Industry estimates forecast that almost half of the U.S. Internet population will be using tablets by the end of 2013. Banks and credit unions have an opportunity to optimize their investments by aligning new tablet banking offerings with the unique ways consumers prefer to use the tablet devices. By solidifying a dedicated tablet channel strategy, financial institutions can respond to the growing trend of tablet banking. Delivering an app-driven, fully functional tablet experience that complements other channels will lead to more customers and members and sustained financial institution performance.

According to Fiserv in a recent white paper entitled, ‘Banking on the Tablet Channel’, “Financial institutions need to align tablet banking to support the unique ways consumers prefer to use the devices. Instead of just enabling consumers to access a financial institution’s online or mobile banking website designed for PC or smartphone users, tablet-specific banking apps should provide a rich experience that leverages touch navigation and makes use of the larger display than that provided on smartphones.”

Tablet Banking Trends

Tablets are becoming the primary device used for a variety of mobile banking tasks. In fact, about 1 in 3 consumers point to tablets as the mobile device he or she primarily uses to email the FI. Users also turn to tablets at higher rates for advanced mobile banking tasks. Just over 3 in 10 mobile bankers view and pay bills using a browser on the tablet. As ownership rates rise, mobile banking primarily through tablets is expected to become more common.

Despite extraordinary growth of both tablet owners and tablet bankers, the support of tablet banking continues to lag across the industry. Many financial institutions still either support tablet banking with a mobile banking application meant for smartphones or expect consumers to access their online banking site using their tablet. This is interesting given that the demographics of a tablet banking consumer are the most favorable of all mobile banking users.

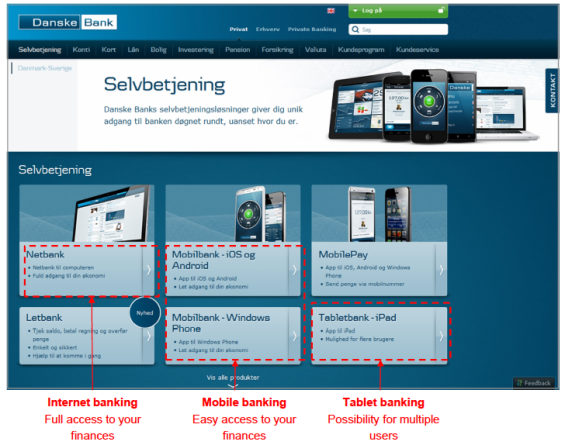

According to the Mapa Research report entitled, ‘Tablet Banking Series: Are you making the most of the tablet opportunity?,’ the leading global banks are more likely to have a dedicated tablet app than smaller institutions. In addition, offering an iOS tablet app is the dominant approach, even though a fair number of institutions in selected countries offer Android tablet apps as well.

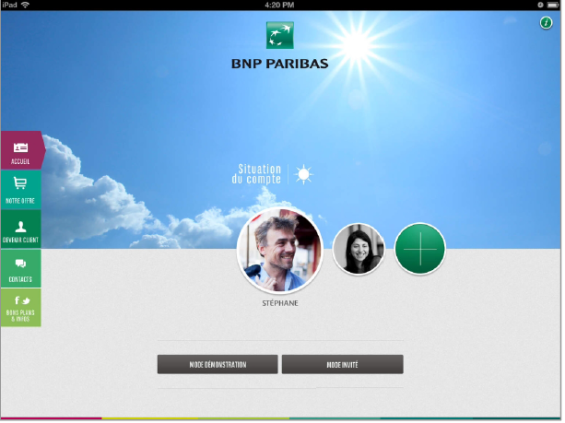

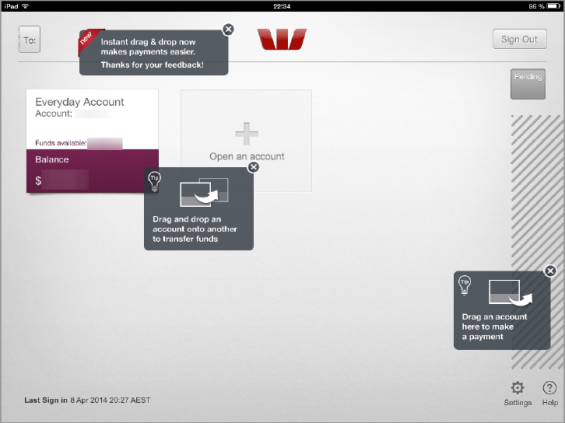

In an analysis of 50 financial institutions across 10 countries, the core strengths of dedicated tablet banking apps versus traditional mobile apps according to Mapa include:

