The COVID-19 pandemic thrust the retail banking industry into embracing a digital-first mindset. With consumers forced to use online or mobile banking alternatives, or face long lines at drive-up teller windows, the use of non-branch banking solutions has increased dramatically. Those financial institutions that were digital transformation leaders have benefited from this behavioral shift, while “fast follower” or “laggard” institutions have had to play catch up.

Unless consumers flock to branches again (unlikely), organizations with the strongest digital solution offerings will be in the best position to satisfy consumers who may still be “kicking the tires” of expanded digital options. These digital transformation leaders will also be in the best position to cut distribution costs as economic stress continues to pressure the industry.

Recent research by J.D. Power highlights trends that many industry followers had predicted for years, but which transpired slowly. Over a period of less than two months, years of behavioral shift have occurred that will reverberate through the industry forever. Some of the early findings of the 2020 Retail Banking Satisfaction Study:

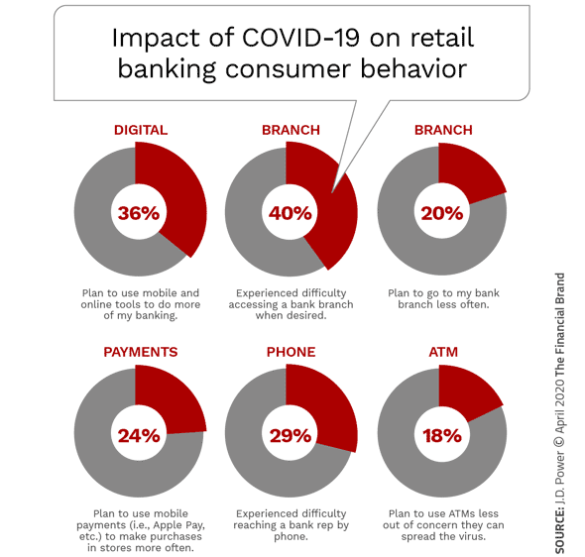

- Approximately one-third of retail banking customers plan to increase their use of online and mobile banking services post COVID-19. (This percentage is expected to increase as the duration of the crisis extends longer.)

- Key digital banking functions that will be impacted the most include mobile check deposit and P2P payments.

- The youngest consumers will be the most likely to increase digital banking use.

- Online banking consumers who have not used mobile banking are more likely to use mobile services than branch-only consumers.

- Large financial institutions have a greater penetration of high engagement digital customers than regional or midsize banks.

- Midsize banks have a significantly lower online and mobile banking satisfaction index than larger banks.

Read More: How Banks & Credit Unions Can Fortify Stressed-Out Customer Support

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Consumer Banking Behavior Shifting

As the shutdown caused by the coronavirus pandemic extends, more consumers are adjusting to vastly different daily behaviors. From increases in working from home and ordering take-out food to reductions in visiting friends or going to a workout facility, everything has changed.

Banking behavior has also changed – sometimes by choice … and sometimes because no other option was available. According to J.D. Power, only 46% of consumers will go back to “banking as usual.” The biggest change will be in the increased use of mobile banking (20%), increased use of online banking (17%) and decreased uses of branches (10%).

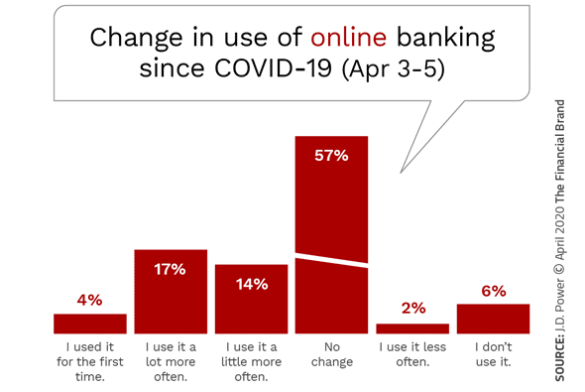

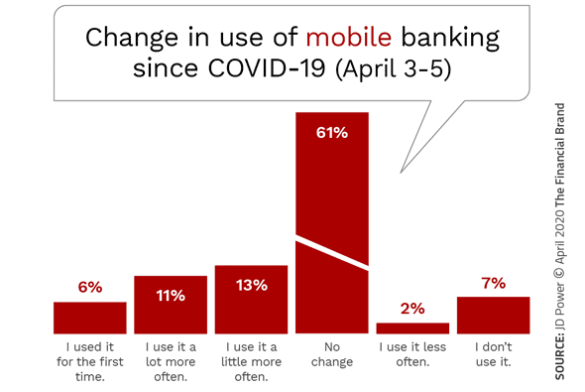

To reinforce these behavioral changes, 35% of consumers stated that they had increased the use of online banking (laptop or PC) since the COVID-19 crisis, with 17% stating they have used this capability much more. At the same time, 30% of consumers have increased their use of mobile banking, with 11% using mobile a lot more.

When consumers were asked about the effectiveness of their bank in meeting their needs online or with mobile banking, only 52% said that their bank was “very effective,” with 30% rating their bank as “somewhat effective,” 7% saying “somewhat ineffective” and 4% saying “very ineffective.”

These are not glowing reviews.

