The impact of digital technology and the digital consumer is transforming the way consumers access financial products and services. Beyond simple transactions, such as checking balances, the intersection of finance and technology (fintech) is impacting virtually all categories of financial services at an increasing rate, reshaping the industry’s status quo.

Technology-focused start-ups and new market entrants are reshaping the banking, payments, insurance and wealth management sectors through innovation and a consumer-focused digital mentality. The impact, according to an analysis of companies included on PwC’s DeNovo platform, is that funding of fintech start-ups more than doubled in 2015 reaching $12.2bn, up from $5.6bn in 2014.

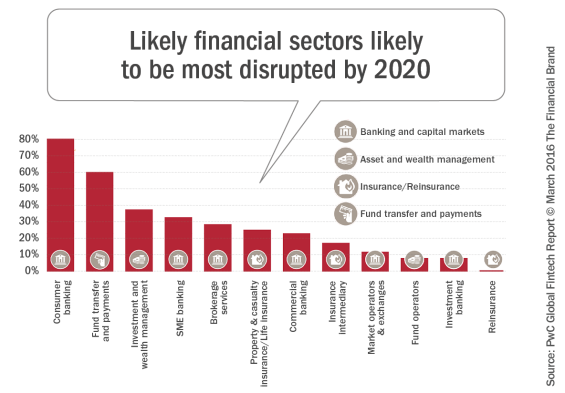

Results from a PwC survey, ‘Blurred Lines: How FinTech is Shaping Financial Services’, found that the majority of survey participants see consumer banking and fund transfer and payments as the sectors most likely to be affected over the next five years. The report included responses from 544 CEOs, Heads of Innovation, CIOs and top management involved in digital and technological transformation across the financial services industry in 46 countries.

The investment industry was also seen as being impacted by technological developments, including the emergence of data analytics that enables tailored products to be delivered as well as automated investing capabilities. An additional wave of disruption is making inroads in the asset management and insurance sectors. Not surprisingly, the responders in each sector rated the disruption of their sector higher than did other responders.

“Fintech is changing the financial services industry from the outside. PwC estimates within the next 3-5 years, cumulative investment in fintech globally could well exceed $150bn, and financial institutions and tech companies are stepping over one another for a chance to get into the game,” commented Steve Davies, PwC EMEA Fintech Leader. “As the lines between traditional finance, technology firms and telecom companies are blurring, many innovative solutions are emerging and there is clearly no straightforward solution to navigate this fintech world.”

“Fintech is changing the financial services industry from the outside. PwC estimates within the next 3-5 years, cumulative investment in fintech globally could well exceed $150bn, and financial institutions and tech companies are stepping over one another for a chance to get into the game,” commented Steve Davies, PwC EMEA Fintech Leader. “As the lines between traditional finance, technology firms and telecom companies are blurring, many innovative solutions are emerging and there is clearly no straightforward solution to navigate this fintech world.”

Fractional Marketing for Financial Brands

Services that scale with you.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Differentiation Through Personalization and Consumer Centricity

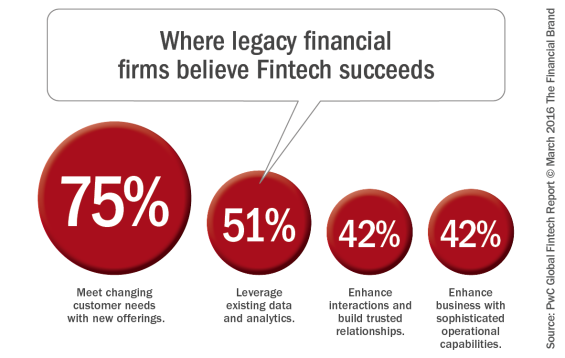

Consumers are increasingly judging their digital banking experience to the offerings from companies such as Amazon, Facebook, Google, Uber and Apple. Unlike the majority of legacy banking organizations, fintech offerings often provide solutions that better respond to consumer needs by offering enhanced accessibility, convenience and tailored products.

According to PwC, “The pursuit of customer centricity has become a main priority and it will help to meet the needs of digital native clientele. The [digital consumer’s] preference for a state-of-the-art customer experience, speed and convenience will further accelerate the adoption of fintech solutions.”

While 53% of financial institutions believed that they are fully customer-centric, this share exceeds 80% for fintech respondents. It is not surprising, therefore, that 75% of the respondents to the study said that the most important impact fintech will have on their businesses is an increased focus on the customer.

Payments and Banking Most Likely to be Impacted

According to PwC, ‘disruption’ hits a tipping point when 50% of the incumbent revenue is lost during a five-year timeframe. For instance, the internet direct insurance model for car insurance has resulted in a 50% shift of revenue from the traditional agent-based distribution model to direct insurance providers over this period of time.

