Often this talk comes around to fintech partnerships. To Shevlin the industry has both overused and misused this term. In years past, traditional financial technology providers tended to refer to their banking clients a “partners,” says Shevlin. Whenever he heard such talk, he says, “I thought that any bank or credit union executive hearing that was thinking, ‘These guys are anything but my ‘partner’.”

“What is emerging is something between a true partnership and a vendor relationship.”

Today when financial institution leaders speak of the need to partner with fintech, they aren’t referring to major tech vendors nor even established fintechs. Instead, they usually mean the pure fintech startups still trying to get traction.

“They are not partnerships as in, ‘Let’s go to market together and see what happens. We’ll split the resources that are needed. And we’ll split the rewards’,” says Shevlin. Instead, what is emerging is something between a true partnership and a vendor relationship.

Partnership will likely remain a gray area for some time. “At the end of the day, you build, you buy, or you partner,” says Sam Kilmer, Senior Director at Cornerstone. Figuring out just where your institution’s arrangement sits, in the third category, will often hinge on how “vested” the financial institution and the fintech are in each other.

Kilmer points out that some bank CEOs, even among smaller institutions, have actually made investments in fintechs they are working with, much like BBVA made in Simple years ago.

The flip side, for the fintech, concerns how many product or service relationships the financial institution maintains with it. Four or five ties signals a strong connection. Making this less likely than might otherwise be the case, adds Kilmer, is a growing tendency among banking institutions to adopt an à la carte approach. He calls this “best of breed” tech adoption.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Making Fintech Partnerships Work Isn’t Easy

Like most trendy talk in financial services, fintech partnerships sound great in theory. They can be harder to make work in practice.

“Like peanut butter and chocolate, financial institutions and fintechs find themselves poised for partnership and ready to make each other a lot of money. But real progress requires more than a sugar high in a flashy wrapper.”

— Cornerstone Advisors report

A report from Cornerstone based on research on both sides of these customer relationships puts the challenge succinctly: “Like peanut butter and chocolate, financial institutions and fintechs find themselves poised for partnership and ready to make each other a lot of money. But real progress requires more than a sugar high in a flashy wrapper. Each side has legitimate reasons to remain wary of the other — and optimal partnerships won’t happen without the right recipe and hard work.”

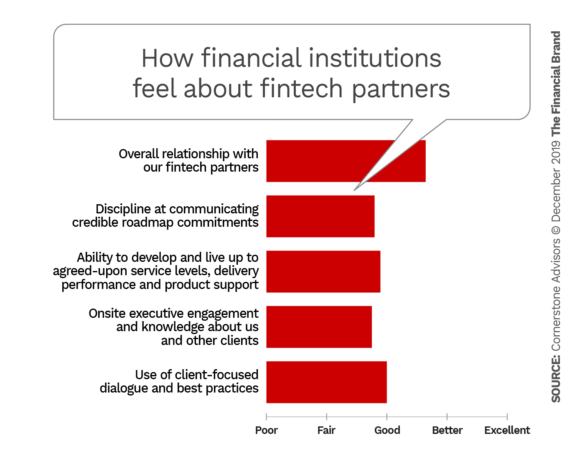

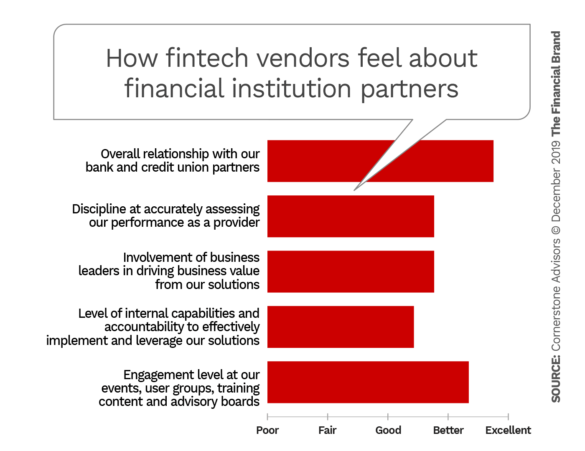

Each must recognize that they have different goals for a partnership in any form. Cornerstone’s survey found a reasonable surface level of satisfaction between financial institutions and fintechs on basic issues, but looking more deeply, found much room for improvement.

In the two charts below, neither side of the deals judged their partner’s performance as excellent, although the tone was generally positive.

“It’s kind of like marriage,” says Kilmer. “When you peel back the onion, yes, you love your spouse, but do they take out the garbage, or whatever?”

Kilmer says he wasn’t surprised that the fintechs, overall, were more positive than the financial institutions. He believes financial institutions tend to be less optimistic because they are responsible for implementation with consumers.

