Powered by

The banking industry has been swarmed by a frenzy of fintechs and neobanks, which continue to pop up en masse around the world. While there are now an estimated 300+ neobanks, some dating back to before the term “neobank” was coined, their road to growth may just be getting started. Leaders of financial institutions, fintechs and neobanks, along with industry observers need only reference The Financial Brand‘s Neobank Tracker — powered by Nymbus — to see the trend.

Visit the List of Digital Banks

The Financial Brand introduced the Neobank Tracker in mid-April 2021 as the first public database of neobanks, challenger banks, digital-only banks, direct banks, and fintechs offering direct-to-market solutions. With the addition of the 14 new listings, described below, the Neobank Tracker now has more than 333 entries in a searchable, sortable online database — the most complete and comprehensive compilation of all the digital challengers in banking.

Bank Dora

Bank Dora is the first neo-credit union offering a full suite of digital banking products, including fee-free checking account with a debit card and two-day early payday direct deposit. The new neobank looks to set itself apart from the crowd by also offering the entire experience in both English and Spanish. It’s spearheaded by credit union USALLIANCE, but it’s not alone.

Prior to launching Bank Dora, USALLIANCE tapped three other credit unions to sponsor the new neobank: Affinity Plus Federal Credit Union, Digital Federal Credit Union and Service Federal Credit Union.

What Makes Dora Different:

- Fully-bilingual services and customer experience

- Multiple credit unions sponsoring the project

Dig Deeper: Bank Dora: The First Neo-Credit Union in the U.S.

Bank Zero

Bank Zero describes itself an app-driven neobank, boasting an executive board that is 45% Black and 20% women. Launched in 2016 by tech entrepreneur Michael Jordaan and banking innovator Yatin Narsai, Bank Zero is available only to South African consumers. The app experience is designed for both consumers and businesses alike, with such out-of-the-box features as:

- Card subscriptions control

- Protection against “rogue debit orders”

- Smart scheduled payments

- QR payments and receipts

- Proof of payment

- Biometrics

- Accounts for users under the age of 16

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Casa do Crédito

Casa do Crédito offers banking services to micro and small businesses while also extending digital payment accounts and microcredit to individuals in South America. Started in 2002, Casa do Crédito is authorized by the Central Bank of Brazil.

Although it is a neobank, it’s quite different from other contenders, starting with the fact that it has been around for almost two decades. Additionally, instead of specializing in a single feature or service, Casa do Crédito extends a portfolio of products to its customers, such as vehicle and real estate financing and commercial banking services.

Standing Out From The Neo Crowd:

Casa do Crédito doesn’t specialize in just one product — they offer many lending and banking services to customers.

Elyps

Elyps is a Belgian neobank, also serving U.K. consumers. Its tagline is “Think Out Of The Bank.” While it offers primarily investment services, Elyps also rolled payments into its game plan, allowing its customers to pay with an international Visa card from their investment account.

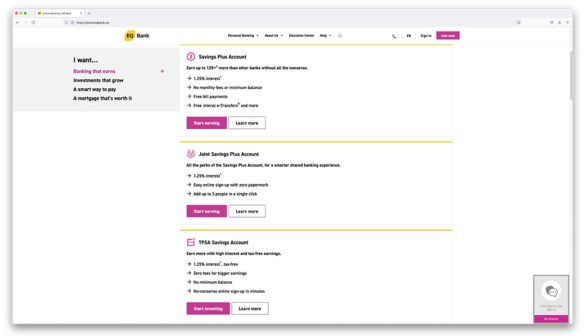

EQ Bank

EQ Bank says it has accumulated over $6.5 billon in deposits, offers “no-nonsense saving accounts,” as well as joint saving accounts and guaranteed investment contracts (GICs) at what it considers highly competitive interest rates. (As of mid October, 2021 its rates started at 1.25%, which the bank says is 125 times more than comparable rates from the “Big 5” Canadian banks.)

EQ Bank isn’t a standalone entity. It was launched by Equitable Bank, also based in Canada. The neobank has been recognized in the industry as a top challenger bank and won first place in Forbes’ Worlds Best Banks rankings in 2021.

Build or Buy Your Own Digital Bank – Powered By NYMBUS

Breakaway from the barriers of traditional technology partnerships with a new digital banking experience from Nymbus. You can build or buy a ready-to-launch niche brand backed by data in just 90 days. LEARN MORE

Fardows

Fardows is based in Mountain View, Calif., but its primary target audience consists of Islamic populations. The neobank, which started up in 2021, says it “allows you to save, spend and invest in a halal and efficient way.” Fardows customers can access their accounts — which do not pay interest, per Islamic law — from any of 55,000 ATMs.

What Does It Take To Be Halal-Certified?

In order to be officially halal-certified, a product must meet the rules of the Islamic Council and law.

Hiver

Based on the traditional community-like sociology of a beehive, Hiver — a division of Australia’s Teachers Mutual Bank Limited — is a neobank offering banking, lending, payments and personal finance management services. The neobank claims it’s not “just another bank — it’s a community.”

