From the outside, the banking industry looks as strong as it has since the financial crisis of 2008. Banks have benefited from a modest increase in interest rates, continued strong loan demand and relatively calm regulatory waters. Over the past several years, improved cost controls and the benefit of new technologies and automation have kept profitability strong. But the real challenge may be ahead for most organizations.

There has never been a greater need for traditional financial services organizations to become ‘digital banks’. Until now, most banks and credit unions have simply put a nice veneer on legacy systems and products, ignoring many of the internal changes that are needed to compete effectively with smaller fintech and big tech organizations. Once considered competitors, fintech firms have become part of the mainstream banking system, allowing institutions to innovate beyond what was possible in the past.

Globally, the retail banking industry is being expected to deliver a seamless digital customer experience, as found in our 2019 Retail Banking Trends and Predictions report. Investments in digital technologies have increased to respond to consumers’ constantly evolving demands, but the changes made by most institutions only scratches the surface of what is needed.

Consumers’ experiences with firms like Amazon, Google, Apple and Facebook have upped the ante. Deloitte’s recent global digital banking survey across 17 countries showed that banking consumers have a stronger emotional connection to these technology brands than to their banks. According to Deloitte, “Some of these companies’ ability to blend experiences from the physical and digital worlds is considered a good model for banks.”

We are even seeing some organizations building digital banking units outside of the traditional banking infrastructure.

Fractional Marketing for Financial Brands

Services that scale with you.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Digital Transformation Starts from the Inside Out

Digital transformation in financial services requires a departure from traditional operating models in order to develop hyper-personalized financial products and services. This movement calls for leveraging new technologies to create more frictionless ways of interacting and transacting. This transformation includes the use of the blockchain and the digitization of virtually all back-office processes, all within the constraints of an evolving regulatory environment.

Unfortunately, very few organizations have the modern applications or back office structure that can meet these business requirements. The legacy systems most organizations still use can’t provide the technical agility that is needed. In fact, many organizations are building partial or sub-standard digital solutions rather than end-to-end solutions that benefit both the consumer and the financial institution.

Digital transformation requires a different business structure, new technologies as well as people who are trained and given the power to lead the digital transformation process. Instead of a ‘project’ approach, there needs to be an acceptance of the risk involved in a major transformation process, understanding the scope of the endeavor, sourcing opportunities, and operational modifications that will be needed.

The process of digital transformation is not easy. It requires a shift from legacy IT systems and traditional business models towards integrated, agile, customer-centric processes. Possibly more importantly, this transformation requires a cultural adjustment and mindset shift in application development and data flows. All of this with a focus on quality and compliance adherence, and security protocols to ensure privacy and data integrity.

According to Forrester, “It’s hard to avoid back-end transformation: Without it, a bank can’t offer true digital banking to its customers. However, to win acceptance from business leaders, back-end transformation needs to encompass more than a pure technology update.”

A Need for Speed

To remain competitive in the future, financial organizations will need a modern digital platform that can support current and future digital solutions. While there is a need for speed, digital transformation efforts will require careful planning and time. Resources must be invested in agile delivery while also supporting a restructured back office process that eliminates many of the steps that traditional banks are used to.

Most organizations will not initiate the required changes all at once, but will implement digital transformation projects incrementally. In the end, the result will be a vastly improved customer experience as opposed to just better reports. An emerging approach to managing transformation is to create a digital banking subsidiary with a separate business model, new business processes and new technology. The rationale is that the ‘mother ship’ is too encumbered with legacy systems, processes and people to succeed quickly.

Banking Industry Oversimplifying Digital Transformation

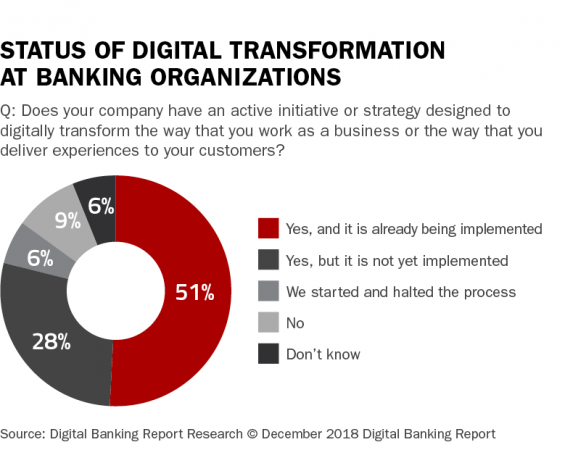

According to the research associated with the 2019 Retail Banking Trends and Predictions report, only half of the organizations surveyed stated they have a strategy in place for digital transformation. Another 28% state that their organization has a strategy, but that the strategy has not been implemented.

