In an effort to generate fee revenue, some banks and credit unions have begun offering expedited bill payment through their online bill pay platform. Auditing a sample of institutions that offered expedited bill payment revealed that none extend this feature to their mobile banking platform.

Why not? Wouldn’t you think that when someone pays a bill with their mobile phone, they probably require, expect, or assume the payment to be expedited?

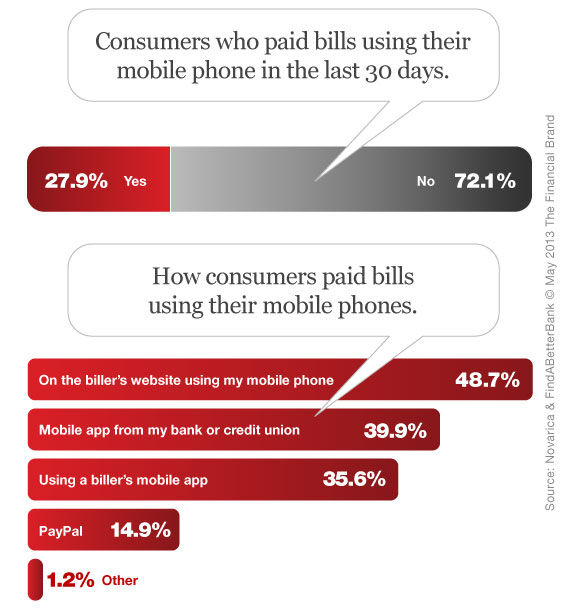

A survey visitors of visitors to FindABetterBank found that a whopping 28% of respondents have paid bills using their mobile phone within the last month. But while many indicate they use a mobile banking app from their bank or credit union, far more use biller-direct services.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Last-Minute, Rush Needs Drive Usage of Mobile Bill Payments

Base: 1,753 consumers responding to a Shopper Insight Survey on FindABetterBank. Responses have been weighted to reflect U.S. consumers with online access.

Banks and credit unions must not stand still, or they will lose control over payments — it’s a big piece of a primary banking relationship. Providing expedited bill payment through mobile banking keeps customers from using other payments providers. Unfortunately, banks and credit unions can’t charge a fee for this service because when consumers pay bills using billers’ services, they get the same immediacy without a fee.