If it wasn’t for the pandemic, this article might have covered a different selection of trends. But COVID-19 has intensified the significance of existing digital banking trends and added others. It has completely shifted customer behaviors and expectations, forcing financial institutions to re-think obsolete ways of operating and to do that expeditiously.

The bar is set very high in terms of user experience (UX) and digital transformation efforts as a brand new generation of post-COVID consumers is emerging. Three quarters of them have tried different brands since the pandemic started, while 60% of those consumers expect to adopt new brands into their post-pandemic lives and routines, according to McKinsey.

Loyalty, empathy and emotional connection are cornerstones to bond financial brands with their customers. 71% of customers state that now is the time for businesses to update and upgrade how they operate, engage and contribute to society across a variety of fronts, Salesforce found.

So, let’s explore how a experience-empowered digital strategy can help financial brands transform and adapt to the emergence of the new post-COVID paradigm.

1. Expanding the Digital Perspective

The global transition to digital technologies has opened up brand new possibilities. However, despite the obvious need for well-developed digital channels and top-notch customer experiences, the pandemic highlighted the fact that the financial industry is woefully unprepared to embrace the digital age. In a situation in which digital means everything, it seems absurd that there are still cases in which people are expected to risk their health just to visit a bank branch.

What makes this situation even more unfortunate is that all the necessary technologies to avoid such situations are already available to the banks, but, for a variety of reasons, they are not utilized effectively enough to guarantee a completely remote service.

In such uncertain times, when the importance of digitalization is stressed, it’s critical to carefully evaluate the proper way to create and integrate a digital strategy. Otherwise, there’s a big possibility of reliving the unfortunate situation in the recent past when financial institutions were the last ones to develop mobile channels while almost the whole world was already relying on them.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

“The number one bank in the world will be a technology company,” predicted Brett King, fintech influencer, author and futurist. It’s true. The banks of the future need to become digital and create their digital strategies accordingly. It’s unimaginable that a digital company would be slow in adapting to technological advancements.

Successful digital businesses are always two steps ahead, constantly monitoring the changing customer behavior and innovating new ways to adapt their products and create new ones according to the rising expectations.

“In the rush for a competitive advantage, many financial institutions forget that their existing digital solutions are full of friction.”

— Alex Kreger, UXDA

The same kind of thinking applies to financial institutions that aim to succeed in 2021 and beyond. Financial brands that want to become the leaders of the future have already started to develop their digital competencies to instantly adapt their service to any kind of digital platform — not only for existing products, but also with a clear vision for future development.

However, in the rush for a competitive advantage, many financial institutions forget that their existing digital solutions are full of friction. In fact, 80% of customers state that the experience a company provides is as important as its products or services, according to Salesforce.

Before we are faced with brand-new innovations, there is a lot that can be done right now to improve the value customers receive from the already existing solutions. All we need is to expand our digital perspective. This will make the transition to the future smoother and easier, as the new technologies will be integrated into the existing products, providing a superb customer experience.

2. Empowering an Experience-Based Culture

Even well-thought-out digital transformation and innovative products can be sabotaged if there is no customer-oriented mindset in place. The key factor here is to integrate this kind of user-centered thinking throughout the whole financial institution — at every level, deep into the operational and strategic processes — ensuring that the financial solutions match the user needs and expectations.

One of the core principles of companies that have adopted an experience-based culture is to perceive design as an ideology that puts the customer at the center of all business operations. It inspires the whole team — from executives to employees — to constantly strive to make the world a better place for people to live. This has always been important but has become a top priority in the post-COVID era. 86% of consumers state that the societal role of companies is changing, Salesforce notes.

Perceiving design as an approach and integrating user-centered culture allows the full potential of a financial company and its digital products to be maximized. It’s an approach for creating financial digital products that live up to the customers’ needs and expectations.

If user centricity is one of the cornerstones of the financial institution’s values and culture, then the drive to create customer service that would attract customers like a magnet increases dramatically.

