Owning a spot on the home screen of a consumer’s mobile device is every app developer’s goal. But, earning that coveted location is difficult due to the increasing array of apps already available and being introduced daily.

So, what makes a great mobile experience and generates everyday use? What are the qualities consumers are looking for when determining what to download and use? Can retail banking learn lessons from the apps people prefer?

To find out, we reached out to the 60 member Retail Banking Strategies Crowdsourcing Panel to find out what their favorite non-financial mobile apps were, and why they liked them. While dozens of different apps were mentioned, the benefits of the apps fell into one or a multiple of the following categories:

- Efficiency (makes something easier)

- Effectiveness (saves time or money)

- Contextual (uses personalized insight)

- Entertaining

What is clear from this informal survey is that the demand for transaction-based apps is diminishing as the digital consumer is looking for their mobile apps to provide value that makes life easier, saves time and/or money, is contextual and potentially entertaining. What was also clear is that virtually every app mentioned had a clean, mobile-first design and was easy to use. Many only needed one or two clicks to accomplish a given task. What banks can make that claim?

For banks and credit unions to win in the mobile space, they need to go beyond providing mobile access to online banking capabilities. It is time to integrate banking apps with a consumer’s daily life, providing simple design and a user interface that is both intuitive and contextual.

Read More: It’s Time to Reinvent Mobile Banking

Transactional Focus of Mobile Banking Limits Use

Gaining a prominent position on a consumer’s home screen has never been more difficult. According to the Statistics Brain Research Institute’s latest mobile phone app statistics, there are almost 1M downloadable apps available for both the iPhone and Android mobile devices. At the user level, the average number of downloaded apps per phone is 88 for iPhone owners and 68 for Android owners. Broken down by app type, the market share for the top five app categories are as follows:

- Gaming: 23%

- Entertainment 11%

- Utilities: 10%

- Education: 7%

- Productivity: 5%

From the perspective of app market share, financial service apps are way down the list at fifteenth, with a 3% app category market share according to this study.

With regard to behavior, the 2014 Consumers and Mobile Financial Services report from the Federal Reserve found that 33% of all mobile phone owners used mobile banking in the previous 12 months, up from 28% a year earlier. This percentage jumped to 51% for smartphone owners.

While the numbers look positive on the surface, the most common activities were transactional in nature, including checking balances (93%) followed by account-to-account transfers (57%) and mobile check deposits (38%). In addition, the frequency of mobile banking use actually decreased from six times per month in 2012 to four times a month in 2013, indicating reduced consumer engagement.

Among consumers who do not use mobile banking, the reasons provided included limited usefulness and benefits as well as a concern about security.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Favorite Non-Financial Mobile Apps

It is hoped that by understanding why financial services industry leaders like specific non-financial mobile apps, we can use this insight to build better mobile banking applications.

It is clear from the outset that some of the most successful apps on smartphones today haven’t introduced new ideas, they just do them better. More importantly, the way an application looks and operates is imperative to its long-term success — if an app doesn’t look as good as a competing app, or the navigation isn’t as fluid, the chances are the user will eventually desert that application.

A great app has a mobile-first design, uses large design elements and provides a logical path to follow, making usage easy and obvious. In short, the app focuses on a primary task and eliminates ‘noise.’ Very few banking mobile apps follow these rules.

Finally, most of the best mobile apps mentioned did well in multiple benefit categories (i.e. Efficient and Contextual as opposed to only being good in a single category).

Efficiency

Of all of the categories of benefits of great mobile apps that the Crowdsourcing Panel preferred, the majority made a process easier. Each had a mobile-first interface and the majority leveraged a simple and clean design that draws the user back to the app often. Not surprisingly, the apps mentioned most frequently were both efficient and contextual.

Several of our Crowdsourcing Panelists rated Google Maps as their favorite mobile application. Said the Financial Services team from Accenture, “Google Maps provides a wealth of information (from directions to local businesses) all relative and tailored to the individual user. Author, speaker, radio host and CEO of Moven, Brett King, said, “Google Maps is indispensable when I am traveling to unfamiliar locations/events, etc. as part of my global speaking tour. It helps me find great restaurants, cinemas, cafes, etc. for the downtime I have in between commitments.”

Bradley Leimer from Mechanics Bank referenced the recent acquisition of Waze when he gave two thumbs up to Google Maps, “Google’s pick-up of Waze has been a life saved – I’m in traffic enough – it’s great to know how to avoid it.”

