According to Accenture’s 2015 North America Consumer Digital Banking Survey, ATMs, online and mobile banking have reduced customer branch visits. But, that doesn’t mean the branch is obsolete. The same survey found that only 29 percent of consumers anticipate using the branch less in 2020. This means that 66 percent of consumers plan to use the branch in the future as often as they do today, or more.

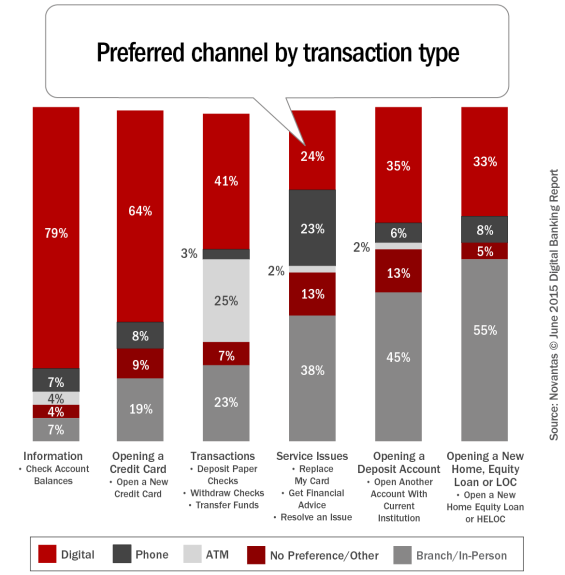

Financial institutions are struggling with how to interpret this mixed message from consumers. Strategic branch consolidation has been a common approach to this issue, but many banks are reluctant to do so because the branch has historically been where customers purchase banking products. For instance, Novantas found that consumers preferred to use the branch to open loan products (55%) and deposit products (45%).

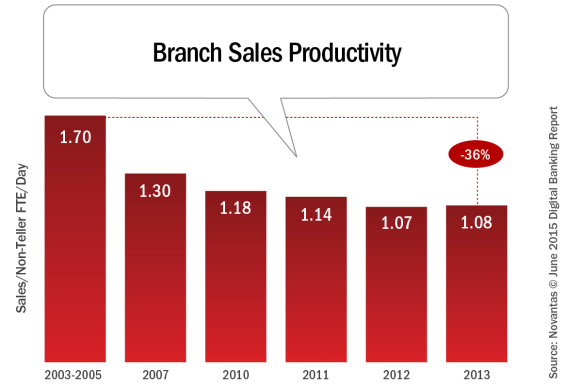

One of the ways banks can enhance their brand and counter the cost of operating a branch (rent, maintenance, IT, and staffing) is to increase the yield on every employee and square foot of real estate in the facility. This is important at a time when the actual sales productivity of branch employees has been decreasing, according to Novantas.

To combat this trend, it is imperative that banks and credit unions leverage new tools and technologies to maximize all the resources of a branch, while still delivering the key services/functions that consumers desire from their face-to-face bank interactions.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Mobile ID Scanning For In-Branch Onboarding

From observing the industry, we can see that leaders in branch transformation are making speed, simplicity and convenience key to all in-branch processes. Some are experimenting with interactive screens or with self-service remote advisors. To expand upon in-branch efficiency and effectiveness, Aite Group also examined how mobile ID photo capture can improve the in-branch customer onboarding experience.

With mobile ID capture, banks can eliminate a source of transaction friction by taking manual data entry out of the equation. The easier banks make it for an employee in the branch to help a customer apply for a car loan or credit card, the more likely they are to sell that product and complete that enrollment process.

The resulting Aite Group white paper looked at the use of the mobile camera for data entry during onboarding and senior analyst, David O’Connell, confirmed that mobile capture used in-branch can help financial institutions maintain their branch network. “Leveraging mobile capture-enabled onboarding processes, by equipping branch employees with tablets or smartphones, may both increase employee productivity and improve the customer experience in-branch,” stated O’Connell. “In addition, it gives banks and credit unions a tool to get the most out of their brick and mortar locations.”