Digital Engagement Provides Experiential Advantage

Now more than ever it is imperative that financial institutions go beyond the basics of providing digital banking solutions. This requires a focus on user experience (UX) design, back-office functionality, seamless integration and a humanized aspect to digital banking. Without all of these components, banks and credit unions run the risk of decreasing customer satisfaction compared to other engagement alternatives.

J.D. Power recommends several significant shifts in the way digital banking services are communicated and delivered to consumers. Done well, these changes in the way most financial institutions deliver digital solutions will result in a differentiation that can decrease costs, improve customer experiences and enhance revenues.

- Increase digital communication frequency. Digital consumers are receptive to a greater frequency of digitally delivered communication from their financial institution. Usually delivered by email, this can include content such as articles, videos and interactive tools.

- Provide advice on financial management. Insights into the basics of better borrowing and saving.

- Reinforce fee waivers and refunds. While highly engaged digital consumers are less fee sensitive, this may be the result of fee waivers and refunds that are offered this segment. Use these benefits to convert less digitally engaged consumers.

- Enable self-service options. Highly engaged digital consumers prefer to solve problems independently using digital tools provided by their financial institution. They don’t want to use other channels to fix issues they can solve themselves.

It should be noted that less-engaged digital-only customers (as a segment) are less satisfied than branch-dependent customers across all age categories. This should not be an indicator that digital consumers don’t like digital, but the realization that most financial institutions do not deliver digital solutions very well. Adding to this narrative, highly engaged digital consumers are more satisfied than lower engagement digital-only consumers.

Read More: When Opening Accounts in Branches Becomes Impossible

Move Online Banking Customers to Mobile Options

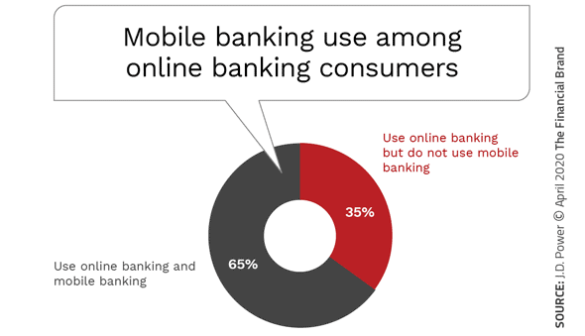

According to J.D. Power, 35% of consumers who use online banking still did not use mobile options before the COVID-19 crisis hit. This creates a strong upside opportunity for financial institutions to increase penetration of mobile banking, especially at a time when consumers may be looking for more convenient alternatives than online or branch banking.

Beyond the impact of COVID-19, J.D. Power found that current online banking customers who do not use mobile banking are far less satisfied with the way their online banking site appears and the overall functionality of online banking. This level of dissatisfaction may provide the platform to encourage this segment to test mobile banking alternatives.

While a majority of online banking customers who have not used mobile banking are from older segments, 28% are Gen X, Y or Z consumers, providing a strong opportunity for banks and credit unions to present the benefits of mobile engagement. This is especially true in the areas of P2P payments, creative banking alerts and using mobile budgeting tools.

Biggest Banks More Prepared to Serve Digital Consumer

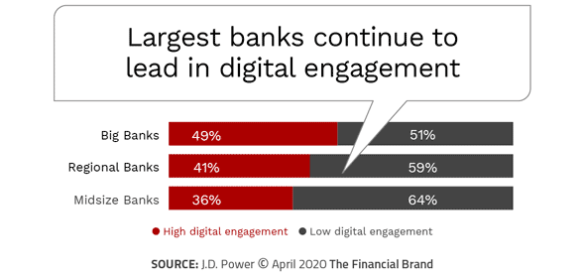

The most recent Retail Banking Satisfaction Study, not yet released by J.D. Power, shows that both regional and midsize banks are not performing as well as the largest financial institutions with regard to digital banking. Nearly half (49%) of the customers at big banks are “High Digital Engagement,” compared to 41% for regional banks and 36% for midsize banks.

One challenge that smaller financial institutions face is that they have older customer bases, which impacts the penetration of digital banking solutions. But there is more than just an age differential. Even taking age out of the equation the largest banks outperform smaller institutions. For instance, midsize banks were found to lag in several digital product usage metrics, such as:

- Paying bills via online and mobile

- Internal funds transfers via mobile app

- Using P2P payments in the mobile app

- Receiving alerts via mobile app

Of greater concern is that consumers who do use either online banking or mobile banking are less satisfied with both the design and functionality of the websites and mobile tools. They also report lower satisfaction with the range of services that can be performed with the mobile apps.

Beyond redesigning the online banking website or mobile banking app, organizations should focus on the lowest-hanging fruit for increased engagement. This would include linking P2P payments to one of the many available services (PayPal, Zelle, Venmo or Apple Pay). Another less important digital option would be to enroll the customer in a proactive alert or advice program.

One thing that the COVID-19 crisis has made clear, while the largest financial institutions may have the most highly engaged digital consumers, financial institutions of all sizes can do more to improve digital engagement levels. With fintech and big tech competitors understanding digital solutions better than legacy banks, there is no option – and time is no longer on the side of the slow to respond.