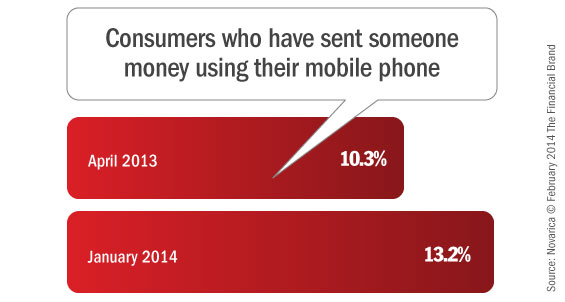

In January 2014, a survey on FindABetterBank asked smartphone owners whether they used their phone to make and P2P payments within the last 30 days. Overall, the percentage of smartphone owners who have made a mobile P2P payment grew by 30% from April 2013 to January 2014.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

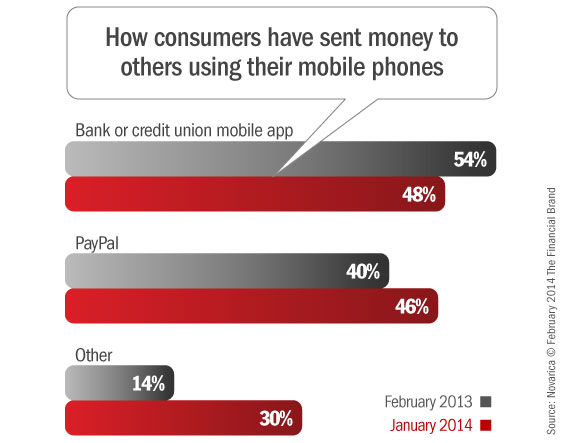

Banks and credit unions are losing the initiative. Most banks and credit unions treat P2P as a “bolted on” feature and it doesn’t receive a tremendous amount of marketing attention or promotion. As a result, the percentage of mobile P2P users using their banks’ or credit unions’ mobile P2P feature has declined, while competitors like PayPal and Google Wallet have grown.

PayPal continues to reach into banks’ domain. More and more consumers are using PayPal for payments. Currently, PayPal is the dominant player in mobile retail payments, they’ve nearly caught up to banks in mobile P2P and they’re also gaining ground in mobile bill payments. Banks and credit unions should tremble at the thought of PayPal acquiring a firm with a neat mobile-centric consumer banking platform, like Simple or Moven.

New entrants are winning business. Another reason why banks and credit unions are losing ground in the mobile P2P space is pricing. Many institutions that offer P2P charge transaction fees. New players (e.g., Venmo), have been winning the young urban set with free mobile P2P payments.

The banking industry is losing its grip as the hub of consumers’ cash management. The mobile P2P payment space is an example where the industry as a whole hasn’t been aggressive enough and now non-traditional players are taking over. What’s next?

June 10, 2021 Editorial Update: As of mid-2021, Simple has shut down and will not resume operations, according to company statements.