- More comprehensive and visual engagement overviews

- More PFM functionality

- More use of drag and drop

- More personalization options

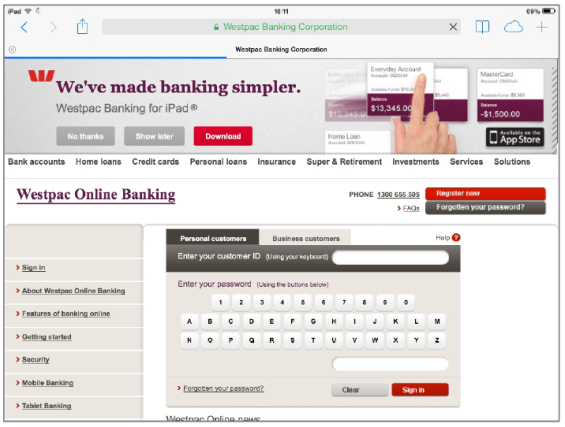

When analyzing browser-based (internet) tablet banking experiences (as opposed to downloadable tablet apps), Mapa found that several institutions promote their tablet apps when users navigate their site using a tablet device. Unfortunately, the vast majority of institutions offering online banking for a tablet result in a poor user experience which is hard to navigate and do not provide any touch use components. While some organizations have a responsive design capability, there is very little use of interactive calculators or guides and virtually no sales functionality.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Read More: 10 Great Tablet Banking Features Enhancing The Customer Experience

Dedicated Tablet Banking Apps

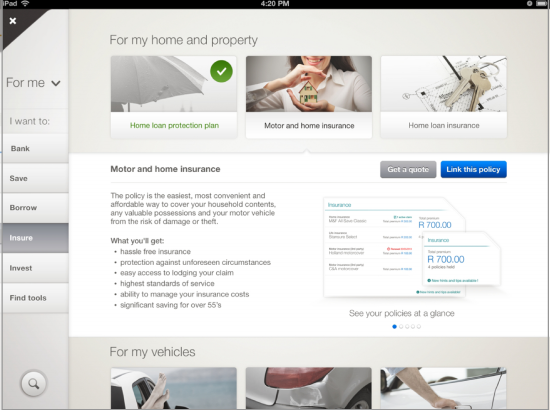

As mentioned, while many of the top banks globally offer a downloadable tablet banking application, almost half of the largest US banks still don’t offer a dedicated tablet banking application for both iOS and Android devices. Below are some of the better dedicated tablet banking apps found by Mapa.

Danske Bank Provides Access To All Mobile And Tablet Applications On Public Site

BBVA Provides Combined Access to Tablet and Mobile Banking

BNP Paribas Allows Tablet Bankers To Create Multiple Profiles For Unique Family/Partner Access

ING Provides PFM View of Relationship at Login

Westpac Highlights Drag And Drop Functionality On Tablet App

Read More: 20 Top Mobile Banking Apps

Browser-Based Tablet Applications

As mentioned, when a tablet is used to login and examine the browser experiences (including landing page, transfer, payments and sales) among 40 retail banks globally, Mapa found the consumer experience to be unsatisfactory. A vast minority provided the following:

- Font size that fits the device

- Dominant use of icons

- Good navigation experience

- Interactive touch use components

- Adaptive / responsive design (1 in 4 sites don’t even resize properly when switching from portrait to landscape view)

Below are a few of the better experiences found by Mapa in their analysis. The analysis also included many experiences that were not as satisfactory including some very prominent US financial institutions.