The vast majority (83%) of survey respondents from traditional financial institutions believe that part of their business is at risk of being lost to standalone fintech companies (it reaches 95% in the case of banks). In addition, incumbents believe that 23% of their business could be at risk due to the further development of fintech, though fintech firms anticipate that they may be able to acquire 33% of the incumbents’ business.

As shown below, the payments and banking sectors are feeling the most pressure from fintech firms. The payments industry respondents believe they could lose up to 28% of their market share, while bankers estimate they are likely to lose 24%. All sectors of financial services believed at least one-fifth of their business was at risk by 2020.

Fintech Threat Goes Beyond New Products

Fintech firms are delivering more than new products to an increasingly digital consumer, they are providing integrated solutions that can proactively provide contextual insights and recommendations in real time. And, because these services are delivered without traditional bricks and mortar, they can be provided to the consumer at a fraction of the cost of traditional banking products.

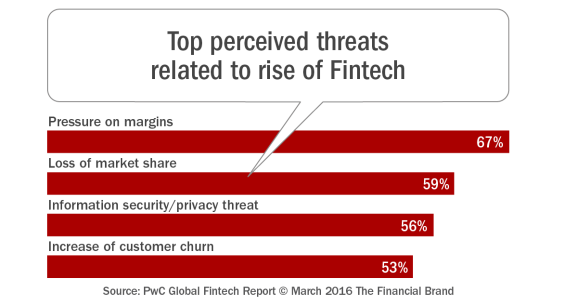

It comes as no surprise then that Two-thirds (67%) of the financial services companies surveyed by PwC ranked pressure on profit margins as the top fintech-related threat, followed by loss of market share (59%). Beyond being able to deliver services digitally, the fintech movement to cloud-based platforms also decreases up-front costs, while reducing ongoing infrastructure costs.

The Fintech Opportunity

As noted in our 2016 Retail Banking Trends and Predictions report, there are many opportunities provided by fintech firms for traditional financial services organizations. Partnerships with fintech firms can expand product offerings, leveraging existing customer/member bases, knowledge of compliance and regulations as well as capital availability. Partnering with fintech firms could also increase the efficiency of incumbent businesses.

In fact, a large majority of respondents (73%) rated cost reduction as the main opportunity related to the rise of fintech. According to the report, “Incumbents could simplify and rationalize their core processes, services and products, and consequently reduce inefficiencies in their operations.”

As has been demonstrated by forward-thinking incumbent firms already, fintech offerings also provide the potential for a differentiated offering, improving customer retention and bringing additional revenues. In this regard, 74% of fund transfer and payment institutions consider additional revenues to be an opportunity from a fintech partnership.

![Top_opportunities_related_to_the_rise_of_fintech[1]](https://thefinancialbrand.com/wp-content/uploads/2016/03/Top_opportunities_related_to_the_rise_of_fintech1-565x338.png)

Challenges for FinTech and Incumbents

PwC’s survey shows the most widespread form of collaboration with fintech companies is joint partnership (32%), which, says PwC, is indicative financial services firms are not ready to go all in and invest fully in fintech. Asked what challenges they face in dealing with FinTech companies, 53% of incumbents cited IT security, regulatory uncertainty (49%) and differences in business models (40%).

In the case of FinTech companies, differences in management and culture (54%), operational processes (47%) and regulatory uncertainty (43%) were deemed the top three challenges when dealing with traditional FS firms.

Strategic Options

According to PwC, the main impact of fintech will be the introduction of new business models, where legacy organizations move to the center of the financial services ecosystem, leveraging trusted relationships, access to data, brand recognition and the ability to invest in new solutions. “The new norm will involve turning away from a linear product push approach, to a consumer-centric model in which financial services providers are facilitators of a service that enables clients to acquire advice and interact with all relevant [solutions] through multiple channels,” said the report.

With the increasing pace of change in digital technology and financial services, incumbent financial services organizations cannot afford to ignore fintech threats or opportunities. Despite this reality, the PwC survey found that 25% of legacy firms still do not deal with fintech companies at all.

Moving forward, PwC states that companies hoping to succeed need to shift their thinking to better meet the needs of the digital consumer, constantly tracking technological developments, and aggressively engaging with external partners, integrating digitization into the corporate DNA. This includes:

- Putting fintech at the heart of strategy

- Adopting a mobile-first approach

- Collaborating with fintech firms

- Understanding regulatory challenges

“By focusing on incorporating new technologies into their own architecture, traditional financial institutions can prepare themselves to play a central role in the new financial services world in which they will operate at the center of customer activity and maintain strong positions even as innovations alter the marketplace,” concluded the report.