For many financial institutions, the pace at which they are pursuing digital transformation is not moving fast enough to meet consumer expectations.

That premise, based on research by consulting firm and financial technology provider Broadridge, calls into question a commonly accepted notion in banking. Namely that the pandemic resulted in great strides in digital transformation.

The pandemic certainly did lead to big advances in usage of digital banking, as well as many new customer-facing innovations. Yet two factors have slowed the momentum: the need to change processes and technology end-to-end within banks and credit unions, and the fact that consumer expectations don’t stand still, but keep moving upward.

Work in Progress:

Around half of financial firms report that they are still in either the beginning or implementation stage of digital transformation projects.

In a survey of 750 C-suite executives at financial services companies about digital transformation, half of the respondents — which included execs from retail banks, insurers and others — said their company was either a “beginner” or “implementer” when it came to digital transformation. Only 21% cited themselves as “leaders.”

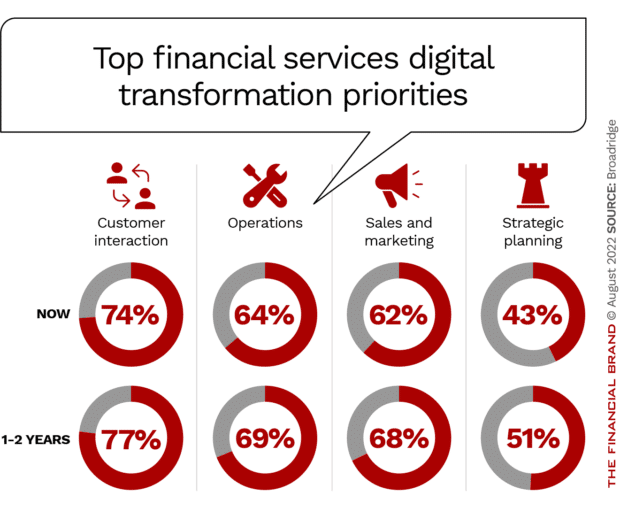

Digital transformation projects around “customer interactions” topped the list of planned goals over the next 1-2 years.

That’s a good thing because consumers, by and large, say that the digital experience across all industries does not meet their expectations.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

What Consumers Say About Digital CX

In a separate poll of consumers conducted by Broadridge, 55% of those surveyed said the pandemic has changed the way they interact digitally with businesses and has increased their expectations. 65% said that most of the companies they do business with need to improve the digital customer experience they provide — up from 59% from a similar poll conducted the year before and 35% in 2019.

Just over three quarters (77%) said they would be willing to spend more money with a company if they could provide a “good” digital customer experience.

Among the suggestions from consumers about what they want in a digital experience are:

“Make it easier for me to access my account, payment history, bills, options and more!”

“Make it easier to navigate my account.”

“Be more interactive or someone else will and it will cost you more to bring me back.”

Read More:

- Fintechs Raise Digital Transformation Stakes, Many Banks Don’t Ante Up

- Banks Spend Billions on Digital Transformation, But What’s The Payoff?

- Executing What’s Possible With Digital Banking Transformation

What Holds Back Digital Transformation in Banking

Digital transformation covers a lot of ground and is often a quite nebulous term, admits Matt Swain, managing director and practice lead for communications consulting at Broadridge, during a webinar on the two surveys.

He defines transformation broadly as “how technology can play a more significant role in processes that have historically taken place in non-digital channels.”

One issue banks have had in pursing digital transformation is a complicated technology infrastructure built up over years, due to mergers and acquisitions and buying different solutions from vendors. Swain also notes that different lines of business often make their own tech buying decisions in a silo, which leads to difficulties.

“It results in a lot of redundant software and an inefficient use of resources,” he states.

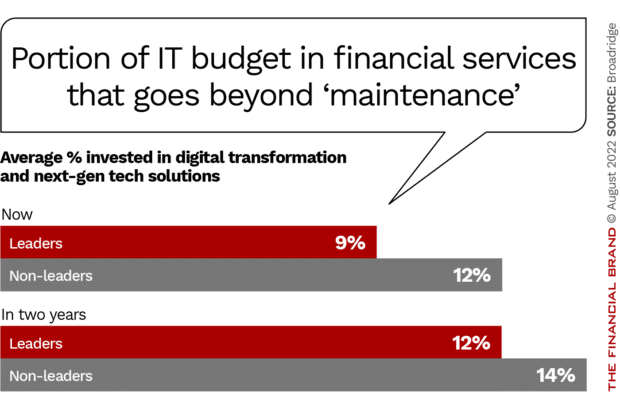

Mostly Just 'Keeping the Lights On':

About 90% of financial services IT budgets goes to maintenance.

Financial institutions also often have to overcome outdated or inefficient processes, observes Martin Seagroatt, senior director, marketing at Broadridge.

“There are a lot of these legacy processes in place, and it’s just because that’s always how it’s been done,” he says. “You’re not even sure how they were established.”

Seagroatt also notes that financial services firms only spend about 10% of their IT budget on digital transformation, with the rest dedicated to maintenance and “keeping the lights on.”

However, this number is expected to increase over the next two years as firms take advantage of next-gen technology, as the chart above shows. As banks move core systems to the cloud or take advantage of advancements such as quantum computing more resources will be freed up for innovation and digital transformation projects. The institutions classified as non-leaders will increase their spending to a greater degree as they strive to close the gap with the leaders.

Swain advises financial institutions to take a client-centric approach to digital transformation.

“Focus on reducing friction and reducing the steps it takes customers to move from point A to point B,” he recommends. “Determine what the customer is looking for and then how to execute on that.”

Swain says one big area is that customers want their banks to have a view of them across products and to have a holistic view of them.

“If I have a loan and a retail account and investments, how can I get that into one view?” he asks. “As opposed to different logins and different experiences for each.”

Read More: Digital Banking Transformation is a Journey, Not a Destination

The Power of People to Impact Transformation

Just as important as technology itself is creating a culture of innovation internally and having the right people in place, says Seagroatt.

“The people part of it is a big reason why many digital transformation projects fail,” he notes.

It’s not just about bringing in data scientists and technologists, but equipping all staff with whatever knowledge they need about the new technology in order to do their jobs better. It’s also about equipping people with the skills they need to have a digital mindset,” Seagroatt adds. “What do they need to know about data science and how this next-gen technology works?”

There also needs to be greater alignment internally such as “matching up tech staff and data scientists with those who understand the business and client problems.”

Banks and credit unions need to work hard at attracting new tech talent, which can be difficult as traditional financial institutions are not often seen as exciting places to work by technologists.

“There’s a large skills gap at the moment,” Seagroatt observes. Financial institutions really need to “work on their talent attraction and retention strategy. They need to promote their culture of innovation.”