Let’s face it: the majority of banking apps look and feel rather similar. While every bank and credit union is unique in its own right, the typical proposition combining remote deposit capture (RDC), account services and security capabilities, while important, is not enough to inspire the next wave of mobile banking engagement.

“In financial services, the quality of the mobile experience has been proven to go beyond propensity to use – it can ultimately be the deal breaker for the entire consumer relationship.” — Alistair Crane, EVP of Monitise Create

In financial services, the quality of the mobile experience has been proven to go beyond propensity to use – it can ultimately be the deal breaker for the entire consumer relationship. Research by AlixPartners suggested that for 48% of account switchers, mobile banking services were either ‘Important’ or ‘Extremely important’ in their decision to switch. Given that financial institutions now vie with the highest usage front-screen apps like social media, messaging and search, there has never been a more important time to set your app apart from the competition, impress potential customers and members and win their business. Technically speaking, many banks and credit unions already have the backend capabilities to allow consumers to do almost whatever they want on mobile. Sometimes web services need to be optimized and online banking partners need to step up to the plate, but for those financial organizations that want to reinvigorate their brand and business badly enough, it is more than possible. Here are three ways that banks and credit unions can achieve market leadership with front-end innovation to keep consumers engaged and coming back to their brand.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

1. Commit to Frequent Updates

The need for mobile innovation is increasing in line with consumer expectations. Facebook, Uber, AirBnB and all other mobile-first businesses are upping the ante; banks and credit unions that follow suit will carry the consumer with them. Rolling out new features on a regular basis is necessary to keep the existing audience engaged and drive new downloads through climbing app store rankings and positive reviews. Companies truly embracing mobile are committing to making frequent updates to their services, sometimes every month, which allows for small and valuable enhancements without lengthy regression testing. Learn from Facebook: Then vs. Now

An early iteration of the Facebook mobile app

A recent iteration of the Facebook mobile app

It took Facebook 26 releases and two years to evolve the product to what we use today. In terms of leading a market, there’s no question that—from a mobile perspective—Facebook put in the time, strategy, planning and development effort to understand how to make the mobile app appeal to consumers. The banks and credit unions that differentiate through rapid, pre-planned updates will win the loyalty and business relationships from a variety of demographic groups, including the all-important highly engaged mobile demographic, set to become the mass affluent and wealthy consumer groups of tomorrow.

2. Don’t Forget the Branch

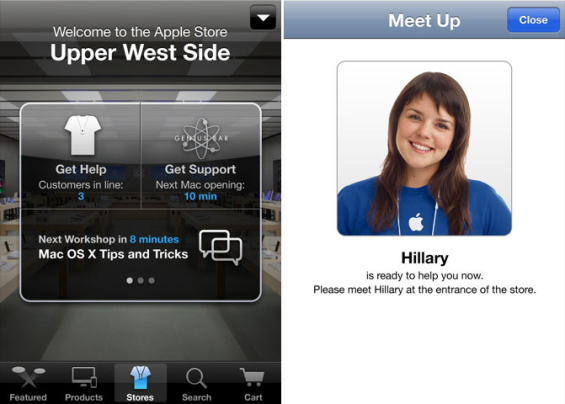

As the world grows increasingly tech-savvy, brands are prioritizing more digital, mobile-centric offerings over the in-store experience. But it’s those that are integrating the two that will emerge as the real winners: one cannot ignore the benefits of a brick-and-mortar consumer experience. Customer service is at its prime when delivered in person. Apple, Nordstrom and Verizon have all incorporated a concierge-like feature into their mobile offerings, maximizing both the benefits of mobile and the importance of the in-store experience. At Apple, for example, in-store activity can be enhanced through their app, which adapts functionality depending on whether you are in or out of store. Apple’s in-store concierge service:

