Americans faced mental perplexity over money before the COVID-19 recession, but it has steadily worsened for many over the course of the pandemic and its continuing economic effects.

While the impact has been broad, financial angst has hit younger generations harder than older ones, in general, according to Andrew Vahrenkamp, Senior Research Analyst and Program Manager at Raddon Research. Raddon has studied the financial effects of the COVID slump in “Stress and Solutions in a Pandemic Age.”

“Millennials have been feeling much more financial stress coming from unemployment, or less employment,” says Vahrenkamp in an interview with The Financial Brand. Boomers and older consumers, as groups, tend to have more in savings than Millennials and that cushion has somewhat eased their financial stress during the outbreak, he adds.

Vahrenkamp adds that 54% of Millennials are worried about their income, versus 49% of Generation X and 30% of Baby Boomers. Fear based on loss of job security is strongest among Millennials as well, with 49% worried over their jobs versus 44% of Gen X and 20% of Boomers. Many Gen Zers have not “adulted” yet, building up debt and recurring obligations, according to Vahrenkamp, so their job status is less statistically significant in the COVID recession context than other generations.

“The financial stress of COVID-19 is going to continue to build up until we see some kind of resolution from a public health standpoint, which will drive improvement from an economic standpoint,” says Vahrenkamp.

Raddon’s report looked at financial stress issues from several perspectives, including ways that banks and credit unions have attempted to help people achieve financial understanding and peace of mind as well as specific types of products that consumers might find helpful. The Financial Brand also looked at three examples of app-based strategies individual banks have been using.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Stress Begins with Lack of Financial Literacy and Financial Health

Across the sample, two out of five consumers consider themselves very or extremely financially healthy and about the same proportion consider themselves very or extremely financially literate. While that’s not a great rate to begin with, the actual situation might be worse.

Across the entire sample, 53% of consumers worry about an unexpected expense. Concern about financial health also had these effects on the consumers surveyed:

- Don’t exercise as much as I should 44%

- Don’t eat as healthily as I should 38%

- Worry about ability take care of family 38%

- Don’t sleep well 36%

- Miss out on time with friends and family 32%

- Work extra hours/jobs to make ends meet 31%

- Forget important tasks 22%

- Smoke or drink more than I should 21%

- Can’t focus at work 18%

What’s really happening: “Consumers seem to say they are fine financially when they are hiding a significant degree of financial stress,” the report states.

As noted, stresses are higher among Gen Xers and Millennials than among older consumers, and one influence cited is social media. Younger consumers buy into the images they see.

“Gen Z, Millennials and Gen X are all far more likely than older generations to confess that when they see their friends or family post on social media, they feel their lives are inferior to theirs,” the study notes. Some admitted to Raddon that they inflate what they post themselves, to look better.

Read More: Financial Wellness Tools Propel Fintechs Deeper into Banking Space

What Product-Level ‘Stressbusters’ Can Banks and Credit Unions Offer?

Probing what could relieve stress, outside of major financial gains and turning off social media, Raddon looked at two potential categories of aids. One was specific product features that could relieve aspects of financial stress. The other was types of accounts, based on real fintech offerings but described by their features.

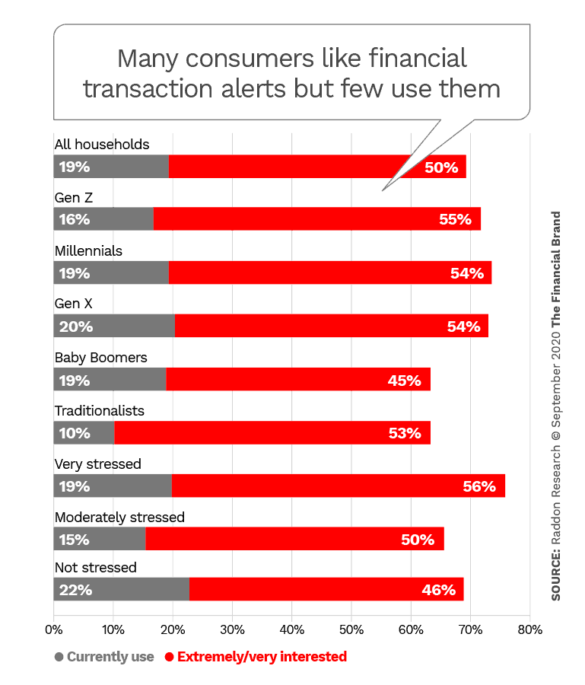

Among services in the first category are text- or app-based transaction alerts. One of the greatest ongoing financial stresses in study after study for consumers is the potential for their accounts to be fraudulently accessed. For some years now card issuers and others have enabled consumers to set up alerts that will tell them when business is being transacted through their account. If they or a fellow account holder didn’t initiate the transaction, they will know to notify their financial provider.

The study found that while interest in this capability is actually quite strong, actual enrollment in this free service is low in all categories.

While a growing number of financial institutions offer services to monitor ongoing subscription charges, in case charges persist past the consumer’s use of a service, interest is strongest among Gen Z. (61% are interested and 18% currently use such a service.) While Millennials are also interested (47%, and 13% using) and Gen X has a similar level of interest (41% and 9% using), older generations have little interest and next to no usage.

