Ask people about their favorite apps, and you’ll get a slew of answers: Instagram, Yelp, and Google Maps. What you aren’t likely to hear is, “my bank’s app.”

A study from the Federal Reserve shows that there are untapped markets waiting for mobile banking. Millions of consumers are going to start banking on mobile in the next twelve months. But millions more aren’t interested.

Financial institutions have done a fairly good job at getting their applications onto their customer’s phones. They’ve done a far worse job at generating enthusiasm around their mobile offerings. A big reason for this lack of enthusiasm comes down to bad design: clunky UX, confusing UI, difficult logins, unattractive graphics and an overload of information frustrate many customers, and keep others away.

There’s no reason financial applications have to remain the ugly ducklings of the app marketplace. Thinking strategically about design – especially by adopting a human-centric approach, backed by rigorous testing and focused attention on individual users’ needs and experiences will satisfy the wants of existing consumers and bring some of the doubters on board.

Younger users and early adopters have come to expect a continuously evolving product, one that keeps up with the expanding capabilities of their mobile devices and which fulfills their desire for personalization, automation and financial education. In short, they want a mobile banking experience that’s easy intimate and quick, and tailored to the specifics of their lifestyle.

Many older users are just getting acquainted with mobile banking. And some still haven’t made the leap. Make a mobile app too complex, and you risk alienating or confusing less mobile-savvy users, those whose engagement with your mobile products is more limited in the first place.

Balancing innovation against ease of use in mobile app design is an ongoing challenge. It takes serious thinking about user needs and interactions backed by rigorous testing and research. It also means having the wherewithal to avoid common design mistakes that limit engagement and frustrate users. A frustrated user often turns into a lost customer, and those customers rarely return for a second experience.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Mobile Banking Growth Moderating

A revealing report from the Federal Reserve, titled Consumers and Mobile Financial Services 2015 highlights the vital importance of mobile banking while also pointing to significant lag between early adopters and habitual users.

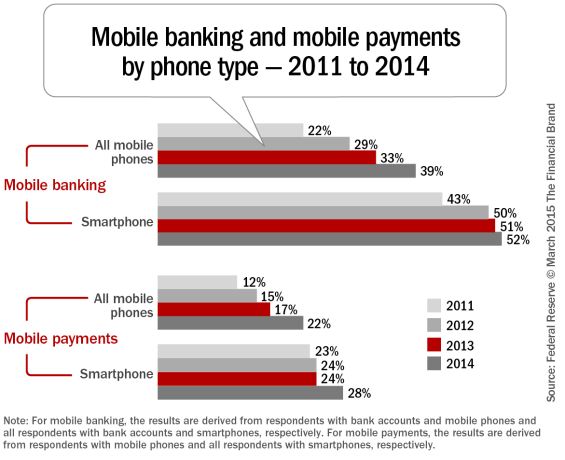

The study shows that the adoption of mobile banking is growing in line with the purchase and use of smartphones.

In 2014, over half (52%) of smartphone users with bank accounts reported using mobile banking in the past year, up from 43% in 2011. A lot of that growth is very recent with more coming in the future as the last wave of consumers move to smartphones.

Fifteen percent of mobile banking users said that they adopted mobile banking in the last six months, and another 11% of consumers with mobile phones who do not currently use mobile banking said that they will ‘probably’ or ‘definitely’ use mobile banking in the following 12 months. The next year is going to see a wave of new users migrating to mobile banking.

