Digital banking transformation has become an imperative for banks and credit unions. Unfortunately, the process of transforming a traditional bank into a digitally-focused institution can be complex and challenging, requiring significant changes to business processes, technology systems and organizational culture.

In research done by the Digital Banking Report, and from discussions with banking leaders on the Banking Transformed podcast, one of the biggest challenges to digital banking transformation is changing a traditional bank’s organizational culture. In becoming more digitally focused, banks and credit unions must shift to a more collaborative and agile culture where meeting customer needs at speed and scale is the priority. This requires collaboration and support from leaders at all levels of the organization, as well as a willingness to embrace change and take risks.

Most organizations are saddled with legacy systems and processes. Existing technologies are often not designed for the real-time flexibility required for digital transformation. Replacing or modernizing these systems can be a costly undertaking that can take years. Adding to this challenge is the reality that many existing back-office processes are not optimized for digital channels. This creates friction and inferior user experiences.

Rather than trying to convert existing processes and technologies for a new digital reality, some traditional financial institutions have decided to build entirely new, digital organizational units to attract new customer segments or provide better digital experiences to their existing customers. This has been done with the realization that there can be infighting within an organization between the legacy bank and its digital twin.

How does this idea play out in reality? Bain & Co. research has found that some of the separate digital banking units have flopped entirely and some have been folded back into the parent bank. But some have succeeded.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

7 Benefits of Building a Separate Digital Banking Unit

There are seven significant pluses to building a separate digital bank within a legacy banking organization.

- Attracting new customers: A separate digital bank can help a traditional bank reach new customer segments. Example include younger, tech-savvy individuals who prefer to bank online; unique business categories like sole proprietors or the medical community; or even segments with lower customer lifetime value. By offering a range of digital products and services, a digital bank can attract customers who may not have considered or weren’t eligible for the traditional bank’s offerings.

- Existing talent, tech and funding: The legacy organization often has a talent pool and decades of experience that can help ensure a digital banking unit’s success. There is also a significant source of existing technology and investment funding that is lacking at many fintech firms. Finally, the digital banking unit can leverage the trust and brand equity built over multiple years at the traditional banking organization.

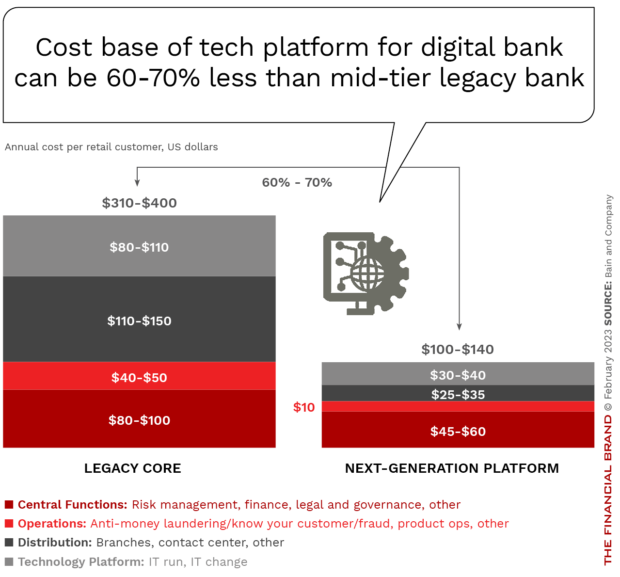

- Lower operational costs: By building a separate digital bank, a traditional institution can operate more efficiently by leveraging digital channels and automating processes. This can reduce required headcount, lower operating costs and increase profitability.