Read More:

- Why Designing Digital Banking Strategies Only for Gen Z is a Big Mistake

- Digital Account Opening: Hot Trend, But Kinks Hinder Speed

- The Best and Worst Practices in Digital Banking UX

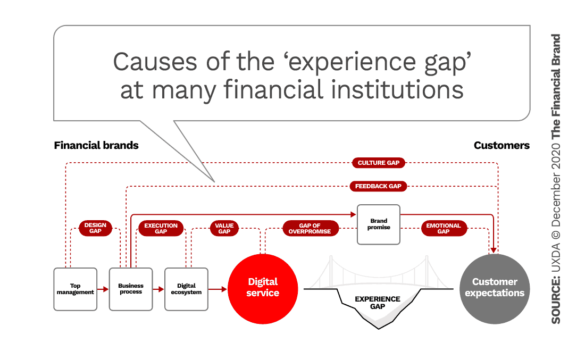

3. Overcoming the Experience Gap

In times when almost everything is accessible digitally, user experience is what differentiates successful digital financial services from failures. Even though this seems obvious, UX improvements often fail due to an “experience gap” — the negative difference between customers’ expectations and the experience they get from a financial product and service. It consists of several factors that often go unnoticed. If the customer experience is significantly worse than expected, it can decrease customer loyalty, lead to negative reviews and even to customers dropping the brand.

Banks and credit unions that aim to succeed in 2021 know how to detect and overcome the experience gap by not only fulfilling but exceeding customer expectations.

Following are the most common experience blind spots in financial institutions and ways that you can spot and fix them:

The culture gap

The lack of customer centricity in a company’s culture prevents employees from bringing service closer to customer expectations. The transformation begins with top management adopting a customer-centered experience culture and spreading this influence throughout the values of the company.

The feedback gap

This gap results from a lack of data about customer expectations and their experience or collecting data but not acting upon it to solve user problems. The first step to bridging this gap is to do a deep dive into the most common complaints shared on social media and customer support calls. If a bank or credit union is open to hearing critiques, it can use this data to bridge the gap and improve agility.

The design gap

This results from poor design execution. If user-centered product design is not a priority, decisions and efforts to create the final product and service will be low quality and inefficient. A design pyramid framework bridges the execution gap by determining the five levels at which design integration will significantly increase a company’s efficiency: process, team, actions, results and value.

The execution gap

This is formed from incompetent design and poor methodology. Financial UX design methodology should provide a step-by-step system for designing digital financial products that bridge the design gap and improve customer satisfaction.

The value gap

This gap is formed when the design ecosystem does not comply with user expectations. Creation of true value and customer benefit can be implemented through the five levels of the value pyramid: functionality, usability, aesthetics, status and mission.

Gap of overpromising

Defined as promising something that the product cannot provide, leading to higher disappointment in user expectations. Digital-age customers demand transparency, care, honesty and open communication. We must make promises that can be fulfilled and even exceeded.

Emotional gap

If brand communication is purely informational and focused on functional features, an emotional connection with users won’t be formed. Building an emotional connection between the brand and its customers will ensure long-term loyalty and demand. This connection is built through all of the aforementioned stages.

4. Enriching the Experience with an Emotional Connection

It often seems that the banking industry is afraid of emotions as if they would somehow reduce their notability. In fact, it’s actually the opposite. Emotions are the language that resonates with people and makes them feel heard, understood and cared about.

Moreover, consumers who have an emotional connection with a brand have a 306% higher lifetime value, stay with the brand for an average of 5.1 years vs. 3.4 years and will recommend brands at a much higher rate (71% vs. 45%), according to Motista.

For banks and credit unions to succeed in 2021 it’s important not only to think about usability and UX but also about the integration of personalized, positive experiences that form an emotional connection.

When customers compare their digital experiences, there’s often quite a large gap between the usability and experience of social media platforms like Facebook and Instagram and their banking app. To keep up with the experiences delivered by the big techs, finance companies should find out what users love about their products and think about how to integrate that to create a more emotionally engaging experience.

It’s also useful to honestly ask: Does your brand experience convey that it puts customers first, cares about them, provides needed solutions and wants to help in any way possible?