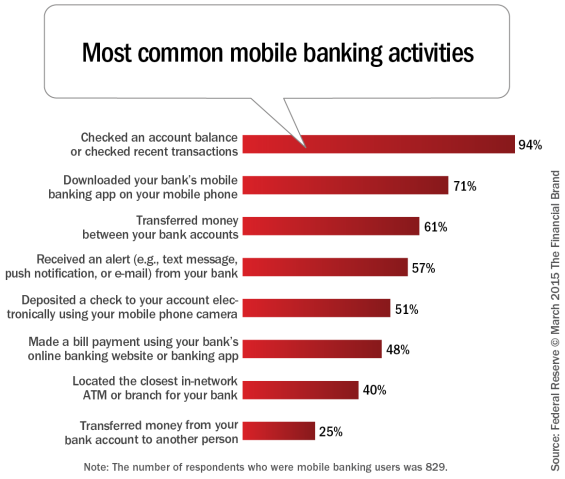

The study also shows that the frequency of mobile banking use among existing users has been increasing over the past year, from four to five times a month on average. The range of activities performed through mobile banking has also been on the rise.

Checking account balances remains the most popular function – 94% of mobile banking users report doing this in the past year. Other functions are on the rise as well – 61% of users transferred money between accounts, 57% received an alert from their financial institution. Perhaps most impressively, 51% reported depositing a check using a mobile phone camera, while fully 71% of mobile banking users have installed their bank’s application on their phones.

Mobile users have eagerly adopted their banks’ mobile products, and they’ve proven to be quick learners of new features. This means that there is a huge opportunity for banks as they enter and expand their presence in the mobile space. However, it’s an opportunity that comes with a certain degree of peril.

Financial institutions need to make sure their mobile offerings are keeping up with the cutting edge of design and functionality. They also have to make sure that applications are easy enough to navigate and use so there’s no barrier to entry for novice users, because the truth is, there are still many customers waiting at the gates.

Opportunity for Future Growth

Seen from above, the picture for mobile banking looks rosy. But a deeper dig into the Federal Reserve data reveals a landscape of engagement and adoption that’s more uneven.

First, there’s the use gap. Among users of mobile banking, there’s a big gap in engagement between high-volume users and the rest. About one fifth (22%) of users bank online ten or more times per month, while the rest does so much less frequently.

Then there’s the age gap. Adoption of mobile banking predictably skews young. Among phone owners with bank accounts, fully 60% of those aged 18 to 29 reported using mobile banking. An impressive 54% of those aged 30 to 44 did as well. But a big drop off comes with the next age tiers. Only 32% of phone owners aged 45 to 60 reported using online banking, as do a paltry 13% of those over 60.

So what’s keeping these users from getting into mobile banking? Some don’t yet see the value of mobile banking. The most commonly cited reason for not using mobile banking is a lack of urgency – the feeling that their banking needs are already being met. This is followed closely by concerns about security.

Ease of use also features prominently, with 39% of those surveyed saying that they didn’t use mobile banking because the screen was too small. A further 20% reported that mobile banking is “too difficult.”

How should brands deal with all these demands in such a fast-paced moving environment? It’s still the same answer as it has been for some time … strategic design. In fact, many of the factors keeping people from using mobile banking are design problems.

In designing an application, it’s important to ask some of the following questions: What are your customers looking for? What features and functionalities will they use on a daily, weekly, and monthly basis? Are you addressing the needs of your different segments, from millennials to retirees? How will you expand engagement of existing beyond account check and bill pay? And finally, are your products staying up to date with the newest trends in mobile design, features, and functionality?

Strategic design will solve some of these problems and can make customer acquisition and engagement significantly easier.

Mobile Innovation – New Features, New Services

In addition to the need for smart design, the state of the industry as it relates to new technology keeps changing. Banks and credit unions keep adding innovative new features and services to their mobile products. As customers come to expect the latest in features and tools, it’s important to provide the latest innovations in technology and services. Adding features users love will grow your customer’s engagement, and can persuade new adopters to switch to your products.

American Express uses smartphones’ geolocation to offer their users discounts and recommendation tagged both to their spending history and where they are at the moment. Capital One lets users bump money between phones. City Bank Texas gives their customers a switch to temporarily turn off a debit card if they think it’s lost. They also let their customers see check images along with their transaction history, and make it easy to look at balances and checking status without logging in.

Mercantile Bank of Michigan has partnered with PayPal and is integrating video technology from uGenius into their app. Banking startup Simple lets customers attach images to their transactions, and lets their customers know what they can afford at any given moment through a “Safe-to-Spend” feature.

