If it works as described, Truist Financial’s new digital assistant — called simply, Truist Assist — will raise the bar for retail banking digital technology.

Not because of the number of questions it can comprehend — the digital assistants of some other banks understand more. But because it addresses one of the most persistent shortcomings in banking: the inability to forward information provided by a customer’s first contact with the bank to a staff member in a hand-off call or text, forcing customers to start all over.

This annoying glitch doesn’t occur only in banking, but banking is one of the leading perpetrators due to the siloed nature of its lines of business and the data they hold. The problem is compounded when two large, complex organizations are thrown together and forced to assimilate into a new entity. Such was the case when BB&T and SunTrust merged to form Truist in 2019.

Pain Point Relief:

A disconnect that has long bedeviled banking and angered customers, is the lack of connectivity between 'channels.' Truist has made the connection.

If the teams that created Truist Assist have indeed been able to create a seamless, real-time integration between the new chatbot and the bank’s contact center staff, that is noteworthy. The announcement accompanying the launch of Truist Assist described the capability this way: “This self-service channel embeds Truist contact centers as part of the experience, providing clients with a frictionless transition from their virtual assistant to a Truist teammate when their request warrants a deeper level of support.”

The Financial Brand probed the point further with Chad Elley, Head of Client Enablement at Truist. We asked: “If a customer has been using the digital assistant, say with a question about a mortgage, and decides to switch to a conversation with a staff member, are all of the text exchanges with the chatbot — including any information the customer entered — carried over immediately to the agent that they connected with?”

Elley’s response: “They are.”

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Touch Plus Context Reduces Frustration

The integration just described is a key facet of what Truist Financial calls its “T3 Strategy”: “Technology plus Touch equals Trust.” Sherry Graziano, Head of Digital and Contact Center Banking for Truist, describes it simply as “an off ramp to a live agent.” She says that this degree of integration is “different from some other chatbots you may see out there.”

Graziano also notes that this “touch and tech bridge” not only helps eliminate customer frustration, it makes for a better interaction for employees as well. That’s because they will be less likely to face an annoyed customer who blurts (or texts): “I just gave you that information and you did nothing with it!” It also means the rep is better equipped to serve the customer because they come into the conversation with the full context.

Read More: How Truist and TD Bank Are Putting New Twists on Innovation Labs

From Clean Slate to AI Bot in a Year

Despite being in the early stages of integrating two large banks in early 2020, Truist managed to set up several different chatbots to meet the needs of customers during the pandemic. Running multiple bots, however, was “a little bit chaotic,” according to Elley, and they quickly saw the need to consolidate into a single solution.

Development of an internally developed AI chatbot began in earnest in the fall of 2021. Elley says the digital assistant “leverages AWS [Amazon Web Services] on the back end,” but is not an off-the-shelf solution. Using the bank’s new agile development process, which simultaneously engages product, engineering and design teams,” the bank rolled out the product in about a year. The rollout is proceeding in stages across Truist’s 15-state market area.

Text and Learn:

The new digital assistant uses natural language processing and natural language understanding — both AI technologies — to help answer customers' questions and provide information.

Truist Assist currently is text-based and is available to retail and wealth customers of the bank. Giving Truist Assist voice capability is under consideration, says Graziano, based on customer interest.

Some digital assistants in banking have “personas,” the best known of which is Bank of America’s “Erica.” Capital One has “Eno” and RBC has “Nomi.” Based on customer feedback, Truist opted to go with the more functional “Truist Assist,” following the example of Ally Assist, Smart Assistant (U.S. Bank), and Chase Digital Assistant.

Read More:

- Why Chatbots Fail in Banking

- Chatbots, Live Chat, Video, Virtual Assistants: Which One Wins?

- Chatbots and Cafés: How Capital One Balances Digital, Physical Banking

What Truist Assist Can Assist With

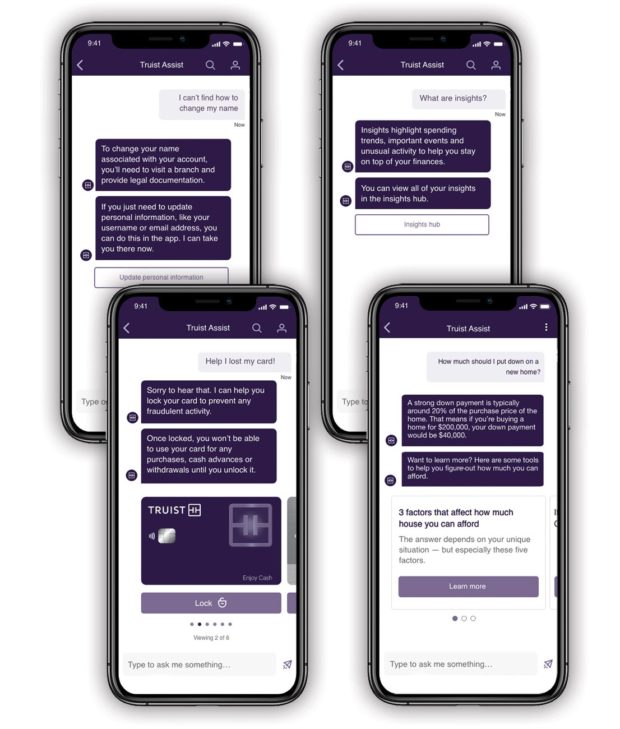

Truist’s chatbot (the bank doesn’t make a distinction between the terms “chatbot” and “digital assistant”) currently supports more than 100 common inquiries and digital banking functions. Graziano says these fall into five “buckets,” which she describes as follows:

- Support. Basic support and wayfinding, including connecting to an agent.

- Transactions and tasks. Paying bills, booking appointments, finding the nearest branch, etc.

- Personalized recommendations and insights. Analysis of money coming in and going out with alerts about potential negative balances. Month over month spending comparisons. Flagging duplicate or recurring charges. In addition, based on a customer’s spending patterns, the chatbot might ask if the person would consider a cashback rewards card.

- Account management. Ability to change account profile. Notifications of changes to a profile. Card controls.

- Promotions and rewards. Helping customers maximize their benefits and rewards.

Personalization is a key differentiator for Truist Assist, Graziano believes. “Instead of it just being a place where I go and ask questions, it serves up relevant information.” For a person inquiring about buying a home, for example, the chatbot will show products the bank offers, compare the solutions and make recommendations, with the option of connecting to a live representative as needed.

Read More: Truist’s CMO Has Strong Views on Fintechs and Personalization

Goals and Success Metrics

Bankers familiar with the chatbot landscape may assume that Truist felt compelled to respond to the staggering success of Bank of America’s digital assistant, Erica, which has roughly 20 million users. Graziano maintains otherwise, however.

“We’re building Truist Assist for what our clients expect us to deliver — trying to meet them when, where and how they choose,” she says. “We’re always assessing the landscape, which includes how clients engage with other brands outside of financial services.”

Consumers are banking 24 hours a day, seven days a week, just the way they engage with other brands, the executive states. “We see new accounts being opened, balances being checked, checks ordered or controls changed at night,” Graziano continues. Having a virtual assistant available 24/7 helps meet that need, she adds.

Truist tracks how many interactions occur with Truist Assist, what they were and whether they led to a conversation with a staff member, among other factors. “But the number one way we’ll know if it’s valuable and working well is client feedback,” Graziano states. In other words, customer experience is the key metric.

“We monitor feedback regularly and make sure our triad of teams — product, engineering and design all see the results to determine if we need to continue something or make a change.” It’s a continual iteration, she states.