Since Apple launched its mobile wallet capabilities alongside the iPhone 6, the mobile wallet has served as a battleground between banks, tech companies such as Google and Samsung, and retailers, with each trying to gain and retain customer loyalty. Despite privacy and data safety concerns, usage of mobile wallets continues to increase.

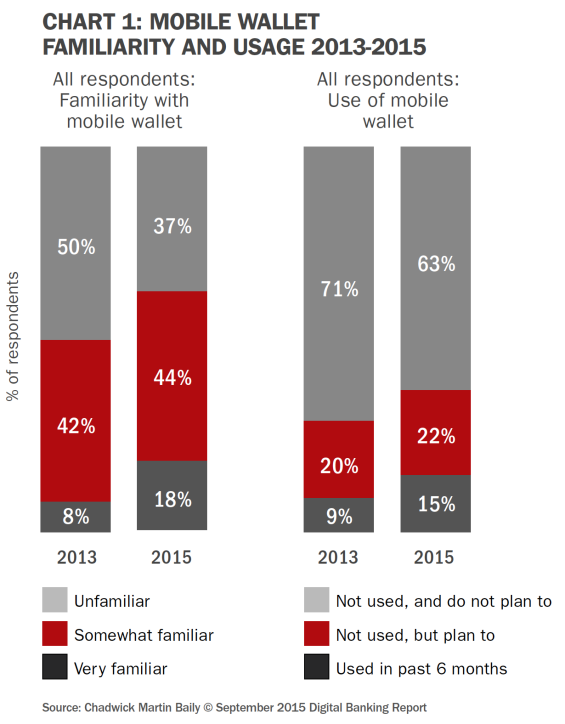

Fifteen percent of consumers have used a mobile wallet in the last 6 months, while 22% expect to use a mobile wallet in the next six months. The winners in this battle will be those who can combine security with a great consumer experience.

The ability to provide a great user experience is why technology providers, such as Apple, Samsung, and Google have superseded bank offerings that usually focus entirely on payment functionality. Early indications are that consumers will adopt technology only if it provides value by being seamless, easy to use and contextual.

Moving from physical to mobile wallets brings challenges when fighting to be on the ‘front screen,’ since customers can attach new cards with just a few simple clicks. The key will be to avoid losing control of customers, finding innovative ways to leverage customer data and building loyalty schemes to earn the ‘top of mobile wallet’ spot.

Moving forward, whether in combination with one of the primary providers or building a proprietary program, the best mobile wallets will focus on providing customer value by combining payments, loyalty and contextual insight to make personalized offers. If done well, the relationship between the bank’s brand and the consumer will be strengthened and loyalty will be earned.

Moving forward, whether in combination with one of the primary providers or building a proprietary program, the best mobile wallets will focus on providing customer value by combining payments, loyalty and contextual insight to make personalized offers. If done well, the relationship between the bank’s brand and the consumer will be strengthened and loyalty will be earned.

The 56-page Digital Banking Report, Mobile Wallets: The Battle for Top-of-Mind provides a snapshot of the highly volatile mobile wallet marketplace. The report provides a strategic foundation for responding to the changes as they occur, and will allow banks and credit unions to compete effectively in the future.

The key research questions raised in the Mobile Wallet Digital Banking Report are:

- What are the trends in mobile wallets?

- Who are the primary players in supporting mobile wallets?

- What kind of growth do we expect with mobile wallets?

- What are the components of a successful mobile wallet?

- Who are the key providers of supporting technology?

- How can banking leverage mobile wallets?

Below are excepts from the Digital Banking Report.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Mobile Wallet Trends

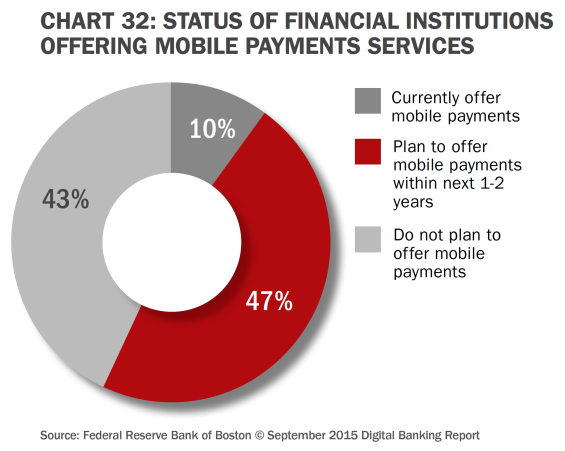

Mobile wallets are often hyped as “the next big thing,” but we are still relatively early in the mobile wallet lifecycle. No one wallet product or solution has emerged as the dominant figure in this ecosystem, and perhaps for that reason financial institutions have by and large remained on the sideline.

But while mobile wallets haven’t taken the consumer world by storm yet, it may only be a matter of time, and so banks are wise to watch the space closely. What is clear is that mobile payments of all varieties are becoming more popular, as consumers become more comfortable doing most everything on their mobile devices.

