Huntington National Bank has earned a reputation for its incredibly strong deposit base, in part the result of an investment in pro-consumer features that it calls “Fair Play.” It also has been a pioneer in digital onboarding, which is proving to be as big a driver in attracting new customers as its branches.

These aspects of Huntington’s retail banking strategy figure into its vision for the future in a big way — and it falls to Brant Standridge, president of consumer and business banking at the $183 billion-asset bank, to meld them just so. He detailed the plan in an interview that offers a clear idea of what success looks like.

“We’re blessed at Huntington in that we have that incredibly strong deposit franchise and also a strong brand,” says Standridge. “In fact, we have one of the most distinguished brands in the country, with the highest trust metrics. We’re very well positioned.”

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Key Advantages: ‘Fair Play’ Philosophy and Digital Acquisitions

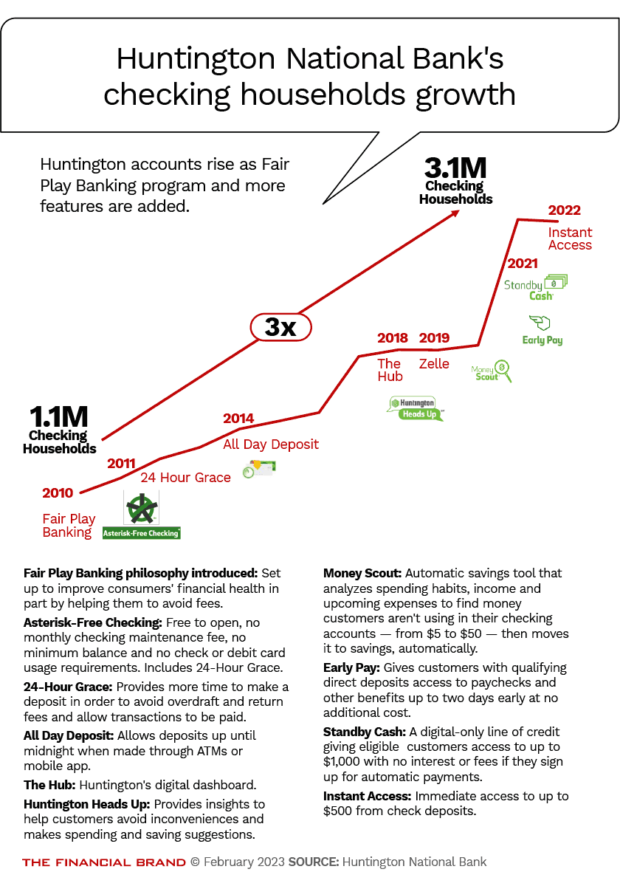

Fair Play kicked off more than a decade ago by giving retail customers a 24-hour grace period to avoid overdraft fees and has expanded over the years to include other features, some of which have since started to become industry table stakes. Collectively, those investments have made Huntington a leader in acquiring primary checking households, still a fundamental building block for consumer banking success.

This strategy brings Huntington more primary customers, and thus more opportunities for building broader relationships with multiple products, says Standridge, who joined Huntington in spring 2022 from Truist. “We’re in a period when deposits matter and primary relationships matter.”

Huntington also has strong results to show for its early investment in digital onboarding. Today, the bank reports that half of its new customers are acquired digitally, with the other half acquired through its branches. And Standridge says the bank acquires those digital-first customers at both a lower cost and a higher rate than many peers.

In addition, Huntington has indicated in investor presentations that 66% of its retail customers have adopted digital banking, defined as having logged into online or mobile banking at least once in a 90-day period.

And yet there’s a hitch in the midst of this success: “skinny” digital relationships.

How Digital Banking Relationships Contrast with Traditional Ones

“When we acquire a customer through digital channels, the relationships we have are very different,” says Standridge. That is, they are relatively shallow.

“Our customers acquired through our branch network have substantially more services with us than a digitally acquired customer,” he adds.

Some comparative statistics on product penetration by originated channel were shared in an Investor Day presentation by parent company Huntington Bancshares in fall 2022:

- Home lending: Branch 11%, Digital 4%

- Credit card: Branch 13%, Digital 5%

- Share of wallet: Branch 15%, Digital 5%

And here’s another wrinkle: Standridge says that 85% of new accounts overall are opened by someone who lives within five miles of a Huntington branch.