Apple’s new in-store concierge app

The in-branch experience is huge in fostering customer loyalty and allows brands to offer more complex services via mobile, perfect for financial service providers with a notoriously complicated product offering. Bringing branch services to mobile allows banks and credit unions to capitalize on the engagement already on mobile and truly expand their offering for consumers. Banks and credit unions are starting to embrace this potential, introducing location-based ATM recommendations, displaying nearby branches with the shortest wait time, and even showcasing nearby stores with special offerings to assist users with everyday to-dos. This is where the new generation of location-aware technology really starts to add value; GPS, Beacon and even NFC are among the most relevant financial institutions need to be evaluating and working with now. While many financial institutions openly discuss the potential of technology, most are yet to act on it. Set your mobile banking app apart by tying in the brick-and-mortar experience to capitalize on another channel of consumer interaction.

3. From Information to Interaction

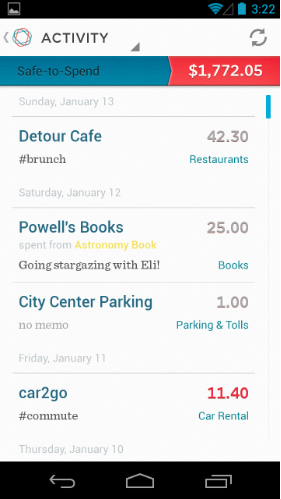

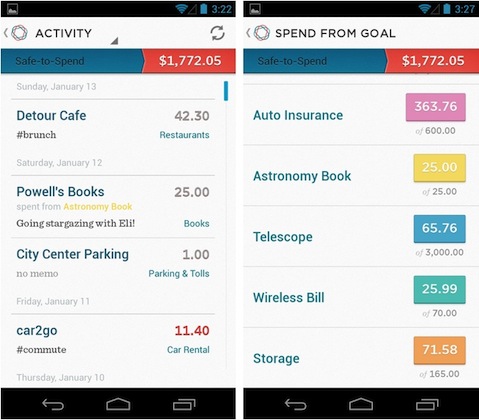

While we’ve seen that consumers rely heavily on apps for information and everyday task management, taking your financial institution’s app to the next level requires introducing more action potential into the mix. Consumers look to their mobile banking apps for instant insight into their finances, but that’s not enough anymore. To really give consumers what they want – and differentiate your organization’s offering from the competition – your app needs to present clear insights, and empower customers to act in one tap. Contextualizing spending and budgeting into easy-to-read categories:

Simple bank’s spending screen with categorization and ability to integrate notes

Simple’s integrated mobile budgeting capability

Viewing account balances on mobile banking apps is commonplace, but what good is that without an action? Incorporating credit card promotions or the option to open a savings account goes perfectly well with the balance information and account management features of your existing mobile banking app.

“Tying design into mobile app strategy is a great way to expand features and help consumers simplify day-to-day business practices for the better.” — Alistair Crane

Halifax Bank produced its HomeFinder app, which not only helps consumers browse local home listings and view their mortgage loan potential, view potential homes to purchase via an augmented reality display, but also allows customers to actually apply for a mortgage directly on their mobile app. Consumers don’t want to just see information on mobile; they’re looking to be able to do something with it. Designing a mobile banking app to incorporate purchasing power empowers the consumer to take action more easily, and creates new opportunities to engage customers—and increase profits—for financial institutions. In a space as crowded as mobile banking, it is essential for banks and credit unions to stand out. We know that user experience on mobile is paramount to satisfaction and adoption, so for financial institutions, tying design into mobile app strategy is a great way to expand features and help consumers simplify day-to-day business practices for the better.  Alistair Crane is is Executive Vice President at Monitise Create, a leading mobile strategy and design service that advises some of the largest brands in the world on how to reimagine their business through mobile. You can reach Al at [email protected] or connect with him on LinkedIn.

Alistair Crane is is Executive Vice President at Monitise Create, a leading mobile strategy and design service that advises some of the largest brands in the world on how to reimagine their business through mobile. You can reach Al at [email protected] or connect with him on LinkedIn.