U.S. Bank is offering photo mobile bill pay, which will let users pay a bill just by taking a photo of their invoice. Meanwhile, USAA out of San Antonio has added a Virtual Assistant which lets members do their banking – including bill pay – through voice command.

To deal with the issue of security, a new generation of biometric security features for mobile applications are being tested and implemented – tools that can make accessing accounts simultaneously secure, frictionless and fun.

These new features might seem all over the map in terms of what they offer customers. But what they all have in common is leveraging the expanded capabilities of customers’ smartphones to offer banking experiences that are easier and more personal – tailored to the specifics of what they need, where they are, how they spend, and who they are.

Balancing Innovation and Simplicity

So how do you square the circle between innovation and usability?

Utilize research, learning and insights from your users to inform your decisions. We use “design immersions” to do this before we commit to a vision for an application. In an immersion, designers, engineers and experts meet with users to rapidly prototype a product.

The process starts with a low-fidelity mockup. It then solicits an intense amount of user input right away. Designers and engineers work on multiple iterations of a design in the presence of testers, which allows them to refine your concept quickly and hone in on key questions of direction and viability before you start paying for development.

Done right, this design immersion yields a wealth of information. You find out what’s confusing, and what key features you might be missing. Best of all, an immersion gives you high-level, high-impact data on what works best for user experience, allowing you to match your product strategy to a comprehensive design vision. Once the immersion is complete, your team can move forward with a wealth of data about the needs and desires of the specific people they’re designing for.

Additionally, build applications that follow strong design principles. Put simplicity and functionality first. Have a logical information architecture that precisely fits the needs of the user and information gained from your research. Use color as a guidepost, and keep fonts consistent.

Avoid common pitfalls, like poor touch targets, unclear navigation and un-optimized assets. Think in terms of multiple use environments. And finally, always remember that your users are going to be more complicated, surprising and dynamic then you are going to be able to anticipate by guess work.

Human-centered design puts the user first. Rather than focusing on what the bank thinks are its most important use cases, we test our design ideas on users and listen closely to their feedback to create user flows that are in line with the needs of mobile banking users. We see where users get stuck and we redesign until the interaction is seamless. Mobile banking shouldn’t involve a steep learning curve. Life is challenging enough.

Constant and Never-Ending Improvement

The days of spending months developing the technical side of a product, and then months more refining the design, are over. Now more than ever, design must go hand-in-hand with development. Design must get done on live code, instead of waiting to refine a ‘finished’ product. This lets you pivot and respond quickly as goals shift and new features entering the marketplace

2015 is a moment of tremendous opportunity for expanding the reach and scope of mobile banking. Millions of users already using financial service applications on a regular basis. Millions more will begin in the next 12 months. It’s the perfect moment to refine your mobile strategy, with an eye towards balancing innovation and usability.

Thinking about design from a human-centered, user-first perspective will also keep you focused on the most important target of your strategy – your consumer.

Sandeep Sood is the CEO of Monsoon, a firm that designs, develops and markets mobile and web applications that help business thrive in a connected world. His firm has worked with companies such as Wells Fargo, Capital One, Guardian Life, and Citigroup to help them get their ideas off the whiteboard and onto people’s devices. He has spoken at SxSW, TED and TiE. Sood is also the founder of RainFactory, a technical marketing agency that has launched a few of the largest crowdfunding campaigns to date. You can connect with Sandeep on LinkedIn or Twitter.

is the CEO of Monsoon, a firm that designs, develops and markets mobile and web applications that help business thrive in a connected world. His firm has worked with companies such as Wells Fargo, Capital One, Guardian Life, and Citigroup to help them get their ideas off the whiteboard and onto people’s devices. He has spoken at SxSW, TED and TiE. Sood is also the founder of RainFactory, a technical marketing agency that has launched a few of the largest crowdfunding campaigns to date. You can connect with Sandeep on LinkedIn or Twitter.