Illustrating the multiple uses of Google Maps, David Birch, director at U.K.-based Consult Hyperion offered, “I love it because it gives accurate public transport directions, so I use buses and transit more and taxis less.” Similarly, Sandeep Deobhakta from Standard Bank in South Africa said that the app was better than the GPS in his car and he used the app often for directions while walking.

Travel organizers were favored by several of our highly mobile Crowdsourcing Panel, with the most frequently mentioned app being Tripit. Bryan Clagett, chief marketing officer of Geezeo said, “Tripit organizes all my travel plans in one tight package. It simplifies my life, but also lets me engage with other travelers and friends.” Ron Shevlin, senior analyst from Aite Group added, “It makes it easy to input data. I usually only need to forward a confirmation email from a hotel or airline to Tripit and the information is automatically loaded.” Finally, Steven Ramirez, CEO of Beyond The Arc made note of the seamless integration across devices (including desktop).

Other travel apps mentioned were the Delta Airlines mobile app (by Fiserv’s Matt Wilcox) and TripCase (by wealth management strategist April Rudin). Both Wilcox and Rudin referenced how the apps removed paper, allowed them to adjust flights, as well as allowing them to check status of flights and upgrades while providing real-time alerts.

The next two most popular mobile apps as rated by the Crowdsourcing Panel were the personalized content aggregator and sharing app Flipboard and the supplemental memory enhancement tool Evernote. Said Sam Maule, managing consultant for Carlisle and Gallagher Consulting Group, “Flipboard was on my new iPhone and I’ve become addicted. Way too easy to post to Twitter and LinkedIn and I’m addicted to the functionality that allows me to have specific topic magazines set up.” Fred Hagerman from FirstMark Credit Union added, “The reason I love Flipboard is that it brings all the news sources I want to one app, with a great tablet AND smartphone interface. It’s also easy to share content with associates and social platforms.”

Both the Financial Services team at Accenture and James Hodges, senior director at WBR loved that Evernote had the same seamless experience across all devices, and that it made note-taking “better than the pen and paper that the app is designed to replace.”

Additional productivity enhancement mobile applications that were favorited by the Crowdsourcing Panel included:

- Cal: “It organizes my life by pulling work and personal calendars together and links with Any.do so both the calendars and a list of things to do can be seen in one place.” – Nicole Sturgill, CEB TowerGroup

- EZ Receipts: “I can scan receipts or explanations of benefits quickly. This app makes my life easier and submitting claims less painful.” – Stessa Cohen, Gartner, Inc.

- If This Then That (IFTTT): “I think it’s a great microcosm of the future of mobile – to notify me of the outcome of predetermined actions I have set up. IFTTT is a real smart assistant driven by preferred outcomes I have defined – where platforms seamlessly interact to drive better human efficiency.” – Michael Nuciforo, London-based mobile consultant

- Passbook: Built into all new Apple mobile devices, several people mentioned the benefits of this app. “It handles my electronic boarding passes and my Starbucks prepaid card flawlessly. I especially like its context-awareness that makes those things bypass my lock screen code so I can access them with a single swipe when I’m ready to board a plane or pay for my iced venti no-classic black tea.” – JP Nicols, Bank Innovators Council

Finally, not to be forgotten are the most functional and easy to access widgets on all mobile devices. From weather and time applications to calculator and card scanning apps, these single purpose apps make accessing information and doing certain tasks easier. Said James Robert Lay, CEO of CUGrow, “My Android widgets combine three of my most used functions on my phone into one unified view.”

Effectiveness

While efficiency apps definitely dominated the list of favorite mobile apps from our Retail Banking Strategy Crowdsourcing Panel, there were many apps mentioned that saved time and/or money. As with the efficiency apps, the most favored effectiveness apps usually also had a contextual component to them.

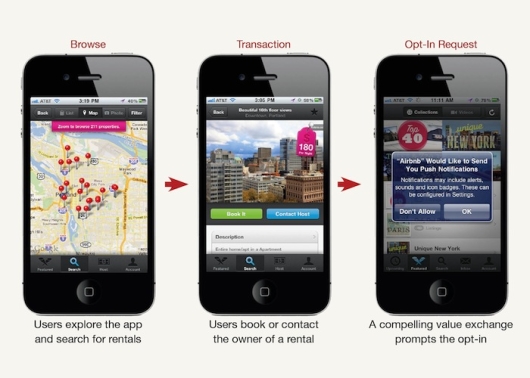

For instance, Carlisle and Gallagher’s Sam Maule’s favorite app was also one of the most unique apps mentioned by our panel. Airbnb is a destination listing site. According to Maule, “I find myself surfing the app to find out-of-the-ordinary locations to stay and to read reviews of the property owners. I love the simplicity of the payment portion of the app as well as the ‘Quick Book’ feature.”

