The economic situation for many consumers continues to be difficult. Various stimulus and support programs help, but the continuing weak job market has taken a toll on people’s wallets and confidence.

For financial institutions, one positive, at least, has emerged during the pandemic period. That is the strong interest among consumers in receiving advice from their primary retail financial institution. A few large institutions, using advanced digital platforms, are already filling this need, which up to this point has been more the domain of fintech innovators such as Mint, Personal Capital and Credit Karma.

Ultimately consumers who are struggling financially will need more than advice, of course. They will need additional loan forbearance, government support, and, most importantly, jobs. Yet the “advice and guidance” explored in J.D. Power research means more than pleasant words of encouragement.

The financial institutions on the forefront of the digitization of financial wellness have launched tools and capabilities that put dollars back in people’s pockets, in addition to helping them budget. These include mobile apps that identify duplicate subscriptions, help consumers avoid overdraft fees by providing low-balance alerts, and track how much money they have compared with their usual spending patterns.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Sobering Snapshot of Consumer Financial Health

J.D. Power has been running regular surveys to assess consumer financial health since July 2020. In September the research found that exactly one-third of U.S. consumers said they did not have enough cash to cover living expenses (just 17% of that group were unemployed) and only three out of five (58%) have enough money to handle a $500 emergency.

“The bottom line is that 56% of American consumers are not fully financially healthy, citing varying degrees of financial stress and vulnerability that range from struggles with credit and with building a savings reserve to severe difficulties paying their daily bills,” a J.D. Power Insight report states. 44% of respondents say this stress has been growing — not surprising considering that 38% report their household income has declined by 25% since the pandemic began.

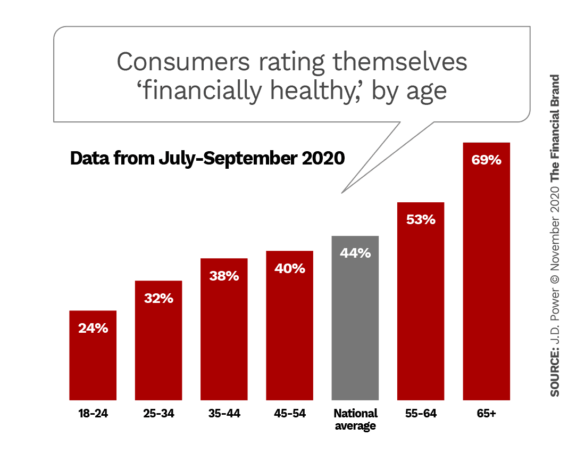

The impact of this financial stress falls hardest on the groups you would expect, says Paul McAdam, Practice Lead for Banking and Payments at J.D. Power — these are the unemployed, people with lower incomes, and retirees on fixed incomes. Older consumers as a whole, however, are significantly more likely to be financially healthy than younger consumers.

Digital Tools Appeal to Struggling Younger Adults

A noteworthy statistic from the J.D. Power data is that more than four out of five (83%) of American consumers are interested in receiving advice or guidance from their primary financial institution. However, the data also show that less than a third of consumers (29%) say they have received such assistance, pointing to both a large need and opportunity. McAdam notes that use of such tools is higher among younger consumers — 39% for those under 40, compared with 25% for those over 40. Further, the research firm found that receiving guidance via digital channels increased while in-branch advice fell, not surprisingly.

That said, the consumers who were able to get advice from real people (branch-based or by phone) found their needs met “completely” more often than with digital channels.

That disparity doesn’t surprise McAdam. As he tells The Financial Brand, “So much more information can be exchanged in an in-person interaction” when discussing buying a home or retirement where there are many questions. “People tend to use online tools or a mobile app for items that are a little easier,” says McAdam, “things like budgeting and quick tips.”

Read More: Financial Wellness Tools Propel Fintech Deeper into Banking Space

Financial Health Strategies Pay Off Big Time for Two Banks

As a precursor to a new study in 2021 that will focus on financial health, and will include the customary rankings, J.D. Power analyzed consumer experiences with advice and guidance among the top ten U.S. financial institutions. What it found was that two banks have a substantial head start over the rest of the industry, particularly in the area of guidance provided digitally. The two standouts — Bank of America and Capital One — ranked equally. (McAdam says the firm reviewed just the top ten because those institutions had the biggest sample sizes.)

“Customers rate Bank of America and Capital One the strongest at helping them make better decisions, manage their spending, meet their savings goals and meet their credit and borrowing needs,” it states in the firm’s Insight paper. McAdam notes that these two institutions were in the lead by “quite a bit” in terms of customer ratings regarding guidance.

Further, the data show that these two institutions have the youngest customer bases among the top ten banks and the highest levels of digital engagement, including receiving digital advice, according to McAdam.

“These two banks have really doubled down on being digital,” he states, “and you just see it in their customer bases.” The paper observes that “Capital One performs particularly well at helping customers under age 45 meet their savings goals, while Bank of America excels at helping customers in this age group make better financial decisions.” This is a result of a clear strategy at both banks of advancing digital transformation beyond transactions into essential customer journeys, including improving consumers’ financial health, the paper states.

Among the innovations the two institutions have implemented are Capital One’s CreditWise mobile app for monitoring credit and setting savings goals, and Bank of America’s Better Money Habits. In September 2020 BofA rolled out its digital financial management platform Life Plan. And of course the two institutions each have highly successful digital assistants — Erica (Bank of America) and Eno (Capital One) — that play a concierge role in providing advice.

Stiffer Competition for Fintech Crowd?

To say that the competitive dynamic between fintech providers of digital money management tools and traditional institutions has abruptly changed might be overstating things. However, the advances made by Bank of America and Capital One, if followed by others, could have an impact.

“The early entrants will probably still move more quickly,” says McAdam, “but these two banks at least seem to be right there with the fintechs in rolling out some really interesting innovations. If they’re behind, they’re only one step behind.”

The analyst believes other large institutions may also step up in financial health, but cautions that the smaller regional banks “run risk of getting caught out.”

One large regional, Huntington Bank, is an example of McAdam’s point. Thanks to a years-long effort to develop sophisticated digital money management tools for consumers, the Ohio-based institution is keeping pace with the largest banks.