Retail banks and credit unions are plagued by inconsistent online- and offline capabilities, and generic customer propositions. To overcome these fundamental issues, Boston Consulting Group (BCG) says financial institutions must embrace a “bionic” a strategy.

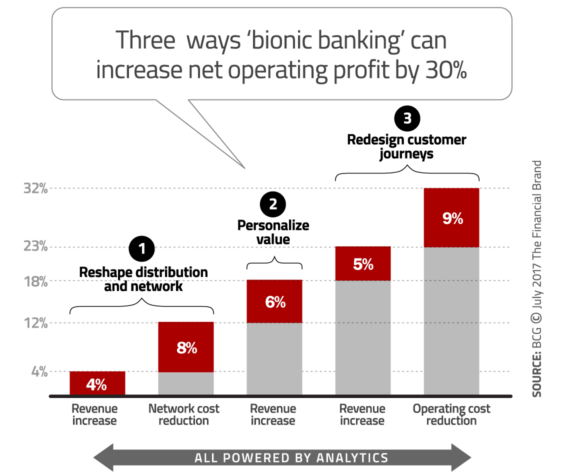

According to BCG, a bionic transformation essentially consists of three interrelated elements. First is the blending of digital and personal interactions to create a more responsive and cost-effective distribution model. Second is the articulation of a value proposition that combines human judgment with data power. And third is the adoption of a customer journey mindset, with end-to-end processes that are supported by robotics and machine learning.

BCG says banks and credit unions must find a way to combine all three if they hope to blaze a path forward. Fortunately, BCG outlined the steps retail financial institutions can take to accomplish this in their 24-page report, Global Retail Banking 2017: Accelerating Bionic Transformation.

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

1. Blending Digital and Personal Interactions

While 43% of respondents in the BCG survey indicated a preference for digital-only experiences, up from 28% only two years earlier. However, an equal percentage of consumers (43% in 2017 vs. 37% in 2015) said they prefered a mix of both physical and virtual interactions — a hybrid banking experience in which digital tools and capabilities combine with human input and advice at the moments that matter.

BCG says a consumer might see an intriguing offer on social media, for instance, research the offer on the bank’s website, sign onto a web chat for help in filling out an application, then telephone the call center to monitor the status.

Customers expect their financial services partners to exhibit the same dexterity with the physical and the digital environment that they do.”

— Boston Consulting Group

“Each of those interactions should feel seamlessly integrated,” the BCG report says. “Yet too many banks view their digital and physical channels as separate entities serving discrete customer segments.”

The report stresses that one of the most important challenges in the move toward bionic distribution is reforming the branch network, which accounts for roughly 30% of a financial institution’s total operating costs. Instead of a uniform branch model, banks need to create multiple branch formats, embedded within a well-rounded multichannel experience.

Banks can also use data-enabled location models to forecast expected changes in customer behavior, product mix, and profitability in order to optimize their footprint, serve more customers per branch, and achieve higher margins.

And finally, BCG says that relationship managers and salespeople must be equipped with the right digital and analytical tools. Customer relationship management systems, next-best-action tools, and other digital enablers can improve the quality and quantity of customer interactions — more digital tools in the bionic toolbox.

BCG says banks that move to this type of bionic network can see revenue gains of 5% to 15%, network cost reductions of 15% to 35%, and increases in customer satisfaction of 10% to 15%.

2. Value Propositions That Combine Human Judgment with Data Power

Retail banking customers expect high-quality, easy-to-understand products at a fair price from a banking provider that knows and understands them. But accustomed to the ease and immediacy of digital channels, they also expect a high degree of personalization, differentiation and localization across online and offline channels.

Many banking bundles are complex, the report notes, with some including more than 50 features. But not every feature holds the same value, nor is pricing always transparent. BCG says banks and credit unions need to enrich the quality of interactions by ratcheting up product and service innovations, with an emphasis on simplification.

“Instituting such practices starts with understanding what customers value most and aligning product and service components accordingly,” the authors of the BCG report said. “It also requires factoring in price elasticity and sensitivity in order to differentiate pricing where appropriate, and improving price realization.”

According to the BCG report, more-effective, value-based pricing practices could allow banking providers to add as much as 15% in near-term revenues — money that goes directly to the bottom line and can help fund the rest of the institution’s strategic agenda — while at the same time improving the customer experience.

3. Adopting a Customer Journey Mindset

BCG says that retail banks and credit unions need to approach process design in a fundamentally different way, identifying the customer journeys that matter most and redesigning them end to end, as well as leveraging artificial intelligence, robotics, and other service enablers to improve both speed and decision making — the bionic combination.

For example, banks can use an AI-based pre-approval process to offer consumer loans in real time. They can also improve sales force effectiveness by providing evidence-backed next-best-action guidance based on customer behavior, social media, and other data.

“While 80% of all customer touchpoints are digital, banks are struggling to convert that traffic into increased sales and efficiency,” the report’s authors noted. “Compared with traditional banks, all-digital banks support twice as many new-account openings per operations FTE and serve 155% more customers per operations FTE.”

Data in BCG’s survey shows that retail institutions that digitize their most important customer journeys can see a 5% to 20% boost in revenues from improved service, increased capacity among relationship managers, and enhanced data-enabled offerings. They can also reduce costs by 10% to 25% through improved processing times, automation and faster and more-accurate decision making.