As financial institutions seek new ways to pull in deposits, one gambit that more may try is setting up a separate digital brand to attract customers from outside their market area.

Doing so is a strategy that has become more common in recent years, starting well before rising rates ignited fierce deposit competition. Some institutions that have had digital brands for a while, such as KeyBank, use this strategy to appeal to niches, while others, such as SalemFiveDirect and UmbrellaBank, aim to attract consumers more broadly.

New brands have to go up against heavy firepower from a cadre of more established, high-profile “direct banks,” such as those from Ally Financial, Charles Schwab and Goldman Sachs. There are also flashy fintech newcomers like SoFi and Varo that now have bank charters, and neobanks like Chime, which rely on banking-as-a-service arrangements to provide relatively narrow services to consumers. All of these competitors have lived their entire existence digitally.

By learning from them, traditional banks and credit unions launching digital-only brands can gain ground, especially since subtle sea changes are underway in this segment of the industry. A good place to start is the 2023 U.S. Direct Banking Satisfaction Study from J.D. Power, directed by Paul McAdam, senior director of banking and payments intelligence.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Playing the Digital Banking Game for Out-of-Market Deposits

Paying a higher rate has been a routine part of direct banks’ marketing strategy, though it was easier (read: cheaper) to brag about paying multiples of the average rate when the traditional players were still expressing their rates in decimal places. With neobanks, though, the appeal often lies more in paying a decent rate on smaller accounts, offering checking with no fees, and allowing early access to wages.

Now the competitive picture and the customer base are changing. J.D. Power’s study found that a greater proportion of neobank customers were in weakened financial circumstances than seen in previous editions of the research. By contrast, direct banks are seeing increasing deposits from affluent and mass affluent consumers as well as people with deposit balances of $10,000-plus.

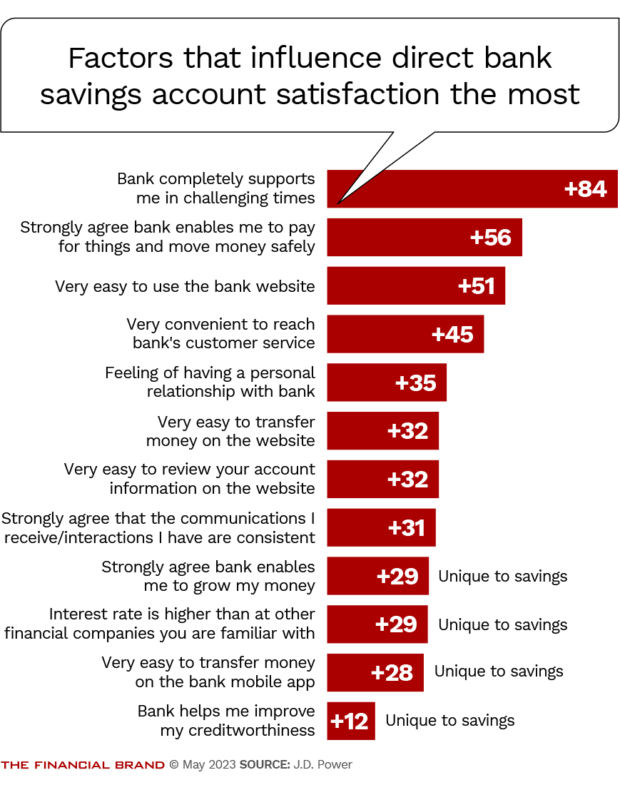

Increasing deposit interest rate levels has helped improve how customers feel about their direct banks’ efforts to help them grow their money, as shown in the chart on savings account satisfaction below.

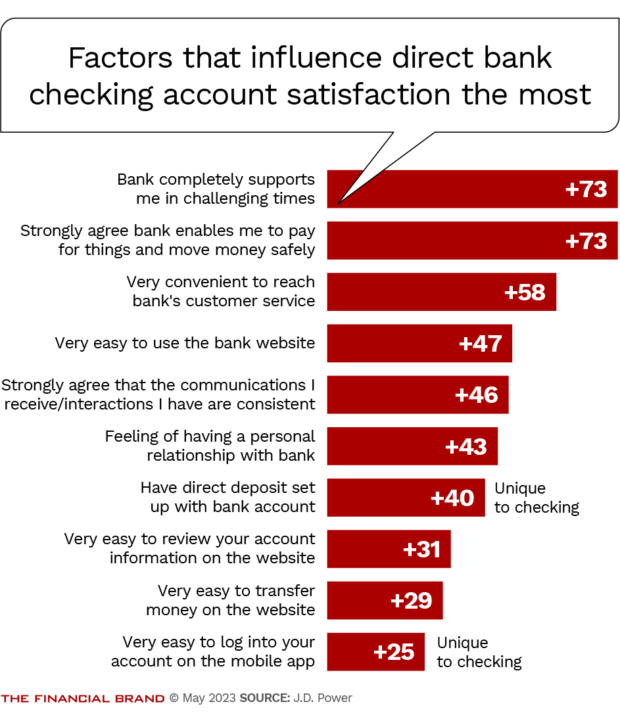

Yet McAdam says rate doesn’t rule it all. Among consumers doing business with direct banks and neobanks, service levels matter in multiple ways, the research shows.

