According to research from NewsCred, half of consumers say they would be less likely to switch to a new bank if their financial institution offered helpful content.

This is just one example how content — blog posts, infographics, eBooks, tutorials, videos, FAQs and other forms of interactive content like quizzes or checklists — has become a powerful digital marketing tool. It boosts awareness, builds trust, reduces attrition, and drives traffic to your website.

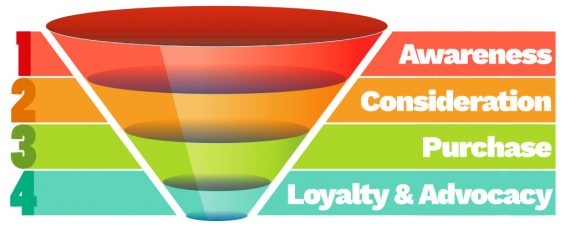

Financial education content can help fill your sales funnel with qualified leads, but only when it’s considered strategically. When outlining the best topics to cover, financial marketers should first think about their target market’s pain points, goals and needs at varying stages in the sales funnel. Audit your website and marketing plans to see what gaps may exist around these stages, and what areas could be expanded upon or repurposed.

1. Awareness. In this stage, consumers are aware of a financial problem (e.g. “I’m not saving enough for my child’s college education”) and are starting their research. Think of what your institution can teach them that may help answer their basic, preliminary questions and solve their problems — in ways that complement your products and services, but remember: this is not the time to sell. The objective here is to work your way into the “Consideration” phase.

2. Consideration and conversion. The consumer now has a general understanding of how to solve the problem (e.g. “I should open an Education Savings Account”) and is evaluating options. Offer content with helpful advice that helps compare solutions, and show how your institution stands out from the competition. Lead them down the funnel with a call to action button, form or another conversion point so you can learn exactly who they are and begin to craft a conversion plan. Don’t leave any dead ends and be sure to measure everything so you understand what produced the best ROI.

3. Loyalty and advocacy. You’ve earned their trust and illustrated you can solve their problem, so they opened an account with you. If they had a positive experience, they may want your help with a new problem down the road. They may even refer their friends and family. Look for ways to build on these new relationships increase cross-sales and referrals with helpful content. This could come in the form of new blog posts, email newsletters, social media and more. The idea is to build upon the momentum, without being too pushy. Like a good friend, remind them that you are there when you need them.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Right Content Flows From Knowing What People Need

Depending on your marketing strategy, you may want to create content that supports various personas, products, life stages or a combination. The idea is to teach people something during their journey while making it relevant to the products and services you sell.

“Banking isn’t the most fun subject, but it presents a big opportunity to help people feel better about financial decisions.”

Banking isn’t the most fun subject for most people, but there’s a big opportunity for banks and credit unions to break down these onerous topics into digestible chunks. Plus, people will feel better about their financial decisions — and you for helping them — when some of the mystery that typically is associated with banking is removed by increasing their knowledge and empowering them.

When people start thinking about buying a home, for example, they may wonder if they can afford a home or how much home they can afford. Some financial literacy topics during this stage could include: Whether someone should buy or rent; first-time homebuyer questions and answers, and how much home a consumer can afford.

Once consumers know they can afford a house and start to research how to take the next step, their questions and searches will change. They’ll want to know about mortgages, rates and finding real estate. Here banks and credit unions can teach them about the differences between types of mortgages, why it’s important to get pre-qualified or pre-approved and offer a mortgage checklist. And, once people get a mortgage, they’ll want to understand how home equity lines and loans of credit work and may want to learn about refinancing.

Read More: Where’s the Marketing ROI on Financial Literacy Programs?

Integrate Financial Education Content Into Your Marketing Strategy

Many financial institutions have financial literacy blogs, infographics or videos on their website. The challenge is how to get people to engage with this content. They seldom do it on their own.

One approach is to create a cross-promotional section that showcases relevant articles on product pages. Financial education content is also great within a solutions finder feature on your website. And it can add a nice touch to campaign landing pages.

Getting a little more technical: To get the most search value from educational content, conduct keyword research using available SEO keyword tools, and work relevant keywords and phrases naturally into the content to ensure it’s optimized for search. If you want to take it a step further, implement schema markup on your blog posts or articles to improve results on search engine pages.

Finally, spend some money to promote your content. Relying on organic search or hoping your site visitors look for this type of content on their own isn’t enough. Allocate some budget towards promoting these informational assets in social media, email and marketing campaigns.

Read More: 6 Steps to Build a Marketing Strategy Around Financial Education

How to Ease The Struggle of Producing Content

More than half of marketers say their biggest struggle is producing content consistently. To make this less of a hassle, part of your content strategy should include an outline what topics are needed, the type of content this will be (blog posts, videos, infographics), and when it should get produced throughout the year.

If you have an annual marketing calendar, try to align financial literacy content to other marketing campaigns and efforts within the bank or credit union. Make developing content a part of these campaigns and allocate resources towards this activity.

Even so, content production can be time consuming, so you may need to hire someone to handle it or use outside resources. Don’t feel badly if you can’t create enough content consistently — it’s not easy! In fact, the two most outsourced content marketing activities are writing and design according to LinkedIn Technology Marketing Community.

Make 2019 the year you put all the pieces in place to have a robust content marketing strategy — based on solid research, a realistic content plan and integration with your other marketing tactics.