“So they may be choosing digital as the means of enrolling,” says Standridge, “but our physical presence has meaning to them.” The two target audiences are not mutually exclusive.

The challenge confronting Huntington is: On one hand, digital onboarding provides efficient acquisition, but on the other it results in less engagement. How the bank is responding to this challenge — with promising early results — is a key part of its continually evolving retail banking strategy.

Standridge discussed Huntington’s “digital deepening” strategy and the broader retail thrust it is pursuing, during recent investor events and in his interview with The Financial Brand.

Read More About Digital Banking:

- How Wells Fargo Rebooted — and Personalized — Digital Business Banking

- Improved Digital Account Opening Must Be a Top Priority for 2023

- 12 Must-Have Mobile Banking Features Consumers Expect Now

‘Digital Deepening’: Huntington Aims to Be Customers’ Main Squeeze

Huntington leaders say that expansion through digital channels is a key goal and that they welcome the current 50-50 digital-branch split with customer acquisition. But they also emphasize that branches will continue to play an important role for the Columbus, Ohio, bank.

Even amid an effort to optimize the branch network — Huntington closed 63 branches in 2022, following its merger with TCF Financial — it has been opening branches in new markets, particularly Colorado.

Pragmatism, rather than any retail banking “religion,” rules here. “We want to meet customers where they would prefer to be served, and we want to grow the number of customers we have. So we will continue to invest in both channels,” says Standridge. “My belief is that the mix will continue to shift to become more digital, but the branch network is very, very important because half of our accounts are opened there.”

Standridge set growth targets for the retail banking business when he spoke during the fall 2022 Investor Day: Over the next five years, the bank aims to increase high-quality deposits by 20% and consumer loan balances by 30%.

Huntington defines the term “high-quality deposits” in a footnote to the investor presentation as “primary bank relationship deposits or low-cost deposits.”

The strategy for achieving much of this growth focuses on getting more out of those “skinny” remote relationships, a process that Standridge refers to as “digital deepening.”

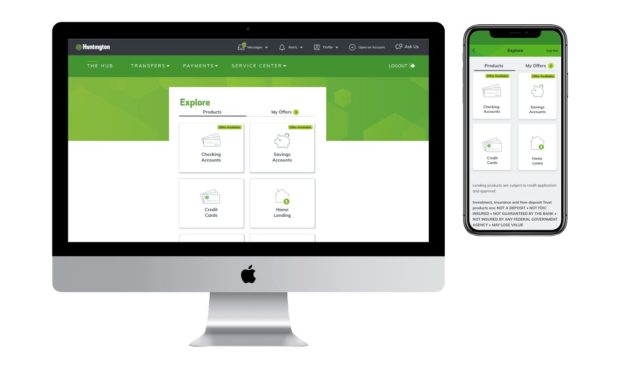

In September 2022 the bank launched a feature called “Marketplace” on its online banking website and its mobile banking app. Marketplace — which is still a work in progress, including its name — is connected to “The Hub,” Huntington’s online and mobile dashboard. (Viewing the Hub and the Marketplace requires logging into an existing Huntington account. But the bank provided screen shots to illustrate.)

After logging in Huntington customers can access the landing page of its Marketplace on either online or mobile banking to explore special deals and curated choices.

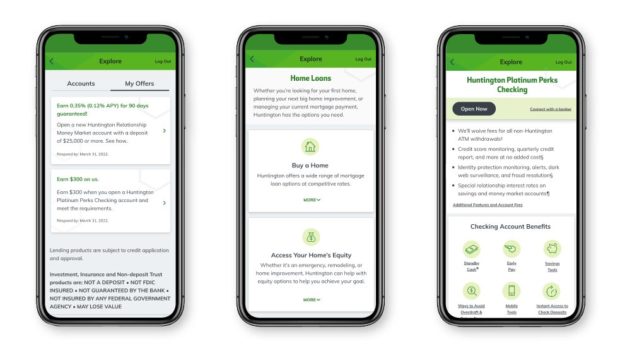

Once inside Huntington’s Marketplace consumers can go in multiple directions to go deeper. The bank hopes to use Marketplace to expand relationships with people who begin their connection with Huntington through digital channels.