“Banks can go in and play the rate game,” says McAdam, “but there is an opportunity here to differentiate your digital effort and generate higher levels of stickiness.” This applies to both current players as well as to traditional financial institutions launching digital brands to bolster deposit gathering.

In the direct banking study and related J.D. Power research on retail banking, some interesting sources of stickiness arise. These include ease of getting financial tasks done remotely — such as depositing, withdrawing and transferring funds. J.D. Power found that direct bank customers have increased their usage of their bank’s website, mobile apps and payments services. The ease of opening new accounts is also important, as is rapid resolution whenever problems with the accounts arise. None of that has anything to do with rates. (The research, conducted in 2023, was completed prior to the large regional bank failures in the spring.)

Read more: BofA Ups Digital Prowess with Marketing & Digital Banking Combo

Incorporate Rates Plus Service with a Smile

The message for those contemplating new national outreach: Financial institutions that can ring the rate bell and impress consumers with their service will be ahead of others. Even as direct banks receive high satisfaction ratings, J.D. Power found that the rate of new customer growth has slowed by 2% in 2023. Growth has slowed even more among neobanks: 6% overall and 10% in terms of savings.

“In addition to offering attractive deposit interest rates, direct banks may need to up the ante on generating word-of-mouth recommendations.”

— Paul McAdam, J.D. Power

Usage versus merely having an account is an important distinction, McAdam stresses. Some consumers reporting that they have accounts with digital-only providers also indicated that their balance is zero, he says, adding that this can be as high as 30% for some brands.

J.D. Power does not include these dormant relationships in its study, but McAdam suggests more attention needs to be paid to account opening and activation. An aggressive acquisition strategy only helps when prospects plunk down funds and become depositors and, perhaps in time, bigger customers via cross-selling. The study indicates that 36% of direct bank customers also have credit cards, making them prospects for fresh offers.

The study evaluated 10 direct banks for checking account satisfaction and 13 direct banks for savings account satisfaction. J.D. Power did not issue rankings for neobanks, but provided observations based on its evaluations of responses from consumers using neobank services. In terms of growth, neobanks still outpace direct banks, but by much smaller margins than in previous years.

Read more:

Digital Banks Must Make Help Readily Available, or It Will Cost Them

One way of improving stickiness is to make it easy to reach help when there is a question or a problem.

It’s not so much rocket science as commitment. Offering support via phone or chat, or even via a robust self-service system that allows for a human default if necessary, are plusses, according to McAdam.

“It’s really important to make sure problem resolution journeys are thought through and that staffing is in place to handle the volumes.”

— Paul McAdam, J.D. Power

He says that neobanks especially are falling behind on problem resolution, with customers complaining that they sometimes can’t get assistance when they have an issue.

With word of mouth becoming a more important factor in selecting where to open an account, no financial institution launching a digital deposit operation should risk getting a reputation for not being there when consumers need help. Word of mouth manifests itself these days not only via experiences shared by friends and family, but also on social media and in comments posted on the Apple App Store and Google Play.

What makes for an attractive digital banking offer is a moving target. McAdam says having no monthly account maintenance fees and no overdraft fees has become less of a factor in consumer selection of direct banks and neobanks than in the past. This is because many traditional institutions have revamped their policies to be more customer-friendly, especially on overdrafts, minimizing the advantage that once worked in digital banks’ favor.

This also suggests that digital banking brands must understand who their target audience is, to ensure that the offerings, pricing and promotion are a good fit.

McAdam stresses the need for clear communication as well. Because the relationship is completely remote, communication, or the lack of it, gets amplified, the research shows. Customers are watching closely for fees charged by mistake and unexpected fees assessed as a result of changes in product design or fee schedules — and they are not particularly forgiving.

Read more: Customer Service Slips Prove Extra Costly Now, J.D. Power Warns

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Both Digital and Human Interactions Must Impress

While quality of mobile apps is a strong factor in satisfaction with direct banks, websites continue to be important, with clarity of information — including the use of plain language — and ease of navigation scoring strongly for both channels.

Yet some basics never go out of style. J.D. Power’s study found that one of the main things direct bank consumers look for is a friendly greeting when they talk to a live operator. That voice is the “face” of the bank.

Incentives are becoming a more significant factor too, McAdam adds. For CDs, higher rates are an incentive by themselves, but traditional financial institutions establishing new online brands for checking and savings accounts will want to consider sweetening the deal to compete effectively. McAdam says it’s becoming more common for direct banking players to offer $250 bonuses for new customers that opt for direct deposit.

See Our Neobank Tracker: The World’s Biggest List of Digital Banks