Digital banking transformation involves the integration of data, advanced analytics and digital technology into all areas of a financial institution, changing the way work is done, priorities set and services delivered. More than just a technological upgrade, digital transformation requires a cultural change that challenges legacy processes, encourages innovation, and rethinks all aspects of risk and reward.

The objective of an organization’s digital transformation process might be to improve the customer experience, reduce costs, streamline operations, reduce friction, become more agile or increase profitability … or any combination of these objectives. In any case, digital banking transformation will disrupt business models that have been the foundation of the organization for decades. This is why true digital banking transformation is so difficult to achieve – it’s more than simply delivering the same product on a new app.

Before COVID-19, every banking organization was talking about digital transformation. In fact, every organization in other industries were doing so as well. But, in the wake of the pandemic, there is a need to go beyond the “talk” of digital transformation. As consumer expectations changed, competition increased. Thus the need to adapt quickly became the norm. Digital transformation has become a matter of survival.

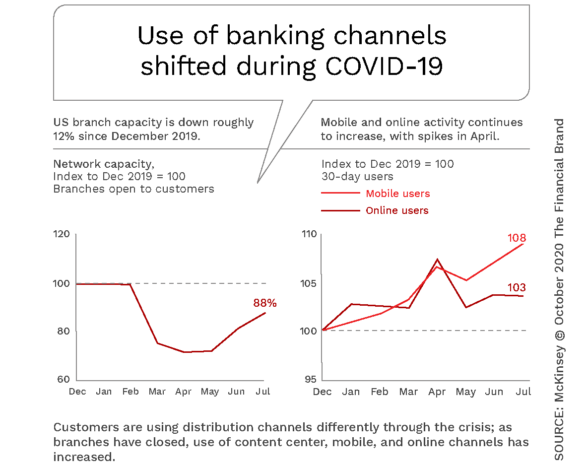

McKinsey data shows that the accelerated shift towards digital channels in banking is likely to stick, and potentially continue to increase. This not only changes the way traditional financial institutions engage with customers, but also the scope of banking options the consumer is likely to consider. This is because both fintech and big tech organizations are creating solutions geared to the growing digital banking public.

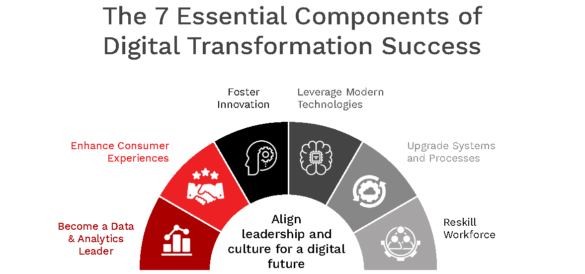

Digital transformation efforts will vary widely based on an organization’s business objectives, target audience, current digital maturity, organization structure and existing culture. That said, the key components of digital bank transformation success are:

- Become a Data and Analytics Leader

- Enhance Consumer Experiences

- Foster Innovation

- Leverage Modern Technologies

- Upgrade Systems and Processes

- Reskill Your Workforce

- Align Leadership and Culture for Digital Future

Read More:

- How to Avoid Digital Transformation Failures in Banking

- Banking Must Bridge the Growing Digital Transformation Skills Gap

- Digital Transformation Requires More Than Technology Upgrades

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

1. Become a Data and Analytics Leader

Unlocking the full potential of digital banking transformation requires the use of data, analytics and artificial intelligence to deliver an exceptional customer experience. Beyond providing the ability to personalize engagement and improve security and privacy, it has been found that organizations that inject big data and analytics into their operations outperform their peers in both productivity and in profitability.

Consumers have come to expect organizations to use their personal information to create custom solutions. Especially during the pandemic, consumers have become accustomed to the benefits of Netflix and Spotify using machine learning for entertainment recommendations, Zoom using just a couple clicks to create video engagement, and Google Home or Amazon Alexa using voice for everything from answering inquiries to simplifying shopping. These same consumers expect their bank or credit union to use their relationship date, behaviors and preferences the same way … or better.

But, advanced analytics and AI should not be a goal in and of itself. These tools should be used to support broader strategies. According to Wharton, “Instead of exhaustively looking for all the areas AI could fit in, a better approach would be for companies to analyze existing goals and challenges with a close eye for the problems that AI is uniquely equipped to solve.” Some solutions include everything from fraud detection to facilitating predictive solution recommendations for customers.

