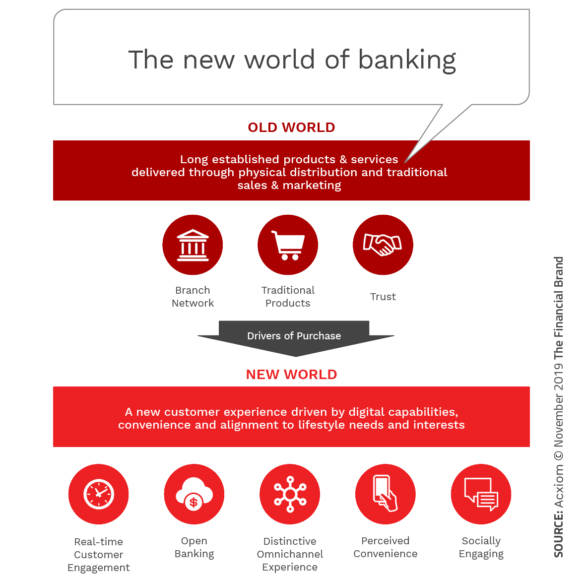

Nobody will disagree that the banking industry is going through massive changes unlike anything seen in decades. New technologies are impacting legacy banking models and consumer expectations, as well as the competitors in the marketplace. We are even seeing changes in the way financial institutions engage with consumers across their financial lifecycle. The question is, what are the most important trends that we will need to take action on in the next 12-18 months? More importantly, what action is needed?

A report from Acxiom addresses several banking transformation trends, including: the growth of partnerships, enhanced use of consumer data, the impact of fintech firms, enhanced ways to build engagement through marketing, and the impact of a platform economy. Transformation in banking will continue beyond 2020, but building competencies that can take advantage of these trends needs to begin now.

Read More: Top Digital Banking Transformation Trends for 2021

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

1. An Age of Collaboration

With change in the banking industry happening so quickly, it is impossible for any organization, of any size to “go it alone.” The value of establishing the right strategic partnerships has never been greater. “Partnering can extend products and platforms into new markets, expose brands to new customer segments and create scale,” Acxiom observes. The ultimate objective is to improve the customer experience with an enhanced value transfer.

When the right strategic partners are selected, there should be greater agility, a seamless integration with systems and products already in place, and a synergy not possible previously. There also needs to be a flexibility within the partnership that will allow the collaboration to adjust to marketplace changes without needing to renegotiate the relationship.

Going forward, partnerships will extend beyond traditional providers to include fintech firms, big tech organizations, communities and potentially even governmental units. In some instances, solution providers will partner with each other to enable a better integration within banks and credit unions with less internal and external friction.

Done well, these bilateral and multilateral networks of providers will be able to deliver more personalized solutions than was possible previously. Imagine 8-10 different savings or lending solutions being available for different segments the retail consumer or business population. These solutions will increase engagement as well as value to the consumer (and financial institution). This will be accomplished by leveraging new data assets, advanced analytics, and modern communication platforms.

Read More:

- The Future of Banking: Tomorrow Will Be Radically Different

- Run Your Bank in the Cloud: Crazy or Fintech Smart?

When markets become disrupted by new technologies and competitors, many legacy companies struggle to keep up. They are often simply ill-prepared to develop new products and services in the midst of the uncertainty. Rather than attempting to go it alone in such circumstances, some companies reach out to partners with an eye toward building a broader ecosystem that will boost their competitive strength

– MIT Sloan Management Research

2. An Age of Enhanced Data Utilization

With enhanced sources of data and technology to process insights, there is an unparalleled opportunity to proactively identify consumer needs and the appropriate product or service to be offered. Beyond using a simple demographic, product ownership and risk-based profile, banks and credit unions can deliver greatly improved results by combining both traditional and non-traditional data.

Today, financial marketers and product managers have access to lifestyle and psychographic data, financial and non-financial product ownership and purchase data, channel preference insights, brand loyalties, geo-location data and even insights from social media use. These enhanced insights, when combined with advanced analytics will not only provide purchase propensity information, but also the projected timing of need.

The result is highly personalized communication that the consumer will welcome delivered to the device or platform the consumer prefers. Done well, this also can increase the prospect market beyond what was possible before, reaching previously underserved consumers who may only have a “thin file” with less data available.

Organizations are often restricted by the fact that their data is locked up in siloed systems and applications. As a result, getting that data into an AI engine to start revealing insights can be a major problem. If AI is the ‘brain,’ we liken APIs and integration to the ‘nervous system’ to help AI really create value in a complex, real-time business context.

– Ross Mason, Mulesoft

Read More:

- Banking Providers Still Aren’t Ready for Big Data

- Digital Account Opening: Hot Trend, But Kinks Hinder Speed

3. An Age of the Non-Traditional Player

What legacy financial institutions have in capital, customers and infrastructure, they often lack in speed, innovation and a genuine focus on the consumer. This is why more and more fintech firms have not only entered the banking ecosystem, but have succeeded in moving market share. The payments ecosystem will never be the same, and the lending battlefield is getting more and more crowded with new players filling the needs of an increasingly diverse consumer.

