The impact of digital technologies on customer satisfaction became apparent in the most recent JD Power Customer Satisfaction survey, where the largest and most digitally-focused banks scored highest in online, mobile and ATM satisfaction. These digital ratings allowed the six largest banks (Bank of America, Citigroup, JPMorgan Chase, PNC Financial, U.S. Bancorp and Wells Fargo) to take the lead in overall customer satisfaction for the first time ever.

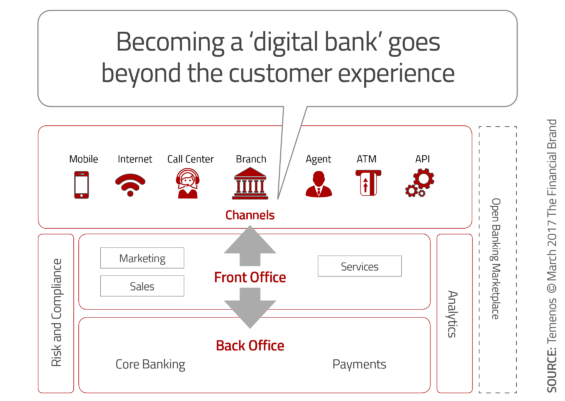

But becoming a ‘digital bank’ goes well beyond just what meets the customer’s eyes and fingers. To deliver the experience expected, a banking organization must leverage big data, new technologies, advanced analytics, a 360-degree view of the customer and personalized engagement. “It isn’t enough for banks to woo customers with nice-looking apps concealing patched-together systems. For innovation to translate into customer satisfaction, banks need to master the bare necessities,” says Ben Robinson, Chief Marketing Officer of Temenos.

Becoming a Digital Bank

Becoming a digital bank can transform a traditional banking organization from being a reactive product provider to being a proactive financial advisor. By developing a digital stack that operates in real-time, with the contextual engagement and the interests of the customer placed at the forefront, financial organizations can combine home grown services with those offered by outside organizations. By definition, digital banks will be more agile and instantly responsive, increasing revenue opportunities and decreasing costs.

According to the Temenos report, Digital Banking, “A digital bank offers customers contextualized, seamless experiences that transform the customer journey. And becoming a digital bank means delivering a compelling and relevant customer experience through an open, integrated and flexible architecture.” In short, Temenos believes a digital banking solution provides:

- Anytime, anyplace, any channel banking: Banking on the customer’s terms.

- Banking beyond the borders: More than just traditional products, using customer data to become a virtual advisor.

- Contextuality: Using customer insights and advanced analytics to proactively provide personalized solutions.

Read More: Top 7 Customer Experience Trends in Banking

Fractional Marketing for Financial Brands

Services that scale with you.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Beyond a Pretty App

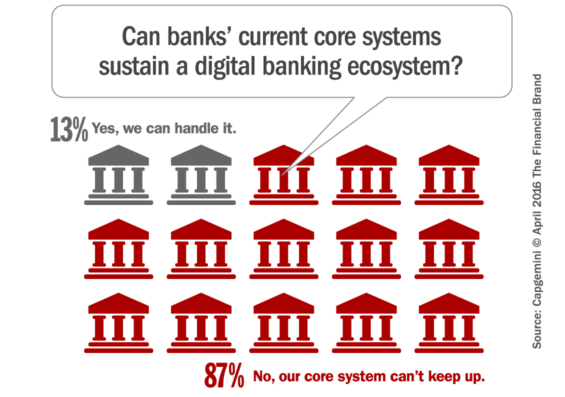

Early investments in providing better digital banking apps has resulted in a shift in customer channel preferences. In fact, the 2016 CapGemini World Banking Report found that 33% of customer interactions were digital in 2016 (vs. 22% in 2014). Unfortunately, not updating core systems has resulted in more complex back offices and an inability to provide a seamless, real-time digital experience overall. The fact that 87% of organizations do not believe their core systems can keep pace has resulted in 80% telling a Finextra study that they hope to replace their core systems in the next 5 years.

Other challenges to becoming a digital bank, according to the Temenos include:

- Data siloes and high IT maintenance costs

- Compliance costs in terms of focus and resources

- Long payback periods for major transformation projects

- Poor ROI on intial investments

- Modest impact of fintech players to date

- Unproven solutions

Read More: Mobile Banking Apps Failing in Key Areas of CX

As has been noted in The Financial Brand and elsewhere however – doing nothing is not an option. For most organizations, the best option will be to implement digitalization in stages.

10 Requirements of a Digital Bank

In the discussion around becoming a digital bank, Temenos provides a list of 10 requirements that need to be met to satisfy the new digital consumer. There are definitely more components to becoming totally digital as an organization, and many of the requirements depend on an updates core system, but these are components that can’t be ignored.

- A digital-first strategy that extends beyond just mobile and online devices to allow for expansion into emerging channels and communication options. The ability to provide anytime, anywhere, any device banking includes an integration strategy that allows for a seamless transition between devices.

- An analytics-driven experience for customers that supports real-time contextual and personalized solutions. With insights delivered across the organization and to all customer devices, these analytics will also support product development in the future.

- A customer-centric perspective that provides a seamless experience and an integrated view of financial affairs.

- Instant fulfillment made possible by straight-through processing and real-time transaction insight availability.

- Ability to support open banking, including the offering of products and services developed by outside organizations. A strong API strategy is the key to becoming a customer’s ‘banking concierge’ offering the best available services in the marketplace.

- Open architecture allowing for the reduction in costs and operational risk. A fully integrated, automated digital solution avoids the duplication and reduces the manual processes that result in sub-optimal end results.

- Upgradable solutions across the organization that tie back-office and front-office processing into a seamlessly integrated solution. With differing innovation cycles, solutions must be easily upgradable independent of each other.

- Agile development where products and services can be brought to market almost instantly. This is important as regulatory changes occur and increased personalization is desired.

- Due to expanding volumes of data, scalability of solutions is imperative. According to Temenos, in the next 10 years, banks will need to plan for 100-fold increase in the number of transactions and enquiries handled by their banking platforms.

- Cloud-based solutions will be required to provide scalability, to drive down processing costs, and to support increased security standards.

Read More: Benchmark Growth Report from Temenos & The Financial Brand

Jumping 50 Years Into the Present

For most organizations, we are using technologies and systems from fifty years ago. In most cases, the only difference is that we are accessing these systems through digital devices. This is not a road to success.

Chris Skinner, financial industry futurist and author of the book Digital Bank: Strategies to Launch or Become a Digital Bank stated, “Digital is not a channel or function, but it’s a fabric and foundation of the new bank. The new bank needs one common digital infrastructure that underpins the whole organization. The new digital bank will have buildings and humans layered upon that digital infrastructure, but it needs to convert thinking from having a physical foundation with channels on top, to a digital foundation with access through physical and digital media.”

Skinner goes on to say, “We are talking about a reformation of the bank. This involves rethinking all of the processes, structures and operations organizations have become used to. It also involves becoming customer-centric, not product-pushers, creating conversations across new formats (social).”

It’s time to move into the present and become prepared for the future.