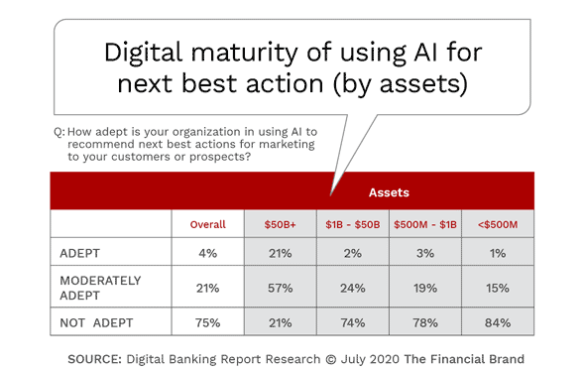

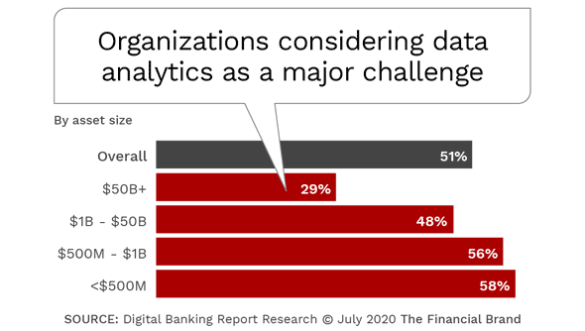

Now more than ever, AI needs to be used to deliver human-like intelligence across the entire organization. At the same time, machine learning needs to be used to improve data interpretation – as part of the advanced analytics process. The challenge that was found in research by the Digital Banking Report is that, while financial institutions understand the importance of data and advanced analytics, 75% of institutions don’t consider themselves adept at using these capabilities. In fact, for most mid-sized and large financial institutions, data and analytics is a major challenge.

Success in the use of advanced analytics, AI and machine learning will be when it is deployed beyond security and risk and to reduce costs and improve efficiency. It will be when organizations use these tools throughout their systems and to create new products and services and enhance customer experiences.

2. Enhance Consumer Experiences

COVID-19 shifted consumers’ use of digital technology in an instant, creating more awareness of the potential of digital apps and creating new digital habits. The integration of new technologies, improved use of data and analytics, the ubiquity of mobile devices, and new digital apps have enabled consumers to get what they want almost exactly at the moment they want it.

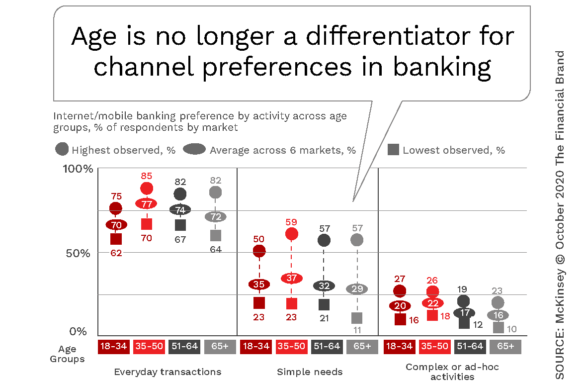

This has impacted the way consumers bank and the expectations consumers have around digital solutions and digital engagement. According to McKinsey, not only have consumers moved away from traditional physical facilities to digital options in increasing numbers as a result of the pandemic, but age is no longer a differentiator for digital preferences.

In other words, digital isn’t just for the young anymore.

Today’s consumers expect organizations to know their personal preferences, leverage their relationship insights, and use data from outside sources to provide real-time, contextual recommendations. According to Accenture, 75% of customers admit being more likely to buy from a company that recognizes them by their name, knows their purchase history, and recommends products based on their past purchases. In research done by the Digital Banking Report, most consumers want their financial institution to use their data, yet 94% of financial institutions can’t deliver on the “personalization promise.”

To meet the needs of a changing consumer, McKinsey believes financial institutions need to reassess the function and future of branch networks. This includes 1) optimizing the branch footprint given the move to digital, 2) changing branch personnel roles to align with new consumer behaviors, 3) building a new omnichannel sales and service model, 4) understanding customer journeys, and 5) improving cross-channel marketing communications.