Vahrenkamp says he has included questions about transaction monitoring features in past research and he finds that time and again consumers say they would like such as service and yet hardly any ever sign up.

Helping their consumers may require that banks and credit unions press the issue.

“Maybe there should be a little more handholding or more automation here,” says Vahrenkamp. He suggests that automatic enrollment might be appropriate, rather than waiting for people to sign up. It’s kind of a no-brainer, in his view. He suggests that as the pandemic gets more consumers of all ages involved in digital banking perhaps more people will focus on signing up for such services.

Don’t Teach Me, Show Me — and Make It Fast

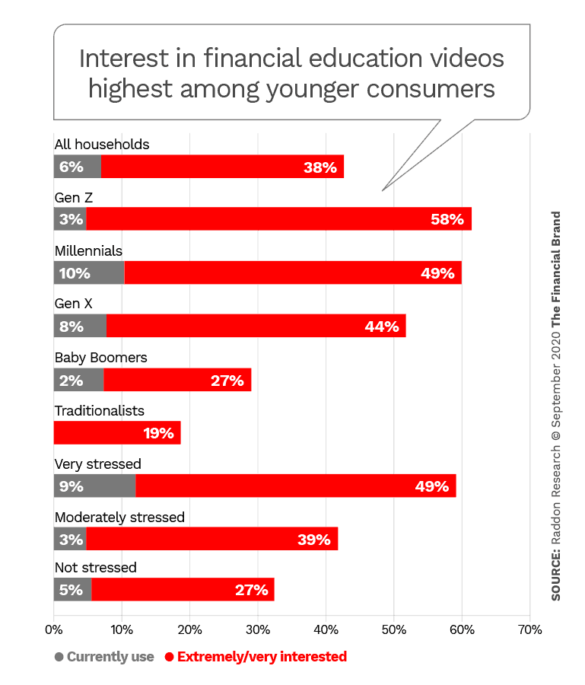

Financial literacy is as much about what one needs to know as what one knows and both banks and credit unions have been trying to push through barriers with credit education and more. Vahrenkamp believes videos would be a strong tool, handled appropriately. At present Gen Z has the most interest in video financial education, while Millennials are somewhat ahead in usage. Very stressed consumers overall also strongly favor video and lead in usage by stress level, although that level remains somewhat low.

Vahrenkamp says the potential for video will grow, but advises banks and credit unions to remember three key rules: “Short, short, short.”

“People don’t want to get invested watching a financial video that’s going to go on for 15 minutes. You’re not writing a symphony. You’re writing a Beatles song.”

— Andrew Vahrenkamp, Raddon

“People don’t want to get invested watching a financial video that’s going to go on for 15 minutes,” he explains. “Something in the area of one to two minutes is usually really good. If it is really educational, you might be able to push it to three or four minutes. As a rule of thumb, think in terms of the length of a pop song on the radio. That’s the length to target. You’re not writing a symphony. You’re writing a Beatles song — short, snappy and to the point.”

A former financial institution marketer, Vahrenkamp adds that it makes more sense to break down a broad subject into multiple short videos than to produce one long one.

And that feature on streaming services like Amazon Prime and Netflix where one episode feeds you right into the next? Think twice before trying that with financial literacy videos.

Vahrenkamp says it would be OK to push along to the next “episode” if it’s all on the same theme, such as aspects of home buying. However, don’t use someone’s interest in a mortgage video to push them into unrelated content — such as a video about annuities.

Read More: Turn Financial Literacy Content Into a Potent Marketing Tool

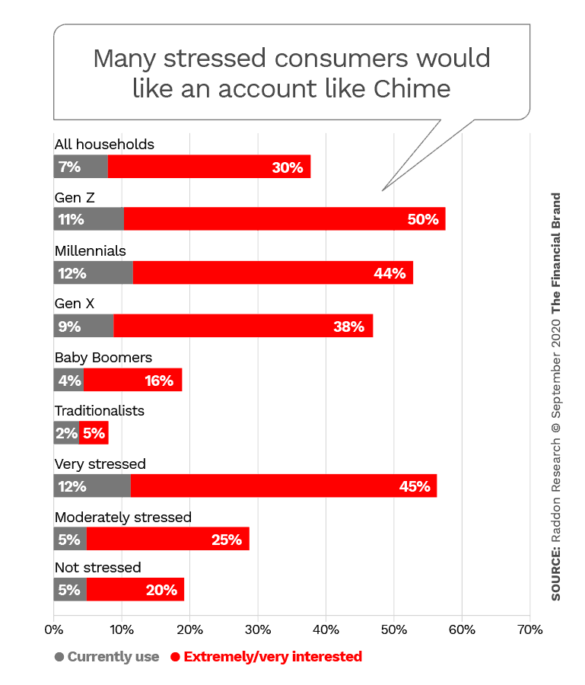

Mobile-Based Transaction Accounts Have Pull Among Young

While all generations exhibit some degree of financial stress, alleviating it through adoption of mobile apps that feature budgeting and related functions is decidedly not on the lists of Baby Boomer and Traditionalists. COVID-19 may have pushed many of them into using mobile banking and other digital channels, but they feel they know all they need to about budgeting.

