While bank and credit union interest in partnering with fintechs continues at a strong pace, the relationships that have been set up aren’t producing the revenue that they could be, according to research by Cornerstone Advisors. Among the reasons for this trend is that institutions aren’t starting out with the right goals, in some cases, and because many institutions that profess interest in partnership aren’t staffing those efforts for success.

A time of reckoning may be coming for lackluster and misguided fintech partnerships, suggests Cornerstone’s “What’s Going On In Banking 2021.”

The report notes that financial institution boards frequently ask management what their fintech strategy is and how it is playing out. It’s been a checklist item.

“2021 will be different,” the report states. “Boards will tire of not seeing results and realize that dedicating one or two people to fintech partnerships isn’t sufficient to get real results. At least, that’s what should happen.”

Key Insight:

Too often fintech partnerships are trotted out at the board’s behest, shown off in a bit of “innovation theater,” and the board moves back to its traditional central concern — loans, according to Ron Shevlin, Director of Research. However, he contends that if institutions paid more attention to the impact that their involvement in fintech projects has had, the payoff could be greater.

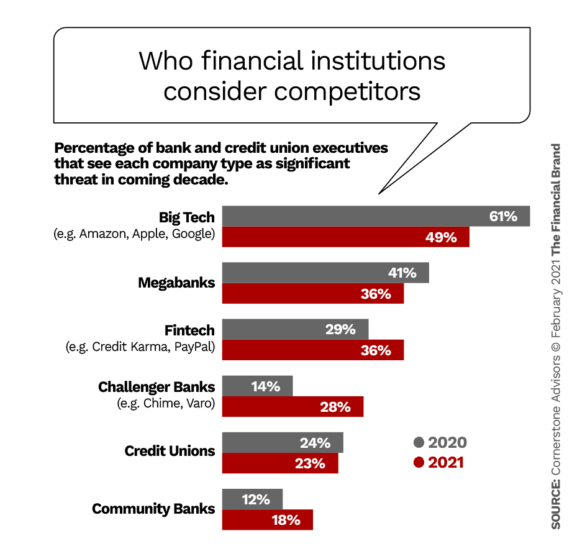

The charts accompanying this article come from Cornerstone’s survey of 260 senior executives at a mix of mid-size banks and credit unions. The report includes a scan of which type of competitors banks and credit unions see as the biggest threat over the next decade.

As the chart shows, the perceived threat of competition rose in certain categories in the survey over the previous edition, notably fintechs and also challenger banks like Chime and Varo. Shevlin notes that two categories, fintech and big tech competition, are unusual in that both represent not only potential competition, but also potential partnership opportunities.

He says he was pleasantly surprised to see how much the executives’ appreciation of challenger banks as a competitive factor has grown — it doubled. Separate consumer research by Cornerstone found that at yearend 2020 Chime had reached 12 million users. The report also explored partnerships with Google and Amazon, which we cover later in this article.

Read More: Do Fintechs Scare You As Much As They Do These CEOs?

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Interest in Fintech Partnerships Doesn’t Always Synch With Potential

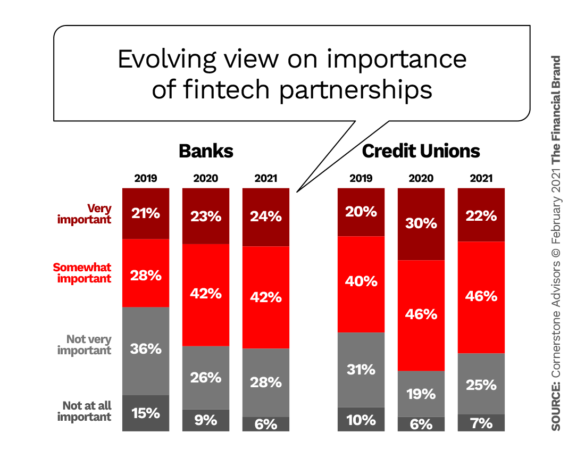

Among banks surveyed the level of interest in fintech partnerships, measured by those who considered this strategy “very important” or “somewhat important,” remained about even with 2020 levels. Among credit unions, those ranking partnerships as “very important” fell off in the latest survey. Shevlin found the drop among the credit unions somewhat surprising, contrasted with the steady interest among banks. Going back to 2019, credit union interested in teaming up has outpaced banks’ interest.

