Financial institutions of all sizes need to understand that mobile payments go beyond the much hyped mobile wallet and mobile payments potential at the point of sale (POS). The real and immediate opportunity within mobile payments could be those beyond the point of sale, where banks and credit unions are best positioned to compete and where hesitant consumers can be introduced to the benefits of digital transactions.

According to a white paper from Fiserv, the best strategic approach to mobile payments starts with the services consumers are using today. The building blocks of mobile payments referenced by Fiserv include:

- Paying Self. Transactions that use a mobile device to make transfers and to deposit checks into a personal bank account, such as mobile deposit and funds transfer capabilities.

- Paying Others. Person-to-person (P2P) payments to individuals and groups of individuals from a mobile device.

- Bill Payments. Payments to a biller either through a financial institution mobile app or a biller mobile app, including eBill presentment and payment capabilities such as photo bill payment.

- Paying Merchants/Retailers. Purchases via mobile proximity payments (NFC), quick response (QR) code, cloud, or online via apps and mobile websites.

“Focusing on these four pillars until mobile wallets and mobile proximity payments mature will enable banks and credit unions to attract, retain and strengthen relationships with key customer segments already heavily using the mobile channel, such as Gen Y,” according to Ginger Schmeltzer, senior vice president, Emerging Payments, Fiserv.

Read More: How Will Banks Respond if Apple Becomes Mobile Payments Player

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Mobile Payments Today

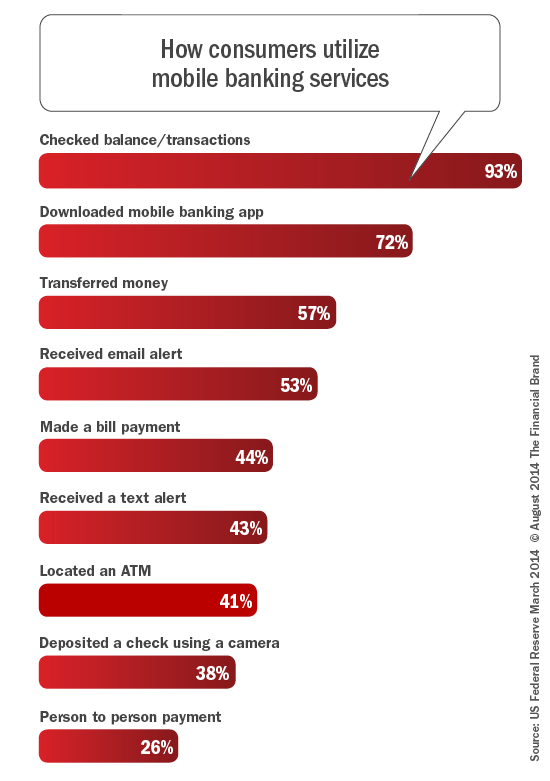

Mobile wallets and mobile POS payments in the U.S. have lagged other countries because of the complex ecosystem and the large number of stakeholders that must work together to achieve scale and value. According to the Consumers and Mobile Financial Services 2014 report published by the Federal Reserve Board of Governors, only two percent of mobile phone users say they have made mobile POS payment even though other payment activities referenced in the Fiserv report are much more prominent (money transfer, bill payments, mobile deposit and P2P payment).

