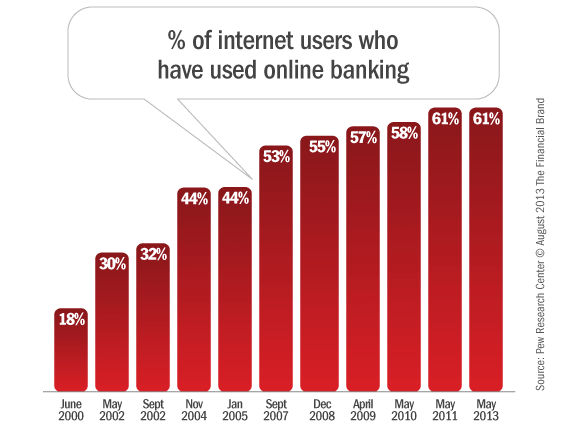

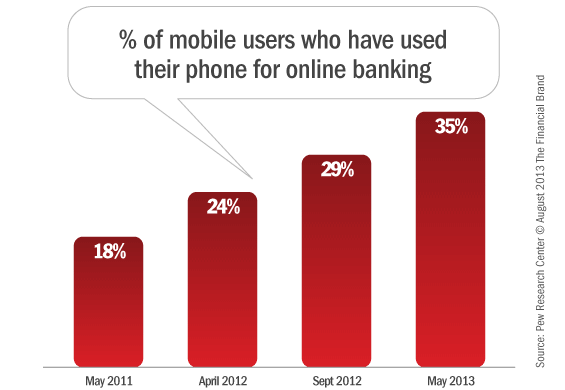

61% of all internet users in the U.S. bank online. 35% of cell phone owners bank using their mobile phones. And both types of digital banking are on the rise, according to research from the Pew Internet & American Life Project.

In 2010, only 46% of U.S. adults (58% of internet users) said they banked online. By 2011, 18% of cell phone owners said they had used their phone to check their balance or conduct some other similar business with their bank.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fractional Marketing for Financial Brands

Services that scale with you.

The Demographics of Online Banking Users

Susannah Fox, Associate Director for the Pew Internet Project and author of the research, says young adults (ages 18-29) and whites represent the two groups seeing the most significant increases in uptake of traditional desktop-based online banking.

| % Who Use Desktop-Based Online Banking |

|

|---|---|

| All internet users | 61% |

| Men | 63% |

| Women | 58% |

| Race/Ethnicity | |

| White | 63% |

| Black | 48% |

| Hispanic | 62% |

| Age | |

| 18-29 | 67% |

| 30-49 | 65% |

| 50-64 | 55% |

| 65+ | 47% |

| Education | |

| No high school diploma | 30% |

| High school grad | 47% |

| Some college | 66% |

| College+ | 75% |

| Household Income | |

| Less than $30,000 per year | 48% |

| $30,000 to $49,999 | 57% |

| $50,000 to $74,999 | 71% |

| $75,000+ | 75% |

| Urbanity | |

| Urban | 62% |

| Suburban | 66% |

| Rural | 42% |

Mobile Banking Users: Who Are They?

Younger adults are also leading the mobile banking trend. However, in contrast with online banking trends, non-white cell phone owners are more likely than whites to engage in mobile banking.

| % Who Bank On Their Mobile Phone |

|

|---|---|

| All mobile phone owners |

35% |

| Men | 35% |

| Women | 35% |

| Race/Ethnicity | |

| White | 32% |

| Black | 39% |

| Hispanic | 41% |

| Age | |

| 18-29 | 54% |

| 30-49 | 40% |

| 50-64 | 25% |

| 65+ | 14% |

| Education | |

| High school or less | 27% |

| Some college | 41% |

| College+ | 41% |

| Household Income | |

| Less than $30,000 per year | 31% |

| $30,000 to $49,999 | 32% |

| $50,000 to $74,999 | 45% |

| $75,000+ | 44% |

These findings dovetail with surveys conducted by Ipsos Public Affairs for the American Bankers Association (ABA). In 2012, 39% of U.S. adults said they prefer to bank online (up from 36% in 2010) and 6% said they prefer to bank on a mobile device (up from 3% in 2010). Adults between the ages of 18-34 years old are driving the growth in both online and mobile banking, according to the ABA.