Shevlin indicated in an interview with The Financial Brand that some confusion remains among institutions regarding what “fintech partnership” includes. He says some institutions still think of their relationship with technology vendors as a financial technology partnership. For Shevlin, fintech partnerships are strictly arrangements where a financial institution and a fintech go into business together. Otherwise, all you have is a vendor relationship.

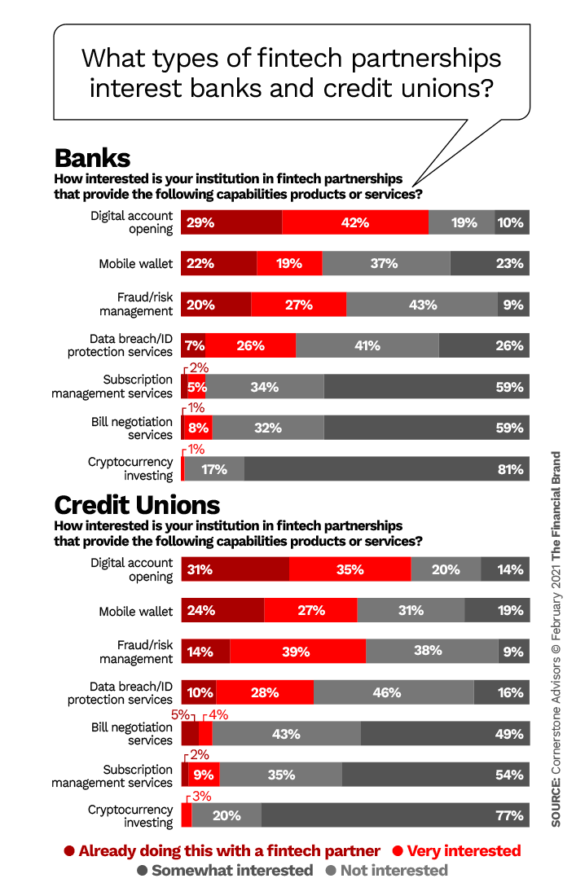

Cornerstone asked institutions about their fintech partnership priorities to gauge the depth and mix of interest. Among both banks and credit unions, the leading interest is in digital account opening.

“By prioritizing digital account opening for their fintech partnerships, banks and credit unions are missing new revenue opportunities,” the report says. Shevlin says this and other means of improving access to accounts for customers and members should by now be readily available from an institution’s tech vendor.

What disturbs the analyst is the low level of interest both banks and credit unions show in services like bill negotiation and subscription management. Shevlin says he has completed unpublished consumer research that indicates that many people would welcome being able to obtain services like this from their financial institutions.

Why It Matters:

Many consumer products and services today are obtained through subscription arrangements. Streaming service memberships like Spotify are just one example. Consumers can “subscribe” to delivery of everything from computer printer ink to themed monthly boxes of knick knacks to razor blades to meal plans to dropbox addresses.

People often forget what they’ve subscribed to. Sometimes they keep paying, automatically, for services no longer required or desired. And sometimes they miss deadlines for important deals on price. Subscription management can help with all of this — and save them cash that they can squirrel away.

“People need services like that today,” says Shevlin, especially consumers who are Gen Z, Millennial or Gen X, who all love subscription convenience. Teaming up with fintechs that can orchestrate such functions makes more sense than trying to create and maintain such services under the financial institution’s roof.

Indeed, Shevlin feels that many banks and credit unions don’t fully understand that consumers don’t think in terms of products, as institutions do, but instead in terms of their needs.

Key Insight:

“People don’t want savings accounts,” says Shevlin. “They want to save more money.” Especially in today’s low-rate environment, he continues, any service a financial institution can provide that helps people save makes a difference.