When the answer to this question will be a confident “yes” from the viewpoint of the customers, there will be no obstacles toward becoming a beloved financial brand.

Read More:

- The Qualities of Digital Banking Champions

- Data Reveals a Surprise Driver of CX Satisfaction in Banking

- Digital Banking Transformation Begins With Quality Data

5. Setting Up Experience-Driven KPIs

For decades, the key performance indicators (KPIs) have been the level of sales, conversion and the number of leads and prospects. But to become a successful financial brand in the new era, the main focus switches toward:

- User feedback.

- The number of actual users who recommend the product to friends.

- The number and reasons for complaints about the service.

- The number of positive and negative comments about the institution on social media platforms.

Many financial institutions are not even aware of the huge resources they already have without hiring a single UX expert. For example, there’s a possibility of conducting user research on the performance of the mobile app, already defining what needs to be improved simply by using Google. This doesn’t compare to thorough user research conducted by a financial UX architect, but it can definitely provide instant insights that would allow immediate improvement.

Following are specific KPIs that banks and credit unions can focus on in 2021 to measure the satisfaction of their customers and seek ways to improve it:

- App ratings on Google Play and the App Store.

- Reviews and feedback on social media platforms, forums and other sites.

- NPS (Net Promoter Score) — how likely customers are to recommend this banking product.

- Customer lifetime value (CLV) — helps to understand the value of investing in long-term relationships with customers.

- Reasons why most users contact the support center.

- Retention and switch rates.

- Active customer volume.

- Customer satisfaction rate.

- Customer loyalty index.

6. Switching from IQ to EQ

In the digital age, the business focus is rapidly shifting from intellect (IQ) to emotion (EQ). The thinking of the brands is shifting from rational aspects like different performance metrics to emotional aspects like the satisfaction of the customers and employees, as well as building long-term relationships. EQ is all about the emotional impact the product or service of the brand has on people’s lives.

Currently, during the pandemic, emotional intelligence and empathy are more important than ever. 86% of Americans have stated that, if brands want to create greater loyalty, it’s critical they show more empathy, according to a study conducted by Ipsos for PepsiCo.

In the near future, empathy will be even more important than it is now. The fight for brand loyalty will just get harder, and customer expectations and demands for a more personalized experience will keep on rapidly increasing, as will the technological chances of satisfying them.

“There is a need for emotionally intelligent people who serve as translators between customers and the complexity of new technologies.”

Future technologies, like artificial intelligence, big data, machine learning and automatization, have the ability to take customer experience to a brand new level. There is only one “but”: 84% of customers state that one of the preconditions for them to stick with a brand is to feel that they are treated like a person, not a number, according to Salesforce.

It’s not enough to have brilliant engineers with a highly developed IQ. There is a need for emotionally intelligent people who serve as translators between customers and the complexity of the opportunities uncovered by new technologies.

This explains why the demand for UX/CX experts is rapidly increasing. They are the “user advocates” that ensure a user-centered approach in digital product development.

Successful financial brands in post-pandemic 2021 and beyond will be ones that unite the power of technological capabilities with the power of genuine empathy and emotional connection only humans can create.

7. Establishing Consistency Through Product Ecosystem

Many banks and credit unions digitize their products separately. This causes high fragmentation within the customer experience as the usability, information architecture and the interface itself differ.

This leads to a broken customer experience, because people expect their banking services to be a connected, holistic flow and not separate fragments. Annoyed by this frustration and digital friction, customers might decide to switch to another financial institution or to a fintech that offers consistency and smooth flow across all of their digital products.

The main cause of fragmentation is the lack of a united vision. This is often due to the fact that digital channels are considered an alternative or additional form of service delivery.

A practical way to bring about a unified vision is to create a proper UX/UI design system and digital strategy. It ensures that everyone working on the ecosystem products are on the same page and can easily develop consistent digital solutions in their specific field of responsibility.

8. Providing a Contextual Experience

2021 will change the way powerful financial brands are built. The key to becoming a successful financial institution post-COVID is having 100% focus on solving the customers’ problems in the most effective way possible, instead of following a standardized scenario.

