1. Bankrate.com

Year Launched: 1996

Description: This site actually began life as the “Bank Rate Monitor” newsletter back in 1976. Bankrate.com currently bills itself as the “web’s leading aggregator of financial rate information.” It provides free rate information to consumers on more than 300 different financial products, including auto loans, CDs, credit cards, home equity loans, mortgages, money market accounts and more. Bankrate.com also publishes original research and personal finance articles that help people make informed financial decisions when they go to purchase a home, select a new car or save for retirement. Bankrate is definitely the 800-pound gorilla of personal finance websites, ranked as the 313th biggest website in the U.S. and the 1,322nd biggest website on earth.

Options for Financial Institutions: The site’s research department obtains that information by regularly making phone calls to and surveying the websites of approximately 4,800 financial institutions. You can “buy” your way onto rate tables with listings that include links to your website. A robust array of display/banner advertising options are also available.

Pricing: The site’s paid listings can run a bank or credit union anywhere from $4.50 to $11.50 per click, depending on the institution’s geographic location and the product category. Display ad rates were not disclosed.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

2. MyBankTracker.com

Year Launched: 2008

Description: The staff at MyBankTracker.com focus their editorial attention on original opinion articles and analysis. The site provides free rate and related information on more than 7,000 banks and 30,000 financial products, including checking, savings, mortgage and general banking fees. It also has a proprietary rating system, called the “Bank Report Card,” that helps consumers evaluate if a particular financial institution is right for them.

Options for Financial Institutions: MyBankTracker.com offers banks and credit unions a variety of options to showcase their products and ensure higher visibility across the site, according to Chief Editor Claire Tak. A financial institution can have its savings product included in MyBankTracker’s rate table free of charge. Banks and credit unions looking to enhance their presence on the site can choose to have their product listed in the top position in specific rate table, or they can choose to make their product clickable — and thereby drive visitors directly to a landing page on the financial institution’s own site. The site also offers enhanced profiles for banks and credit unions, along with standard display advertising options.

Pricing: Most or all of the programs offered by MyBankTracker are sold on a performance basis (i.e., cost-per-click)

3. FindaBetterBank.com

Year Launched: 2009

Description: Backed by Novarica, itself a division of Novantas, FindaBetterBank.com looks to “enable consumers to compare institutions and checking accounts based on location, feature preferences and banking behaviors.” It also looks to bolster the bottom lines of banks and credit unions by promising to help them figure out why, when and what new customers are looking for in checking account. They conduct extensive research into why consumers are looking to leave their current checking provider and make the switch.

Options for Financial Institutions: Rather than generate revenue through paid advertising, FindaBetterBank.com sells “data-driven insights” to banks and credit unions about what consumers in their trade areas want, including which types of accounts they’re most interested in. The site also provides “on-going insights through access to analysts, regularly published briefs and reports and ad-hoc custom reports” to smaller institutions, he adds.

Pricing: Fees are determined by an institution’s footprint.

4. GoBankingRates.com

Year Launched: 2004

Description: This site aims to “make it easy to navigate through the world of finance,” whether consumers are looking for investment strategies or the best CD, credit card, mortgage or savings account rates. GoBankingRates’ team of writers and market research experts also report on which financial institutions are providing the best service and the strongest offers.

Options for Financial Institutions: Although GoBankingRates.com collects and publishes various rate tables for free, the site also provides a few paid marketing opportunities for financial institutions. A key one is a sort of subscription-based package deal that’s aimed at helping smaller banks and credit unions spotlight their products and services both on GoBankingRates.com via featured placement within its rate tables as well as on local news sites. For example, a bank in Tallahassee, Florida, GoBankingRates can take information about them — let’s say about a current product or promotion — and promote that for them not only within their site but also externally in local, Tallahassee-based media.

Pricing: Inclusion in the site’s rate tables is free. Banks and credit unions interested in taking advantage of the subscription-style package deal outlined above pay $5,000 per year for the service.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

5. DepositAccounts.com

Year Launched: 2005

Description: The folks at DepositAccounts.com like to describe it as “a different kind of bank account comparison site.” The site generates what it describes as “unparalleled coverage” of current deals and saving strategies, and stresses its “not-for-hire” approach to collecting and presenting financial and product information”on approximately 15,000 banks and credit unions. They say that “advertising relationships never affect which rates are included in their tables nor the order in which they are shown.” As the name might imply, DepositAccounts.com only covers deposit products and not loans or credit cards.

Options for Financial Institutions: Banner ads and featured listings.

Pricing: Did not disclose.

6. Bankaholic.com

Year Launched: 2006

Description (of Site and Services): This site, acquired by Bankrate, in 2008, differs from others in that it focuses on editorial content — lots of articles rather than gobs of rate tables. However, the bulk of articles discuss the best rates — for CDs, credit cards and savings accounts, mainly, although other banking products are covered, too.

Options for Financial Institutions: The site offers banner ads and display advertising. Banks and credit unions can also get placement on the site’s rate tables based on their overall activity and spending. Editorial coverage and paid placements are not available.

Pricing: Did not disclose.

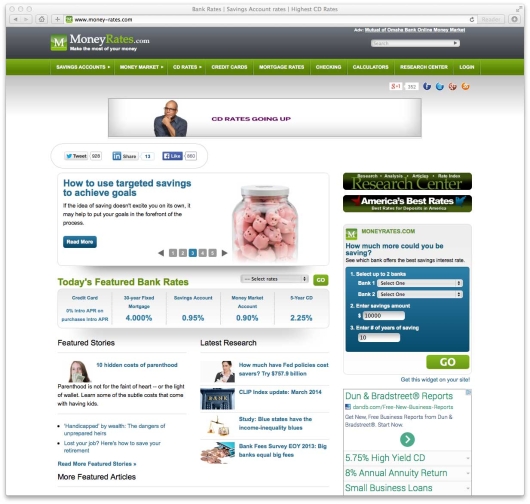

7. MoneyRates.com

Year Launched: 1999

Description: The main goal of MoneyRates.com is to “help consumers find the highest rates on certificates of deposit, money market accounts and high-yield savings accounts,” although it also publishes rates related to other banking products as well as information regarding personal finance (including macro-economic and government policy issues, saving for retirement and more) and investing.

Options for Financial Institutions: Aside from accepting and publishing rate information from and about financial institutions, MoneyRates.com is happy to “entertain inquiries for display, listings and cost-per-click tables,” according to the advertising section of the site.

Pricing: Did not disclose.