A growing percentage of consumers expect to be able to apply for a mortgage and complete the application online. They want a high-touch and high-tech experience starting before and extending beyond the application process. Traditional financial institutions have been slow in adopting technology to streamline the front-to-back process of getting a mortgage, opening the door for digital providers to capture significant market share. According to Inside Mortgage Finance, an industry research group, non-banks now issue about two-thirds of U.S. mortgages.

“Financial institutions are questioning if the significant investment in digital mortgage technology is worthwhile given the marketplace priorities, and at the same these banks and credit unions are also questioning if offering mortgages is worthwhile,” stated Sam Schey, EVP of Rocket Mortgage in a Banking Transformed interview.

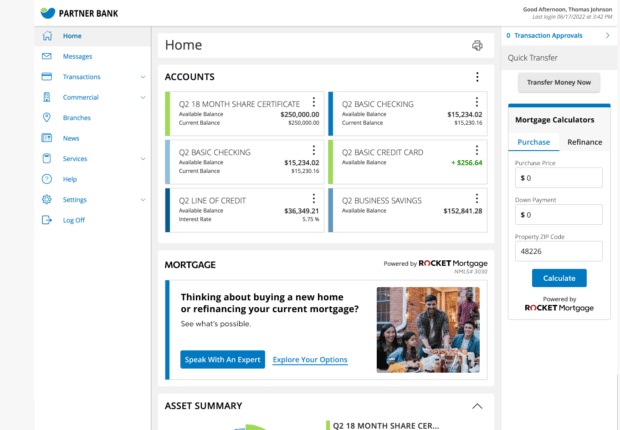

In response to this shift to digital providers, Rocket Mortgage and Q2 have announced a partnership that enables banks and credit unions to offer customers and members digital access to Rocket Mortgage, integrated on the Q2 digital banking platform. Rocket Mortgage will take care of everything related to the loan and servicing at no cost to the financial institution – including no implementation or subscription fees.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Access to the Largest Mortgage Provider

No digital mortgage player is larger than Rocket Mortgage. The company doubled its mortgage originations in 2020, and grew them by more than 30% in 2021, making it the biggest mortgage lender in the country. In fact, Rocket makes nearly as many home loans as Wells Fargo and JPMorgan Chase combined.

Rocket’s mission has been to make the mortgage process as simple as possible. They accomplish this with a fully digital process that was created more than six years ago. The process combines digital functionality, with access to live agents that help during the mortgage process. This combination of capabilities has made Rocket the top mortgage lender for customer satisfaction for 11 years running, according to J.D. Power.

Power of a Partnership

This collaboration of Rocket Mortgage and Q2 gives homebuyers the ability to go from application to a rate confirmation and approval in under ten minutes, instead of days that many people have become used to. Under the new arrangement, consumers can complete the entire process on their existing financial institution’s Q2 platform, being able to use their current financial institution’s app to monitor their mortgage over time.

The companies believe this new mortgage experience simplifies the time-consuming and paper intensive mortgage process that most traditional financial institutions currently offer. “Partnering with Rocket Mortgage allows us to embed what is a best in class digital experience within the home buying process, from the application experience through ongoing servicing, and have that be part of the overarching customer engagement on our platform because we believe that banks and credit unions need that to compete,” said Jonathan Price, EVP of Q2, on the Banking Transformed podcast.

What is unique about this collaboration is that financial institutions will have dedicated partnership banking teams as well as enhanced pricing for their customers. According to Price, financial institutions will also be able to segment their customer and prospect markets, determining who gets offered a Rocket Mortgage offer and who may get an offer of a mortgage directly from the financial institution.

Read More: Top Mortgage Lending Trends in Banking

Just as importantly, Rocket Mortgage will not be able to solicit customers who engage on the Q2 platform for an expanded relationship beyond the initial mortgage unless approved by the financial institution. “These are the customers or members of the banks and credit unions, so we put in place an absolute non-solicit by Rocket Mortgage,” Schey stated. “That doesn’t mean in the future, we can’t evolve our relationship through the Q2 platform with these institutions by offering complimentary services as adjacent product offerings powered by Rocket if the financial institution desires.”

Fourth Capital, a Nashville-based community bank, was the first to add Rocket Mortgage’s digital home loan application to its mobile and online banking app. The institution expects the capability will help new and existing customers simplify their home buying experience without needing to leave the bank’s online or mobile app, enhancing Fourth Capital’s vision of providing digital tools with a human touch.

Expansion of Innovation Lab Ecosystem

The Q2 partnership with Rocket Mortgage is a major addition to the Q2 Partner Marketplace Program that provides financial institutions the ability to evaluate, select, and deploy solutions from a catalog of pre-integrated third-party products with no up-front investment. This gives financial institutions the ability to provide customers fintech capabilities integrated directly into their digital banking platform.

The advantage of this marketplace is the speed of implementation and the ability to scale and customize solutions based on a financial institution’s needs. In many cases, a financial institution can ‘turn on’ the functionality within their existing mobile and online platforms in days, according to Q2.

“The thesis of what we’re trying to build with our Innovation Studio, is to find the best in class digital players around the banking ecosystem and bring them inside the digital banking experience,” said Price in the Banking Transformed interview. “This provides banks and credit unions with more digital engagements, more opportunities to partner with fintech firms, more non-interest income revenue generation opportunities, and the ability to deliver innovation faster.”