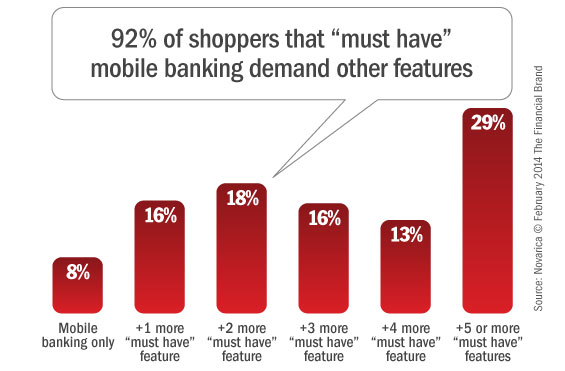

In the final quarter of 2013, over 25% of bank shoppers at FindABetterBank indicated that mobile banking is a “must have” feature when choosing a new checking account. But as most product marketers know, potential customers are rarely interested in only one feature/capability. We found that 92% of shoppers that must have mobile banking also indicated other must have features.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

What Other Features Do Mobile Bankers Want?

Shoppers that said mobile banking was a must have checked off an average of 3.6 additional features as must haves. Which were the most frequently selected additional features?

Online Billpay. Over the last 8 quarters, we’ve seen overall interest in online billpay decline by 33%. In Q4 2013, 24.8% of shoppers said they want online billpay. But nearly half of those who must have mobile banking also said that they must have online billpay.

Mobile Check Deposit. In Q4 2013, 12% of shoppers overall said mobile check deposit was a must have and 43% of those wanting mobile banking also want mobile check deposit. When a shopper wants mobile banking and only one other additional feature, mobile check deposit is the most popular choice.

Email Alerts. Shoppers’ demand for email alerts correlates with smartphone ownership and take-up of mobile banking. This is because people with smartphones receive emails immediately and consumers want immediate access to alerts about their accounts.

Surcharge-Free ATM Access. Many of the largest banks offer amazing mobile apps to their customers. But on FindABetterBank, these institutions are less visible to people who want mobile banking because their offerings don’t include surcharge-free ATM access. We expect to see the correlation in interest in other electronic services, but a whopping 42% of people who want mobile banking also indicated that they want surcharge-free ATM access.