Running a financial institution in the 21st century is a balancing act between physical and digital, security and creativity, personalized engagement and ease of use.

It’s immensely challenging, but not everything has to be that hard. Traditional banking providers can achieve growth objectives without performing masterful fintech-like stunts, if they keep a few essentials in mind.

Here are six of the top methods and features The Financial Brand found banks and credit unions could add to their repertoire to keep customers hooked.

1. Give People Immediate and Easy Access to Funds

People all over the world have grown accustomed to the idea they can get funds from their banking provider at any time of the day or night —through an ATM, through their credit card for 2 a.m. online shopping or to pay a friend for dinner through payment apps like Venmo and Zelle.

It’s a modern concept: No matter where you are or at what time it is, your bank account is accessible and working for you.

Equally important is for banks and credit unions to be hyper-aware of consumers’ need to access credit other than by a card. Almost nine out of every ten consumers (86%) — across all income levels — say they are somewhat or very likely to want to take out a small loan from their financial institution soon, according to a 2020 survey conducted by Alchemer (formerly SurveyGizmo).

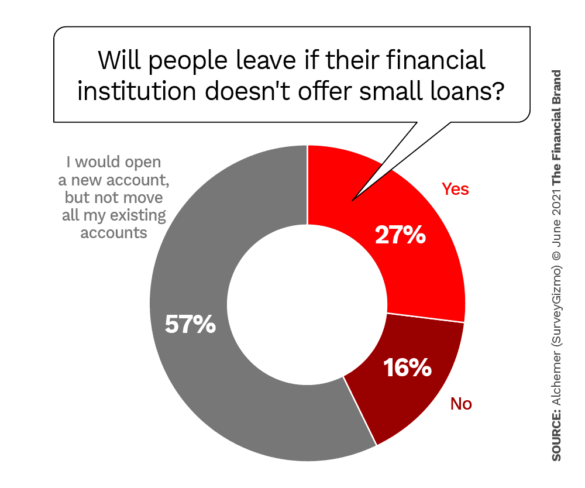

Notably, nearly three out of five people (57%) would start a new relationship with a banking provider if there was a better option for such a small loan than their current bank or credit union. Another 27% of consumers say they would up and leave entirely.

( Read More: 4 Ways To Become Consumers’ Primary Financial Institution )

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

2. Offer Money Management Tools

People today increasingly love to keep track of everything in their life. And they can. More and more consumers are staying ahead of their finances with apps that track subscriptions and help them build — and maintain — a budget.

Whereas such monitoring was extremely cumbersome before “digital transformation” became a term in the financial industry, consumers can now stay a step ahead using mobile apps, according to Scientia Consulting.

Meeting this need no longer needs to be a complex, months-long project for financial institutions. Instead of developing unique money management tools, they can more easily integrate existing products created by third parties, with such features as:

- Spending and saving tracking

- Budget development

- Expense reports

- Subscription management

- Crypto investments

Read More: Millennials and Gen Z Demand Digital Investing Tools

3. Up the Security Game

Security is an underrated element of the customer banking experience. Yet its importance cannot be understated. People trust traditional banks and credit unions more than neobanks and fintechs, but that could soon change.

Sotiris Fousekas, VP of Scientia’s Fintech Insights, recommends banking providers go beyond passwords and security questions. Instead, biometrics could be the way of the future.

“Imagine losing your phone, wouldn’t you feel more secure about your money if others had to use your fingerprint or scan your iris to login your bank account?” he writes in a blog.

The setup can happen at the point of onboarding, Fousekas advises, and financial institutions can introduce products, such as live videos or instant selfies to verify security. Then, banks and credit unions can expand on that, integrating device pairing networks where users re-take a selfie or a picture of their ID if they try to login on a new device.

While that is not the only approach, the bigger point is that consumers expect security to be ironclad. The next section covers a related point.

4. Approach Alerts The Right Way

Alerts are an easy way to provide security and instill trust in a consumer. If people always know what’s going on with their bank account, they are that much more likely to stay with a financial institution.

