Why would someone willingly choose to hop in their car, drive to a branch and wait in line for a teller just to deposit a check? It makes no logical sense, considering how easy it is to pull out a smartphone and deposit a check simply by snapping a photo of it.

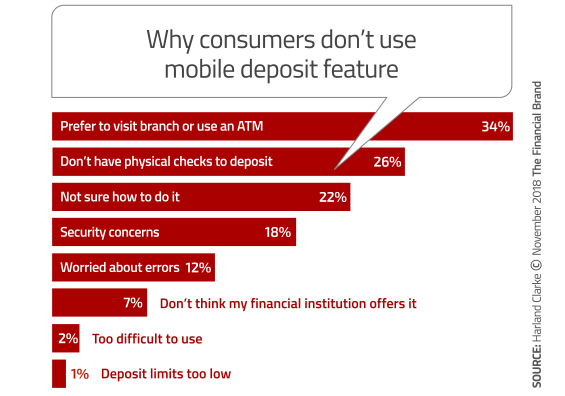

And yet many Americans do just that — taking their checks to a branch instead of using mobile photo deposits. According to a study by Harland Clarke, a third of those that have installed their banking provider’s mobile app don’t use the mobile deposit feature because they actually claim that they prefer to visit a branch or an ATM to make deposits.

In Harland Clarke’s report, one quarter (26%) of consumers surveyed said they have no physical checks to deposit, which makes sense in a world where direct deposit, ACH and other electronic means of transferring funds are increasingly the norm.

Harland Clarke speculates that the real underlying issues are centered around emotional concerns more so than rational considerations. Fear and uncertainty are most likely the reasons keeping more consumers from adopting mobile banking and/or more of the tools such apps offer.

“Who really likes going to the branch or ATM versus not going to the branch or ATM?” the report’s authors ask, almost rhetorically. “Saying ‘I prefer to visit my branch or use an ATM’ just doesn’t ring true.The real takeaway here is that humans generally don’t like change. Change is uncomfortable.”

Read More:

- Building The Killer Mobile Banking App

- 19 Awesome Mobile Banking Apps From Banks and Credit Unions

- 3 Common Myths That Could Be Wrecking Your Mobile Banking Program

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Mobile Banking Uptake Still Has a Long Way to Grow

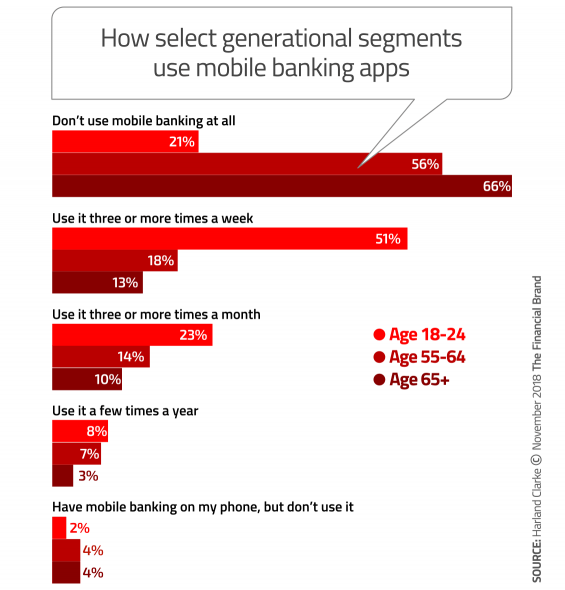

According to the Pew Research Center, 77% of all Americans have smartphones. But half (52%) of consumers surveyed by Harland Clarke said they don’t use mobile banking apps, period. Clearly there’s still tremendous potential for adoption of mobile banking apps.

Among all consumers who use mobile banking, a quarter (23%) say they use mobile banking three or more times a week. One in seven (15%) use mobile banking three or more times a month, to the 7% that use them a few times a year.

Two thirds of consumers 65 and older don’t use mobile banking apps at all. But neither does one in five (21%) of consumers 18-24 — surprising for a generation of which most members not only own smartphones, but seem to live on their devices.