Marketplace is meant to be more than a static catalog of Huntington’s retail banking services. It will use artificial intelligence to parse data, so that it can create “a personalized experience for each of our customers,” according to Standridge.

Over time, Marketplace will become the cornerstone of how Huntington engages customers digitally, he says. It will serve up specific products, special deals and perks curated for the individual consumer. (Recent research on retail banking by Accenture suggests that such tailoring will be a strength of successful banking.)

Read More: Mobile Banking Apps Need Personalized Experiences to Hold On to Consumers

Early Success with Digital Engagement via Marketplace

Deepening all customer engagement, but especially bulking up skinny digital banking relationships, is critical for Huntington to get a payoff on its tech investments. The goal is to increase “customer lifetime value,” not simply rack up multiproduct relationships that may not pan out in the long run.

“We think about having a customer for life and driving a more valuable relationship between them and us. We provide more value to them, they provide more value to us, over the long term,” Standridge says.

Early signs indicate that this new form of customer outreach has promise. “We’re seeing nearly 400,000 unique visits a month to the Marketplace,” he says. This represents an engagement level of 17% among digitally active customers.

In terms of actual business results, the effort to deepen relationships is also off to a good start. In the fourth quarter of 2022, about 11% of total account openings came about via Marketplace — so these were existing Huntington customers opting to do more business with the bank.

At launch, Marketplace was considered an “MVP” — a “minimum viable product,” in agile development terminology. Huntington viewed it as something of an internal startup, not a final iteration. More functionality is coming.

Going forward the bank wants to use the Marketplace as a way to introduce new capabilities and products to appropriate customers.

Huntington has made several acquisitions in the last year or so that have expanded its offerings — including Capstone Partners, an investment banking and advisory firm, and Torana, a digital payments firm.

Standridge indicates that it is open to more deals, whether as acquisitions or partnerships. In the consumer area these could include wealth management and payments services.

There’s a preference for “bolt-on” deals, which he describes as acquisitions that don’t overlap with what Huntington already has, but instead bring new products, services and expertise to the existing operation.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Injecting a Human Element into Digital Banking Relationships

With so many of Huntington’s customers using its digital channels — and some of them doing so exclusively — Standridge sees an opportunity to introduce some human interaction there. He points to the findings of post-pandemic research the bank has been conducting.

“We’re seeing customers shift to what we would describe as a more ‘human-driven’ era,” says Standridge. “The digital efficiency and convenience that customers have gained over the last 10 years, there’s now a desire to marry that with humans. How do we engage customers in a different way and yet provide more guidance and advice to our customers?”

To accommodate this, the Marketplace will include features the bank is developing to enable consumers to connect digitally with Huntington staff for information and advice.

“We know that transactions are going to continue to evolve to be executed more in digital channels,” says Standridge.

But instead of digital banking entirely removing human contact from the interaction, he wants to make use of those touchpoints to facilitate human contact selectively. “It creates an avenue to connect colleagues to customers,” Standridge explains.

The contact needs to enhance the experience, though. So the idea is to create “seamless opportunities,” in his words, to be able to talk to bank staff. And he anticipates that happening mainly around life events.

The initiative will be an extension of what Huntington intends to do inside its branches — which now number more than 1,000 across 11 states.

The Changing Role of Huntington’s Branch Staff

One certainty is that branch staff will be spending more time in advisory work.

So the deliberations ahead for Huntington include the physical attributes of branches and much more. “It will also be about things like, ‘How do we staff and who do we staff it with?'” says Standridge. “‘What will they do day to day? What will we hold them accountable for?'”

To meet the need for advice, Standridge views training as essential, to bolster both staff confidence and consumer confidence in the staff.

The training must entail not only investment advice and life-stage counseling, but also help for customers affected by fraud. Standridge says making sure the branch staff can allay the worries of compromised customers is a critical challenge.

“Our job,” he says, “is to ensure they’re well trained, in order to guide customers in a way that’s meaningful for them.”

A physical presence also continues to be an advantage over fintechs and other players that are completely digital. “Having a great local model really shows our commitment to customers and communities and sets us apart,” says Standridge. “We believe that if we combine that with great technology and great insight using data that we can create a compelling value proposition for customers.”