But, while people appreciate being notified of potential security threats, unnecessary alerts can burden a consumer — even to the point where they start looking elsewhere for their banking experience.

While there may be an “art-form” element to sending alerts to people, there are a few important things to consider when establishing alert programs for consumers:

- Timing — Taplytics, a push notification and analytics program, recommends banks and credit unions think about the timing of their notifications. For instance, if consumers need to order a new debit or credit card before it expires, financial institutions can send out 30-, 45- and 60-day reminders to ensure people follow through.

- Intention — It’s not enough to notify people at every point of the customer journey. It’s imperative there is a good reason behind every message. Learn what each consumer cares about and values, notifying them when something happens they want to know about.

- Variety — Of course, when there is a security concern, customers want to be in the loop. However, they also want to keep up with their budgets. If they meet a wealth management goal or hit a savings target, send them a notification encouraging them to check out their progress. Positive notifications mixed in with the alerts will keep consumers coming back for more.

5. Walk The ‘Phygital’ Line

Going from one set of study results to another, a financial institution could easily get thrown off — do we cut our entire branch network? Do people still care to go to a local bank or credit union? What are the implications of going completely digital?

It’s not surprising that financial institutions feel confused, especially given that their customer base is a generational mix. However, there does seem to be an inkling of congruity: People love banking digitally, but they still want that branch, even if they don’t go frequently.

This has led to the coining of the term, “phygital” banking.

Dig Deeper: Branches Still Dominate, But Banks Won’t Need as Many to Compete

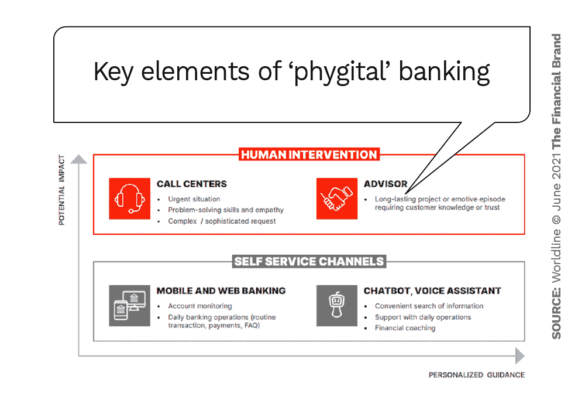

“Banks opt for a remote omnichannel communication strategy using digital tools while maintaining the physical relationship in branches,” says Lucile Diboune, Junior Marketing Product Manager for French payment solutions company WorldLine. “The ‘Phygital’ strategy then seems to achieve the right balance.”

Whereas a digital approach opens up various lines of communication for consumers, the physical branch is still the preferred method for “high value-added exchanges,” Diboune explains, adding it’s much easier to maintain the dialogue between advisor and consumer. Then, digital automation frees up time by executing the recurring tasks.

A Winning Strategy:

Banks and credit unions can walk that ‘phygital’ line by utilizing in-person conversations for high-value tasks and online banking for the repetitive, low-value tasks.

6. Make CX Effective — and Fun

One area where fintechs and neobanks have a leg up on banks and credit unions is in their ability to make banking not only simpler, but sometimes even entertaining. Sure, their lack of significant regulatory oversight is a big factor, but not the only one.

A characteristic that people associate with neobanks is how they are very open with their objectives and manage to make dealing with money interesting. However, despite the conservative mindset of traditional banking providers, financial institutions can make the customer experience fun too.

Moroku, a software company intent on getting financial institutions to better engage consumers, says it’s pivotal to look at the human focus, which thrives on making progress by having fun.

“As we acquire new skills, we instinctively look for the next challenge, which in turn builds the next level of skill,” Moroku’s “Making Banking Fun” report reads. “This is how games work and is very useful model for mapping progression professionally and personally.”

That’s not to say banks and credit unions always need to build games into their existing banking platforms. However, brainstorming techniques to get — and keep — consumers of all ages engaged is the key to unlocking loyal customers.