Within the last two years, more and more banks and credit unions have begun offering mobile check deposit on their mobile banking platforms. Today, there are 137 institutions listed on FindABetterBank.com and 33% offer mobile check deposit (see table below). Many banks and credit unions plan to roll out the service within the next 12 months.

Institutions Listed on FindABetterBank.com with Mobile Check Deposit

| National Banks (1000+ Branches) |

Regional Banks (100-999 Branches) |

Community Banks and Credit Unions (>100 Branches) |

Direct Banks (Online Only) |

Total | |

|---|---|---|---|---|---|

| # listed on FindABetterBank.com |

14 | 53 | 66 | 4 | 137 |

| # with mobile check deposit |

10 | 12 | 19 | 4 | 45 |

| % with mobile check deposit |

71% | 23% | 29% | 100% | 33% |

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Banks and credit unions with mobile check deposit report high take-up and usage amongst customers that have downloaded their mobile banking apps because it makes depositing checks more convenient. For institutions, it’s less expensive to process checks deposited through mobile check deposit then deposits made at teller windows.

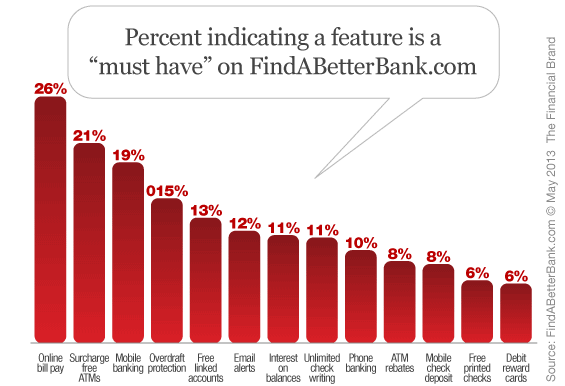

But is this a feature that propels people to switch banks? Probably not too many. Research shows that high fees are the number one reason consumers switch banks. Bank shoppers on FindABetterBank.com indicate which features are “must have” and in 2013 Q1, only 8% of these shoppers indicated they must have mobile check deposit (see chart below).