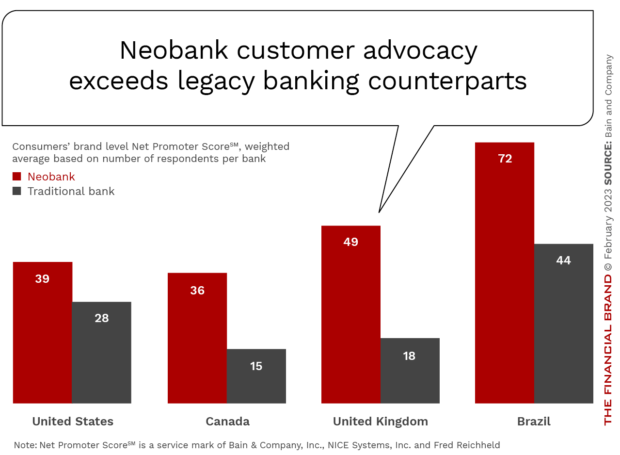

- Improved customer experience: Digital banks often offer a more streamlined, intuitive user experience compared to traditional institutions. By building a separate digital bank, a traditional one can offer customers the convenience and speed of digital banking often with lower costs and increased engagement opportunities for the consumer. The Bain & Co. research found that the customer advocacy of the digital unit exceeded that of the parent bank.

- Speed to market: In a rapidly changing marketplace, building a separate digital banking unit within a legacy organization can enable a bank or credit union to become a highly competitive digital player faster than would be possible if trying to digitally transform an existing organization. This is important because much of the profit potential in banking resides within digital acquisition and relationship growth.

- Greater agility: Digital banks are often more adaptable to marketplace changes compared to traditional banks. By building a separate digital bank, a traditional bank can experiment with new digital products, services and delivery methods, responding more rapidly to changing customer needs and preferences.

- Diversification of revenue streams: Building a separate digital bank can enable a traditional bank to diversify its revenue streams by offering new products and services to customers. In an open banking environment, some organizations have built digital solutions that receive virtually all of their revenues from outside partners. This can help mitigate the risks of relying too heavily on traditional banking products and services.

Read More: Digital Banking Readiness Is Top Priority in 2023

4 Challenges to Building a Digital Banking Unit

Bain’s probe into several existing digital banking units within existing organizations found that “the economics of [a separate digital bank] model remain a work in progress for most banks, with the particular challenges of moving from a rapid growth phase to delivering sustainable returns, and from small to large scale.” This impacts the appetite for continued funding and increases the pressure to create a sustainable ROI.

Here is just a sampling of the challenges that must be addressed;

- Cultural alignment: Building a digital banking unit can create divisiveness within an organization as well as the potential for internal competition for leadership attention, investment and talent. In addition, while most traditional banks are slow-moving, and siloed, a digital banking unit must be more agile and innovative, prioritizing speed, experimentation and collaboration. The question becomes, can a legacy organization create the challenger mindset required to step outside the status quo?

- Technology infrastructure: Most traditional banks rely on legacy technology that is not designed for digital banking. To build a successful digital banking unit, the legacy bank must invest in modern technologies and platforms — which the legacy institution also needs.

- Skills and Training: A digital banking unit requires leaders and staffer who have a different set of skills than those traditionally found in a legacy bank. The skills include data analytics, programming, and user experience design. Unfortunately, these skills are in high demand, and traditional banks may struggle to attract and retain digital talent.

- Seamless Integration: A digital banking unit needs to be integrated with the traditional bank’s operations to ensure a seamless customer experience across the organization. Integration can be challenging due to different core technologies, processes and third-party collaborations. The digital banking unit must be aligned with the existing bank’s brand and values, while still offering a new digital experience for customers.

Read More:

- Digital Banking Transformation Trends for 2023

- Top Retail Banking Trends and Priorities for 2023

- Top Retail Banking Innovation Trends for 2023

- 5 Payment Trends to Watch in 2023

When to Consider Building a Digital Banking Unit

Most incumbents interviewed by Bain & Co. decided to embark on the building of a separate digital bank as an opportunity to build a new, high-growth business that leverages the parent’s capabilities — a form of portfolio diversification. The legacy institutions’ focus on the endeavor and long-term investment took center stage because there was either a significant opportunity or a threat that would disrupt business as usual if the parent didn’t act.

The research states that building a digital banking unit makes sense when an incumbent bank:

- Faces disruption by fintech competitors that threaten the core business.

- Wishes to serve a segment where a digital banking model can be used for market entry and growth.

- Sees their existing core growth stalled or reversing.

- Has gained commitment from executive management.

- Builds or already has the capital to invest to support the digital bank.

- Believes in the digital banking business model as a way to future-proof the existing organization.

Read More: The World’s Biggest List of Digital Banks