Sarah Cooke, publisher and editor-in-chief at the Credit Union Times like her Joss and Main mobile shopping and inspiration app the best. According to Cooke, “The app is well designed both functionally and aesthetically. It allows me to see what others with similar interests are buying, when a special on a product is ending or supply will run out, and it puts the product in real life settings to help me visualize it better.”

Additional time and money saving mobile applications that were favorited by the Crowdsourcing Panel included:

- AmaZing Deals: “It saves me a good chunk of change in offers and provides exclusive savings in my area.” – Deva Annamalai, Zions Bank

- Nest Learning Thermostat: “Nest is a great example of how a mundane task of controlling the temperature and energy consumption in my home can be made intelligent … by watching my household’s behavior and making smart recommendations. ” – Paul Kadin, AOL

- Sephora to Go: “Sephora’s mobile app seamlessly connects me to products I buy and love (and tells me how to use them or share via Beauty Boards and social networks ). It integrates their Beauty Insider loyalty program and has the potential to expand into other areas where consumer trust are important, such as social commerce and mobile payments.” – Anonymous

- INRIX Traffic: “The app shows, in real time, where accidents have recently occurred and where traffic is slow, based on input from thousands of users. I have found it to be an accurate navigational aid that’s helped me make it on time more than once.” – Penny Crosman, Editor-in-Chief, Bank Technology News.

Read More: Today’s Mobile Banking Apps: Table Stakes or Cutting Edge

Contextual

For the most part, companies are designing mobile sites for the lowest common denominators (e.g., standard screen sizes, devices and operating systems), but ignoring all of the great insight that mobile apps can provide. A mobile device should deliver a different type of contextual experience than a desktop application.

This is increasingly important as mobile fast becomes the primary source of traffic to most websites. It has been said, “Mobile is not a channel anymore, Internet is mobile.” The most potential going forward, for non-financial and financial organizations alike, is in creating a personalized learning experience delivered on a mobile device.

Today, the most contextual mobile apps are usually in the category of news, information, sports, etc. Obviously, some of the best shopping sites leverage contextual information as well, with the majority of apps favorited by the Crowdsourcing Panel in this article having contextual features.

So which contextual apps fared the best with our Crowdsourcing Panel?

The app that was mentioned most often from a contextual basis was Zite (recently acquired by Flipboard mentioned above). Paul Amisano might have communicated the power of contextual design best when he said, “Zite is completely personalized and it learns over time about what I like to read. And I don’t mean what I SAY I’d like to read, but what I ACTUALLY do read!”

Serge Milman from SFO Consultants also favored Zite as well as mentioning the world’s largest crowdsourced traffic and navigation app Waze (recently acquired by Google).

Additional contextual apps that the Crowdsourcing Panel mentioned as their favorites were news sites:

- BBC News: “BBC News mobile makes is easy for me to get a news digest and summary that gets me up to speed in a few minutes.” – Sandeep Deobhakta, Standard Bank in South Africa

- Google Now: “Much more than a search tool, Google Now anticipates what I will want to know about during my day and answers my questions before I ask.” – Danny Tang, Worldwide Channel Transformation Solutions Leader, IBM

- Yahoo News Digest:”I like the fact that this app is selecting content for me, based on what I have read previously. Just to make a parallel, I think this is the next big thing with banking: provide the right information based on use.” – Patrick Bucquet, Partner at CH&Cie in France

Read More: Top 10 Mobile Banking Mistakes

Entertainment

By their nature, most of the most successful entertainment mobile apps bring together straight entertainment with contextual design while including a bit of social engagement. From games to straight social applications, entertainment apps are a way to escape what is around us using our mobile devices.