But the statistics show that while mobile payments are gaining in popularity, they still have a way to go before they reach critical mass, especially for the mobile wallet. According to a survey conducted by Chadwick Martin Baily of more than 1,700 consumers in the spring of 2015, 15% of those polled said they paid with a mobile wallet in the last six months for an item. 22% said they hadn’t done so, but planned to in the near future, while 63% did not have any plans to use a mobile wallet at this point.

Research has also found that while they do exist, barriers to mobile wallet adoption are diminishing overall, with security concerns remaining the number one barrier to mobile wallet adoption. Sixty-two percent of respondents list security as the number one barrier, down from 73% in 2013. The near ubiquity of online shopping (86% have made a purchase from their desktop or laptop in the past 6 months) may be acclimating consumers to perceived security risks like identity theft.

According to Thad Peterson, a senior analyst with Boston-based Aite Group, security concerns around using mobile wallets are largely based on perception, and should begin to disappear once consumers realize that mobile payments are generally more secure than using a plastic card for making purchases. Another factor that could bode well for increased mobile wallet adoption, notes Peterson, has to do with the slow, but steady shift in the U.S. to EMV cards.

So it’s clear that the mobile wallet revolution is beginning, though still in the early stages. But the winning providers are far from decided. Indeed, even the winning payment form factor is still ultimately to be determined.

Mobile Wallet Hype vs. Reality

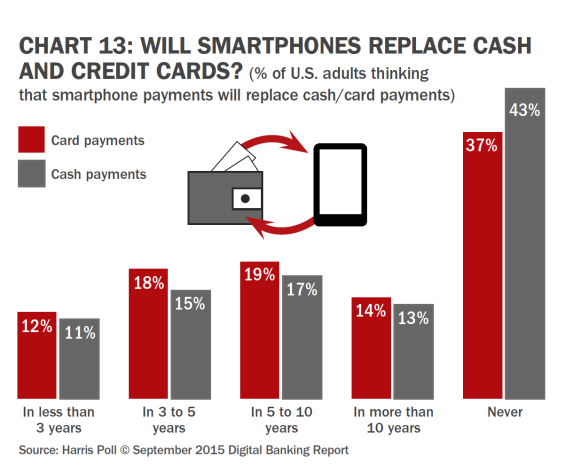

While the hype overshadows reality on many fronts, consumers are increasingly ready to adopt a mobile wallet. Mobile proximity payments, which reached $3 billion in 2013, are projected to top $53 billion by 2019, and consumer confidence in the mobile phone as a method for purchasing is growing steadily. The key to growth going forward will be to alleviate concerns over privacy and security. This is followed by lack of usability versus credit cards or cash and not being top of mind as a form of payment. Consumers have also noted the need for rewards to either try mobile payments or increase mobile payment use.

The largest hurdle before mobile payment usage can become widespread will be for habit driven consumers to finally ditch their traditional payments methods. Security concerns are another key inhibitor of mobile payment adoption, with roughly four in ten non-mobile purchasers avoiding the behavior due to concerns about the safety of mobile payments. Also, a perceived lack of value to making payments through a mobile device was another reason consumers avoid using mobile wallets.

There are also some real structural barriers remaining in the U.S., and these will continue to slow adoption rates, notes Bain. According to the firm, since U.S. payment systems and technologies remain so fragmented, any U.S. mobile payment solution is likely to be built on top of the existing credit card networks. And the U.S. lags behind other markets in upgrading its point-of-sale terminals to allow them to accept advanced payment technologies, including credit cards with contactless chips or NFC.

In many developing, rising markets around the world, however, mobile wallets and mobile payments in general are much more commonplace. In fact, in many instances they far outpace the use of cash and plastic cards.

Mobile Wallets: A Global Perspective

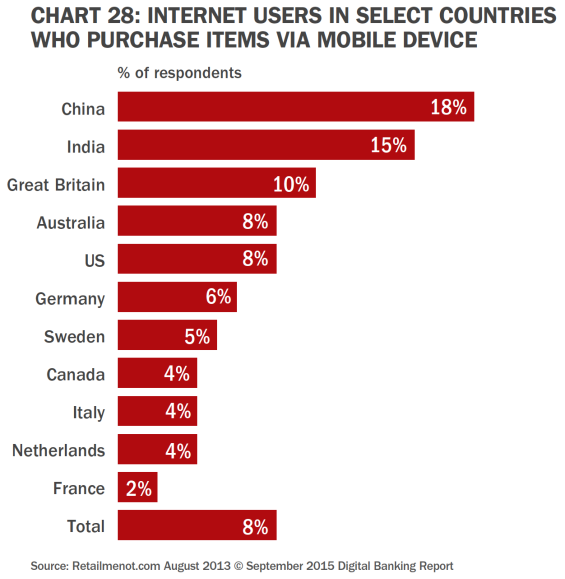

While consumers in the U.S. and many other developed economies are taking to mobile payments in slow but steady numbers, in developing countries – or countries with much newer banking systems that exist without legacy technology and processes – using a mobile device to pay for goods and services comes much more naturally.

In a 2013 study, India and China had the highest percentage of consumers who indicated they have made purchases through a mobile device of all the countries studied. Eighteen percent of respondents in China, and fifteen percent of those in India, indicated they had purchased items via a mobile device. The global average for all countries studied, by comparison, was 8%.