Read More:

- Digital Banking Transformation Strategies Neglect The Customer Experience

- How Bank of America and Chase Get Mobile Account Opening Right

- Becoming a “Digital Bank” Requires More Than Technology

3. Foster Innovation

Digital transformation cannot be achieved without a culture of innovation. As we have interviewed dozens of founders of disruptive fintech firms and leaders of exciting new digital units of legacy banks for the Banking Transformed podcast, the first thing they mention is the importance of an innovation culture.

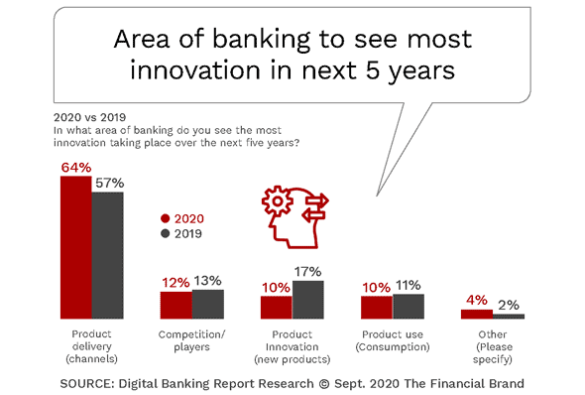

Innovation and digital transformation are interlinked and correlated. The organizations furthest along in the digital transformation journey are also those that are innovation leaders. As was found during the early stages of lockdown with COVID-19, there is an opportunity when financial institutions can use digital to drive innovation and reset the paradigm for both the present and the future. The threat for those organizations not fostering innovation as part of the digital transformation process is that traditional and non-traditional competition is changing the banking ecosystem by embracing innovation as part of their business model.

When looking at the financial services industry, we need to remember that technology is available to all institutions equally, therefore technology, in and of itself, affords no distinct competitive advantage. Instead, it is the leadership, culture and human component behind the technology and innovation process that sets firms apart. In other words, digital technologies provide the opportunity for efficiency improvements and improved customer experiences. But, if the people within the organization lack the innovation mindset to change current processes and solutions, the technology will simply magnify flaws within the organization.

When looking at innovation initiatives, banks and credit unions must start with consumer needs. In other words, any effort must be preceded by a diagnostic phase with in-depth input from consumers around what they expect – knowing that these expectations are shifting rapidly. And, as opposed to trying to hit the center of the target in a single major change, most organizations have found that the best way to improve a customer experience is to make smaller-scale changes to different components of the engagement that can be implemented more easily with rapid iterations over time.

Remember, as with digital transformation, innovation is not a destination, but a journey that involves evolution over time.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

4. Leverage Modern Technologies

Research discussed in the book The Technology Fallacy: How People Are the Real Key to Digital Transformation reveals that the human and organizational aspects of digital transformation are often more important than the technological ones. That said, modern technology is still required to digitally transform an organization.

In other words, banks and credit unions must deploy new technologies into all areas of the business, changing the way organizations operate and deliver value to customers. It also requires an ongoing challenge to the status quo, with experimentation and an increasing comfort with failure. The reason for embracing new technologies is because the playing field in banking has changed because of new competitors and a greater awareness by consumers of what is possible as they order meals from a voice device, engage with others with video, hail a cab with their phone, and get a home loan in minutes.

Some of the technologies that enable digital transformation in banking include:

- Mobile apps. One of the fundamental changes in the banking industry is the movement from branch delivery to web and online applications to mobile apps. In fact, many organizations are foregoing the development of online capabilities, using mobile upgrades to be the forerunner to online improvements. The most progressive organizations are making incremental upgrades more frequently than ever, focusing on speed, simplicity and user experience.

- Cloud computing. Cloud computing has democratized data collection and increased the capacity and security of information processing, allowing financial institutions of any size to upgrade legacy systems piecemeal or all at once. By moving most services to the cloud, banks and credit unions can move quicker and better manage scale.

- Automation and AI. More and more functions within banks and credit unions are being automation and improved with robotics and artificial intelligence. One of the most common uses of automation and AI is in customer service, where firms use data, analytics and automated systems to respond to basic inquiries from consumers. This not only saves money, but improves the standardization of solutions, allowing humans to be used for more important tasks.

- Voice technologies. While still in the formative stage and many organizations, the ability to perform inquiries and transactions using voice is quickly becoming a differentiator as consumers become accustomed to the functionality of Siri, Alexa, etc. Bank of America’s Erica solution is a leader in financial services.