From a practical perspective, this calls for personalized, contextual banking experiences. As the number of advanced personalization solutions using AI are becoming more and more accessible, it is broadening the solutions banks and credit unions can offer their customers.

Personalized, contextual financial products powered by technology should:

- Inform the users about any situation that requires their attention, even when they have thought of it themselves.

- Help to improve users’ financial health by monitoring it and providing recommendations.

- Make financial forecasts and offer uniquely crafted possibilities according to the user’s specific needs and goals, in a specific context.

- In the near future, it should also enable the users to conduct financial operations using voice processing, gestures, neuroscience, virtual reality and augmented reality.

An app that provides a contextualized experience should be able to predict the exact moment when a consumer needs a specific product, and provide it by combining big data with behavior-based predictive analytics. The data already available to the incumbents could be used to provide personalized offers based on the user’s purchasing and financial behavior.

An example of a brand new player in banking using some of the latest technology is a bank named Bella Loves Me. It’s based on a conversational interface, and it aims to take personalization to a new level using AI and concierge services.

9. Teaming up with Fintech and Technology Companies

It is already obvious to many that future success in the digital world depends on the willingness to collaborate. Integrating third-party solutions allows incumbents to improve the service package for users and deliver additional value. The most advanced banks are actively investing in fintech companies and integrating their technologies into their services.

“Big techs set the vectors for the future development of the digital world. Some institutions will ignore them and be disrupted. Others will actively integrate to gain a competitive advantage.”

But new development opportunities are associated not only with fintechs but also with big tech companies. Banks that are transforming into digital companies are actively using big tech platforms and services to improve customer experience, optimize work processes and promote their services. Technologies implemented by big techs set the vectors for the future development of the digital world. Some institutions will ignore them and be disrupted, while others will collaborate and actively integrate to gain a competitive advantage.

The digital strategy of successful financial institutions must include guidelines for tracking, using and collaborating with fintechs and big techs. Financial institutions’ future digital potential depends on how quickly they utilize technologies introduced by big techs and adopt them. For example, banks that were late in connecting their cards to Google Pay and Apple Pay caused anger and frustration among customers who wanted to pay by smartphone.

10. Taking the Value of Customer Experience to a New Level

As a result of the pandemic, regulators and government agencies were forced to respond to the global challenge by making the financial industry more open for newcomers, such as fintechs. This has increased the demand for digital financial products and reduced market entry barriers.

As a result, in the post-pandemic era, we will witness the emergence of even more aspiring digital financial companies and products. To survive and succeed in such circumstances, plain functionality or even acceptable usability are not enough.

The new generation of post-COVID customers expects much more. To ensure a market advantage, financial products must provide an exceptional customer experience, look aesthetically pleasing, fit the specific requirements of the customer’s status and even present a socially significant mission that would create a community around it.

Most of the traditional incumbents are still offering basic functionality and working on improving usability. Customers are able to perform their basic daily scenarios, but the level of user experience is quite low. Missing are the positive emotions a superior digital experience would cause through enjoyable design, gamification elements or animated interactions.

Meanwhile, new fintechs keep overflowing the market with digital solutions that build upon the basic functionality by offering an amazing customer experience. For example, the Ant Forest program that was enabled in the Alipay app encouraged users to collect energy points to plant trees. Half a billion users took part in the Ant Forest, resulting in 100 million trees being planted!

This is the time for incumbents to step up their game and provide the wide range of possibilities they have by upgrading their digital ecosystems of financial products. Banks and credit unions can build up a great UX, work on a modern interface and connect to the specific needs of their audiences, whether they be families, teens, seniors or VIPs.

Incumbents have such a deep loyalty and trust from their customers, formed throughout the years, that this is a huge advantage over the newcomers. When it comes to money, trust is everything. 82% of customers agree that a company’s trustworthiness after the pandemic matters more than it did a year ago, according to Salesforce.

Using trust as a foundation, incumbents can build upon that by developing their products so that they would be not only functional but also very easy to use, to look at and recommend.