Mitek Systems will be piloting its new Mobile Photo Bill Pay technology with U.S. Bank early this year. Customers will be able to set up bill payments by simply snapping a picture of their paper bill with their camera-enabled smartphone or tablet.

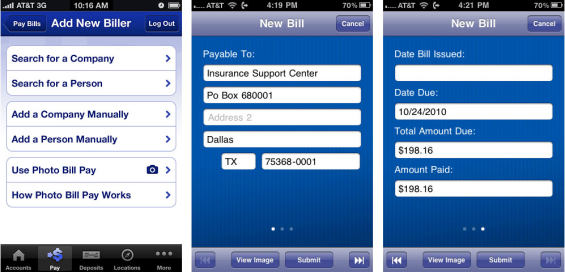

Consumers can quickly add a new payee to their online bill pay, pay one-time or non-recurring bills, and set up recurring bills and payments from anywhere, at anytime.

Consumers can quickly add a new payee to their online bill pay, pay one-time or non-recurring bills, and set up recurring bills and payments from anywhere, at anytime.

All a user has to do is take a picture of the bill and the app does the rest — correcting for any image distortion, reading relevant data and processing the transactions through the users’ bank. There is no need to manually enter biller and payment information anymore. The technology then automatically extracts relevant information from the paper bill and auto-populates the fields required to make a mobile payment. Data extracted from image includes the payee name, address, account number and amount due. The consumer then schedules the payment and clicks “pay.” Transactions conclude with verification that the users’ bills have been paid and electronic payments have been sent from their financial institutions.

Users only need to snap a photo of a bill once and that particular payee information will be automatically saved in the app’s vendor list for future use. Mitek says the ability to add a new payee with a mobile device is a key competitive advantage over existing mobile bill pay applications.

Mitek is no stranger to the mobile banking space. Indeed the company is one of the financial industry’s earliest innovators of mobile remote deposit capture (RDC) technology.

It’s harder scanning bills to pay than it is checks for deposit. Even though much of the data is structured, bills come in some 100,000 different formats and layouts.

“What really differentiates Mitek is the dynamic extraction of data from any invoice or bill, regardless of layout,” said Mitek CEO James DeBello. “That’s not easy.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Fractional Marketing for Financial Brands

Services that scale with you.

“With mobile check deposit, we have 564 banks, including the top 10 retail banks,” said James DeBello, Mitek’s Chief Executive. “Our technology has enabled $10 billion in deposits. But we think the mobile bill payment product could be even bigger. The market could achieve 50 million Americans.”

According to Mitek, more than six million Americans use smartphones to pay bills, and 58% of online households that own a smartphone stated interest in mobile bill payment. Mobile photo bill pay adoption is forecasted to reach 33% among adult U.S. consumers by 2018, resulting in 1.4 billion bills migrating to this channel.

While the technology will be initially piloted exclusively with US Bank, DeBello confessed that Mitek is in discussions to distribute Mobile Photo Bill Pay with a number of leading banks and tech providers in the financial industry. Translation: Expect an appropriately aggressive sales effort from Mitek, with rapid adoption across the retail banking sector. Mitek says additional pilot tests are already planned with two other major banks, but won’t yet say who.

None of this bothers Chris Peper, VP of US Bank’s mobile channel, who is decidedly upbeat about his bank’s debut of mobile photo deposit.

“We’ve seen the customer enthusiasm for mobile check capture and want to provide that same level of convenience to bill payment,” Peper explained in an interview with American Banker. “What we hear from customers is that one of the biggest barriers to the adoption of bill pay is taking the time to do all that data entry, manually inputting the addresses and entering the payment info. It’s easy to do transpositions and other typing errors, especially on a mobile device.”

“We’re excited and we do feel it’s an opportunity for us to differentiate in the market,” Peper added. “This is the killer app for bill pay in the mobile space.”

Peper won’t say whether the bank plans to charge for the new service or not, however US Bank is one of the few to charge a fee (50¢) for mobile check deposit.

Mitek’s system is phone-agnostic, meaning the app’s sends information to a server that does not know or care what type of phone (or tablet) the user has.

A Differentiated, Sticky Service With Massive Switching Potential

“The major banks don’t really have many ways of differentiating their core service offerings from each other,” noted a market analysts at Trefis. “They have to rely largely on technology to stand out in the crowd.”

But mobile photo bill pay represents more than just a powerful brand differentiator. The feature just may be the switching breakthrough the banking industry has been waiting for.

Think about it. What’s the number one pain point for consumers wanting to switch banks? For those using the service, it’s online bill pay. No one feels like going through the hassle of transferring payee data and details to a new institution. Banks somewhat euphemistically call this a “sticky service,” but it would be more accurately described as “inertia fueled by cynicism surrounding a perceived inconvenience.”

“Banks have also been searching for ways to make bill pay more portable,” notes Andy Schmidt, a Research Director with the TowerGroup. “Mobile photo bill pay can be used to onboard new customers into the bank’s bill pay portal.”

“The ability to enroll new payees and pay a bill on a mobile device extends the utility and stickiness of mobile banking while streamlining the bill pay process,” Schmidt observes.

Schmidt suggests mobile photo bill pay could play a major role as a new account switching and migration tool. Moving accounts and bill pay arrangements from one bank to another the old way is a tedious chore.

“Banks looking to acquire new customers or increase bill pay usage among existing customers could use mobile photo bill pay to facilitate the migration,” Schmidt says.

Julie Cunningham, VP of Corporate Communications at Mitek Systems couldn’t sum it up any better: “The name of the game is to make as easy as possible for the customer.”