While signups are comparatively low, younger generations show much stronger interest in mobile-only banking accounts like Chime, the study reports. Likewise do the very stressed.

Chime has quadrupled its consumer base in the last year, including the COVID period, with the base coming to over five million people. Certain features have appeal to the financially stressed — account holders can receive direct deposit payroll payments two days ahead of schedule. However, Vahrenkamp thinks ease of use has played a larger part in making Chime appealing.

“The interface is easy to use, simple, and — dare I say it — attractive,” says Vahrenkamp. He says when Raddon researchers described the product’s features without naming it, consumers were interested in finding out more about it. He says traditional financial players can’t count on consumers trusting them to be a safe place to keep their funds. Trust in fintechs and other tech companies like Apple is rising.

“If I have a soapbox to stand on for 2020 and beyond,” says Vahrenkamp, “it’s that traditional financial institutions need to figure out how to streamline their processes.” Addressing financial stress will in part be about providing service “with fewer clicks and fewer roadblocks,” says Vahrenkamp.

Solving financial stresses takes multiple forms. Here are capsules of how three institutions — Ally Bank, BankMobile and ChoiceOne have been approaching this challenge.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Fractional Marketing for Financial Brands

Services that scale with you.

BankMobile: Blending Workplace Banking with Financial Wellness

Multiple studies have shown that financial anxiety can hurt employee productivity. Company-provided financial wellness programs have been used to reduce that anxiety.

BankMobile has launched a platform called Workplace Banking, which features accounts for employees that feature higher-than-typical interest, an early payday feature, money management tools and a banking app and access to fee-free ATMs.

While physical workplace banking programs have been around for years — using minibranches, calling officers and other efforts — two points set BankMobile’s effort apart. First, it is designed to be a digital offering, from a pioneer of banking as a service. Second, the company isn’t offering the accounts directly through employers. Instead, it has launched the effort as an option among features that employers can arrange through an existing employee benefit broker called BenefitHub.

The bank’s platform includes checking and savings accounts; CDs; personal loans, mortgages, home equity loans and other credit products; and both digital wellness tools as well as educational materials, employer workshops and personalized financial coaching.

Andrew Crawford, Chief Commercial Officer at BankMobile, says operating through a broker such as BenefitHub saves the bank the costs of mounting a sales campaign, going company by company. “This was so we can reach a wider group of people more quickly,” he explains, adding that deals with additional brokers are pending.

The first efforts for the new channel began pre-COVID, according to Crawford, and it remains to be seen whether widespread working from home will accelerate or decelerate signups. With the massive move to digital services during the pandemic, that seems an unlikely obstacle. “People are thinking about ways to run their lives differently,” he says.

ChoiceOne: Small Amounts Add Up to Savings Goals

Michigan’s ChoiceOne Bank has been offering a savings app called Plinqit to customers and noncustomers since 2017. The app is designed so that consumers can set savings goals, with the installments coming out of their checking accounts.

In mid-2020 the bank announced that it has raised over $500,000 in deposits through the program, with average savings goal deposits at roughly $1,000. During the pandemic the bank noted that some people were adding an emergency savings goal on top of their original choice of goal.

A key feature of Plinqit, provided by HT Mobile Apps, is that besides facilitating goal-based savings the financial institution offering it provides small reward payments each time the app user takes a short lesson on financial health and passes a quiz.

Adom Greenland, Chief Operations Office of ChoiceOne, says the program has proven so popular that the bank has been opening more Plinqit accounts than it has traditional standard checking accounts. While app users range among all ages, the average skews younger, at around 40.

Greenland adds that offering the app has brought interest from noncustomers as well. “It’s a good introduction to ChoiceOne,” he says. “We feel Plinqit is helping to expand our brand.”

Ally: Savings Buckets Help People Insulate What They Accumulate

Early in 2020, before COVID had surfaced, Ally’s innovation lab, “TM Studio,” launched a new savings app that features “Buckets,” which gives consumers the ability to pick up to ten savings goals in a single savings account. The function was in the right place at the right time. Emily Shallal, Senior Director, Customer Strategy & Innovation, notes that custom savings category choices migrated as the differences in the COVID economy and the pre-COVID economy became apparent.

For example, the top five custom categories as of late August were Wedding, Christmas, Medical, Gifts and Emergency Fund. The top two had been the same earlier, but others had moved up from lower on the list. Only appearing in the top ten after the pandemic arrived were Rent and Student Loans. Absent from the list in August was February’s #9, Travel.

Shallal notes that during the pandemic a satisfied user of Ally’s savings app launched a discussion of the service that spawned an impromptu community on Reddit. Any financial marketer interested in developing savings products as a financial peace of mind play will find the 500+ consumers posting on the Reddit thread give a good scan of what products are out there, complete with their own opinions of them and advice on how to use them and other online tools.

The key is to recognize that people crave structure to help them save and have the peace of mind of having money put by for their priorities. “They need tools to automate their journey,” says Shalal.