Read Mor How New Consumer Payment Habits Advance Fintechs at Banks’ Expense

Fintech Partnership Results Are Lackluster

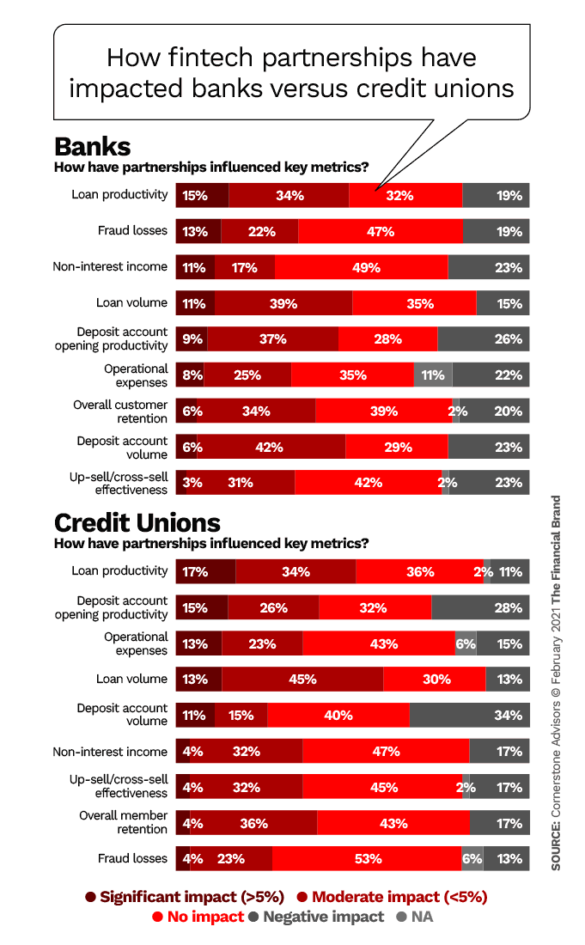

Thus far, the research found, most financial institutions surveyed that have experienced positive results from fintech partnerships have seen moderate improvement in the categories studied.

Shevlin thinks this situation can be improved in two ways.

First, he says that banks and credit unions have to make the shift to thinking about revenue, noted earlier, but simultaneously they have to stop expecting every new activity will be a home run.

As an example, Shevlin suggests financial institutions could be doing much more with mobile apps. The beauty of this type of service is that tech companies have already established the device, the channel and the platforms — and even deployed the technology. Financial institutions can devote themselves to delivering small, helpful apps through the pre-established route.

“Institutions should think of their fintech partnership managers not as banking IT people, but as sales staff.”

— Ron Shevlin, Cornerstone Advisors

“It’s a different mentality,” says Shevlin.

The second critical step Shevlin believes institutions must take with fintech partnerships is to staff up for success. The study found that one out of four banks and 15% of credit unions don’t devote any staff to maintaining, expanding or creating fintech partnerships.

Shevlin finds this inconceivable: How do you start up a partnership and leave no one in charge? Even among institutions that do assign people to work with fintech partners, most appoint one or two employees to the task.

That level of staffing explains why partnerships with revenue potential don’t get the attention they deserve. Shevlin says he’d hire a cadre of ten or more people to work on fintech partnerships, from evaluating new opportunities to troubleshooting existing ones.

“Institutions should think of their fintech partnership managers not as banking IT people, but as sales staff,” Shevlin insists.

Working With Bigtechs Like Google And Amazon

The study also explored partnerships with large technology firms. Interestingly, while in some ways Google has presented a clearer path for institutions to follow, with its Google Plex program, there is more enthusiasm for partnering in some way with Amazon.

The report notes that three of the handful of institutions that have announced their participation in the Google Plex project were in the survey database. Of the remainder of the sample, 4% of banks and 8% of credit unions are talking to Google about a partnership or plan to do so. And 17% of banks are evaluating a Google partnership and 24% of credit unions are. However, 75% of banks surveyed say its unlikely they will partner with Google, as do 61% of credit unions. 3% of banks and 7% of credit unions have already dropped the idea.

Some community institutions may feel that they will not be the centerpiece of a Google Plex relationship. Shevlin is inclined to agree, pointing out that most consumers will be far more interested in “Google’s cool stuff” than in which bank or credit union underlies the account relationship. In fact, in separate research, only 20% of consumers were interested in a Google Plex account offered by a community bank or a credit union.

Interest in partnering with Amazon, which has shown few cards, is stronger. Among banks, 6% said they are very interested in this and 39% are somewhat interested. In turn, 9% of credit unions are interested and 40% are somewhat interested. This question was asked in the context of lending to Amazon merchants, something that Amazon initially tried itself and then began to offer in partnership with Marcus in 2020.

Shevlin thinks there could be some real opportunity for institutions here. It is in Amazon’s DNA to be a platform offering multiple opportunities to users, so a program in which multiple lenders take part is quite possible. The deal with Marcus is merely a testing of the waters, Shevlin suspects.