That’s the ultimate motivation behind the neobank, according to the website, which says they build services that are for the “betterers,” i.e essential workers. Even though it was only established in 2021, it already has a following of 210,000 members and over $8.1 billion in assets.

Bigger Doesn’t Mean Better:

Most financial institutions in today’s world prefer to have affluent populations as customers. Hiver’s goal is cater to the ‘betterers,’ — i.e. the ‘real people.’

Read More:

- Why Most Banks Struggle to Deliver a Killer Customer Experience

- People Love Digital Banking, But Will They Surrender All Their Data?

- Fintech Success Story: How ‘Current’ Is Rising To Be The #2 Neobank

ILoveSMB

Another new neobank, called ILoveSMB — short for I Love Small and Medium Businesses — is still in beta mode. This neobank looks to offer small business owners the banking tools they need.

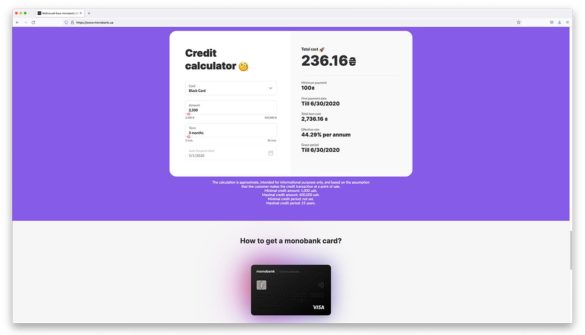

Monobank

Based in the Ukraine, Monobank provides bank service for Ukrainian businesses and consumers alike. It’s considered the first mobile-only bank in that country, offering services such as: free money transfers, bill paying options and cash-back features on the neobank’s accounts.

What’s unique about Monobank is it’s not all about traditional banking services. Built right into the website is a credit calculator where customers can, depending on the different cards Monobank offers, calculate a line of credit available through the neobank.

Build or Buy Your Own Digital Bank – Powered By NYMBUS

Breakaway from the barriers of traditional technology partnerships with a new digital banking experience from Nymbus. You can build or buy a ready-to-launch niche brand backed by data in just 90 days. LEARN MORE

REGO Payments

Designed for parents and children/teenagers, REGO Payment Architectures is an e-commerce solution that helps kids spend and manage money with full parental supervision. Its flagship product, Mazoola, allows families to set up debit cards and allowance plans for their children.

The features REGO brings to the table:

- Automatic allowance transfers

- Limit shopping to specific retailers

- Parental approval prior to purchase authorization

- Chores and reward system

- Secure back-end infrastracture

Smarty Pig

Customers of SmartyPig (a product of Sallie Mae) can set up online-only savings accounts and designate different “piggy banks” for various savings goals, such as holiday gifts, vacations and retirement plans.

But how do people know how much they should be setting aside in their savings accounts? In addition to its monthly blog, SmartyPig says it can help customers out by offering three different kinds of calculators:

- Emergency fund calculator

- Vacation calculator

- Wedding calculator

Ualá

A South American fintech company, Ualá offers consumers in Argentina financial services on its mobile app, which can be linked to a prepaid Mastercard, so people can transfer money and make payments and purchases, both in Argentina and abroad.

Vergo

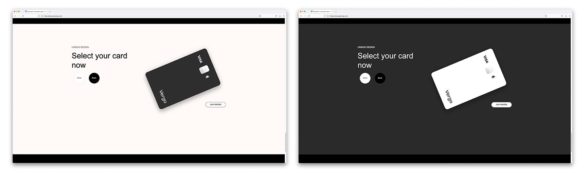

In the new neobank landscape, there already exist apps for musicians, gamers and gamblers. Yet, who knew that there were flocks of architectural, engineering and construction (AEC) communities who would also need banking services?

Vergo may be the first to offer such a hyper-focused financial product to this particular audience. Still in beta mode, the neobank looks to offer a debit account, cashback card, and invoice management software. With a stark chromatic themed website, customers of Vergo can even personalize their experience by choosing a white or black Visa debit card.

Read More:

- Does a New Neobank for Musicians Herald a Micro-Niche Trend?

- Startup Bank Goes All-In Gambling on a Niche Market

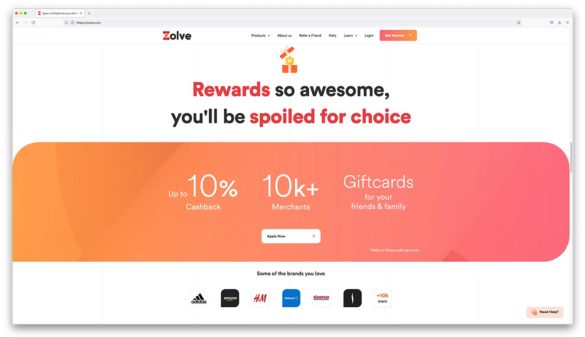

Zolve

Zolve is a neobank based in India with an aim to help immigrants become “financially free.” Launched in 2020, Zolve allows customers emigrating to America to open an American bank account before they set foot in the United States. Customers don’t have to sign up for an account months in advance either — Zolve says the application only takes five minutes, so people can sign up before they leave their home country and have an American account by the time they arrive.

Customers don’t need a Social Security number either.