iPad Browsers Are Prompted To Download iPad App When Accessing Online Banking

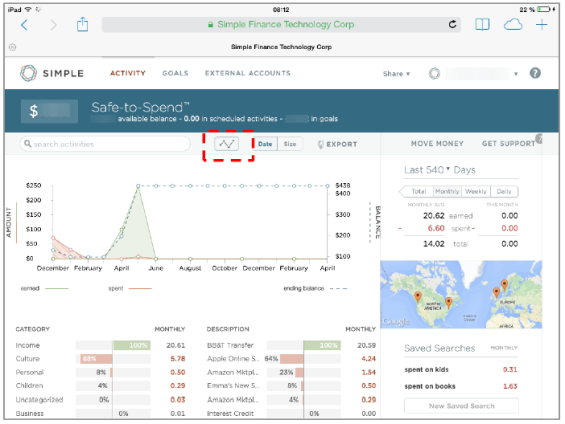

Recently Acquired Simple Illustrates How Simplicity In Design Is Welcome With Mobile And Tablet Apps

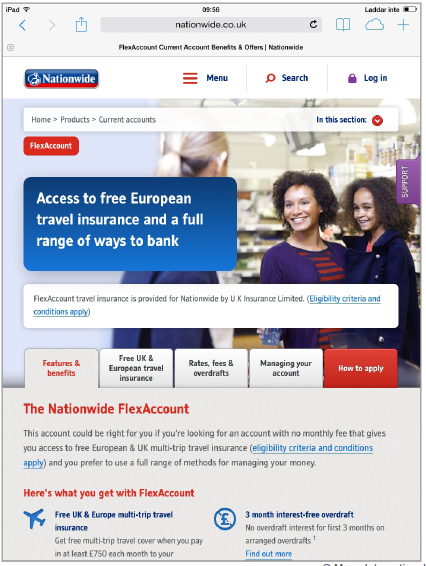

The Good News Is That Nationwide Uses Responsive Design. The Bad News Is That Their Application Is Not Responsive

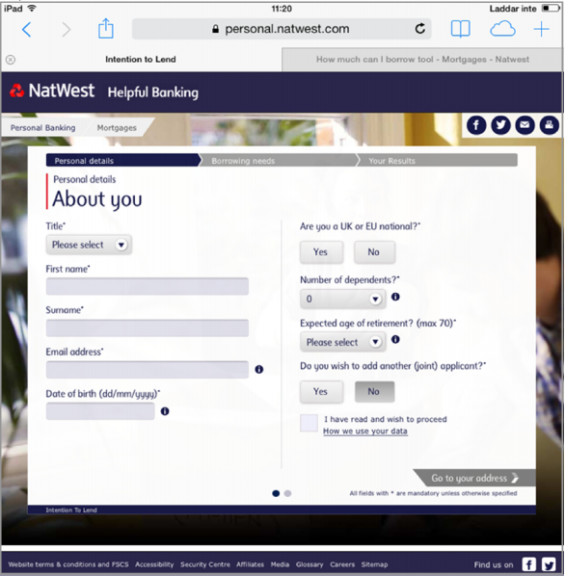

NatWest Provides Calculators That Are ‘Touch Optimized’

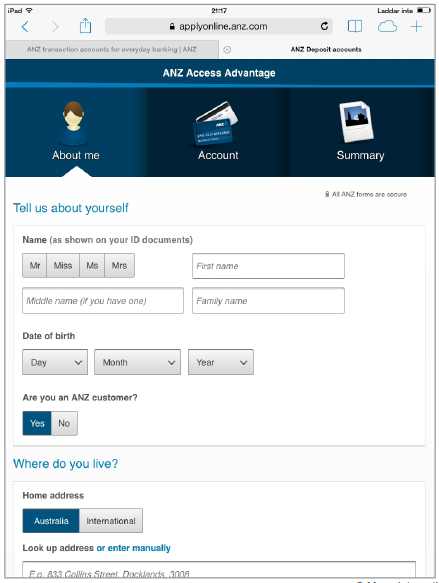

The Bad News Is That The ANZ Site Is Not Fully Responsive. The Good News Is That Applying For A New Service Is Responsive And Touch Optimized