Well known by almost everyone, some of the favorite entertainment apps mentioned by the Retail Banking Crowdsourcing Panel included:

- Pandora Radio: “Love being introduced to music that is based on my listening habits, likes and dislikes. I never know what is next, yet the offerings are usually in line with what I like, even when the music is completely new to me.” – Sam Kilmer, Cornerstone Advisors

- GroupMe: “The ability to group friends together for posts and the ability to ‘like’ posts makes this app unique. The app lets me easily keep a running, casual conversation groups of friends, like an email listserv, but with shorter, instant updates. There is even a gamification component — who can write the funniest update and get the most likes?” – Melanie Friedrichs, Andera

- Shazam:”Lets me discover new music by recognizing the song that is playing around me if I don’t know the artist.” – Zilvinas Bareisis, Senior Analyst for Celent in the UK (note: This app may be integrated in the upcoming iOS6 software, allowing users to ask Siri, “What song is playing?”)

Highest Rated Mobile App

Possibly reflecting the globetrotting nature of our audience and the desire to save both time and money, the favorite overall mobile app for the Retail Banking Strategy Crowdsourcing Panel was Uber.

Possibly reflecting the globetrotting nature of our audience and the desire to save both time and money, the favorite overall mobile app for the Retail Banking Strategy Crowdsourcing Panel was Uber.

Not surprisingly, this app was mentioned as being strong in the Efficient, Effective and Contextual categories. Users of the Uber app can hail black cars and taxis right from their smartphones at any location, thanks to the built in GPS. When the ride is over, Uber automatically charges the user’s predetermined credit card or PayPal account and generates an email receipt, making expense reporting easier.

What was once a service available in a limited number of cities, Uber is now in close to 50 North American cities and dozens more worldwide.

According to Mary Beth Sullivan, managing partner of Capital Performance Group, “Uber works every time. It lets me know exactly when I will be picked up – seeing my car on a map so I can track its progress … and no cash is needed. Driving in corporate cars through Uber feels much more safe than taxis – especially in Washington DC and NYC.”

Both Sam Maule from Carlisle and Gallagher and Singapore-based author, speaker and strategist Scott Bales loved the seamless experience and the ease of use of Uber. Maule specifically mentioned the value of the contextual ‘push’ messages that are delivered when he arrives at a new city, and the fact that he gets both driver reviews and valuable offers.

Jelmer de Jong, global head of marketing at Backbase, highlighted the payments aspect of the app when he said, “Uber completely eliminates to need for cash, eliminates the need for a credit card swipe and eliminates the need for a POS device on the drivers side. This kind of ease of use and the ability to eliminate three potential payment hurdles, instead of trying to improve them, is real innovation.”

Lewis Goodwin, CEO of GoBank (a pretty good financial app itself), probably summed up the benefits best when he said, “Uber has changed a miserable cab ride experience into an enjoyable and reasonably priced game.”

(Note: For a similar mobile application, but with bookings of taxis being done with existing fleets on a bid basis, GrabTaxi is growing quickly in Southeast Asia. Says Singapore-based and NextBank founder Rob Findlay, “The drivers have the direct account not the cab company, so there is a direct connection that is much quicker than going to the cab company app. Multiple cabs bidding makes this app both a time and money saver.”

Read More: Banks Not Meeting Mobile Banking Customer Expectations

Lessons for the Banking Industry

Scott Bales, author of the new book Mobile-Ready, said in an exclusive interview that the same rules apply to financial services as they do for any successful mobile app. “My favorite mobile app is always the one that understands that mobile is about enabling context, behavior and utility. If organizations can’t get this mix right, they are already way behind the pack as consumers go untethered.”

He went on to say, “As consumer demand and behavior shifts, and as interactions happen in new locations, times and contexts, users expect a more engaging experience. Transaction-based apps, like mobile banking, are quickly falling to the bottom of the pile. Its’ time for financial service leaders to wake up and ask themselves, ‘Do we understand the new consumer, new commercial models and new contexts?’ Or are they like most dinosaurs trying to apply traditional thinking to the new market?”

Serge Milman from Optirate believes that few banks, and even fewer banking apps create any value. In another exclusive interview, Milman said, “There are very few reasons for me to tap on one of my seven banking apps (other than to deposit a random check). For me, there are very few transactions that must be performed on the spot using my mobile device. My banking providers have failed to communicate the value inherent in their mobile apps – and I have been unable to identify value creation that may have been intended.”

“Unfortunately, most banks seem to want to stuff their mobile app with the a la carte selection that is found with their online offering. As a result, most are seeing rather depressing results based on customer acquisition and cross-sell metrics,” continued Milman.