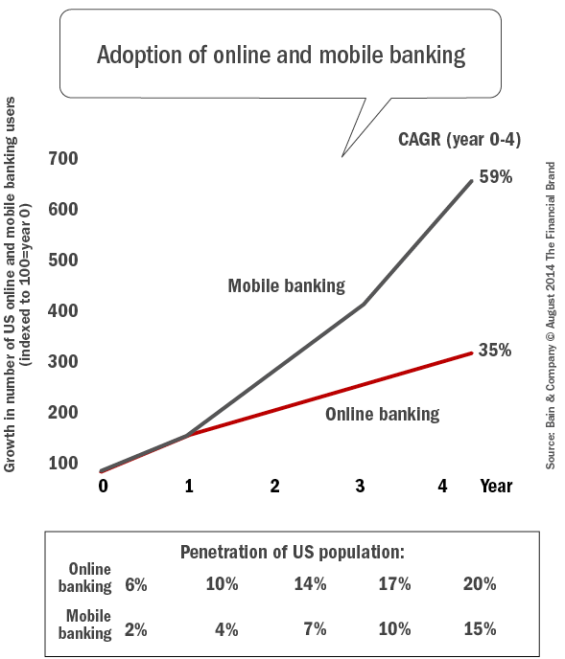

In a report from Bain & Company, Mobile Payments: The Next Step In A Bank’s Digital Journey, it was found that industry leaders view mobile payments as part of a long-term trend around rising consumer expectations around digital value and convenience. Just as consumers embraced online banking and then mobile banking (see below), they will expect their banks to provide them with a ‘viable’ mobile payment solution that lets them use their phones like credit or debit cards, that support loyalty programs and help manage money. They also expect these apps to be secure, widely accepted and easy to use.

Read More: 20 Top Mobile Banking Apps

The Time to Act is Now

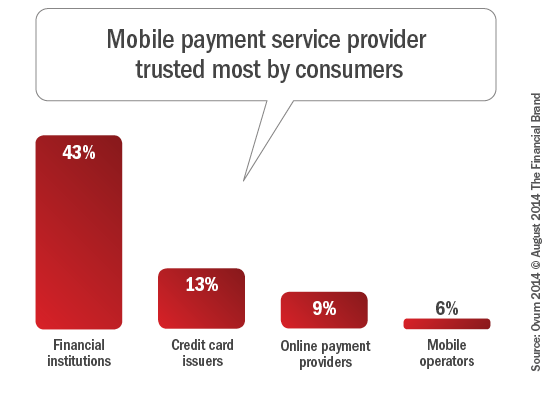

Both Fiserv’s and Bain’s research indicate that the time to act is now. Bain believes that most customers will have only one or two payment apps on their phone. And, while research from both firms shows that consumers trust banks and credit unions with their data more than they trust retailers, technology companies or alternative payment providers, non-bank competitors such as Apple, Google, Square, PayPal® and others will continue to leverage digital channels and large customer bases to compete head-on for mobile payment relationships.

Bain provides three important reasons – the three “Ds” – to explain why banks need to move quickly to address consumers’ needs.

- Disintermediation. Banks and credit unions that wait for others to create their payment solutions could be excluded from conversations between consumers and the payment solution provider. Although current payment mechanisms may prevail (credit and debit cards in the US, and bank cards and other systems in Europe), brand recognition and consumer relationships could shift to whoever is providing their digital wallet.

- Data. Mobile wallet providers will have the best view of consumers’ payment behavior, including the what, when and how of purchase behavior. This is the Holy Grail of consumer insight that is the foundation for expanded consumer relationships and targeted offers and solutions.

- Digitization. Mobile payments are the centerpiece of multichannel relationships with digital consumers. With the possibility of only one or two mobile payment apps being prominent on a consumers’ phone, banks and credit unions should move quickly to ensure their app is one of them.

Even if a financial institution is not ready to dive into the proximity payments waters yet, they can still focus on the three other pillars of mobile payments that consumers are already using – paying self, paying others and paying billers according to Fiserv.

“Due to their trusted relationship with consumers, financial institutions have a distinct advantage over non-bank competitors as the mobile banking and mobile payments user experiences converge,” said Ginger Schmeltzer. “Banks and credit unions that offer mobile deposits and transfers, and that facilitate mobile payments to billers and individuals, can position themselves successfully as the provider of choice for mobile retail payments.”

Avoid Boiling an Ocean

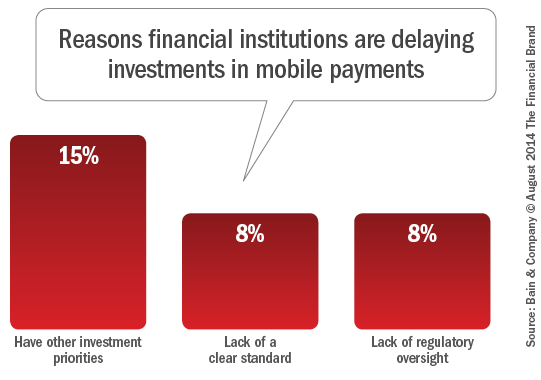

The key to moving forward in mobile payments for most financial institutions is to avoid boiling an ocean. Most consumers find current card and cash based payment methods easy and secure. So, banks and credit unions need to either offer something more convenient or of greater value. For most organizations, it will be best to start small. Unfortunately, financial institutions find more than enough reasons to delay investment in mobile payments.