Improving the in-Branch Experience

By automating much of the onboarding data entry process with mobile capture-enabled tools, banks will be able to maintain the connections that make their services and employees part of the community. Employees can use the camera on a mobile device to capture data and auto-populate most entry requirements for the enrollment or account opening process.

This frees the employee to engage with the customer during the process, rather than being heads-down to transcribe data from one document to another. In beta deployments at several large banks, mobile capture for onboarding has proven to be quite successful.

With mobile capture onboarding, any relatively private space in the branch can be used to process new applications. Branch staff can use tablets to snap a picture of the applicant’s ID to initiate the process, without needing desk space or a computer to fill out application paperwork.

The ability to capture all the information on a driver’s license in one click reduces the length of time spent with each applicant while allowing the employee to better connect with the customer. This has the potential to increase the volume of applications an employee can process each day and can help create more acquisitions per campaign. The result is a better experience for the customer with shorter wait times and higher yields on branch employees.

Furthermore, switching to a mobile capture-enabled enrollment solution has been shown to improve the quality of the data acquired. By capturing data from official identification documents, financial institutions obtain highly structured data that can be more readily ingested by downstream data management and analysis systems. Employees are able to spend less time vetting application data and more time on the areas of their work that add greater value to the business.

Malauzai, a provider of mobile and Internet banking SmartApps, has heard from their customers that a key reason they are considering the addition of mobile capture for in-branch onboarding is because, “Combining branch functions with the mobility of a tablet will elevate member service and convenience to a whole new level.” Another Malauzai customer reports that they, “want to make banking easy and convenient for our customers,” and believe that employee assisted mobile tools may do just that.

Aite Group’s research finds that mobile capture used in-branch has the potential to help financial institutions in five main areas:

- Reducing friction: Using mobile-camera-enabled onboarding to prefill forms that would otherwise be manually completed reduces opportunities for errors, delays and abandonment.

- Capturing user data and trailing documents: Branch employees can use mobile tools to capture driver’s licenses and passports required to close a sale, and automatically import these documents into the system.

- Processing applicants in real-time: Using the camera to capture data provides banks the ability to analyze that data in real-time, leading to rapid fraud-deterrent and credit-related decisions.

- Supporting in-branch staff: Bank branches are limited in the number of transactions that employees can realistically complete in a day. Tablets with mobile capture capabilities have been shown to help bank employees complete transactions without a customer waiting in line for a teller. These benefits also can be expanded to off-site account openings at employers and community events.

- Additional sales: By delivering more structured data than traditional onboarding, new mobile tools can reduce the amount of manual input required by staff, increase their productivity and free them up for additional sales.

In addition to all the benefits of leveraging mobile technology in the branch, there is a lot at stake for financial organizations that are slow to adopt. In recent Cisco survey of 7,200 banking customers in 12 countries, they found that 75 percent of all respondents would move their money to another provider for more Internet of Everything-enabled banking.

This included concepts specifically related to advice and mobility in the branch. Accenture also give a cautionary tale for banks that are hesitant to evolve amid digital disruption. The firm calls out Blockbuster as an example of a company that clung to outmoded physical distribution model as competitors reinvented how people experienced the services they provided.

Conclusion

As financial institutions face increasing pressure to identify new channels and methods for customer acquisition and retention, the mobile channel has emerged as a strong preference among today’s consumers – even when engaging in face-to-face customer service. Improving the in-branch onboarding process through the use of the camera is one way for financial institutions to not only streamline new account enrollment, but also improve the customer’s overall experience with the bank.

Aite Group estimates that mobile capture onboarding can help reduce mobile new account abandonment by as much as 25% when used in a self-service model. But when the technology is applied in-branch, banks are likely to increase the volume of new applications and enrollments that branch employees can accurately complete each day, helping to counter-balance the branch’s fixed costs. Most importantly, it provides an improved experience for customers, which allows financial intuitions to attract and retain more customers in an increasingly competitive environment.