In countries such as India, mobile payments are seen as a prime way to bring the unbanked into the formal financial system. Many African markets have also seen sky-high adoption of mobile payments and wallet solutions. According to a report from EdgarDunn Company, M-PESA, Kenya’s mobile money system, is the leading example of how this can rapidly be achieved.

It’s clear that mobile payments in many parts of the globe are adopted at far higher rates than in more developed economies, such as North America and western Europe. Much of that has to do with the fact many citizens in these countries are not part of the formal banking system, and thus don’t have to be “weaned off” of traditional payment methods.

Moving the Needle in Mobile Wallets

Digital wallets get plenty of media hype, but adoption is still quite low. While there are many reasons for the lack of consumer interest, digital wallet providers surely have work to do on their value propositions. Blanket digital wallet value propositions such as, “a fast, easy and secure way to make payments,” and “it stores credit, debit and loyalty cards, eliminating the need to carry a physical wallet,” aren’t resonating. This is why, when asked by Gallup, 38% of respondents with digital wallets say there is no single greatest benefit of using the app.

Mobile wallets are often promoted as being a faster and easier method of payment. In reality, the time saved with a digital wallet (i.e., tapping a button on the phone and holding it near a scanner) versus pulling a card out of a wallet and swiping it, isn’t discernible. And a digital wallet is certainly not easier than a physical card if the digital wallet is not accepted at the point of sale. In fact, only 3% of digital wallet users say they paid with their digital wallet at retail locations every time it was available as an option.

Mobile wallets also aren’t the ideal vehicle for storing many identification cards, non-digital loyalty cards, membership cards, business cards and other receipts that end up in a traditional wallet. And while digital wallets can store movie tickets, airline tickets, etc., wallet users may have other apps with greater functionality.

According to Gallup, “The industry has so far created digital wallets with merchants or payment processors in mind, but has not yet made a compelling offer for consumers. To remedy this, digital wallets – like any other service offering – should be helpful, easy to use and make customers feel special.”

In other words, banks and credit unions need to identify the ‘pains’ consumers are trying to overcome and create a mobile wallet that helps address these pains in a contextual manner. They should address the desires of the consumer to ‘know me, understand me, and reward me.’

Banks need to create mobile wallets that alert users to their spending limits, bank deposits and other customer-defined parameters. Mobile wallets also need to differentiate themselves by tracking customer spending across both physical and online retailers and across all payment methods while providing basic budgeting tools. Finally, they need to track and encourage loyalty through tangible rewards.

Preparing for the Future

When examining the current state of the mobile wallet, it seems apparent that while they are not widely adopted by consumers in the U.S. right now, the numbers and cultural shift to mobile-digital as part of people’s daily lives points to an explosion of growth in the next several years. With recent launches of Apple Pay and Samsung Pay, a newly re-launched Google mobile wallet product, and things like the MCX on the horizon, consumers will soon have no shortage of mobile wallet providers to choose from.

It’s difficult to make the case that banks and credit unions need to offer some kind of mobile wallet solution at this very moment or else risk extinction. But it also is something organizations clearly should not be ignoring, and indeed should have medium-to-long term plans to get in the mobile wallet game.

Key takeaways include:

- While mobile payment growth has not lived up to the hype, most believe we are entering a phase of significant growth in acceptance and usage.

- The key to success of mobile wallets will be the ability to integrate payment, loyalty and contextual engagement functionality while addressing security concerns.

- While tech companies have a significant head start in the race for mobile wallet supremacy, many major banks will develop their own mobile wallets to acquire and serve digital consumers.

- It is still unclear if mobile wallets will become an integrated function within the mobile banking app or be a separate tool primarily for payments.

Some big banks may have the resources to develop something in house, while the vast majority of others will partner with existing solutions. But whatever path is chosen, banks and credit unions that are ignoring mobile wallets can afford to do so no longer.

It’s always much better to be at the forefront of innovation – or at least to be a fast follower – than to be left behind in the dust.

About Mobile Wallets: The Battle for Top-of-Mind

The Digital Banking Report, Mobile Wallets: The Battle for Top-of-Mind is an in-depth review of the ever changing mobile wallet and payment marketplace. Focused on the players, the opportunities and the challenges of mobile wallets, this Digital Banking Report is available for purchase as a single issue or as part of an annual subscription.

The Digital Banking Report, Mobile Wallets: The Battle for Top-of-Mind is an in-depth review of the ever changing mobile wallet and payment marketplace. Focused on the players, the opportunities and the challenges of mobile wallets, this Digital Banking Report is available for purchase as a single issue or as part of an annual subscription.

Subscriptions to the Digital Banking Report are available to individuals and institutions, with the distribution of reports being done digitally. Subscribers not only receive monthly reports but also have free access to the 150+ report archive.

This report on mobile wallets will help banks and credit unions move forward with their planning for how to participate in the mobile wallet marketplace, providing a guide to ensure that value is provided to the consumer. With 32 charts, this report provides an in-depth view of options available to all sized organizations and predictions as to when the marketplace will be ready for a fully digital mobile wallet experience.