A study of over 1,400 consumers from market research firm Chadwick Martin Bailey reveals some interesting differences between consumers’ feelings towards megabanks, regional banks, community banks and credit unions. The survey set out to gauge what factors drive consumer perceptions of “convenience” in retail banking.

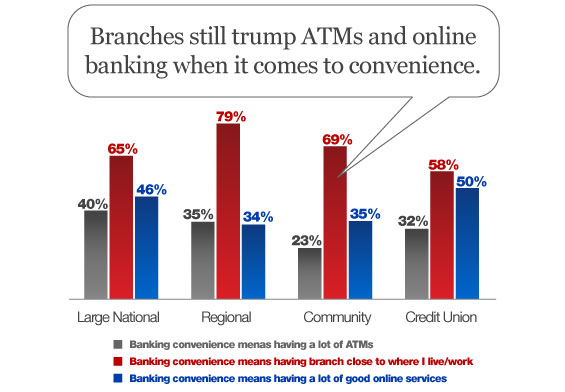

Branches are still seen as the most important touchpoint. 67% of consumers say having a branch close to where they live or work is the key driver of convenience of banking convenience. That compares with 43% who say online services are critically important, and 35% who cite ATMs.

The growth of online and mobile banking services means convenience and accessibility don’t belong solely to large bank customers anymore. Credit unions are providing customers with more and more remote banking services, closing the convenience gap and enhancing their value proposition as larger banks struggle to positively differentiate themselves.

Market Share

One in six consumers believe all banking providers are essentially the same.

Not surprisingly, large national banks in Chadwick Martin Bailey’s study claimed the most customers, with 42% saying their primary financial institution was a megabank. 21% said they bank with a regional institution vs. 13% who use a community bank. One in five consumers said their primary institution is a credit union.

Key Finding: Half those under the age of 29 use a large national bank today.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

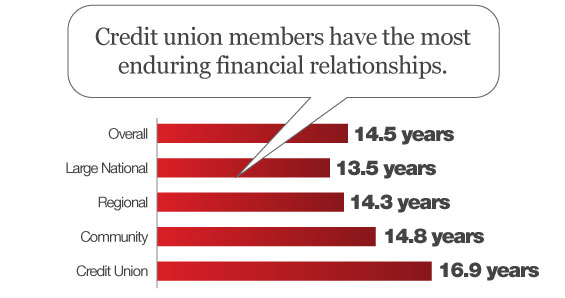

Average Tenure With Primary Banking Provider

The bigger the bank, the shorter the relationship with customers. As the size of institution shrinks, the average tenure of customers increases. The average tenure for big bank customers is 13.5 years. At credit unions, that number spikes to 16.9 years.

Key Finding: Nearly one in three credit union members have been with their institution for more than 20 years.

What Affects Consumer Perceptions of ‘Banking Convenience’

Credit union members value physical branches less and online services more than customers at banks. Having a vast network of ATMs is nearly twice as important to customers at megabanks than to those at community banks. Four out of five regional bank customers rank branch proximity as the most critical convenience factor.

“These findings suggest a new banking value proposition is emerging,” says Jim Garrity, Managing Director of Chadwick Martin Bailey’s Financial Services practice. “The growth of online and mobile banking services means convenience and accessibility don’t belong solely to large bank customers. Banks able to provide secure, usable, and reliable online services combined with top notch service will be most competitive.”

That doesn’t mean consumers are ready to give up branches altogether. Of those with a community bank or credit union, one in six rated their institution’s branch convenience as “poor.”

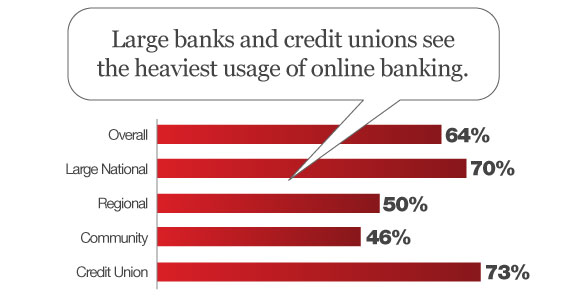

Online Banking Usage By Type of Institution

While megabanks and credit unions have nearly the same number of online banking users (both around 70%), the reasons driving utilization are likely to be very different between the two. Large banks tend to have the most sophisticated online banking systems in the industry, loaded with bells and whistles. Credit unions, on the other hand, tend to have lower branch density, driving more of their members to adopt alternate channels.

Credit union members are extremely satisfied with their online services, where 85% rate their credit union’s online/mobile banking experience as “excellent.” That compares with only 55% at community banks and 53% at regional banks. 66% of customers at large national banks rated their provider’s online/mobile offering “excellent.”