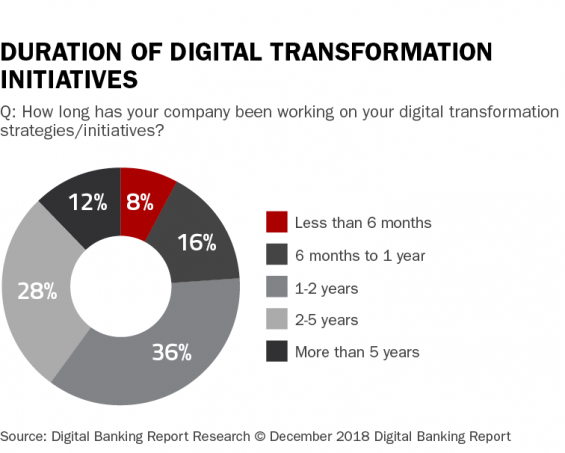

When asked how long organizations have been working on digital transformation, the vast majority of institutions have been working on digital initiatives for 1-5 years. Twenty-four percent of organizations have only begun the process (under one year), while 12% of banks and credit unions have been engaged in digital transformation for more than 5 years.

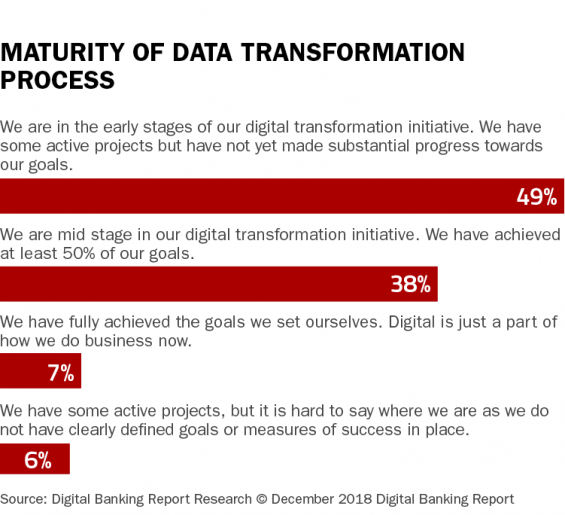

When we dug further into the maturity of the digital transformation process, we found that almost half of the organizations felt that they were in the early stages of digital transformation. The good news is that 38% thought they we at the ‘mid-stage’ of their transformation journey. Only 7% thought they were well positioned for digitizing their organization.

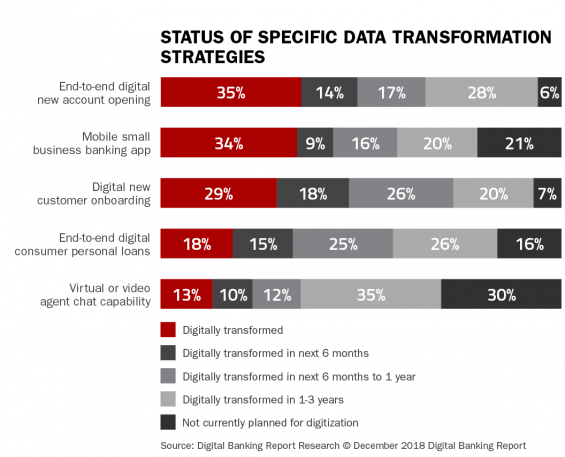

Despite these upbeat responses regarding the digital capabilities of financial institutions, the respondents to this year’s Retail Banking Trends and Predictions report found that only one-third of organizations had digitally transformed the most basic functions (new account opening and small business mobile banking).

What this shows is that the vast majority of financial institutions far underestimate the scope of what is needed to become a ‘digital bank’. More concerning in the short-term is that most organizations are not yet delivering the basic components of a digital organization.

Build, Buy or Partner?

There have always been options as to how to digitally transform an organization and provide better solutions for consumers. The difference today is the importance of speed in the equation. No longer is it acceptable to be a “fast follower.” Instead, it is more important to embrace change, accept risk and disrupt the financial institution/consumer paradigm. The digital banking environment is moving faster today than ever before, with the consumer leading the call for new solutions.

Because the marketplace is rewarding digital organizations, there is a greater need to find partners who can provide the solutions that can be implemented quickly and integrated easily. From new products to improved marketing capabilities, sitting on the sideline is no longer an option.

The key is to take action NOW as opposed to simply talking the talk. This may require a change in internal culture, realigning the overall organization and finding new talent. As the boundaries between banking and the rest of the digital economy continue to blur, the potential for Amazon, Google or another big technology firm to jump into the banking ecosystem in a big way is becoming more likely every day.