The distinction between fintech and traditional banking is blurring, and will likely disappear. The ramifications of that trend are many, but a dominant one is the growing talent gap faced by traditional institutions. Fintechs, too, will face difficulty finding the best talent as the numbers of these challengers continue to increase.

A big new study — “The Fintech Job Report: Technology is Eating Finance,” by the Centre for Finance, Technology and Entrepreneurship — highlights the gap between the ever-advancing technologies that will be needed to succeed in banking and the individuals financial institutions need to implement that tech.

The 244-page report’s main contention is that banks and credit unions must focus on individuals more skilled in various digital technologies, rather than having a background in financial matters.

“The main thing that comes out from the report is that technology constitutes the core competency that is needed,” Tram Anh Nguyen, cofounder of CFTE and co-author of the report, says in an interview. “If you don’t understand technology, I think you can’t do any jobs with fintech.”

What It Means:

The success factors for financial institutions have changed dramatically due to technology. Without people who understand this, institutions risk obsolescence.

CFTE adopts a very broad definition of “fintech.” It is simply: “The impact of technology in financial services.” That applies to retail/commercial banking, insurance, payments, cryptocurrency and wealth management.

Despite this broad sweep, the report is very relevant to traditional institutions, Nguyen says. “At some point all companies in financial services, big or old, small or new, will be heavily leveraging technology, including, of course, retail and commercial banks and credit unions,” she says.

“There is a seismic shift in what is required to compete in financial services,” she continues. For example, successful community institutions in the past could leverage their strong relationship with customers to offer mortgages or provide good coverage from their branches.

“Today that is not sufficient at all,” Nguyen maintains. “The success factors are the same as those for Amazon, which are customer centricity, real-time interactions and product innovation, thanks to technology. That means banks and credit unions need to adapt to these factors, or become totally obsolete because of new competitors that use these new tools.”

Read More: How the Banking Industry Will Survive ‘The Great Resignation’

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Scope of the Fintech Challenge

To put an exclamation point on the what this means for traditional institutions, in the last ten years more than $200 billion has been invested by venture capital and private equity in fintech startups. Worldwide, fintechs employ 300,000 people — yet there are 40,000 jobs that are unfilled, according to CFTE.

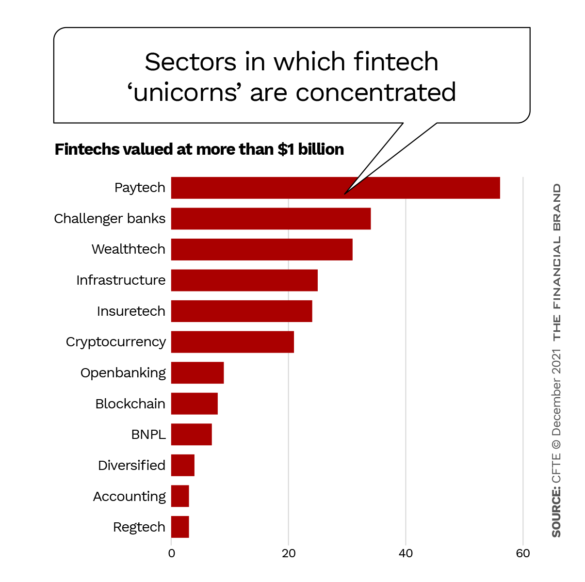

The report identifies 225 fintech companies each valued at more than $1 billion — so-called “unicorns.” The United States claims by far the most such firms, topping 100, followed by the United Kingdom, China, and India. By sector, most unicorns focus on payments technology, banking and wealth management services.

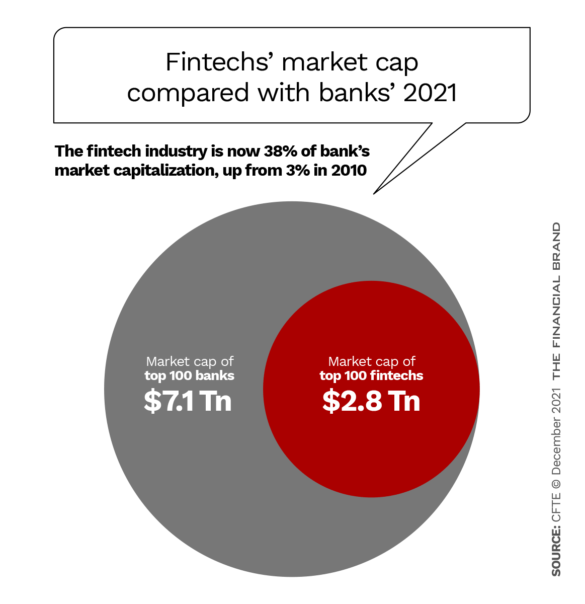

Strikingly, the report states that the 100 largest banks in the world have a combined market capitalization of $7.1 trillion, while the 100 largest fintech companies have a combined market cap of $2.8 trillion. “These are incredible numbers considering that fintech has been around for ten years vs. hundreds of years for banking,” the report states.

Read More: How Financial Institutions Can Snag Top Tech Talent

Where the Talent Will Come From

Various studies show that banks and credit unions understand that financial technology represents the key to not only their future growth but their very survival. They recognize that digitization, cloud services, remote access and more are crucial, and many if not most are hustling to get on board.

What’s not so clear is exactly who is available to be hired that will implement all this new technology.

The answer could come from several sources. One could be young people more skilled in technological applications than financial knowledge, but who are willing to absorb enough of the latter. Another source could be people already in financial services who are open to retraining.

“The fintech industry finds it challenging to recruit the right talents, not because of a lack of candidates, but a lack of qualified candidates,” the CFTE study states. Whichever type of institutions is pursuing them, a key may be simply convincing professionals with the right skills that banking (or fintech) is a good fit for them and that their skills are easily transferable to financial services.

Counterpoint:

One advantage for incumbents is that tech skills alone are not sufficient. Soft skills and industry knowledge are also important.

Conversely, while “tech” skills are more important than “fin” skills in fintech, in its broad sense, they are not sufficient in and of themselves. “Hard skills such as programming or data science might be the first things that come to mind when thinking about fintech, but there are many other requirements … depending on the job roles,” the report observes. “Interestingly, mindset, soft skills, and industry knowledge are equally important for fintech companies, but usually overlooked by applicants.”

Read More: Banks Barely Keeping Up with Staff Shortages

Reskilling: Responsibility and Solution

A question financial institutions wrestle with is how to handle employees who have been in the business for decades, doing great jobs as defined by the traditional set of rules before technology uprooted everything.

“What do we do with people who have a solid knowledge of finance, who have had 20, 30, 40 years of experience and suddenly they see technology taking their place?” Nguyen asks. “I think there is a responsibility from the banks to spend time to re-skill and upskill the talents of these employees. It’s not necessarily learning about how to create artificial intelligence, or how to create core coding, but much more fundamentally about the use of it.”

Speaking more broadly, Nguyen rejects the notion that fintech is causing a net loss of jobs in the financial arena.

“People are saying that with all these tools and all this technology we’ll just reduce the workforce,” she says. “I have the opposite view. With this report we identified 40,000 new jobs that require people to fill. It is a huge knowledge gap and skills gap, but the talent is there. How do we work together to make sure that we can get people already in the industry to fill those gaps? The opportunities are there.”