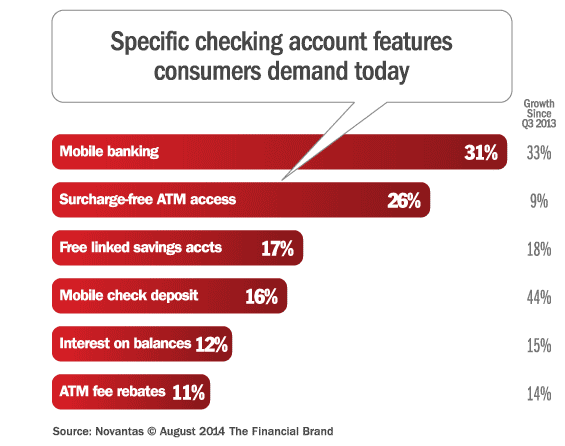

BankChoice Monitor learns from thousands of consumers everyday who indicate they will open a new checking in the next 90 days. Over the last four quarters, BanckChoice has seen a steady increase in demand for a variety of features — some, like mobile banking, have been consistently growing and other features are more cyclical.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Demand in mobile capabilities continues to soar. It’s no surprise that mobile banking capabilities have been the fastest growing features among bank shoppers over the past few years. According to Pew Internet Research as of January 2014 90% of American adults own a cell phone and 58% own a smartphone. Mobile banking has seen a 33% increase and mobile check deposit has seen a 42% increase since last year.

Consumers want free access to ATMs. Both the demand for surcharge-free ATM access and ATM rebates has both gone up over 10% since Q3 2014. As consumers are becoming more mobile-minded, their needs for overall convenience — like access to cash anywhere — is becoming more important too.

More people expect to earn interest on checking account funds. Industry experts anticipate deposit rates will rise and we’re starting to see more consumers expecting to earn interest on the checking account balances: Since Q3 2013, demand for interest bearing checking accounts has seen a 15% increase.

Checking account shoppers want a free linked savings or money market account. Over 17% of checking account shoppers indicated that they “must have” a free linked account with their new checking account compared to around 14% last year. Given high fees for overdraft protection and the ease of transferring money using a mobile phone, more consumers want to proactively transfer money to their checking account when their balances are low.