“There are differences in expectations,” says Shevlin. “Financial institutions are expecting more immediate results — maybe not really immediately, but within a quarter. Fintechs that have gone through partnerships and sales cycles before tend to be more realistic about things.”

From the report and a discussion with Kilmer and Shevlin come these suggestions for banks and credit unions that want their fintech partnerships to be successful.

Read More:

- 5 Risks Banks and Credit Unions Face By Partnering With Google

- Trends in Fintech Collaboration: Start With The User Experience

1. ‘Build It and They Will Come’ is Wishful Thinking. Go In Committed

Simply popping in technology like a set of fresh batteries won’t work by itself. Shevlin says financial institutions thought this way about digital account opening: spend 90 days putting it in place, and watch things take off.

“It takes a lot more work,” Shevlin says. Throwing around digital transformation terms and adopting “innovation theater” won’t drive any profits.

Building a product with a fintech partner is just a beginning. “You’ve got a lot more work to do around marketing, process improvement, and integration,” says Shevlin. This takes time and money.

Kilmer points out that one of the growth stories of banking at present is direct banking, which started as call center banking and evolved into online-only banking. While the appeal of convenience is strong, these institutions work hard to promote their advantages because without marketing, their branchless existence renders them invisible. Financial institutions peddling fintech solutions must learn from this.

2. Get Used to Very Different Concepts of Timing and Growth

While fintechs with some experience know that results won’t be instantaneous, the youngest and smallest of this fraternity hear a ticking clock. The cultures and circumstances differ.

“Many banks are trying to grow,” says Kilmer, “but they are not usually trying to grow as rapidly as some of the fintechs.” Even aggressive banks and credit unions operate under regulatory scrutiny and rules, and when they have losses, it’s a big deal.

On the fintech side of the table, the pressure is on to grow, even before profitability. “If they aren’t creating major change quickly, they have a problem, because in many cases they are not making money or are barely making money. They are building themselves to sell,” says Kilmer.

3. Put Someone Important and Able in Charge of Partnerships

Kilmer says fintechs frequently become disappointed when they realize that their partnership with a bank or credit union is not the centerpiece of the CEO’s day. In a bank where the commercial side drives revenue, digital innovation may not even be a daily priority.

“If you were to ask a CEO whether they are losing any sleep over whether a new user experience gets deployed, they probably aren’t,” says Kilmer.

But what is even more important is to appoint someone in the institution with authority to be the one is charge of driving integration of the fintech product into the scheme of the business. Kilmer says deployment hinges on internal accountability. Partnering with a fintech can’t be seen as a way of outsourcing integration of a new product.

“The institution is going to be doing a lot of building, even if it is buying something,” Kilmer explains. “You’re tailoring here, working on user interfaces there. You’re tinkering with the website to make things cohesive.”

In short, a fintech partnership is not a turnkey relationship. Both partners need to count on heavy lifting.

Read More:

- The Biggest Technology Trends That Will Disrupt Banking

- The Future of Retail Banking Through a Digital Challenger’s Eyes

4. Involve Line of Business Representatives in the Process

Sometimes the emphasis on the “tech” part of fintech leads to forgetting the “fin” part. The point of getting involved in a partnership should be to advance some business goal, and someone besides IT generally owns that goal.

“It’s about tying the person with the purse strings to the person driving the decisions, and then getting connected to the people who create the revenue,” says Kilmer. Challenging, yes. “It’s a huge but worthwhile undertaking.”

Kilmer points out that the advent of cloud computing offers a fresh angle on technology.

“A lot of line of business leaders view partnering with fintechs as an alternative to partnering with IT,” he explains.

5. Head into a Fintech Partnership with an ‘Execution Culture’ and a Definite Roadmap

Before a joint project goes too far down the tracks, both parties need to be clear on where those tracks will lead. But beyond that, Cornerstone recommends, both sides must agree on performance measurements, key working objectives, and who is responsible for what.

Even when all this is in place, Kilmer says the roadmap needs a heavy shot of reality: “Does the fintech have the resources to live up to the commitments it’s making? On the flip side, does the financial institution have the resources, plus the execution culture and the accountability in place to actually implement things?”

Absence of this from the financial institution’s side often frustrates fintechs, the Cornerstone report says. “Fintechs lament a lack of cogent performance management on the part of their financial institution customers,” it states.

6. Commit to Active Participation with Your Fintech Partners

Kilmer says many fintechs’ leaders spend a huge amount of time on site with financial institution partners. This goes beyond hand holding. They want to learn more about the industry’s needs and about the individual institution’s digital future.

What they hope for, in return, is commitment from the financial institution to their own processes for improvement. They look for active participation in their advisory boards, conferences and other feedback mechanisms.

This helps them improve their offerings and approaches. More broadly, agreeing to become a showcase site for the fintech’s service demonstrates major commitment in their world.