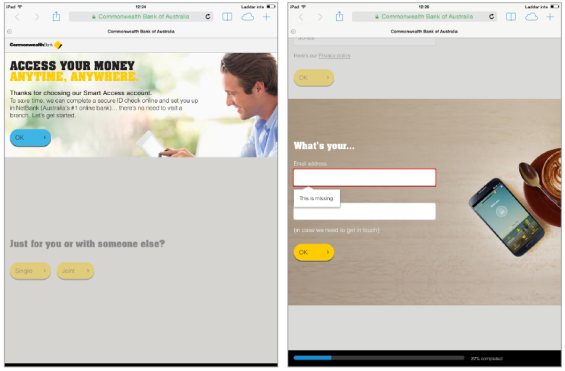

CommBank Received The Highest Marks By Mapa For Their Tablet New Account Application Process

Read More: Top 10 Mobile Banking Mistakes

Selling Within Tablet Banking

As with mobile phone banking, selling within the tablet banking app is far from optimized or maximized. Many financial institutions use the free tablet real estate at all, while others simply provide the same non-personalized messages to all users.

Before login, Mapa Research found the following:

- Focus is on letting customers login to manage their finances

- A banner (static and carousel) and text on the app landing page is the most popular approach to promote products and services

- Amount of space dedicated to banners vary by provider – from subtle approaches to very sales driven ones

- When tapping banners, customers are usually directed to product information pages

- The general call to action is to request a ’call back’ or ’call to apply’

After login, the experience doesn’t improve:

- Use of interstitial login messages to promote a product or service was found to be used only by one provider

- The vast majoirity of providers do not provide any sales and marketing message

- A banner is the most typical choice for communicating sales messages

- Tiles with clear signposting to ’Open an account’ is being used by few organizations

- Product applications are scarce

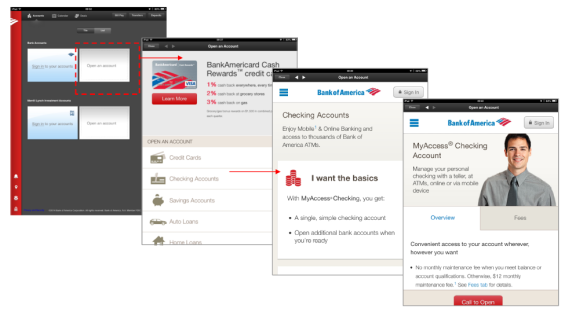

While Bank of America Provides An Excellent Sales Process Flow, There Is No Way To Apply Online

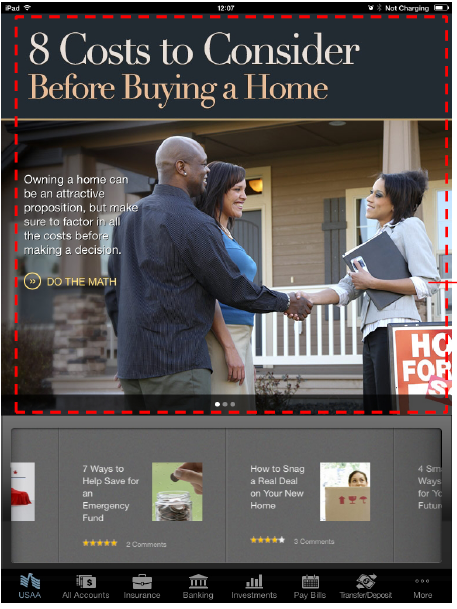

USAA Combines Financial Education With Sales Links To Maximize The Consultative Sales Approach

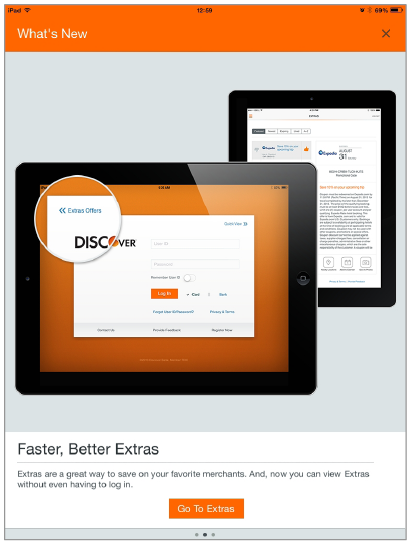

Discover Uses Interstitials For Promoting Services AndTo Prompt Sales

Standard Bank Takes A Unique Approach By Providing A ‘Digital Banking Store’ To View Product Descriptions And See How Product Works On A Tablet