Fiserv recommends that financial institutions think of every consumer with a debit or credit card as a potential candidate for mobile payments. Branding and marketing programs should continuously reinforce the integrated nature of the mobile channel while also extending branding and sales messages to the mobile channel. “Since mobile banking sets a good foundation for mobile payments, campaigns should be implemented to convert customers to the mobile channel and encourage channel use,” according to the Fiserv white paper.

Fiserv recommends the following path to improving the engagement in mobile payments:

- Invest Now in the Mobile Payments Consumers Are Already Using (pay self, pay others, bill payments)

- Build Out Capabilities Related to POS Payments (merchant-funded rewards, loyalty programs, payment-related alerts)

- Design the Product to Leverage Cognitive Association Between the Mobile Banking Experience and POS Payments

- Include card and payment information (for example, in the contacts and help sections)

- Consider using card-aligned PINs for authentication

- Use visual metaphors in your design; for example, wallet and card icons

Once the basics are managed, Bain (and others) believe financial institutions need to strive to provide an ‘Uber mobile experience,’ which is integrated, seamless and provides an exceptional value for a targeted segment. Bain also believes that banks and credit unions could generate new value for customers by helping providing real-time money management tools that are integrated within transactions.

Ongoing Challenges

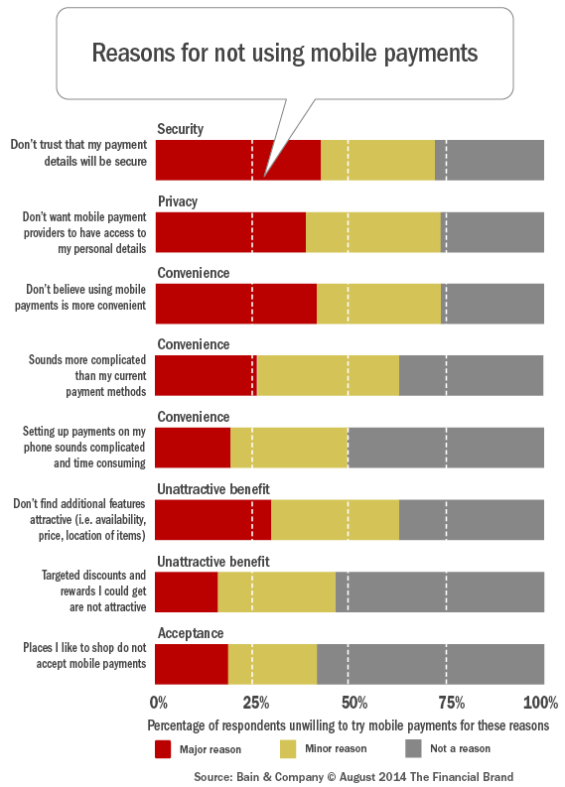

Even if financial institutions start small and provide added value for changing current payment behavior, challenges remain. These include, but are not limited to security, privacy, various convenience concerns and the lack of value-oriented benefits. This doesn’t even touch the major issue in the U.S. related to overall acceptance.

Moving Forward

Despite the above recommendations that may appear to be individual solutions, mobile payments won’t succeed as a standalone solution. Instead, both Bain and Fiserv stress that mobile payments must be part of a broader transformation to a digital model that includes mobile banking, online payments and integrated money management (PFM).

In addition, unlike most banking solutions, mobile payments will most likely involve the partnership of both traditional and non-traditional players that will need to combine the needs of disparate parties while tapping the power of the network behind the interface. In the meantime, financial institutions should be working now to make it easier for consumers to add their bank cards into any mobile payment app (iTunes, Starbucks, Amazon).

Finally, the power of ‘big data’ will need to be leveraged to provide contextual benefits that can be accessed through mobile devices. Unlike other solutions, mobile payments can combine the what, where, when and even why for the benefit of the consumer.

According to Ginger Schmeltzer from Fiserv, “Understanding the behavioral and market shifts that are taking place will enable financial institutions to develop strategies and marketing programs that leverage the trust consumers already have in them as providers of secure payment services. By accelerating the development and execution of their mobile offerings, financial institutions can remain competitive as the market matures, and provide a firm foundation for the addition of the right mobile commerce solutions at the right time.