Fintech firms compete by serving the consumer without being tied to a legacy of operations and organizational rules and structure. This allows them to provide products and services that are faster, easier, and/or cheaper than what traditional banks can deliver. According to Acxiom, “The movement toward open banking and open APIs will only increase the speed of change as fintech business models and technologies allow them to align with new opportunities very quickly.”

The consumer wants speed, simplicity, intuitive design and the ability to complete a task with a simple push of a button. Legacy financial institutions struggle to provide that level of user experience. Beyond smaller fintech organizations, big tech firms are now leveraging their platforms to combine shopping, ride-sharing, searching and engaging with new distribution options for traditional financial services.

While there has always been the benefit of trust on the side of legacy financial institutions, big tech firms as well as smaller fintech firms that have been in existence for more than a few years are receiving trust scores approaching and even surpassing legacy banks and credit unions. This should be a cause for concern especially for mid-tier and smaller financial institutions in the foreseeable future.

In the future, we anticipate seeing more joint ventures, acquisitions, and investments in Fintech firms. Incumbent banks can learn from and acquire Fintechs to enhance existing offerings, provide new services, address customer needs, and improve operational efficiency. All financial institutions will need to evolve – incumbents, digital banks, and neobanks.

– Acxiom

4. An Age of Advanced Marketing Performance

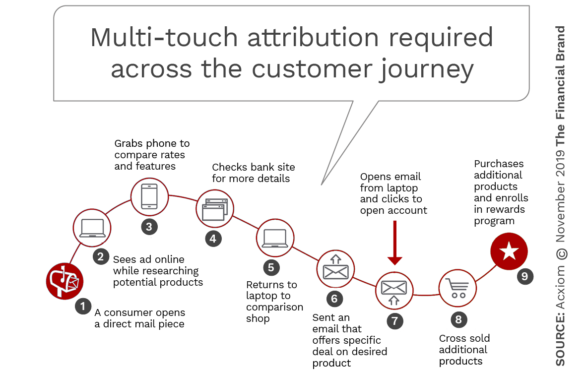

Data, advanced analytics and the deployment of new marketing technologies make it possible to target and specific audience at the proper time of engagement better than ever in the past. And, at a time when fewer consumers are switching providers, effective multichannel marketing is needed to stimulate new customer and organic growth.

The challenge is that the ability to measure the effectiveness of increasing investments in marketing has lagged. With most organizations using multichannel marketing campaigns, it is more important than ever to measure the effectiveness of each channel in the customer journey and to understand the best cadence and sequence of messages for the optimal ROI.

In the end, last-touch attribution is no longer an acceptable measure. Instead, it is imperative to understand the interrelationships of channels and messages to apply spending to the key moments of a customer purchase journey.

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

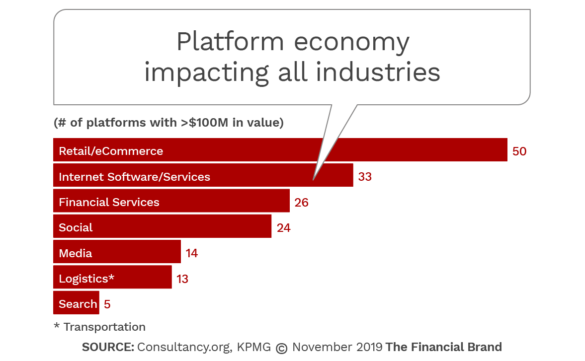

5. An Age of the Platform Economy

“A platform is a plug-and-play business model that allows multiple participants (producers and consumers) to connect to it, interact with each other and create and exchange value,” according to Acxiom, While the retail industry has the greatest number of organizations with platforms (50), the financial services industry has 26 platforms organizations, according to a KPMG analysis.

A true platform would offer products and services from multiple organizations to serve the needs of a broader array of consumers. Most financial institutions have not come close to offering a platform solution. This could definitely be a problem in the future.

According to Ron Shevlin, “Platforms hold opportunities for financial services marketers to access and use data they’ve never had access to before, deliver levels of personalization they’ve never achieved before, and do it more efficiently than they ever have before.” Shevlin continues, “Three challenges facing financial services marketers competing on platforms are: 1) Over-personalization, 2) Unintended consequences of data sharing and 3) Cloud adoption immaturity.

As we approach 2020, it is clear that we can’t stop change or the impact it is having on banking, the consumer and even regulators. Today’s consumer expectation are different from the past, and they will continue to change in the future. As consumer expectations change, so must the financial institutions that serve them. If traditional organizations don’t meet the needs, fintech or big tech firms will.

The biggest threats to banking in 2020 and beyond: complacency and the unwillingness to change the way banking has been done for decades.