In the report “Mobile Banking 2013 – Are You Following or Leading?,” Mapa Research provides an in-depth quantitative and qualitative review of the mobile banking offerings of 67 banks in 14 countries to find the best innovations in the industry. Using a panel of live bank accounts from around the world, the report has close to 100 visual examples of mobile innovations including reviews of 15 additional offerings that put the best and mobile banking developments under the microscope.

The report debunks a number of myths that seem to be prevalent both inside and outside of the financial services industry:

- The largest banks have been hampered by legal constraints and legacy systems meaning ‘risky’ or innovative ideas have been shelved. Innovations are coming from large traditional banks as well as nimble mobile centric disruptors

- Few banks let customers make payments to new payees in mobile banking. In fact more do than don’t

- Payments to mobile/email services have been pioneered only by the most innovative banks. Again, the banks who don’t provide this functionality are now in the minority

- Meaningful customer support and advanced functionality such as PFM and share trading are hard to deliver on mobile. In fact more and more banks are proving that these features can be deployed successfully

Devices and Platforms

As has been documented by various sources in the past several months, mobile banking has been adopted at a much faster rate than any other banking technology. In fact, at some institutions, the number of online banking sessions conducted from a mobile device currently exceeds the number through non-mobile channels (while the mix of transactions performed at a computer, tablet and smartphone differ).

With smartphone penetration reaching the tipping point, it is not surprising that all 67 banks analyzed by Mapa provide native apps for both the iOS and Android platforms. In addition, 3 in 5 banks also have either a Blackberry (43%) or Windows (39%) phone app, with only 25 percent having both.

As has been the case since the beginning of the mobile banking revolution, most institutions also have a mobile optimized web product (75%), with banks staging the introduction of innovations across different platforms at a different pace based on the platform penetration within their customer base. Interestingly, only 4% of the banks reviewed have built a fully responsive website.

Current Mobile Banking Functionality

While the ‘table stakes’ for mobile banking offerings continues to change, Mapa analyzed how banks are currently providing core mobile banking functionality to customers. The primary areas reviewed included:

- Registration and login

- Understanding basic financial status

- Transacting

- Communicating with the bank

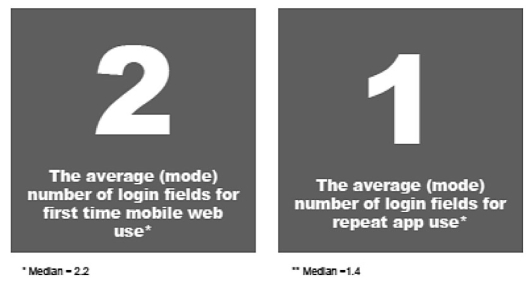

Registration and Login. With security and privacy being at the forefront of concerns for mobile banking customers, balancing the need for robust authentication with ease of registration and simple ongoing use requires striking a delicate balance for banks. As can be expected, there is greater scrutiny during the initial registration process than is required after the registration is complete. That said, U.S. financial institutions seem to be taking a more conservative approach than their counterparts overseas, with most requiring an ongoing two-factor authentication with more information required at login.

The two most common approaches found in the research are the use of cookies to remember online banking usernames and the use of SMS verification in conjunction with account/card numbers for first time registration.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Understanding Basic Financial Status. While all banks reviewed allowed customers to view balances and see recent transactions, the ease of access to this information and depth of insight differ rather significantly. Eleven of the banks reviewed (none in the U.S.) allow customers to view their balance before login.

While there are examples of organizations that provide this functionality in the U.S. (GoBank’s ‘balance slidebar’ being the most notable), the balance between privacy and simplicity keeps many banks on the sidelines. Interestingly, the availability of pre-login balance was voted as the most favorite feature of CommBank’s Kaching offering.

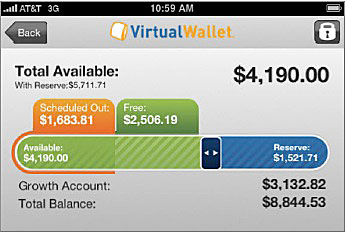

The Mapa research provides many specific visual examples of how banks around the globe are still grasping for the ‘sweet spot’ of PFM on mobile and how to visualize the customer’s financial position. Some banks reviewed provide a snapshot of a customer’s complete financial position using easy to understand graphics, while others provide just a transaction overview.

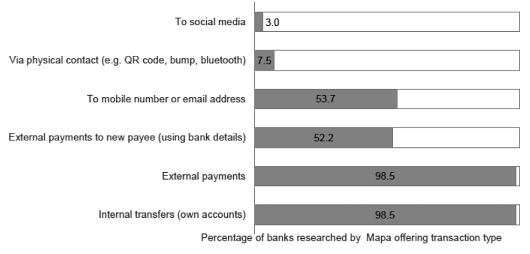

Transacting. The movement to a pure mobile wallet environment has been much slower than projected, but the options for P2P payments and transfers are increasing at a pace consistent with each bank’s risk tolerance and internal compliance perspective. As a result, almost all banks allow for external payments and internal account transfers, while fewer provide a means to pay via mobile phone number or email address or to make external payments to a new payee.