Conversely, 10% of consumers 65 and older use mobile banking apps three or more times a month, and 13% of them use the apps three or more times a week. Roughly half (46%) of this age group have smartphones. If Harland Clarke’s data is accurate, that means nearly half of all Americans age 65+ are mobile bankers.

“They can do it!” says the authors of the Harland Clarke report. “They just need some incentive and instruction to illuminate mobile banking’s benefits.”

Some institutions have been known to send a complimentary check for a small sum to those who don’t yet make mobile deposits as an incentive to try the service.

Read More:

- 7 Ways Financial Marketers Can Increase Mobile Banking Adoption Rates

- What Consumers Love (and Hate) About Mobile Banking Apps

- Not All Mobile Banking Apps Are Created Equal

Why Consumers Are Reluctant to Make Mobile Photo Deposits

The ability to make mobile photo deposits is coming up on its tenth anniversary. USAA scored a first with consumer mobile capture in 2009 on the iPhone — a natural for their mostly remote banking consumer base. Today, thousands of banks and credit unions offer mobile deposit, with over 80 million using the service, according to figures from Celent.

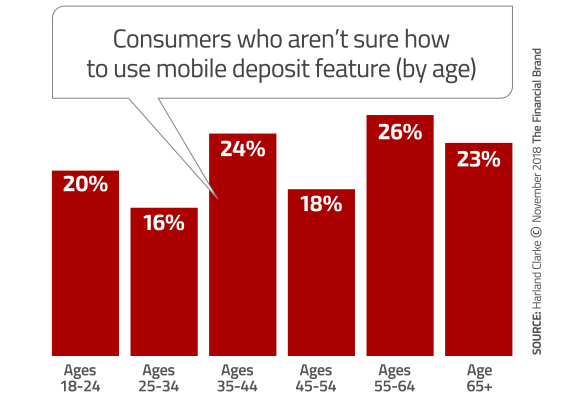

Why don’t more people use the service though? One in five (22%) say they simply don’t know how to do it. Technology issues including security concerns and transactional errors prevent another 30% from adopting mobile photo deposits.

The study found that even regular users of mobile banking apps can get hung up on mobile deposits. For example, almost one in four people who use their mobile banking app at least three times a week say they’re not sure how to make a mobile deposit, nearly the same response given by people who use banking apps only a few times a year.

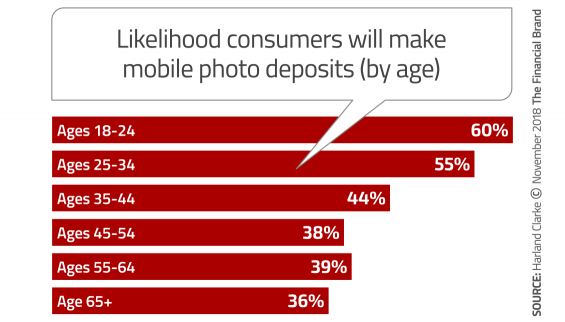

The good news is that people are generally receptive to making mobile photo deposits. The younger a consumer is, the more likely they are to give the feature a try.

“The challenge for financial institutions is reinforcing the simplicity and security of these transactions,” Harland Clarke states in its report. “Showing an account holder how to do it during the onboarding process goes a long way toward overcoming both the perceived confusion and emotional barriers.”

“Engaging and educating account holders and giving them a no-risk incentive to try mobile deposit will let them experience its convenience and allay their security fears,” Harland Clarke says.

Mobile deposit capture isn’t just more convenient for consumers, it promises major savings for institutions. According to JLL Research, each mobile deposit costs 8 cents per item, versus 80 cents per item for ATM deposits and a staggering $8 for deposits made with tellers in branches.

Cutting costs and increasing profits should be adequate motivation for banks and credit unions to aggressively push mobile deposits. But Harland Clarke says there are other benefits. More engagement with consumers should stimulate additional use of features beyond mobile deposits, according to their report.