Over the last several years, the awareness and usage of non-traditional financial services has risen exponentially across almost all regions of the world. As fintech firms have matured from small specialized start-ups to include global organizations offering a broad array of financial services, consumers are increasingly trusting these relatively new organizations to hold funds, process transactions, provide credit and offer advice.

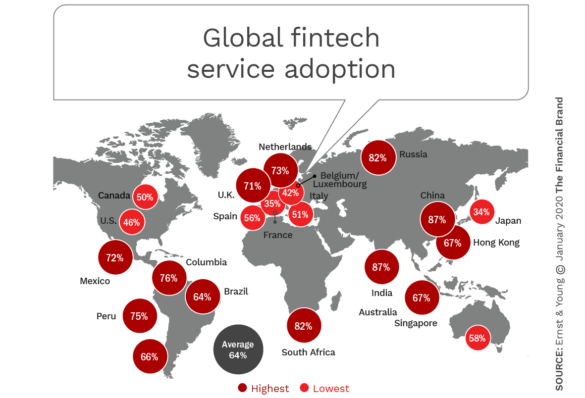

According to the Global Fintech Adoption Index 2019, issued by EY, adoption of fintech services has doubled every two years since 2015, from 16% in 2015 to 64% in 2019. For this study, a fintech adopter is defined as someone who has used two or more “buckets” of such services, since this indicates a habitual change in behavior. A bucket consists of one or more of the 19 fintech services included in the study.

The awareness of alternative fintech money transfer or payment services has also risen to new heights, reaching 96% worldwide. The greatest level of fintech adoption is in the emerging markets of China and India (both at 87%), while the lowest level of adoption was in the far more developed markets of Japan (34%) and France (35%).

Surprisingly, fintech adoption is also relatively anemic in the U.S. (46%) and Canada (50%). In comparison, fintech adoption in Russia (82%), Mexico (72%), the U.K. (71%) and Australia (58%) far exceeded North American adoption levels. This compares to the average global fintech adoption level of 64% noted above.

Read More:

- Consumer Use of Fintechs For Banking Services Skyrockets

- Fintechs vs. Traditional Banks: Who has the Bigger Advantage?

- Trends in Fintech Collaboration: Start With The User Experience

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

What Differentiates Worldwide Financial Markets

When looking at the markets on an international scale, it is clear that many of the highest levels of fintech adoption occurred in developing countries. Countries such as Russia and South Africa (each with 82% adoption), as well as all of the regions in South America, were markets where use of traditional banking institutions ranked lower and movement to mobile financial applications was less disruptive.

Among developed markets, two different models emerge. In Southeast Asia and India, legacy financial institutions existed, but the markets were greatly underserved. Fintech firms have especially impacted the payments and lending ecosystems in these regions, creating giant organizations and entirely new ways to pay and borrow. Digital shopping, transportation and even micro financing have been disrupted by digital tools offered by fintech firms.

Alternatively, in the U.K., the Netherlands and Ireland, both the incumbents and fintech firms have benefited from more progressive regulations, especially around open banking. As a result, some European digital challenger banks have gained significant traction across regional and global markets, attracting millions of customers since they launched just a few years ago. This has prompted incumbent banks to develop their own fintech solutions and/or partner with fintech organizations.

Fintech penetration in the U.S. and Canada lags most of the rest of the world. This is primarily because the region is the stronghold of traditional institutions and the slowness of regulators to resolve the fragmented and outdated regulations existing in these markets. In addition, there is a high consumer trust factor in both the U.S. and Canada, stalling the acceptance of non-traditional financial products.

“Fintech challengers are looking less like start-ups and more like professionally managed companies with broad operational capabilities, a full suite of products and a global reach,” states the report. “Many of these companies have been through several rounds of fund-raising, increased their staff, created corporate departments such as human resources, accounting and legal, and expanded beyond their home markets.” In other words, in many regions, fintech firms have entered the mainstream of financial services.

Current Fintech Awareness and Use: Opportunity or Threat?

So, is high awareness of fintech services in most regions of the world an opportunity for traditional financial institutions or a threat? Alternatively, is the low penetration of fintech services in North America good news or bad news given global trends?

In research done for the U.S. by Cornerstone Advisors, commissioned by Q2, they verified what many in the industry already know … that acceptance of fintech services is not uniform across all demographic groups. According to Cornerstone Advisors, “Older Millennials” (63%) and “Gen Xers” (54%) have above average adoption, while “Younger Millennials” (37%) and “Boomers” (27%) have lower penetration.

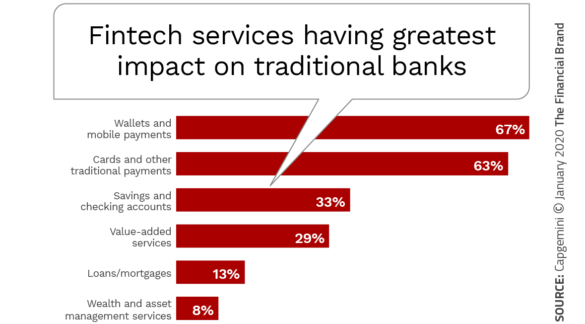

One way to move market share will be to emphasize the services that have the greatest level of acceptance — digital payments and lending services — while also focusing on the reasons consumers use fintech services. (These include ease of account opening, better rates/fees and improved experiences.) A large part of making the experience better is to integrate fintech solutions as part of a traditional offering, according to Cornerstone research.

In other words, traditional financial services firms can turn an existing threat from fintech firms into an opportunity by focusing on building collaborations with fintech organizations that offer the services and experience consumers crave. According to Ron Shevlin from Cornerstone Advisors, smaller and mid-size organizations can jumpstart this process by hiring a Chief Digital Officer who takes on the mission of finding ways to improve the digital offerings.

The Future of Fintech

In the future, fintech organizations will continue to grow, challenging traditional financial institutions and influencing the way consumers manage their financial portfolios. Because of the lower cost of digital distribution and the increasing use of advanced analytics to segment offerings, the level of financial inclusion is expected to continue to increase, especially in the less-developed countries.

Despite the growth of fintech organizations, few will reach the mass scale of legacy financial institutions. That said, with the expansion of open banking and APIs, there will be far more fintech acquisitions and partnerships creating improved scale for many non-traditional firms. While the majority of fintech organizations have been B2C, we will also see a greater number of B2B solutions, especially as digitalization in all industries takes root.

Finally, the use of fintech services in North America will begin to increase, reflecting the expansion of fintech solutions offered by traditional institutions, the insurgence of solutions from other regions of the world and expansion of current fintech offerings as regulations begin to catch up with the rest of the world.