Only the most progressive banks reviewed allow payment via QR code or ‘bump’ with 3 percent providing a social media mobile payment option as shown below (Commonwealth Bank in Australia and Commonwealth owned ASB in New Zealand). Additional banks allow for ‘Facebook Banking’ on the desktop according to the Mapa study.

Note: Mapa provides a very thorough review of different approaches banks have taken to allow for payments to new payees and how banks handle their pay-to-mobile service in the Mobile Banking 2013 – Are You Following or Leading report.

Communicating With The Bank. One of the most important, and least developed, areas of mobile banking innovation is in the ability communicate with the bank through the mobile banking application. Several examples of communication innovations are provided in the study. Some require a user to leave the mobile banking application to reach the bank, while others went as far as providing personal phone numbers, email addresses and even work schedules of primary contacts.

Mobile Banking Innovation

It is clear from the more than 100 Mapa visual examples in the research that exciting innovations are occurring at every mobile banking customer touchpoint and at every large bank in the world. From initial registration and transacting to channel integration and social media engagement, banks are leap frogging each other with new ideas that will simplify mobile banking while providing additional functionality.

When asked whether the gap between mobile banking innovation ‘leaders’ and ‘followers’ has widened or shrunk, Mapa consultant and one of the authors of the report, Joshua Grant stated, “The gap between the leaders and followers has been closed simply because many of the followers did not previously have a concrete mobile banking proposition.” He added, “Going forward, some banks will be content simply to provide hygiene factors to their customers. But from working with many digital mobile teams around the world, these banks will be in the minority.”

Core Functionality. Simplicity and engagement are the key objectives with innovations connected to most core banking functionalities. With the registration and login process as well as understanding finances, banks are pushing the envelope around the insight a customer can easily access. One of the banks reviewed by Mapa provides six recent transactions before login, while another actually enables the customer to display their balance as a widget on their mobile homepage upon authorization.

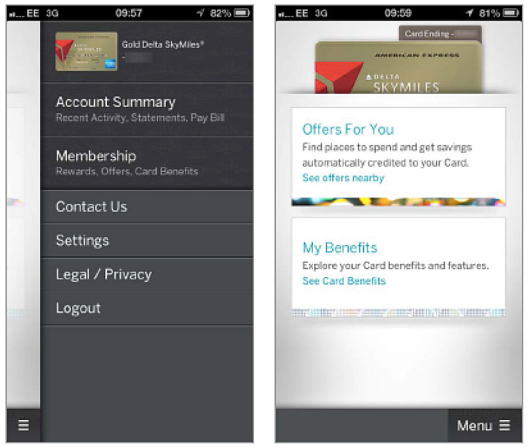

In addition, the ability to get real time categorization of purchases, understand future financial obligations and, in some cases, integrate photo capture of receipts within the mobile banking application sets banks like Moven, Simple, Chase, GoBank and American Express apart from many other competitors. The visual examples in the study make it clear that there is definitely not just one way to accomplish these tasks however.

While not reviewed in depth within this Mapa Research report, it was noted that the PFM functionality of virtually all of the banks analyzed differed significantly between the smartphone application and the desktop and tablet applications. Not only are many of the leading banks streamlining PFM for mobile, but also using many of the unique interactive capabilities of the tablet in displaying a customer’s finances.

Payments. Innovation in the payments space is not limited to traditional banking organizations. Examples are provided as to how PayPal, Google, Square and others continue to set the bar with regard to simplicity and mobile integration of the payments function. While QR code payments appear to be a phenomenon mostly outside the U.S., the use of the smartphone camera for depositing checks and (more recently) paying bills is gaining momentum.

Communicating With The Bank. Since the mobile channel was expected to offload many of the basic interactions the customer was previously having with the bank (balance inquiries, bill payments, depositing checks, etc.), building dialogue options into mobile apps has lagged some other innovation categories. That said, Mapa does provide examples of how banks allow for feedback generation within the mobile app (ICA Banken), customized push notifications as opposed to SMS or email messaging (Skandia Bank, Bank of America), and even how a couple banks are providing offers via mobile push notifications (Standard Chartered).

The best example of communication innovation within the mobile platform (my opinion) can be found where banks are integrating live chat functionality into their mobile apps to provide instant access to customer support. Both BMP Paribas and NatWest provide this capability, with NatWest allowing for specific account queries.

