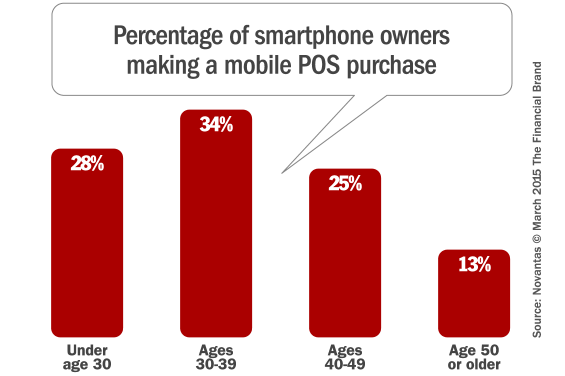

Research based on actual, active bank and credit union shoppers at FindABetterBank indicates 27% of smartphone owners have used their device to complete a purchase transaction at a retail store — 29% growth compared to a year ago. As with other types of mobile payments (e.g. P2P) consumers aged 30-39 are more likely than Millennials to make mobile POS purchases. Income partly explains Millennials’ lower mobile POS adoption. But even when we analyze respondents with similar incomes, those ages 30 to 39 years are still more likely to have made a mobile POS transaction.

Many Millennials using FindABetterBank to shop for a new bank or credit union find the site because they’re shopping online, and for their first checking account. They need checking accounts (or reloadable debit cards) before they can even consider making mobile purchases, so this partly explains why Millennials are less likely to have made mobile payments. Nevertheless, marketers should focus their mobile payment messages towards Millennials. Why? Because once they establish their new banking relationship, many will start using their smartphones at retail locations. It’s where everything is heading.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

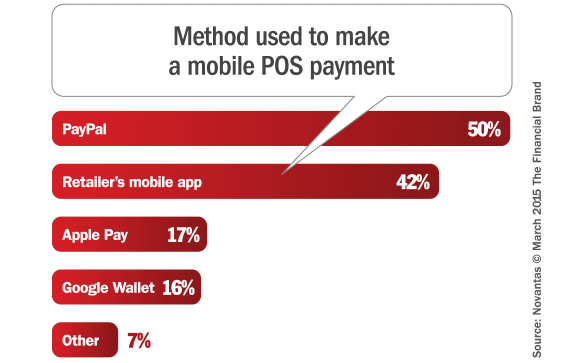

PayPal dominates with the most POS terminals. Half of respondents indicated they used PayPal to make a mobile payment at a retail store. PayPal has strong relationships with retailers, either directly or through value-added resellers that provide retailers with POS terminals and software. As a result they have well over 1 million mobile-enabled POS terminals in the US – by far the largest network of any mobile payments provider.

Retailers succeed with loyal customers. Over 40% of respondents reported making a mobile payment using an app provided by a retailer. Starbucks and other retailers provide their customers with apps that subtract the register amount from a preloaded account. Other retailers, like Panera Bread Company, have succeeded by providing an app that withdraws funds from a credit or debit card account.

Apple Pay moves past Google Wallet. A year ago Apple Pay did not exist. In a very short time, more respondents have indicated that they’ve used Apple Pay than Google Wallet (which has been around for at least 3 years). This is partly due to the popularity of the iPhone 6, but also because of excellent co-branding and marketing with Bank of America and Apple.