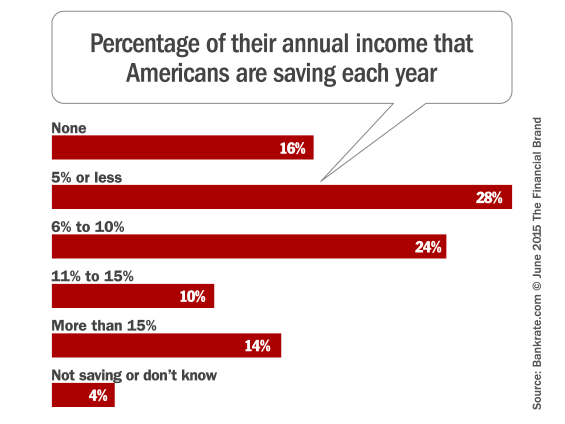

About half of Americans are saving no more than 5% of their incomes, according to Bankrate. Roughly one in five (18%) are saving nothing at all, and another 28% are saving only 5% of their annual income or less.

A study by the Federal Reserve found that 47% of consumers could not cover an emergency expense costing $400, or would have to cover it by either selling something or borrowing money.

According to a survey fielded by BMO Harris, 29% of Americans say that whatever they’ve got scraped together in their rainy day fund would last them no more than one month. One in five confess they would need to dip into their retirement savings in a financial emergency (and that’s probably most of those who have any money saved for retirement).

One in five say they are guilty of spending more than they made last year.

— Federal Reserve

Medical expenses scare people the most. Three out of five Americans are uncertain whether their savings could weather any type of medical emergency in their family. In fact, 31% report going without some form of medical care in the past 12 months because they could not afford it.

More than half of America is sweating about potential car repairs, unsure if they’ve got enough money to cover anything unexpected. An equal number of consumers worry that home repairs might inflict financial pain.

Three quarters of Americans admit they have dipped into their savings, with unexpected repairs cited as the most common reasons (car 31%, home 28%).

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Can America Survive Financial Hardships?

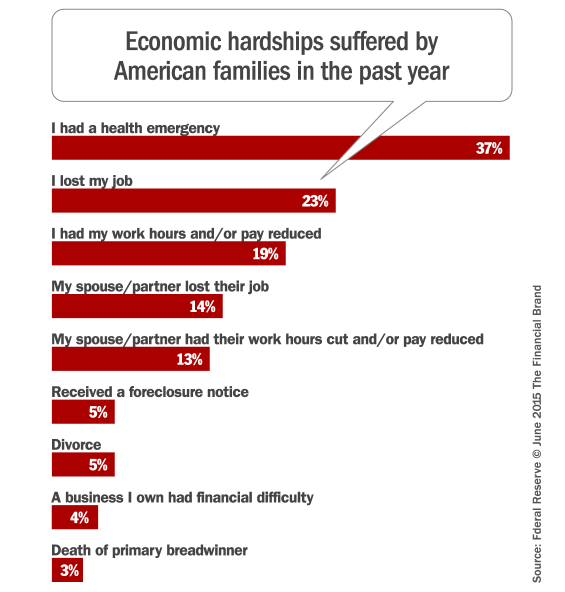

One in four Americans say that either they or a family member living with them, experienced some form of financial hardship in the previous year. Among those who experienced a financial hardship, 35% report that either they or their spouse lost a job — including 2% who indicate that both they and their spouse lost their jobs. 29% say that either they or their spouse had their work hours cut, 37% had a health emergency, and 5% received a foreclosure or eviction notice. Additionally, 27% of those experiencing hardships say they received financial assistance from friends or family in the past year.

Who’s Saving, How Much and Where?

According to Bankrate, fewer than one in four Americans (24%) are saving more than 10% of their incomes. That figure includes 14% (one in seven Americans) who are saving more than 15%.

America’s best savers are the middle class. More than one-third (35%) of households with annual income between $50,000 and $74,999 are saving more than 10% of their incomes, a rate that outpaces even the highest-income households.

Those in the western U.S. are out-saving their counterparts elsewhere around the country; 31% of westerners are saving more than 10% of their incomes, compared with just 20% of southerners. The picture isn’t entirely rosy out west, however, because 19% of westerners aren’t saving anything. That’s worse than all other regions.

Hispanics were more than twice as likely as whites to say they don’t save any of their income.

People with larger salaries were more likely to invest a larger portion of their income. Those with incomes of $75,000 or more were twice as likely to invest more than 15% of their income as people making under $30,000 a year.

People living in urban areas were more than twice as likely as suburbanites to invest more than 15% of their income.

Little Interest In Savings

Concerns about savings appear to be generally on the decline. Between 2010 and 2012, Americans who were less comfortable with their savings than 12 months earlier outnumbered those who were more comfortable by a three-to-one margin. Today, nearly one in four consumers feel they are more comfortable with the amount of money they have in savings than they did 12 months ago.

One-third of Americans between 18 and 29 years old were more comfortable, compared with only 18% of those between 50 and 64.

People with jobs were more than twice as likely to say they were more comfortable as those who were unemployed (ya think?).

27% of all consumers say they are less comfortable with how much they’ve saved. Among women, 30% said they were less comfortable with their savings. Among men, 23% said they were less comfortable.

Half of America says they feel the same about their savings as they did last year — some good, some bad and some indifferent.

Reality Check: It’s hard for anyone to get really excited about saving money when interest rates are at rock bottom.