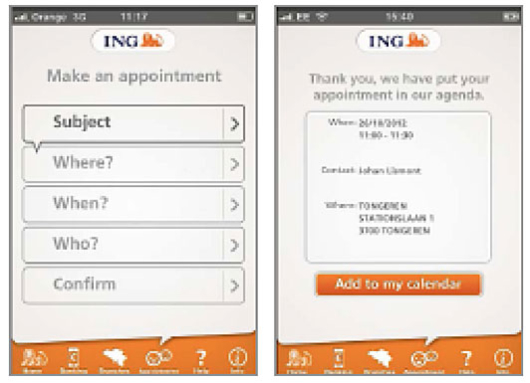

Channel Integration. Unfortunately, most mobile banking applications traditionally have been the outgrowth (miniaturization) of a bank’s online banking application, thereby creating channel silos as opposed to a fully integrated functionality. This is changing, however, as more of the larger banks building new mobile applications from the ground up, integrating branch, online, ATM and other channels seamlessly.

Examples of using a mobile device to get cash without a card at an ATM (NatWest, Bankinter, IsBank), authenticate transactions made online, and booking appointments at a branch (ING Belgium), all help move banking to a more omnichannel environment.

Customization and Social Media Integration. It is clear that leading banks are just beginning to allow customers to customize their mobile banking experiences through personalization (adding photos). Eventually, it is believed that the ability to customize a mobile banking app will increase as improvements in some of the basics of mobile banking are completed. The objective of introducing personalization is to increase engagement, use and loyalty to the bank’s brand.

Investment in mobile social media strategies has also lagged more basic functionality as banks continue to try to validate the ROI of this endeavor. There are some standouts in the banking industry, however, who have built their mobile banking platform with social media integration in mind as shown in the Mapa research.

Joshua Grant from Mapa notes, “A key trend is the social aspect of mobile banking. Banks are now including themselves in their customers’ personal dialogues by allowing them to, for example, request payments from friends, send photos and messages along with payments, share financial goals and access community support. Personalization and communication with the bank are also very active areas.”

As mentioned, social media integration within the U.S. continues to lag, with some notable exceptions by USAA and Moven.

Voice Navigation. One of the more exciting areas of innovation is the ability to conduct basic transactions with voice commands. According to Bank Innovation, US Bank will soon begin offering voice control technology to users of its FlexPerks mobile app. The technology is being provided by Nuance, a provider of digital speech and imaging tools. The bank will be using Nina, the Siri-like virtual assistant that USAA has been using for its 2.5 million mobile customers.

The benefit of this innovation is that customers can navigate around the mobile banking application using voice commends in a hands-free mode. Mapa notes that BBVA is also experimenting with voice technology.

Monetizing Mobile. At a time when cost reduction and revenue enhancement are at the top of every banker’s list of goals, the ability to potentially extend the benefits of mobile banking to include online and offline commerce is enticing. While early mobile applications have been of the standalone variety that can be accessed by both customers and non-customers, some banks are attempting to integrate rewards platforms and internal product offers within the mobile platform.

Bank of America may be the first to to provide notification and redemption of merchant-funded reward offers within the mobile banking application. Other banks are testing gamification around online and mobile activity or associated with Foursquare check-ins. Integrated rewards are also prevalent in non-banking mobile applications by Square, Shopkick and Starbucks.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Future of Mobile Banking

It is clear that the marketplace will be continually evolving with new competition from traditional banks and non-banks. To stay relevant, banks will need to stay in touch with consumer mobile expectations and the needs of the bank. New players will likely emerge including aggregators like Mint and mobile wallet providers like Google and PayPal.

According to Mapa’s research chairman Mark Pavan, successful banks will need to be reactive, responsive and forward-looking. Strategies of successful providers will include:

- Exploring many different opportunities simultaneously. The market is moving too quickly to take on a single mobile innovation initiative at a time.

- Collaborating with external providers to fast track launches (this was evident with Commonwealth Bank’s Kaching)

- Segmenting features against needs with simplicity being the focus of new innovations.

- Thinking buy rather than just pay like has been done by American Express and a number of other American banks.

Looking forward, banks will not only have to do more of what has been discussed above, but they may need to engage more expert contractors to keep the innovation process active. Some banks are opening up their APIs to third parties to create add-on services. Differentiation through mobile is possible even though the cycles may be short.

Other areas of innovation include mobile banking beyond smartphones such as wearable technology (Pebble) and innovations like Google Glass as well as new security solutions that include voice biometrics, fingerprint scanning and iris recognition.

Finally, while it may be easy to look at other bank’s innovations, there is really no one-size-fits-all approach according to Mapa’s Joshua Grant. “The most important thing is that senior management buys into mobile – some of the most innovative digital teams are hampered by constraints from above.”

A download of the Mapa Research preview deck (including an excellent diagram of the current and future generations of mobile banking) is available for free with information on how to purchase the complete 70 page research report.