- Internet of Things (IoT). From smart watches to sensors throughout the home, the potential for embedded finance is becoming more commonplace. As organizations are looking for ways to make banking easier, more and more will be done using interconnected devices that talk to each other for payments, loans, savings and investments.

- Blockchain. Distributed ledger technology has moved quickly beyond cryptocurrency and has been used by the financial services industry for everything from smart contracts to the simplification of loan applications. A consortium of banks in Canada have even used the technology to give people more power over the data collected by financial institutions.

- 5G. As digital transformation hits full-speed, the speed of data processing and customer engagement become more important. Fifth generation wireless (5G) technology will enable exponentially faster data transmission and uninterrupted connectivity, opening doors for solutions previously impossible with 4G technology.

5. Upgrade Systems and Processes

The prevalence of legacy systems still hinders most financial institution’s ability to successfully embark on a digital banking transformation strategy. In research done by the Digital Banking Report, legacy systems are considered a primary barrier to transformation. If an organization is spending 75% of their IT budget on supporting legacy systems, there is a limit to what is available for modernization.

The good news is that there are many solution providers that can upgrade systems incrementally, allowing organizations to focus on areas of greatest need. For banks and credit unions to keep pace with the rapid marketplace changes, many firms are also moving to cloud computing and adopting agile principles, which allow for the processing of massive amounts of data and insights in real times and at a greatly reduced cost.

Legacy systems modernization doesn’t happen in an instant. It is an incremental process that differs for each organization based on institution objectives and anticipated business needs. For most financial institutions, it will involve the integration of cloud computing, mobile technologies, advanced analytics, cybersecurity, etc. The goal is to build a flexible infrastructure that can support existing needs and future innovations.

Just as important as changing legacy technology, financial institutions must completely rethink existing back-office processes that were created decades ago. These processes transcend the roles of product development, delivery, sales, marketing, and customer service. It goes beyond simply using a digital channel to deliver legacy solutions. Digital transformation must begin and end with the customer experience and therefore be built from the inside-out.

All existing processes must be rethought from the perspective of digital delivery, which requires the removal of friction, the contextuality of engagement, and a focus on speed, ease of use, and user experience.

6. Reskill Workforce

The skills needed for embarking on a digital transformation journey most likely do not exist in sufficient numbers in most financial institutions, making talent management and employee reskilling particularly important. While some of the new skills required can be solved through hiring, banks and credit unions must consider a long-term approach to growing their talent base using training and cross-functional deployment.

Beyond the hard skills required for digital transformation, organizations also must consider the adjustment of legacy mindsets that will be required, especially as back-office processes and procedures are rethought. For instance, how does a tenured product manager expand their thinking around how a digital deposit account needs to be built or a digital loan application process needs to be simplified?

Unfortunately, most financial institutions are continuing to under-invest in training in a sector where the skills shortage is particularly acute. In a relatively short period of time as many as two-thirds of current employees will need to be skilled to become “digital workers” and “digital makers.”

We also need to realize that the pace of change has created a reality where the majority of children in primary school today will work in jobs which do not even exist today. In other words, for existing workers or those not yet in the workforce, there will be a need to continually reskill and embrace lifelong learning to be relevant in the marketplace.

7. Align Leadership and Culture for Digital Future

As mentioned often, digital transformation requires more than just updating technology or building new digital applications. Failure to align the efforts, values and behaviors of leadership and employees can create friction and risks within an organization.

Alternatively, when leadership embraces the changes that are needed, and supports a comprehensive and collaborative effort to advance digital transformation, all efforts to “become digital” will have a greater chance of success. Part of any successful digital transformation effort is having the communication and actions support the efforts at the top of the organization. It also requires support and buy-in by those in other levels of the organization, including the same middle management that has been doing things the same way for decades.

In addition to making the goals of the digital transformation clear, and how the process will positively impact corporate objectives and strategies, top management and boards must focus on communicating the cultural aspects that will help efforts succeed, including transparency, accountability, and a willingness to experiment and even fail.

Despite the uncertainty about the course of the pandemic, the time to act is now. Those institutions that do so will emerge more prepared to compete in a ever-changing banking ecosystem, with a stronger value proposition, greater efficiency, and higher profitability.